Diacetone Alcohol Market Outlook:

Diacetone Alcohol Market size was valued at USD 1.5 billion in 2025 and is expected to reach USD 2.29 billion by 2035, registering around 4.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of diacetone alcohol is evaluated at USD 1.56 billion.

The global diacetone alcohol market is driven by the expanding paints and coatings industry along with rising infrastructure developments. As urbanization and industrialization accelerate, particularly in emerging nations, the demand for high-performance coatings in construction, automotive, and industrial applications rises. Paints, lacquers, varnishes, and coatings are frequently made with diacetone alcohol as a solvent. It aids viscosity control, expedites drying, and improves the product's overall performance. Additionally, large-scale infrastructure projects, including roads, bridges, and commercial buildings, require high-quality protective coatings, further escalating DAA consumption. With governments worldwide investing in smart cities and sustainable construction, the widespread adoption of eco-friendly and high-performance coatings will propel the demand for diacetone alcohol market expansion.

In August 2023, in the U.S., the General Service Administrator (GSA) announced USD 30 million to increase jobs, sustainable construction, and building efficiency in Ohio. Similarly, in March 2024, to decarbonize energy-intensive industries, lower industrial greenhouse gas emissions, support well-paying union jobs, revitalize industrial communities, and boost the country's manufacturing competitiveness, the U.S. Department of Energy recently announced up to USD 6 billion for 33 projects spread across more than 20 states.

Key Diacetone Alcohol Market Insights Summary:

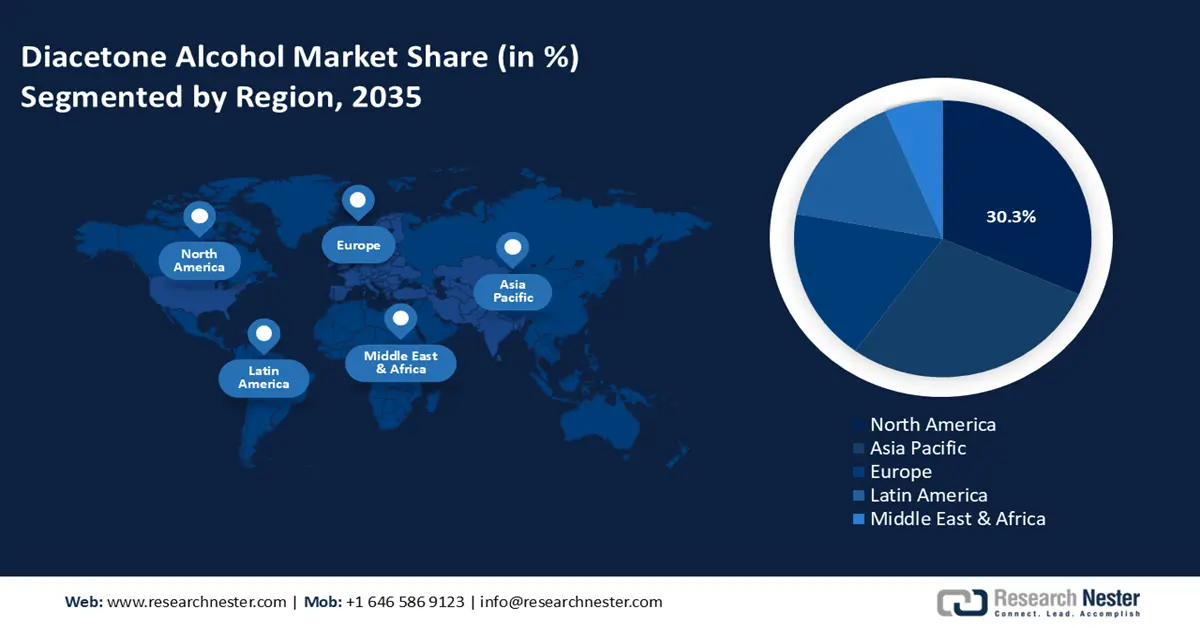

Regional Highlights:

- North America leads the Diacetone Alcohol Market with a 30.30% share, propelled by increasing use of DAA as an organic solvent, sustainability trends, and industrial expansion, positioning it for growth through 2035.

