Dewatering Aids for Mining Market Outlook:

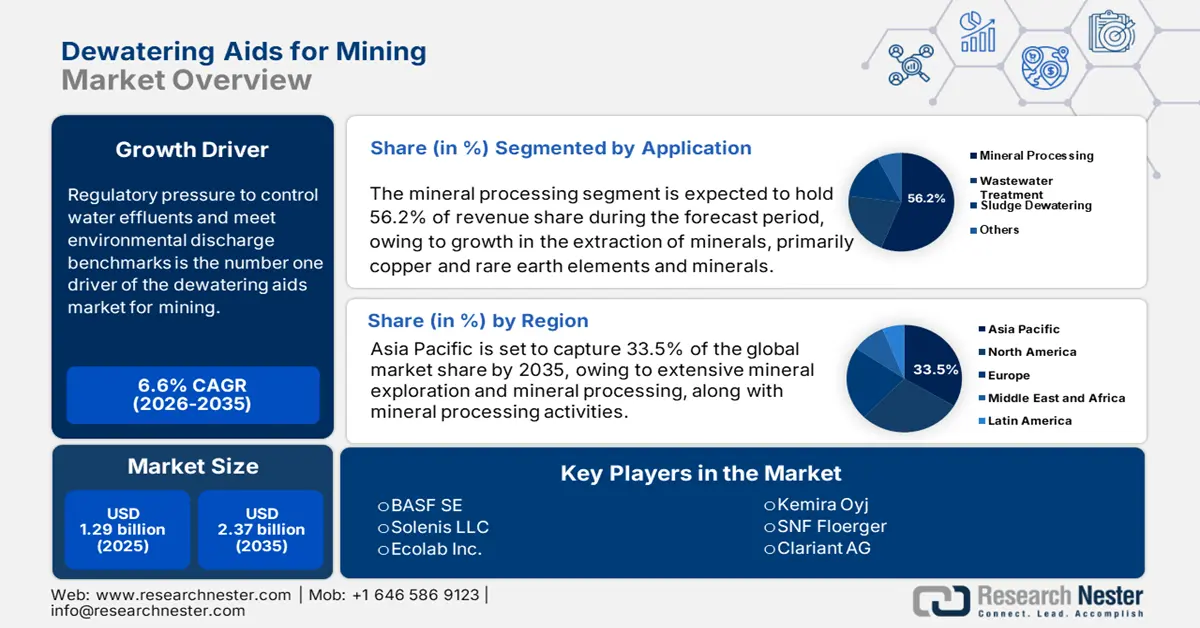

Dewatering Aids for Mining Market size was estimated at USD 1.29 billion in 2025 and is expected to surpass USD 2.37 billion by the end of 2035, rising at a CAGR of 6.6% during the forecast period, i.e., 2026-2035. In 2026, the industry size of dewatering aids for mining is assessed at USD 1.37 billion.

Regulatory pressure to control water effluents and meet environmental discharge benchmarks is the number one driver of the dewatering aids for mining market. The Environmental Protection Agency (EPA) regulations state the use of advanced chemical and mechanical dewatering systems to meet the effluent limitations for the releases of storm and mine waters. This means that the mining operator will have to integrate high-performance flocculants, coagulants, filter systems, and monitoring solutions into their process. This demand for highly efficient and effective dewatering will increase mining operators' demand, as stated by the EPA in the Producer Price Index for Chemicals and Allied Products, which includes the dewatering aid formulations, has increased above the index value of 201 points (1983=100) for the past couple of years as part of increasing compliance demand of mining, biomass and other industries.

The supply chain of dewatering aids relies on specialty Chemicals and Polymers that are domestically supplied and also imported. EPA's recent analyses of the water treatment Chemical market indicate that there is a track record of stable domestic manufacturing with limited chemical expansions (restart capacity) on occasion to meet demand. In 2022, US exports of environmental technology (dewatering systems are included) were $7.8 billion. The US manufacturers have established assembly lines in the US, Mexico, and other countries to support their global customer base in mining. Currently, there are federal R&D grants funded to improve mine water treatment and polymer function, but no dollar figures are available as investments are private to firms. However, continuing R&D and increasing capacity will likely need to be completed to comply with future stricter regulations.

