Diesel Fired Portable Inverter Generator Market Outlook:

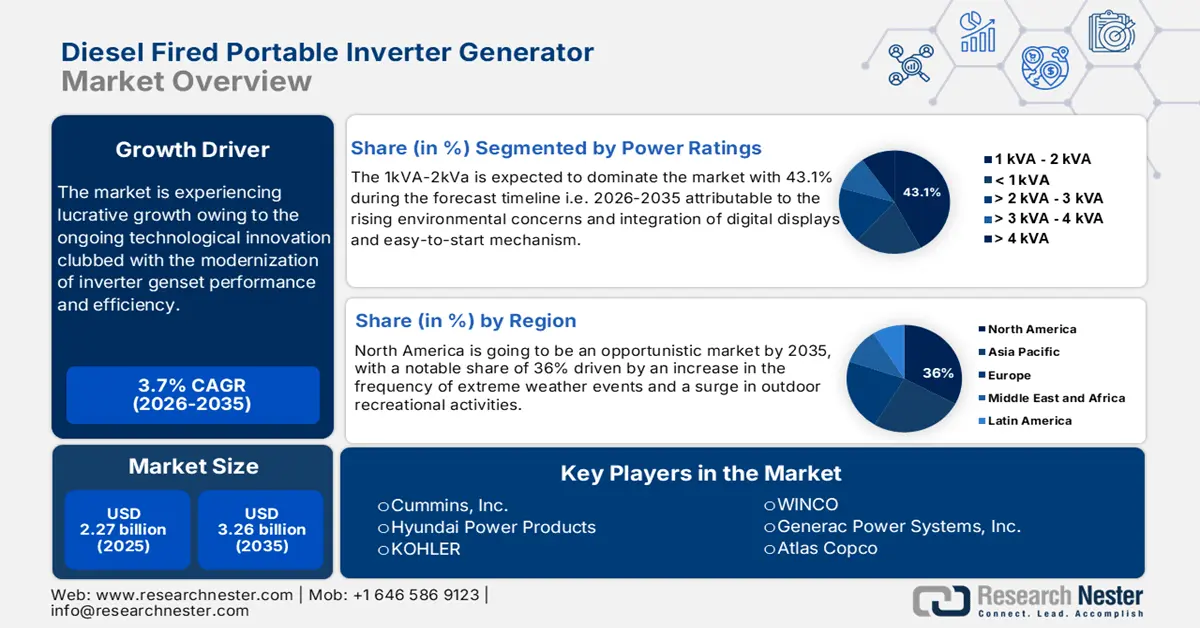

Diesel Fired Portable Inverter Generator Market size was over USD 2.27 billion in 2025 and is poised to exceed USD 3.26 billion by 2035, witnessing over 3.7% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of diesel fired portable inverter generator is estimated at USD 2.35 billion.

A portable diesel fired inverter generator is a power solution that has greatly improved to fit mobility, durability, and guaranteed electricity. The growth of the market is stimulated by the higher demand for reliable power solutions in off-grid and remote areas, especially in the constructional region and regions prone to frequent disasters.

In addition, increased awareness of energy efficiency and reduced emissions in diesel engines, with strict government regulations on emissions are pushing technological advancements in generators. For instance, in April 2024, Cummins Power Generation introduced two new models of generator sets as a continuation of their acclaimed Centum Series, which is powered by Cummins Inc.'s durable QSK78 engine. The product ensures power density, sustainability, low emissions, and guaranteed dependability. Furthermore, the increasing adoption of renewable energy sources in hybrid power systems continues to propel the diesel fired portable inverter generator market along the growth trajectory.