- The Asia Pacific region is expected to witness significant growth in the Diacetone Alcohol Market from 2026 to 2035, driven by rapid urbanization, infrastructure development, and increasing demand from automotive and textile industries.

Segment Insights:

- The paints & coatings segment is projected to hold a 38.5% share by 2035, driven by the rising need for protective and aesthetic coatings.

Key Growth Trends:

- Increasing demand as a chemical intermediate

- Recent advances in the production of diacetone alcohol

Major Challenges:

- Volatile raw material prices

- Safety concerns

- Key Players: Solvay S.A., Arkema S.A., Monument Chemical Inc., Recochem Inc., Prasol Chemicals Pvt. Ltd., Solventis Ltd., SI Group, Inc., Alpha Chemika, Arihant Solvents and Chemicals, LG Chem Ltd..

Global Diacetone Alcohol Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.5 billion

- 2026 Market Size: USD 1.56 billion

- Projected Market Size: USD 2.29 billion by 2035

- Growth Forecasts: 4.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (30.3% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: China, India, Brazil, Mexico, South Korea

Last updated on : 13 August, 2025

Diacetone Alcohol Market Growth Drivers and Challenges:

Growth Drivers

- Increasing demand as a chemical intermediate: The increasing demand for DAA for the production of phorone, isophorone, hexane diol, methyl isobutyl alcohol (MIBC), and others, is escalating the diacetone alcohol market growth. The growing need for both organic and inorganic chemicals, a well-established basis for specialty chemicals, and thriving chemical manufacturing facilities are all contributing causes to the chemical sector's notable growth. The growing demand for methyl isobutyl ketone (MIBK) in various industries, such as paints and coatings, medications, and agrochemicals, contributes to the demand for diacetyl alcohol. Diacetone acrylamide and bisphenol A (BPA), which are utilized extensively in the production of polymers, resins, and plastics, are also made from DAA. DAA provides better bonding properties and increased adhesion to a variety of surfaces when used as a solvent in the production of adhesives.

Diacetone alcohol, or DAA, is an organic compound with the chemical formula CH3C(O)CH2C(OH)(CH3)2. Acetone is industrially converted into diacetone alcohols, which have two alcohol groups and a ketone functional group. Alcohols containing diacetone can dissolve both organic and inorganic substances.

The global trade of acetone plays a crucial role in driving the diacetone alcohol market, as acetone serves as a primary raw material for DAA production. The increase in international trade agreements and reduced tariffs on chemical exports have facilitated smoother cross-border transactions, enhancing market expansion.

|

Exporters |

Export Value of Acetone (in USD million) |

Importers |

Import Value of Acetone (in USD million) |

|

Saudi Arabia |

165 |

China |

444 |

|

Spain |

154 |

Germany |

199 |

|

South Korea |

142 |

Belgium |

91 |

|

Thailand |

137 |

India |

80 |

|

Chinese Taipei |

129 |

Mexico |

76.9 |

The Observatory of Economic Complexity reported that acetone was the 1748th most traded product in the world in 2022, with USD 1.53 billion in total sales. Exports of acetone fell by 28.3% between 2021 and 2022, from USD 2.14 billion to USD 1.53 billion. Acetone trade accounts for 0.0065% of global trade.

- Recent advances in the production of diacetone alcohol: Scientists from several fields have been searching for ways to create chemicals like n-butanol using sustainable biorefinery techniques in place of petrochemical processes to transition the current society and chemical industry to more ecologically friendly alternatives. Recent research in 2022 explored the conversion of bio-based acetone to diacetone alcohol (DAA) through an aldol reaction using Amberlyst A26-OH, a strongly basic ion exchange resin, as a catalyst. Studies have demonstrated that conducting this reaction at lower temperatures enhances both conversion rates and selectivity towards DAA. Additionally, the introduction of water into the reaction medium positively impacts selectivity and extends the catalyst’s service life.

