Desktop-as-a-Service Market Outlook:

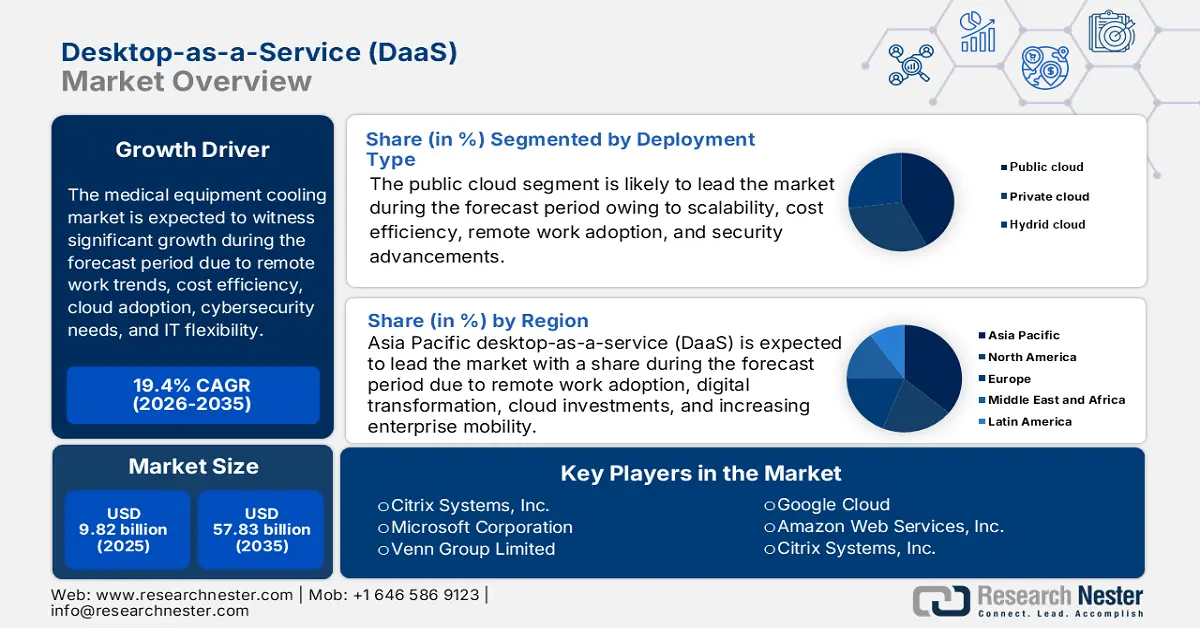

Desktop-as-a-Service Market size was over USD 9.82 billion in 2025 and is poised to exceed USD 57.83 billion by 2035, growing at over 19.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of desktop-as-a-service is estimated at USD 11.53 billion.

The growth of the market can be attributed to the increasing government initiatives to improve IT infrastructure along with increasing IT spending, demand for cloud-based virtual services and adoption of cloud computing services, and growing trends of BYOD (bring-your-own-device) policy. Global IT services spending was estimated to be over USD 1 trillion in 2021, while, in 2020, cloud computing was estimated to have generated over USD 300 billion in revenue.

Organizations are rapidly moving beyond desktop-centric workspace to a multi-device anywhere, anytime infrastructure providing remote access across length. Growing trends of remote working and BYOD policies are creating potential growth opportunities for virtual desktop services, transforming the IT infrastructure. Desktop-as-a-service is a component of virtual desktop infrastructure (VDI) where it is outsourced to and operated by third-party through a cloud-based server. The cloud services provider hosts the infrastructure, network resources, and storage in the cloud server, streaming a virtual desktop, where a user can access the desktop’s data and applications through a web browser or other software. Moreover, benefits such as cost-effectiveness, data control, continuous security control, and centralized administration along with potential opportunities for smart factory are also expected to foster the growth of the global DaaS market. It has been projected that nearly 80% of all virtual desktops will be DaaS by 2024, up from over 30% in 2021 across the globe. Therefore, all these factors are expected to influence the market growth positively over the forecast period.