Key Dewatering Aids for Mining Market Insights Summary:

Regional Insights:

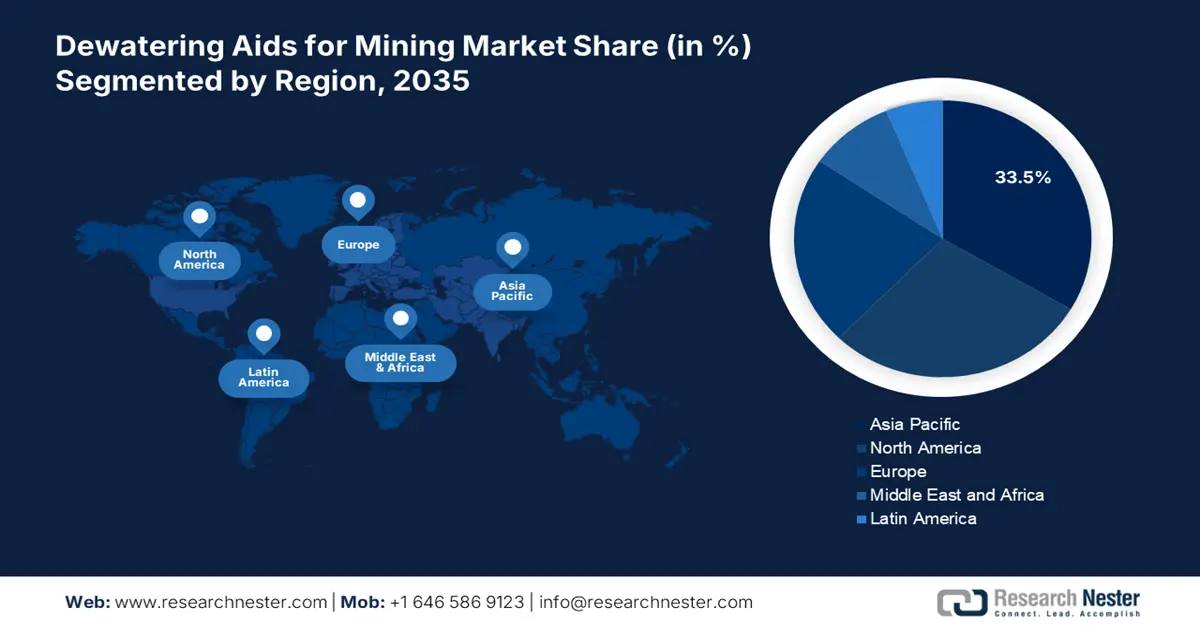

- By 2035, the Asia Pacific region is anticipated to command a 33.5% share of the Dewatering Aids for Mining Market during 2026–2035, owing to expanding mineral exploration and processing activities across China, India, and Southeast Asia.

- The North American region is projected to secure a 28.8% share by 2035, underpinned by rising metal and mineral mining activity and the growing adoption of bio-based dewatering aids aligned with stringent disposal norms.

Segment Insights:

- The Mineral processing segment is forecast to represent a 56.2% share by 2035 in the Dewatering Aids for Mining Market across 2026–2035, propelled by tightening discharge regulations.

- The Polyacrylamide (PAM) flocculants segment is expected to achieve a 43.2% share by 2035, supported by escalating requirements for enhanced water-recycling performance.

Key Growth Trends:

- Water scarcity and recycling regulations

- Expansion of copper mining activities

Major Challenges:

- Limited skilled workforce for chemical application

- High capital expenditure requirements

Key Players: BASF SE, Solenis LLC, Ecolab Inc., Kemira Oyj, SNF Floerger, Clariant AG, Huntsman Corporation, Ashland Global Holdings Inc., Nalco Water (Ecolab), Cytec Solvay Group, Chemifloc Limited, Aries Chemical Inc., NALCO India Limited, Ixom Operations Pty Ltd, Jutasama Sdn Bhd.

Global Dewatering Aids for Mining Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.29 billion

- 2026 Market Size: USD 1.37 billion

- Projected Market Size: USD 2.37 billion by 2035

- Growth Forecasts: 6.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (33.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Australia, Canada

- Emerging Countries: India, Indonesia, Chile, Brazil, South Africa

Last updated on : 30 September, 2025

Dewatering Aids for Mining Market - Growth Drivers and Challenges

Growth Drivers

- Water scarcity and recycling regulations: Mining operations utilize significant amounts of water. The International Council on Mining and Metals reports that roughly 71-81% of mine water is used in mineral processing. Concurrently, increasing scarcity of fresh water due to climate change, regulators (e.g., the EPA and Australia's National Water Initiative) are enforcing more stringent water recycling rates. As a result, polymer-based dewatering aids that support solid-liquid separation, reduce the amount of fresh water required, improve process water recovery, and support the lowest environmental impacts while decreasing operating costs and risk associated with fresh water sourcing are being demanded.