Continuous flow experiments in fixed bed reactors have shown higher selectivity for DAA compared to batch reactors, ascribed to shorter contact times that minimize side reactions. This method offers a sustainable pathway for DAA production by utilizing bio-based acetone but also improves process efficiency and catalyst longevity. As industries increasingly shift towards green chemistry and sustainable practices, such advancements are poised to escalate the diacetone alcohol market. In September 2023, global governments pledged to establish laws to promote safer substitutes and a regulatory framework to lessen chemical pollution by 2030.

Challenges

- Volatile raw material prices: Acetone serves as a primary raw material for diacetone alcohol, an essential chemical solvent and intermediate employed across various industries. The production costs and pricing strategies of diacetone alcohol manufacturers can be significantly influenced by the unpredictable fluctuations in acetone prices. Given the volatility of acetone prices in the international market, companies often contend with unforeseen cost increases, which directly affect their ability to maintain stable and competitive pricing for diacetone alcohol. This volatility hampers diacetone alcohol market expansion and poses challenges for long-term planning and investment.

In response to these challenges, businesses operating in the diacetone alcohol sector must consider implementing risk management strategies, diversifying their supply sources, and exploring more cost-effective acetone production alternatives. Such measures are not only vital for mitigating the adverse effects of acetone price fluctuations but will also foster resilience and support sustained growth in the face of fluctuating raw material costs.

- Safety concerns: Since improper exposure to diacetone alcohol can be harmful to human health in a number of ways, its usage is strictly restricted by regulatory bodies around the world. By 2037, the market is expected to grow more slowly because of the complications and stringent regulations around the use, storage, and shipping of diacetone alcohol.

Diacetone Alcohol Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.3% |

|

Base Year Market Size (2025) |

USD 1.5 billion |

|

Forecast Year Market Size (2035) |

USD 2.29 billion |

|

Regional Scope |

|

Diacetone Alcohol Market Segmentation:

Application (Solvents, Chemical Intermediates, Cleaning, Drilling Fluids, Preservatives)

The solvents segment is expected to gain a notable diacetone alcohol market share by 2035. Diacetone alcohol is a versatile solvent essential in various industries, particularly paint and coatings. It is used in both solvent-based and water-based paint formulations due to its effective solvent properties for resins, binders, and pigments, leading to high-quality finishes. Additionally, it plays a crucial role in varnish production, enhancing the appearance and protection of surfaces like metal and wood. The growing global demand for building and remodeling projects has further increased its use in varnishes. Diacetone alcohol is also an important ingredient in cleaning and degreasing solutions, gaining popularity due to the rising focus on hygiene in residential and commercial settings.

End use (Paints & Coatings, Textiles, Automotive, Oil & Gas)

Paints & coatings segment is poised to dominate over 38.5% diacetone alcohol market share by 2035. The segment’s growth can be attributed to the rising need for protective coatings in industrial settings and the increased emphasis on quality and aesthetics in infrastructure development and construction. In the paint and coatings industry, diacetone alcohol is well known for its efficiency as a solvent and a coalescing agent.

In addition to promoting film formation and coating quality overall, it facilitates the dispersion of pigments, resins, and additives. As a result, coatings have superior adhesion, durability, and environmental resistance. The demand for high-quality paints and coatings has been fueled by the market's notable expansion in the industrial, automotive, and construction sectors. Diacetone alcohol is an essential ingredient in coating formulations because of its adaptability and performance-enhancing qualities, which guarantee brilliant colors, longevity, and protection for a range of surfaces.

Our in-depth analysis of the global diacetone alcohol market includes the following segments:

|

Application |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Diacetone Alcohol Market Regional Analysis:

North America Market Statistics

North America diacetone alcohol market is expected to capture revenue share of over 30.3% by 2035. The regional market is influenced by key industries like textile, chemical, pharmaceutical, and automobile. The use of diacetone alcohol as an organic solvent in various sectors is expected to increase due to a growing emphasis on sustainability, which will also propel regional market expansion. Furthermore, the regional diacetone alcohol market demonstrated stable pricing despite various market challenges. This stability was primarily due to a balance between supply and demand, with consistent production levels sustaining sufficient availability. While there were fluctuations in demand from key industries like paints and coatings, overall consumption remained steady.