Key Diesel Fired Portable Inverter Generator Market Insights Summary:

Regional Highlights:

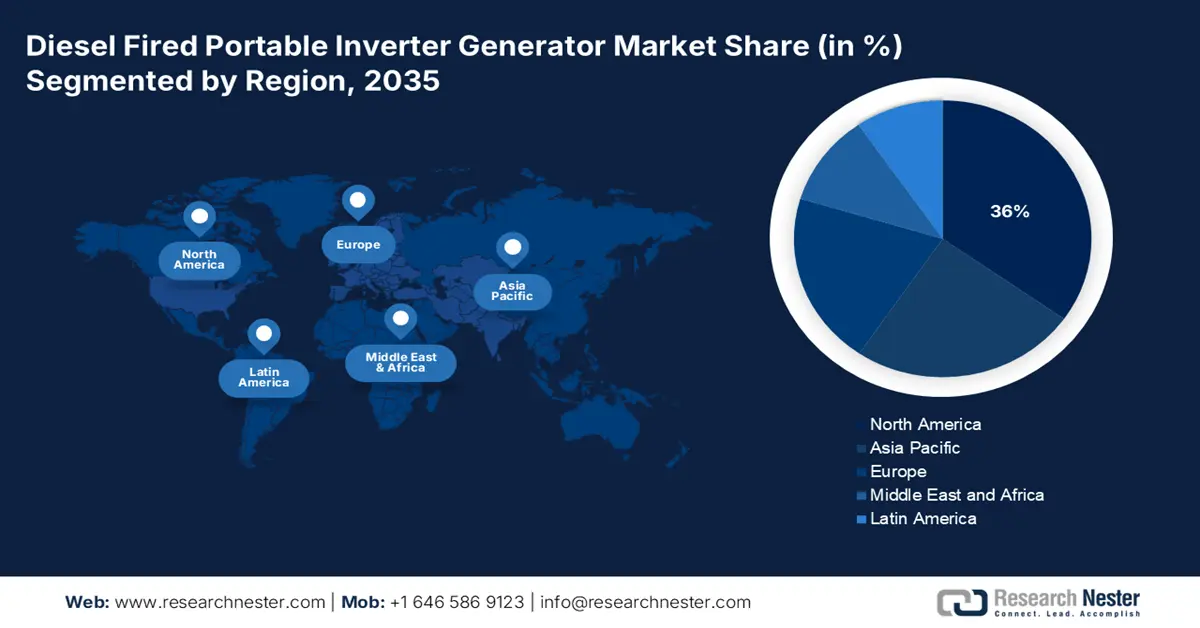

- North America diesel fired portable inverter generator market will account for 36% share by 2035, attributed to increased construction, agriculture, and emergency power needs.

Segment Insights:

- The 1kva-2kva power rating segment segment in the diesel fired portable inverter generator market is forecasted to maintain a 43.10% share by 2035, driven by its wide use in residential and small commercial applications for reliable power.

Key Growth Trends:

- Supportive regulatory standards

- Expansion in industrial and construction areas

Major Challenges:

- High initial costs

- Maintenance and technical complexity

Key Players: KOHLER, Powerac, TAIZHOU POWERWORK Industrial Co., Ltd., WINCO, Yamaha Motor Co., Ltd., YANMAR Holdings Co., Ltd..

Global Diesel Fired Portable Inverter Generator Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.27 billion

- 2026 Market Size: USD 2.35 billion

- Projected Market Size: USD 3.26 billion by 2035

- Growth Forecasts: 3.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (36% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, India

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 18 September, 2025

Diesel Fired Portable Inverter Generator Market Growth Drivers and Challenges:

Growth Drivers

-

Supportive regulatory standards: Governments and regulatory bodies are enforcing emission regulations effectively to check air pollution, impelling manufacturers to innovate and offer improved products to customers. For instance, in Europe, the EU Stage V requirements in inverter generators intend to lower their particulate matter to 5% and nitrogen oxide emissions to 15%. These regulations compel manufacturers to innovate advanced technologies, including cleaner combustion processes and advanced filtration systems, making diesel-powered portable generators more attractive to consumers. Thus, regulatory standards compliance is a stimulus of being more responsible in an environmentally sensitive market.

- Expansion in industrial and construction areas: Diesel-fired portable inverter generators have strategic relevance in the construction industry for powering tools, lighting, and machinery at remote sites where it is not feasible to have a grid. Their portability and high-power outputs make them ideal for large-scale projects, such as highway construction and commercial buildings. Additionally, a sophisticated construction site requires clean and reliable power, which would fit the bill admirably. Moreover, it gives an extra edge for quieter operation, cleaner emissions, and better fuel economy compared to a conventional generator, as it provides precision in supplying power.