- Expansion of copper mining activities: The expansion of copper mining will be a very strong market driver. The International Energy Agency estimates a nearly double demand for copper by the year 2040 under net-zero scenarios. Major projects like Peru's Quellaveco and Chile's Quebrada Blanca Phase 2 have resulted in increased copper concentrate production. Mining copper ore creates significantly large quantities of tailings, which require effective dewatering technologies in order to sustainably manage and profitably dispose of slurry and tailings. This creates demand for polymer-dewatering aids, which can improve filtration rates for tailings, final cake dryness, and overall plant throughput efficiency.

- Growing preference for energy-efficient processes: Mining companies are being asked to decrease energy consumption per ton of ore treated. From its data, SNF Group showed that dewatering aids can reduce filtration cycle times and reduce jammed mechanical dewatering energy consumption by up to 31%. As interest in energy-efficient mineral processing increases, metal producers are marketing what they do to help meet carbon emission targets, mitigate rising power costs, and comply with sustainability frameworks like the ICMM Climate Change Position Statement. The increase in the appropriate use of advanced chemical aids will further enhance the productivity of solid-liquid separation processes.

Production of Copper Ore and Rare-Earth Metal

Dewatering aids are chemical additives used to improve water removal from mineral slurries, optimize tailings management, and enhance filtration efficiency in mining operations. The production of copper ore and rare-earth metals generates large volumes of slurry and fine tailings that require effective dewatering to maintain operational efficiency and reduce environmental impact.

Production of Copper Ore (2021)

|

Country |

Trade Value |

Quantity (Kg) |

|

Indonesia |

5,386,225.82 |

2,235,450,000 |

|

Canada |

4,136,652.37 |

495,327,000 |

|

U.S. |

2,924,569.88 |

364,269,000 |

|

European Union |

1,433,214.82 |

999,685,000 |

|

India |

61,042.10 |

42,307,500 |

|

China |

508.52 |

472,628 |

|

UK |

58.18 |

7,713 |

Source: WITS

Country-wise Rare-Earth Metal Market Data (2025)

|

Country |

Trade Value |

Quantity (Kg) |

|

China |

334,018.32 |

7,784,470 |

|

U.S. |

22,096.38 |

400,171 |

|

China |

20,381.01 |

256,232 |

|

European Union |

8,867.30 |

492,052 |

|

India |

4,902.68 |

1,085,220 |

|

UK |

4,418.68 |

77,199 |

|

Germany |

4,281.09 |

345,462 |

|

Canada |

948.20 |

50,742 |

Source: WITS

Challenges

- Limited skilled workforce for chemical application: Effective performance of dewatering aids is dependent on proper dosage and optimized process. There is a skills shortage in the mining sector, the Society for Mining, Metallurgy & Exploration (SME) reported a 43% decrease in qualified mineral processing professionals in North America over the past ten years, and similar figures are evident in Australia and South Africa. This skills gap creates operational inefficiencies and reduces the speed of adopting advanced chemical aids due to a lack of application skills.

- High capital expenditure requirements: The implementation of dewatering aids necessitates a considerable investment in dosing machinery, automation, and the integration of monitoring systems. These substantial expenses are frequently a barrier for small and mid-tier mining companies, particularly in regions such as Latin America and Africa, where operational budgets are constrained. Consequently, numerous miners find it challenging to invest in these technologies, which hinders their adoption and delays market penetration in these regions.

Dewatering Aids for Mining Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.6% |

|

Base Year Market Size (2025) |

USD 1.29 billion |

|

Forecast Year Market Size (2035) |

USD 2.37 billion |

|

Regional Scope |

|

Dewatering Aids for Mining Market Segmentation:

Application Segment Analysis

Mineral processing segment is fueled by the intensive extraction of essential minerals such as copper, lithium, and rare earth elements (REEs), anticipated to command a significant dewatering aids for mining market share of 56.2% by the year 2035. This anticipated growth necessitates the implementation of advanced water management practices, driven by stringent discharge regulations and the need for high-efficiency water recycling. As a result, there is an increasing demand for effective dewatering agents to mitigate operational costs and the substantial fees linked to compliant effluent disposal. In support of this trend, the U.S. Geological Survey forecasts that global copper production will reach 29.0 million metric tons by 2030, highlighting the vast scale of processing activities.

