- An Outline of the Desktop Music Market

- Market Definition

- Market Segmentation

- Product Overview

- Research Methodology

- Executive Summary

- Analysis on Market Dynamics

- Drivers

- Trends

- Opportunity

- Restraints

- Regulatory & Standards Landscape

- Industry Risk Analysis

- Impact of COVID-19 on Global Desktop Music Market

- Regional Analysis on Number of Desktop Music User

- Pricing Analysis

- Industry Value Chain Analysis

- Competitive Landscape

- Market Share Analysis, 2021

- Market Share Analysis of Major Players (%), 2021

- Competitive Benchmarking

- Ableton AG

- Image Line Software (FL Studio)

- Logitech

- Panasonic Holdings Corporation

- Sony Corporation

- Bose Corporation

- Avid Technology, Inc.

- Adobe

- Sennheiser electronic GmbH & Co. KG

- Bitwig GmbH

- Apple Inc.

- Cockos Incorporated

- Market Share Analysis, 2021

- Global Desktop Music Market

- Market Overview

- By Value (USD million)

- Global Desktop Music Market Segmentation Analysis 2023-2036

- By Component

- Software, 2023-2036F (USD Million)

- Digital Audio Workstation (DAW), 2023-2036F (USD Million)

- Audio Player, 2023-2036F (USD Million)

- Services, 2023-2036F (USD Million)

- Accessories, 2023-2036F (USD Million)

- Headphones, 2023-2036F (USD Million)

- Speakers, 2023-2036F (USD Million)

- Others, 2023-2036F (USD Million)

- Software, 2023-2036F (USD Million)

- By Software Deployment

- On-Premises, 2023-2036F (USD Million)

- Cloud, 2023-2036F (USD Million)

- By OS Compatibility

- Mac, 2023-2036F (USD Million)

- Windows, 2023-2036F (USD Million)

- Others, 2023-2036F (USD Million)

- By End-User

- Commercial, 2023-2036F (USD Million)

- Individual, 2023-2036F (USD Million)

- Global Desktop Music Market by Region

- North America, 2023-2036F (USD million)

- Europe, 2023-2036F (USD million)

- Asia-Pacific, 2023-2036F (USD million)

- Latin America, 2023-2036F (USD million)

- Middle East & Africa, 2023-2036F (USD million)

- By Component

- North America Desktop Music Market

- By Component

- Software, 2023-2036F (USD Million)

- Digital Audio Workstation (DAW), 2023-2036F (USD Million)

- Audio Player, 2023-2036F (USD Million)

- Services, 2023-2036F (USD Million)

- Accessories, 2023-2036F (USD Million)

- Headphones, 2023-2036F (USD Million)

- Speakers, 2023-2036F (USD Million)

- Others, 2023-2036F (USD Million)

- Software, 2023-2036F (USD Million)

- By Software Deployment

- On-Premises, 2023-2036F (USD Million)

- Cloud, 2023-2036F (USD Million)

- By OS Compatibility

- Mac, 2023-2036F (USD Million)

- Windows, 2023-2036F (USD Million)

- Others, 2023-2036F (USD Million)

- By End-User

- Commercial, 2023-2036F (USD Million)

- Individual, 2023-2036F (USD Million)

- By Country

- US, 2023-2036F (USD Million)

- Canada, 2023-2036F (USD Million)

- By Component

- Europe Desktop Music Market

- By Component

- By Software Deployment

- By OS Compatibility

- By End-User

- By Country

- UK, 2023-2036F (USD Million)

- Germany, 2023-2036F (USD Million)

- Italy, 2023-2036F (USD Million)

- France, 2023-2036F (USD Million)

- Spain, 2023-2036F (USD Million)

- Netherlands, 2023-2036F (USD Million)

- Russia, 2023-2036F (USD Million)

- Rest of Europe, 2023-2036F (USD Million)

- Asia Pacific Desktop Music Market

- By Component

- By Software Deployment

- By OS Compatibility

- By End-User

- By Country

- Australia, 2023-2036F (USD Million)

- Japan, 2023-2036F (USD Million)

- Singapore, 2023-2036F (USD Million)

- South Korea, 2023-2036F (USD Million)

- China, 2023-2036F (USD Million)

- India, 2023-2036F (USD Million)

- Rest of Asia Pacific, 2023-2036F (USD Million)

- Latin America Desktop Music Market

- By Component

- By Software Deployment

- By OS Compatibility

- By End-User

- By Country

- Brazil, 2023-2036F (USD Million)

- Argentina, 2023-2036F (USD Million)

- Mexico, 2023-2036F (USD Million)

