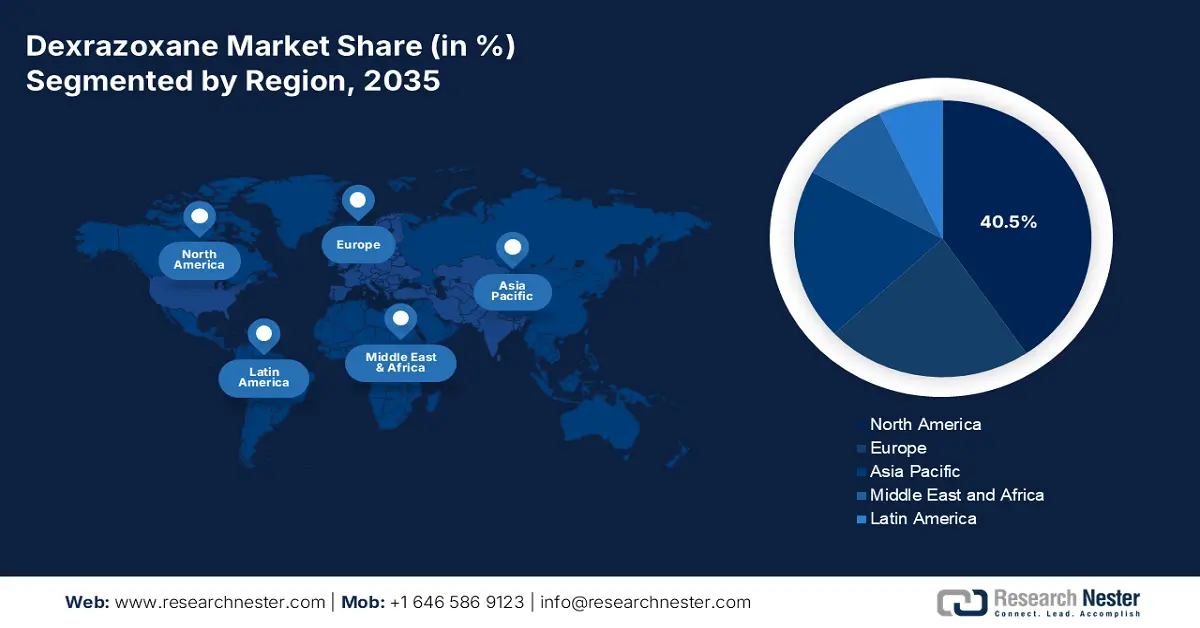

Dexrazoxane Market - Regional Analysis

North America Market Insights

The North America dexrazoxane market is poised to capture the largest share of 40.5% during the forecast period, 2026-2035. The region benefits from the presence of emerging nations such as the U.S. and Canada, which contribute to the maximum revenue share in the region. U.S. dominates the North America market owing to the extensive utilization of chemotherapy treatments and insurance reimbursement policies. Besides, the CMS states that Medicare expenditure for this element in 2024, fueled by the coverage for pediatric oncology. The U.S. FDA’s 2023 label expansion for adults having a higher risk further increased the adoption of dexrazoxane, contributing to market progression in the region.

The U.S. dexrazoxane market is dominated by huge government expenditure and favorable reimbursement policy. The major trend is the increasing coverage of Medicare for cardioprotective agents due to population aging and long-term cancer care needs. As reported by the AACR Cancer Progress Report in 2025, the NIH’s National Cancer Institute (NCI) supports extensive research to focus on managing adverse effects of cancer treatments, with extramural grants contributing to overall NIH cancer research funding that surpassed USD 37.81 billion in FY 2023. There is also federal funding reflected, with the NIH having given priority to research on preventing chemotherapy side effects, solidifying demand. These together create a stable growth in the market, aiming to enhance patient outcomes in oncology care.

There is a huge opportunity for the market in Canada, driven by the increasing provincial healthcare investments. The market is anticipated to grow with government-backed funding and increasing instances of cancer cases. Besides, Ontario report in July 2023 states that Ontario for the Ministry of Health, provides 75% of the total funding for intravenous cancer drugs. This budget supports in adoption, accessibility, and clinical use as part of the broader oncology drug budget. Moreover, Health Canada mandated this element for pediatric anthracycline use, reflecting the higher efficacy.