Type Segment Analysis

The segment of polyacrylamide (PAM) flocculants is anticipated to secure a 43.2% share of the dewatering aids for mining market by the year 2035, marking the most substantial growth within the dewatering aids sector. This leading position is due to PAM's exceptional effectiveness in aggregating particles and recovering water for tailings management, surpassing the performance of less efficient alternative products. The implementation of stringent environmental regulations that require increased water recycling rates and minimized discharge volumes in the mining industry a significant factors driving this trend. The U.S. Geological Survey emphasizes the importance of this efficiency, noting that more than 90% of the water utilized in copper mining is consumed during the milling and concentration stages, highlighting the considerable demand for high-performance flocculants that facilitate water reuse.

End use Segment Analysis

The coal mining segment is anticipated to constitute the most significant growth by 2035, with 38.2% dewatering aids for mining market share, mainly as the U.S. Energy Information Administration (EIA) states that thermal coal production remains in the Asia-Pacific to satisfy regional power needs. Dewatering aids such as flocculants and coagulants are crucial in coal wash plants to increase moisture reduction, reduce transportation costs, and improve calorific value before being shipped. The need for effective tailings consolidation and water recovery for reuse is increased by environmental restrictions on slurry disposal in coal mines, which in turn increases flocculant use. According to the U.S. Energy Information Administration, China produced 4.01 billion short tons of coal in 2022, underscoring the immense scale of operations requiring efficient dewatering.

Our in-depth analysis of the dewatering aids for mining market includes the following segments:

|

Segment |

Subsegments |

|

Type |

|

|

Application |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Dewatering Aids for Mining Market - Regional Analysis

Asia Pacific Market Insights

By 2035, the Asia Pacific market is expected to hold 33.5% of the dewatering aids for mining market share due to extensive mineral exploration and mineral processing, along with mineral processing activities in China, India, and Southeast Asia. Although China's management policies are becoming stricter, ultimately, the rapid increase in coal mining in India will strengthen demand. The forecast value of the market will show substantial growth on account of ore recovery efficiency improvements and in processing plants where demand for water scarcity mitigation is being addressed. Investments being made in gold and nickel extraction technologies in Australia and Indonesia will collectively enhance market growth. Advances in technology that improve solid-liquid separation will still be in strong demand and directly correlate to the positive growth of dewatering aids for the mining market.

China will provide a sustained growth of dewatering aids for mining market in the region from 2026 to 2035, as its environmental policies related to zero-discharge tailings facilities and dewatering improvement policies will create value. The market will be sustained based on the continued high level of mineral extraction, including coal, iron ore, and rare earth elements. Additionally, the rapid uptake of advanced chemical reagents that promote filtration improvements and reductions in slurry moisture content will drive growth in the category of conformance, where the customer buys dewatering aids. The adoption of green mining under the five-year plans will warrant higher consumption of dewatering aids. Furthermore, the expansion of mineral processing capacity to meet domestic and export demand will continue to expand development in China, a core area for growth. This is evidenced by the scale of its mining sector; according to the U.S. Geological Survey, China accounted for 60% of global rare earth mine production in 2023, extracting 240,000 metric tons.

India is anticipated to emerge as the fastest-growing dewatering aids for mining market in the Asia-Pacific until 2035, propelled by the expansion of its mining sector and a governmental objective of achieving 1.5 billion tonnes of coal production by 2030. The National Mineral Policy of 2019 emphasizes sustainable mining practices, scientific mineral processing, and the integration of advanced technologies, thereby underscoring the necessity for effective dewatering solutions. These regulations advocate for water recycling and stringent tailings management, which in turn boosts the demand for high-performance flocculants and dewatering aids within mineral processing operations.

North America Market Insights

The North American market is expected to hold 28.8% of the dewatering aids for mining market share due to the increased metal and mineral mining activity in the region. The rising demand for effective tailings and sludge treatment and disposal options (along with stringent environmental disposal requirements) is driving adoption in North America. Large producers in North Mountain are investing heavily in bio-based dewatering aids to meet EPA and mining regulatory agency sustainability standards.