- Rest of Latin America, 2023-2036F (USD Million)

- Middle East & Africa Desktop Music Market

- By Component

- By Software Deployment

- By OS Compatibility

- By End-User

- By Country

- GCC, 2023-2036F (USD Million)

- Israel, 2023-2036F (USD Million)

- South Africa, 2023-2036F (USD Million)

- Rest of Middle East & Africa, 2023-2036F (USD Million)

Desktop Music Market Outlook:

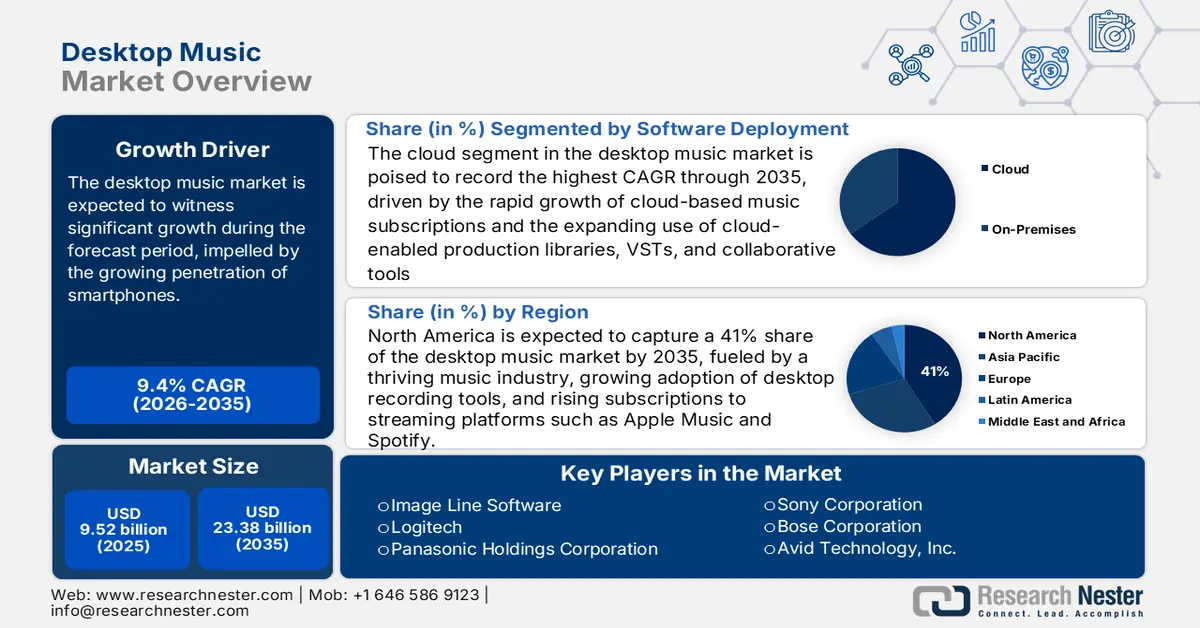

Desktop Music Market size was over USD 9.52 billion in 2025 and is poised to exceed USD 23.38 billion by 2035, growing at over 9.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of desktop music is estimated at USD 10.33 billion.

The growth of the market can be attributed to growing number of people who listen to podcast for the purpose of entertainment, knowledge, and for inspiration or motivation. There are currently approximately, 400 million podcast listeners worldwide. By the end of 2024, it is anticipated that there would be about 500 million listeners globally. Hence owing to the number of podcast listener, the consumption of audio media is growing rapidly. Additionally, podcasters are focusing more on serving the best quality audio to the listener. As a result, podcasters are extensively using digital audio workstations (DAW) to edit their digital audio recordings to remove any unpleasant gaps and create the ideal podcast, which is also expected to boost the demand for the product.

Further, there has been growing investment made by various audio streaming industry which is also estimated to boost the growth of the market. Additionally, owing to increase public interest in electronic music genres and widespread use of electronically produced songs by music producers around the world, the production of electronic music is also expanding rapidly, which is further estimated to boost the market growth. DAW has made it simple to create electronic music on desktop Along with features such as editing, it also offers virtual instruments to the musician. Hence DJs, and music composers all around the world are extensively using DAW for producing music.