Challenges

-

High initial costs: Diesel-powered inverter generators are initially more expensive in comparison to the traditional ones, making them less competitive. It deters purchasing by price-conscious consumers and thus limits the diesel fired portable inverter generator market penetration. It further impacts the adoption rate, and shifts the focus on niche markets. Moreover, the manufacturing process requires expensive materials and components to integrate into the diesel fired portable inverter generator which drives up the manufacturing costs clubbed with more investments in research and development and ensuring regulatory compliance.

- Maintenance and technical complexity: The maintenance and technical complexity represent a significant challenge. Non-technical user servicing entails activities such as replacing fuel filters, cleaning or replacing injectors, lubricating moving parts, and ensuring the fuel system is not submerged in water that may damage it. A poorly serviced component may result in inefficient engines, more emissions, or expensive repair costs as these are quality-sensitive when poorly managed. Clogging or corrosion could easily occur, which later causes additional complexity to the generators when in operation. Thus, increased operational costs for regular maintenance eventually outweighs the advantages of low fuel consumption for small businesses or residential users.

Diesel Fired Portable Inverter Generator Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

3.7% |

|

Base Year Market Size (2025) |

USD 2.27 billion |

|

Forecast Year Market Size (2035) |

USD 3.26 billion |

|

Regional Scope |

|

Diesel Fired Portable Inverter Generator Market Segmentation:

Power Ratings Segment Analysis

1KVA-2KVA segment is projected to hold diesel fired portable inverter generator market share of more than 43.1% by 2035, owing to its wide use in residential and small commercial applications where reliability and portability are a cause for significant preference. With the growing rate of blackout occurrences and the ever-increasing trend of off-grid living and outdoor recreation, consumers always prefer these units as perfect for RVs and sensitive electronic devices. Since 1KVA - 2KVA generators are affordable, these units are attractive both in terms of performance and cost. The 1KVA-2KVA segment will witness a significant surge concerning versatility, affordability, and rising applications by various industries.

In May 2023, The GP18000EFI and GP15500EFI portable generators from Generac Power Systems are part of the GP series, which offers backup power for the entire home via a manual transfer switch. It is a dependable portable power source for high-wattage worksite needs, do-it-yourself projects, and emergency home backup. In addition, by ensuring optimal fuel efficiency across a range of engine speeds and load demands, these two models contribute to the reduction of emissions and fuel consumption. Furthermore, it has COsense technology helps to automatically turn the unit off in case of high carbon monoxide emissions.

Application Segment Analysis

Based on application, the residential segment will dominate the diesel fired portable inverter generator market attributable to the ever-increasing demand for energy combined with the growing concerns associated with power outages. Also, a growing requirement for backup power solutions by residential users increases the demand. As people tend to install more smart home technologies and are becoming reliant on electronic devices, the need for stable and uninterrupted power supply becomes critical. Furthermore, the extended duration of these generators over gasoline alternatives is making homeowners choose them more frequently thus, the global commercial potential is further encouraged by rising disposable incomes, which enable homes to invest in superior power solutions.

Our in-depth analysis of the global diesel fired portable inverter generator market includes the following segments:

|

Power Rating |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Diesel Fired Portable Inverter Generator Market Regional Analysis:

North America Market Insights

North America diesel fired portable inverter generator market is set to hold revenue share of more than 36% by 2035, due to some crucial factors attributable to the rise in construction, agriculture, and applications requiring a power source in case of emergencies. The proliferation of outdoor recreational activities along with increased occurrences of natural disasters has dictated a significant surge in the need for a portable source of power also leading to fueling market growth in this region. Infrastructural development and renewable energy projects are high in creating a need for diesel generators as a backup power source. For instance, Cummins Inc. has introduced Onan QG 2800i and 2500i and made significant advancements over the sets these generators have 60.6% less vibration and are 62.7% quieter.