Key Desktop-as-a-Service Market Insights Summary:

Regional Highlights:

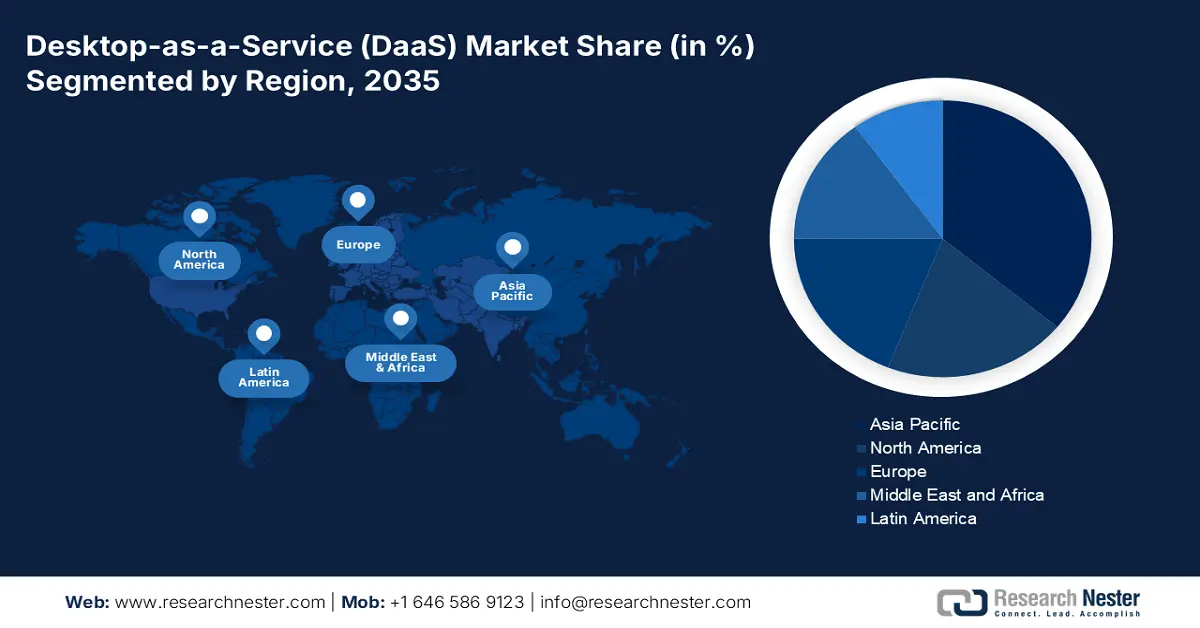

- Asia Pacific desktop-as-a-service (DaaS) market secures the largest share by 2035, driven by rapid adoption of cloud-based services and strong digitization trends.

- North America market will register significant growth from 2026 to 2035, driven by high IT infrastructure adoption and rise in remote work trends.

Segment Insights:

- The small & medium-sized enterprises segment in the desktop-as-a-service market is expected to secure a significant share by 2035, attributed to SMEs adopting device-as-a-service models to minimize upfront costs and enable digital transformation.

- The public cloud segment in the desktop-as-a-service market is forecasted to hold the largest share by 2035, fueled by the cost-effectiveness of public cloud services.

Key Growth Trends:

- Growing Utilization of DaaS in SMEs & MSME

- Rising Adoption of IoT Infrastructure along with Increasing IT Spendings

Major Challenges:

- Lack of Awareness Regarding the Benefits of DaaS

- Concerns Over Data Privacy and Security

Key Players: VMware, Inc., Citrix Systems, Inc., Microsoft Corporation, Venn Group Limited, Google Cloud, Amazon Web Services, Inc., Citrix Systems, Inc., Nutanix, Inc., SolarWinds Worldwide, LLC, Parallels International GmbH.

Global Desktop-as-a-Service Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 9.82 billion

- 2026 Market Size: USD 11.53 billion

- Projected Market Size: USD 57.83 billion by 2035

- Growth Forecasts: 19.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, United Kingdom, Japan

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 9 September, 2025

Desktop-as-a-Service Market Growth Drivers and Challenges:

Growth Drivers

-

Growing Utilization of DaaS in SMEs & MSME – the number of SMEs is growing at a rapid pace. For instance, there were nearly 60 million MSMEs functioning in India alone in 2022 while around 300 million SMEs were observed to function across the globe in 2021.

SMEs are functions as a backbone of a nation’s economy. Small and Medium Enterprises (MSME) do not have large capital to begin with, therefore, desktop-as-a-service (DaaS) becomes quite beneficial for those who owns SMEs. DaaS provides scalability and flexibility such as a user can access the virtual desktop from anywhere and the monthly subscription are very cost- effective.

- Rising Adoption of IoT Infrastructure along with Increasing IT Spendings – based on the statistics, the number of devices connected to IoT were estimated to be around 8 billion in 2019 across the globe which further forecasted to reach around 20 billion by the year 2025 and 30 billion by 2030 globally that is 3 times higher from 2020.