Key Desktop Music Market Insights Summary:

Regional Highlights:

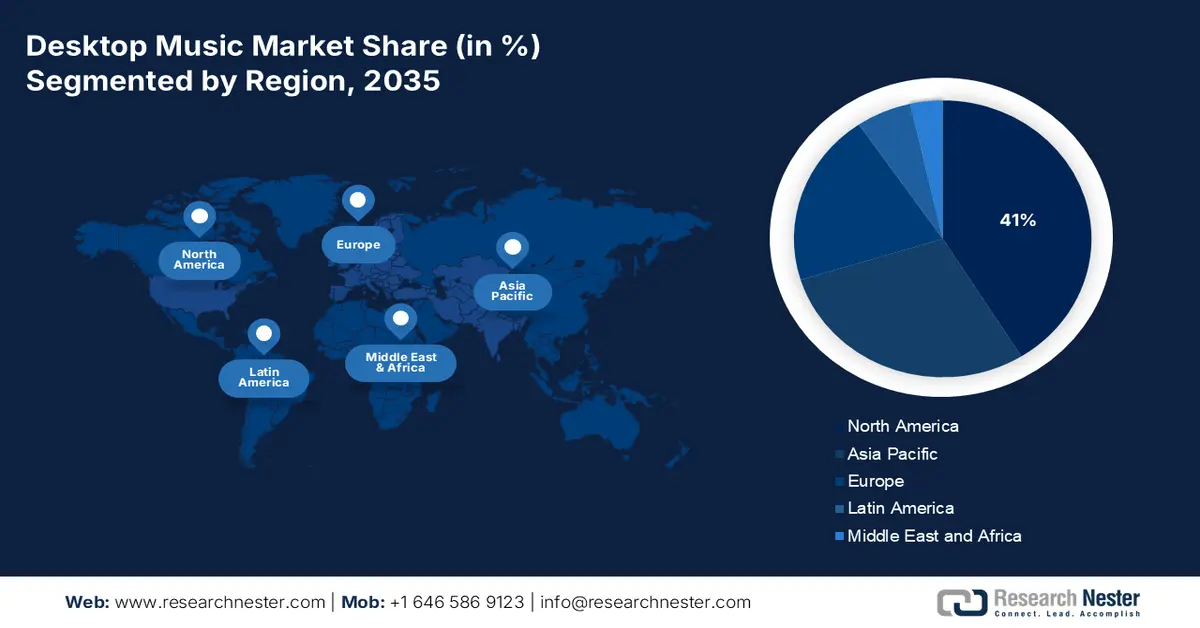

- North America is expected to capture a 41% share by 2035 in the desktop music market, fueled by a thriving music industry, rising adoption of desktop recording tools, and surging subscriptions to streaming platforms such as Apple Music and Spotify.

Segment Insights:

- The cloud segment in the desktop music market is poised to record the highest CAGR through 2035, driven by the rapid growth of cloud-based music subscriptions and expanding use of cloud-enabled production libraries, VSTs, and collaborative tools.

- The Windows segment is projected to generate the highest revenue by 2035, supported by a large and growing Windows user base, broad DAW compatibility, and rising adoption of laptops, iPhones, and smart computing devices.

Key Growth Trends:

- Growing Penetration of Smartphones

- Large Number of OTT Service Users

Major Challenges:

- Challenges for Multitasking Operating Systems

Key Players: Ableton AG, Image Line Software, Logitech, Panasonic Holdings Corporation, Sony Corporation, Bose Corporation, Avid Technology, Inc., Adobe, Sennheiser electronic GmbH & Co. KG, Bitwig GmbH, Apple Inc.

Global Desktop Music Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 9.52 billion

- 2026 Market Size: USD 10.33 billion

- Projected Market Size: USD 23.38 billion by 2035

- Growth Forecasts: 9.4%

Key Regional Dynamics:

- Largest Region: North America (41% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: India, Brazil, Indonesia, Mexico, South Korea

Last updated on : 24 November, 2025

Desktop Music Market - Growth Drivers and Challenges

Growth Drivers

- Growing Penetration of Smartphones - Owing to the growing penetration of smartphones, there has been growth in number of people streaming music and podcast. In 2021, a poll of South Korean music consumers revealed that about 85 percent of participants listened to music most frequently on their smartphones. Furthermore, in Mexico in 2021, about 89% of those who streamed music, used a smartphone to perform the action. Additionally, approximately 80% of Americans use their smartphones to listen to podcasts. Since smartphones allow viewers to access services from anywhere, their preference for listening to music and podcasts is expanding. As a result, it is predicted that more people would consume audio media, which would drive market expansion.

- Large Number of OTT Service Users - About 1 billion individuals used sub-OTT services such as Netflix, Disney+, and Amazon Prime Video in 2022.

- Growing Sales of Electric Music - Electronic artists produced an approximate 75 percent of about USD 50 million in music NFTs that were sold in the year 2020.