Cancer Statistics in U.S. and Canada

|

Category |

U.S. (2025) |

Canada (2024) |

|

New Cancer Cases |

2,041,910 estimated new cases |

247,100 new cases |

|

Cancer Deaths |

618,120 estimated deaths |

88,100 deaths |

|

Men (Top 3 Cancers) |

Prostate, Lung, Colorectal 48% of diagnoses |

127,100 new cases (all cancers combined) |

|

Women (Top 3 Cancers) |

Breast, Lung, Colorectal → 51% of diagnoses |

120,000 new cases (all cancers combined) |

Source: National Cancer Institute May 2025, Canadian Cancer Society 2025

APAC Market Insights

Asia Pacific is expected to demonstrate the fastest growth in the market with its strong capacity in pharmaceuticals, including cancer therapeutics. The region is augmenting such growth due to the increasing burden of cancer, expanded medical access, and proactive government initiatives aiming to enhance management strategies. Besides, countries in the region are appreciably integrating cardioprotective therapies in cancer treatments, denoting an increased adoption. Hence, these factors will readily bolster the market positioning of Asia Pacific as a key leader in the market.

The market of dexrazoxane in India is growing at a very fast rate because of the high dedication of public and private healthcare centers to provide phenomenal cancer care. In this respect, the PRS Legislative Research report in 2025 has stated that during 2025-26, Rs 99,859 crore has been invested by the Ministry, which is an 11% rise compared to 2024-25 in the healthcare sector. This increased investment reflects more access to advanced oncology drugs such as dexrazoxane, bolstering cancer care infrastructure in India.

The China dexrazoxane market is experiencing stable growth, driven by the rising cancer burden and growing application of anthracycline-based chemotherapies that require cardioprotective measures. According to the NLM report in February 2022, the number of cancer cases in China in 2022 was 4,820,000. This persistent disease incidence underscores the need for supportive therapies such as dexrazoxane to avert chemotherapy-related adverse effects. Increased hospital infrastructure expansion, along with increased investment in oncology research, positions China as a leading emerging market for dexrazoxane in the Asian region.

Europe Market Insights

The market in Europe is influenced by high rates of cancer prevalence and treatment, strong healthcare infrastructure, and strict regulatory systems that provide drug safety and efficacy. Key growth drivers include the increasing adoption of anthracycline-based chemotherapy and a growing emphasis on cardioprotection to mitigate associated cardiac toxicity. Trends indicate a transition towards treatments, which include cardioprotective agents such as dexrazoxane that are driven by positive reimbursement policies and government programs.

The UK is set to have the largest revenue share in Europe by 2035, led by a strong healthcare policy environment and accelerated uptake of clinical guidelines. The National Institute for Health and Care Excellence (NICE) guideline recommends dexrazoxane for certain patient populations, providing uniform application in the NHS. Based on nhs.uk statistics, the Cancer Drugs Fund spending in 2023/2024 was about £247 million, covering early access to novel cancer drugs. Strong clinical research facilities in the UK, financed by Cancer Research UK, also enhance market penetration.

Germany is also leading the dexrazoxane market in Europe and is fueled by its rising population and comprehensive statutory health insurance system. The Federal Ministry of Health states that a continuus reimbursement expansion codes for support in oncological care. Further the high decentralized healthcare system in Germany allows a swift adoption in university hospitals and regional cancer centers. The major trend is rising the focus on outcomes on long term patient in reducing the chemotherapy related comorbidities which is prioritized by the German Cancer Research Center.

Cancer Drugs Fund Expenditure 2023-2024

|

Total CDF budget 2023/24 |

£340 million |

|

n/a |

Cumulative YTD Totals |

|

n/a |

Quarters 1 to 2 |

|

n/a |

Actual (£) |

|

Interim funding agreements |

£20.56 million |

|

Managed access agreements |

£226.51 million |

|

Total drug cost |

£247.07 million |

Source: NHS December 2024