Canada is expected to demonstrate the most significant growth rate in the dewatering aids for mining market across North America, propelled by its Critical Minerals Strategy, which focuses on enhancing the production of essential resources such as nickel, cobalt, and lithium. The stringent environmental regulations enforced by Environment and Climate Change Canada (ECCC), along with the necessity to process intricate ores in remote mines located in cold climates, are driving the demand for sophisticated, tailored dewatering solutions. Additionally, Natural Resources Canada is promoting innovations such as in-line dewatering to minimize the volumes of oil sands tailings ponds.

In the U.S., the dewatering aids for mining market is anticipated to grow at a 5.6% CAGR by 2035. This growth trend is driven by an increase in underground mining operations, the development of tailings filtration units, and the increased focus of the US mining industry on water recycling and compliance with Clean Water Act discharge limits. Major producers are looking to invest in new polymer blends to increase separation efficiency for coal, gold, and rare earth mineral processing applications in both the Western and Appalachian mining belts of the U.S.

Europe Market Insights

The European dewatering aids for mining market is significantly shaped by strict environmental regulations, particularly the EU Water Framework Directive, which requires improved wastewater treatment and resource recovery initiatives. Major factors driving this market include increasing urbanization and the growth of industrial activities that heighten the demand for sophisticated dewatering technologies. Germany and the UK play pivotal roles in this market due to their well-established industrial sectors and dedication to sustainable water management practices, bolstered by robust regulatory frameworks.

Germany is anticipated to command the largest portion of Europe’s dewatering aids for mining market by 2035, driven by its strong industrial foundation and stringent environmental policies that align with EU directives. The country’s 2025 Annual Economic Report underscores the importance of infrastructure development, especially in water and wastewater systems, as vital to its economic growth and environmental sustainability objectives. In a similar vein, the UK is expected to emerge as a prominent market player by 2035, fueled by its advanced water treatment infrastructure and rigorous government regulations. The UK government’s spending review highlights ongoing investments in enhancements to wastewater treatment, including dewatering technologies, to comply with changing environmental standards.

Key Dewatering Aids for Mining Market Players:

- BASF SE

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Solenis LLC

- Ecolab Inc.

- Kemira Oyj

- SNF Floerger

- Clariant AG

- Huntsman Corporation

- Ashland Global Holdings Inc.

- Nalco Water (Ecolab)

- Cytec Solvay Group

- Chemifloc Limited

- Aries Chemical Inc.

- NALCO India Limited

- Ixom Operations Pty Ltd

- Jutasama Sdn Bhd

The dewatering aids for mining market is consolidated, as it is led by global chemical firms such as BASF, Solenis, and Ecolab. The key competitive factors for companies making dewatering aids for mining were identified as innovation in technology, integration of supply chains, and sustainability. For example, while BASF and Kemira were focusing on research and development of environmentally-friendly, acceptable flocculants, SNF Floerger and Clariant were focused on regional expansion of production to reduce logistics costs. Huntsman and Ashland are investing in improvements in polymer chemistry to improve the performance of the product, ideally, the operational integrity for mining customers. All had strategies of partnerships with mining companies, mergers to broader portfolios, and production in the Asia Pacific and Latin America to establish a local supply logistics.

Some of the key players operating in the dewatering aids for mining market are listed below:

Recent Developments

- In July 2024, Atlas Copco announced a new expansion range of WEDA submersible dewatering pumps made for heavy-duty mining and construction. Their properties make them mobile, reliable, low maintenance, and now feature efficiencies of about 16-21% improved from the last WEDA pump models, thanks to optimized motor design and automation in the pump assembly. The development will help mining operators lower downtime and operational costs, and at the same time, it furthers the growth momentum of dewatering aids as a sought-after commodity in the global mining marketplace.

- In 2024, Veolia and ANDRITZ patented next-generation organic-inorganic adjustment hybrid flocculants to overcome the dewatering of ultra-fine particles in the mining sector. The advanced polymer was tested and achieved approximately 26% higher solid capture efficiencies. Within one year, the three major South American copper mines that adopted this technology saw a 13% improvement in concentrate dry stacking capacity, as well as better overall operational performance and environmental compliance during their mineral processing operations.

- Report ID: 4286

- Published Date: Sep 30, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Dewatering Aids for Mining Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.