- Rising Adoption of Digital Audio Workstations - Panasonic and Klipsch, a tech-driven audio company, recently announced an exclusive agreement to bring the famed "Klipsch Sound" and audiophile-quality performances to the in-vehicle experience at the CES trade show in Las Vegas.

- Surge in Number of Independent Artist - There were about 1,500 independent musicians working full-time in the United States as of May 2019, an increase from the approximate 1,300 recorded the year before.

Challenges

- Challenges for Multitasking Operating Systems - The recording application programme and the computer's operating system (OS) communicate with one another. Although multitasking operating systems are becoming more and more common, they could provide problems for time-sensitive applications in sound recording. The hardware frequently needs complete focus owing to the real nature of the recording process. If numerous processes are running at once, the audio interface might not be able to use the system bus to transport data from the interface to memory or the hard drive. In order to give priority scheduling to time-critical processes, the operating system must coordinate all requests for bus and hard disc access, including those from the OS itself.

- Compositions Are Vulnerable to Loss Owing to Viruses, Data Corruption, or the Loss or Theft of a Computer.

- Disadvantages Older Composers in Comparison to Younger, More Technologically Advanced Musicians.

Desktop Music Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

9.4% |

|

Base Year Market Size (2025) |

USD 9.52 billion |

|

Forecast Year Market Size (2035) |

USD 23.38 billion |

|

Regional Scope |

|

Desktop Music Market Segmentation:

Software Deployment Segment Analysis

The cloud segment in the desktop music market is estimated to grow at the highest CAGR over the forecast period. The growth of this segment can be attributed to rising number of cloud-based music subscriptions. It was observed that, there were about 520 million paid streaming subscribers globally at the end of 2021, up from about 440 million at the end of 2020. This also applies to family plan members who are not paying their own bills. Additionally, in order to give recordists access to large libraries of audio samples, synthesizer presets, VSTs (which, in some cases, include both synthesizers and mixing tools), partially finished works, or finished works for remixing, cloud-based music production (CBMP) services use cloud computing technologies. Hence this factor is also estimated to boost the segment growth.

OS Compatibility Segment Analysis

The global desktop music market is also segmented and analyzed for demand and supply by OS compatibility into Mac, Windows, and others, amongst which the Windows segment is anticipated to garner the highest revenue by the end of 2035. This growth can be attributed to the growing number of window users especially in Asia Pacific region. Microsoft is known for having amazing functionality and features, as well as a sleek and simple user interface. Further, with all popular DAWs, MS Windows offers a great user experience, and it gives user more freedom to select the gear one requires. Additionally, the growth of the segment can be attributed to growing adoption of iPhone, laptops, and smart computers. However, the Mac segment is anticipated to grow at the highest CAGR of 10.0% over the forecast period.

Our in-depth analysis of the global market includes the following segments:

|

By Component |

|

|

By Software Deployment |

|

|

By OS Compatibility |

|

|

By End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Desktop Music Market - Regional Analysis

North American Market Insights

North America industry is likely to hold largest revenue share of 41% by 2035. The growth of the market in this region can be attributed to growing music industry in this region, along with growing demand for desktop recording tools. Also, it has been observed that, on a scale of 1 to 10, 93% of respondents place the music industry's reliance on live performances above seven in United States. Further, there has been growing subscription for streaming services which is also estimated to boost the growth of the market in this region. According to the most recent data, Apple Music had about 48 million monthly customers as of September 2022, making it the most popular music streaming service in the United States. Following closely behind was Spotify, which had an approximately 46 million monthly users. This increase in demand may also be attributed to the increasing use of the internet.

Desktop Music Market Players:

- Ableton AG,

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Image Line Software

- Logitech,

- Panasonic Holdings Corporation,

- Sony Corporation, Bose Corporation,

- Avid Technology, Inc.,

- Adobe,

- Sennheiser electronic GmbH & Co. KG,

- Bitwig GmbH,

- Apple Inc.,

- Others.

Recent Developments

-

Avid Technology, Inc., announced the return of its MBOX desktop audio interface with a brand-new solution, the MBOX Studio powered by Pro Tools software. The announcement was made at the AES Show 2022 in New York City. For artists and other audio makers who want to record, edit, and mix vocals, instruments, and other sources for songs, podcasts, streams, and other audio with remarkable sonic quality in their home studios, MBOX Studio completes the picture.

-

Apple, Inc., introduced Apple Music Sing, a fun new tool that enables users to sing along to their favorite songs with customizable vocals1 and real-time lyrics. To let users, take the lead, sing duets, sing backing, and more within Apple Music's unmatched lyrics experience, Apple Music Sing offers a variety of lyric views.

- Report ID: 4669

- Published Date: Nov 24, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Desktop Music Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.