Additionally, factors such as rising raw material costs and logistical issues had minimal impact on pricing. The price of diacetone alcohol in the U.S. was stable at USD 2266/MT at the end of the quarter. This stability places DAA pricing within a steady and predictable range throughout the third quarter of 2024, highlighting the diacetone alcohol market's tenacity and capacity to preserve supply and demand equilibrium.

Moreover, in the U.S., the construction and automotive sectors, both major consumers of high-performance coatings, are expanding as a result of infrastructure investments and a rebound in manufacturing activities. Additionally, the country is a major producer of acetone, a key raw material for DAA, ensuring a stable and cost-effective supply chain. Around 12% of the worldwide capacity of acetone is located in North America. The U.S. exported over 100 ktpa in 2023, primarily to Canada. The country also imported about 50 kilotons in 2023. Moreover, growing environmental regulations promoting eco-friendly solvents have also increased the demand for DAA as a low-VOC alternative.

In Canada, stringent environmental and worker safety regulations have led to a shift from traditional solvents to safer alternatives such as DAA, further driving its demand. Canada's official guideline for communicating hazards is the Workplace Hazardous Materials Information System (WHMIS). It ensures workers obtain information about hazardous items through labels, pictograms, Safety Data Sheets (SDS), and staff training. Consistency and clarity in hazard communication are ensured by WHMIS's alignment with the Globally Harmonized System of Classification and Labelling of Chemicals (GHS). Furthermore, the country’s well-established industrial sectors, including, paints and coatings, automotive, and pharmaceuticals, are significant consumers of DAA.

APAC Market Analysis

Asia Pacific market for diacetone alcohol is expected to grow at a significant rate during the projected period. The market is growing as a result of rapid urbanization and industrialization, which has raised infrastructure development, automobile manufacturing, and building activity. These nations' evolving lifestyles and growing disposable wealth have also increased demand for paints, coatings, and adhesives, propelling diacetone alcohol market expansion.

Furthermore, the Government of India is investing heavily in construction and smart city initiatives, and the need for high-performance solvents in protective coatings and paints has surged. Additionally, the booming automotive and textile industries, which rely on DAA for formulations, are further driving diacetone alcohol market demand. The India Brand Equity Foundation reported that by 2030, the textile and apparel industry in India is forecast to reach USD 350 billion at a 10% compound annual growth rate (CAGR), with USD 100 billion in exports anticipated.

As one of the largest producers and consumers of chemicals, China benefits from a well-established supply chain and access to raw materials such as acetone, which is essential for DAA production. China is expected to raise its chemical capacity by 18.7 million tons annually by 2024, which will make up 81% of the worldwide capacity growth. Additionally, the country’s shift towards eco-friendly and bio-based chemicals aligns with global sustainability trends, encouraging investment in advanced production technologies for DAA.

Key Diacetone Alcohol Market Players:

- Solvay S.A.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Arkema S.A.

- Monument Chemical Inc.

- Recochem Inc.

- Prasol Chemicals Pvt. Ltd.

- Solventis Ltd.

- SI Group, Inc.

- Alpha Chemika

- Arihant Solvents and Chemicals

- LG Chem Ltd.

The diacetone alcohol market will continue to expand as a result of major players in the industry making significant investments in R&D to expand their product ranges. Major market developments include new product releases, contractual agreements, mergers and acquisitions, increased investments, and cooperation with other organizations. Market participants are also engaging in a variety of strategic initiatives to broaden their presence. The Diacetone Alcohol market needs to provide affordable products to grow and thrive in a more competitive and expanding market environment.

Recent Developments

- In December 2022, Parsol Chemical Ltd. concentrated on R&D and product development. The organization's R&D team consists of 14 competent and experienced chemical engineers and chemists.

- In July 2022, LG Chem revealed that it has begun to ship its first bio-balanced phenol and acetone. It is a product that has obtained the International Sustainability & Carbon Certification PLUS (ISCC PLUS), a global sustainable eco-friendly material certification, by utilizing renewable bio-feedstock such as biomass or waste frying oil.

- Report ID: 7110

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Diacetone Alcohol Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.