The cold climate of Canada creates a constant demand for portable generators during stormy winters and blackouts. Increasing demand for outdoor recreation activities such as camping and construction projects that require transportable power also fuels the demand. For instance, in July 2023, owing to possible fire and burn risks, Health Canada issued a recall for two Generac portable generator models. Off-grid living and the general pursuit of sustainable energy solutions further projected the adoption of the diesel-fired inverter generator in the diesel fired portable inverter generator market.

The industry for diesel-fired portable inverter generators in the U.S. is expanding significantly due to increased emphasis on environmental compliance and emergency preparedness. Product adoption will be increased by the rapid paradigm shift, residential building expansion, and incorporation of cutting-edge features such as digital displays and their effortless mechanisms. Additionally, there is a growing need for portable units in commercial and industrial settings, such as remote job sites, event venues, and construction sites which will have a positive effect on business growth.

Asia Pacific Market Insights

Asia Pacific is likely to experience lucrative growth in the foreseeable future owing to the growth in the economy and urbanization with rising energy demands mainly in remote areas with no reliable electricity source. The growing demand for portable power solutions coupled with the evolving of SMEs helps businesses to operate independently when the main supply is hindered by outages. In addition, natural disasters and climatic change have raised awareness of alternative power supplies. Furthermore, government incentives promoting clean energy and sustainable practices are motivating demand for high standards of emissions-compliant diesel generators driving diesel fired portable inverter generator market growth.

India remains plagued by the lack of electricity supply throughout the rural and semi-urban regions, where regular power cuts have been a regular phenomenon. Moreover, the increasing number of infrastructure projects and fast-developing industries such as construction and telecommunication are demanding portable generators at work sites. Lastly, an increased demand for generators that abide by new emissions standards will contribute to diesel fired portable inverter generator market growth. For example, in February 2023, the Supreme Court-appointed Commission for Air Quality Management (CAQM) to ensure the use of diesel generator sets with a maximum capacity of 800 kW in the Delhi, NCR if they switch to a dual fuel system up to 70% gas and 30% diesel.

China is emerging to unfold significant opportunities with its fast industrialization and urbanization pace. The rapid upgrade of infrastructure and manufacturing investments have resulted in an increased demand for a stable electricity supply. In addition, the growing frequency of natural catastrophes has prompted businesses and households to seek alternative sources of power. Technological improvements in generator efficiency and noise reduction have also increased their penetration. Moreover, government regulations support sources that are emission-friendly and abide by stricter norms.

Diesel Fired Portable Inverter Generator Market Players:

- Cummins, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Generac Power Systems, Inc.

- Honda Power Products Indonesia

- Hyundai Power Products

- HIMOINSA

- KOHLER

- Powerac

- TAIZHOU POWERWORK Industrial Co., Ltd.

- WINCO

- Yamaha Motor Co., Ltd.

- YANMAR Holdings Co., Ltd.

Several major companies shape the market with their innovation and competitiveness. A great amount of significant research and development is undertaken by manufacturers to improve fuel efficiency, reduce emission rates, and even enhance overall performance in response to increasing regulatory pressures and consumer demands for cleaner technology. For instance, in April 2024, with the release of the KD800 model, Kohler Power System increases the number of industrial generators in its KD SeriesTM lineup for 50 Hz markets. This generator has a state-of-the-art engine (KD18L06) that runs on hydrotreated vegetable oil (HVO), a renewable fuel source.

Companies are also broadening their distribution networks and enhancing customer service operations to capture the growing demand in emerging markets. Cooperation with local manufacturers helps also in tailoring products to better suit regional needs, further deepening market penetration. Furthermore, striving for innovations and the development of new models with streamlining fuel-efficiency, cost-effectiveness, and portability features. Some of the key companies are

Recent Developments

- In May 2024, Trime introduced a line of diesel-powered generators that can produce single- or three-phase outputs and a wide range of power yields to accommodate an endless number of applications.

- In August 2022, Caterpillar Inc. announced the expansion of its line of standby diesel generator sets with the addition of three new 60 Hz power nodes from 20 to 30 kW for telecommunications, small industries, and commercial applications in North America.

- Report ID: 6550

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Diesel Fired Portable Inverter Generator Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.