- Increasing Ownership of Desktop and Smartphones among Global Population – in the incorporated sector, smartphones and desktops are heavily utilized to perform various tasks and also by global population for multiple purposes. For instance, approximately 52% of the visits on websites were tracked down to be coming from desktops in 2022. Additionally, in 2018, nearly USD 80 billion were spent by consumers on smartphones.

- Growing Inclination toward Work from Home – around 80% of the employees preferred working from home full-time. Additionally, the increment of productivity was estimated to rise by nearly 45% in work from home jobs. Work from home jobs are highly preferred by women, for instance, around 60% of the women showed their affirmative opinion toward work from home culture globally.

- Spiking Implementation of 5G Technology and Cloud Computing – cloud computing is backbone for desktop-as-a-service (DaaS) since it assists DaaS in offering its features to the end-users across the globe. For instance, in 2021, more that USD 375 billion were generated by the cloud computing segment. Moreover, the launch of 5G technology has also spurred the demand for DaaS globally by providing high-speed internet.

Challenges

-

Lack of Awareness Regarding the Benefits of DaaS - Lack of awareness regarding the benefits of DaaS is restraining the market growth. A remarkable number of people has no awareness of the existence of DaaS. In addition to that, concerns over data privacy and security are hindering the adoption of DaaS, challenging the growth of the market further.

-

Concerns Over Data Privacy and Security

- Complex Maintenance Procedures Associated with Desktop-as-a-Service (DaaS)

Desktop-as-a-Service Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

19.4% |

|

Base Year Market Size (2025) |

USD 9.82 billion |

|

Forecast Year Market Size (2035) |

USD 57.83 billion |

|

Regional Scope |

|

Desktop-as-a-Service Market Segmentation:

Deployment Type Segment Analysis

The public cloud segment is estimated to gain the largest market share over the projected time frame, attributed to the fact that public cloud is the most cost-effective, where services are offered to customer through a pay-as-you-go model which means there is no upfront investment to be made. The cloud service provider ensures proper management and maintenance of the system and the customer only pays for services consumed. Global public cloud DaaS spending in 2021 was estimated to crossed approximately USD 2 Billion.

Organization Segment Analysis

The small & medium, sized enterprises segment is expected to garner a significant share. Owing to low capital, SMEs have high device-as-a-service adoption rate to prioritize their investments by leasing hardware and associated services instead of purchasing high-cost hardware devices. This leads to higher adoption of desktop virtualization services among SMEs also backed the digital transformation worldwide. As of 2021, approximately USD 1 trillion were spent on the digital transformation across the globe which also anticipated reach around USD 6 trillion in 2023.

Our in-depth analysis of the global market includes the following segments:

|

By Deployment Type |

|

|

By Enterprise Size |

|

|

By End-User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Desktop-as-a-Service Market Regional Analysis:

APAC Market Insights

The Asia Pacific desktop-as-a-service (DaaS) market is projected to hold the largest market share by the end of 2035, attributed majorly to the fact owing to rapid adoption of cloud-based solutions and services. Furthermore, strong economic growth in countries such as China and India, and rising digitization along with increasing investments in IT infrastructure are expected to provide potential growth opportunities for the market. For instance, in 2022, the total spending on IT infrastructure in Asia Pacific was evaluated to be approximately USD 550 billion which was as increase of around 15% from previous year.

North American Market Insights

Furthermore, the market in North America region is also expected to witness significant growth over the forecast period. The growth of the market in the region is ascribed to the higher adoption rate of IT infrastructure coupled with IoT, AI platform, and voice assistant. As of 2021, in United States, over 100 million people were observed to be using digital voice assistant. Additionally, rapid growth in the consumer electronics industry and escalating trend of work from home in the region is further estimated to influence the market growth in the region positively.

Desktop-as-a-Service Market Players:

- VMware, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Citrix Systems, Inc.

- Microsoft Corporation

- Venn Group Limited

- Google Cloud

- Amazon Web Services, Inc.

- Citrix Systems, Inc.

- Nutanix, Inc.

- SolarWinds Worldwide, LLC

- Parallels International GmbH

Recent Developments

-

Citrix systems, Inc. and Google Cloud teamed up and expanded their strategic partnership to deliver hybrid work for enterprise customers, with Citrix launching a new desktop-as-a-service (DaaS) offered on Google Cloud.

-

Nutanix, Inc. optimized its multi-cloud services, Xi Frame, Xi Leap and Xi Beam, which are desktop-as-a-service (DaaS) solutions, with additional capabilities.

- Report ID: 4123

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Desktop-as-a-Service Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.