Dermocosmetics Market Outlook:

Dermocosmetics Market size was valued at USD 74.14 billion in 2025 and is expected to reach USD 197.61 billion by 2035, expanding at around 10.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of dermocosmetics is evaluated at USD 81.01 billion.

The dermocosmetics market is substantially growing owing to the increasing appetite for products that combine cosmeceutical with therapeutic functionalities, offering consumers functional solutions for skin diseases such as acne, hyperpigmentation, and aging manifestations. In addition, the prevalence of skin diseases is growing coupled with an increased consciousness about maintaining the standard of beauty, which will continue to fuel the market's growth. Common applications for dermocosmetics are often found in skin disorders, including eczema, acne, and so forth. For example, based on the statistics released by WHO in 2022, exposure to ultraviolet radiation is the main cause of skin cancers. In the year 2020, there were more than 1.5 million global diagnoses of skin cancer cases.

Therefore, the huge utilization of dermocosmetics in disease prevention and cure with varied applications is likely to drive the expansion of the market. Moreover, formulation technologies are also supplementing the growth aspects through clinical study findings whose results endorse the suitability of dermocosmetics products thus enhancing confidence in both consumers as well as brands. The impact of social media and digital marketing strategies is gaining traction as dermatologists and beauty influencers create more visibility and boost engagement with endorsements. Furthermore, the e-commerce platform has widened access to a more comprehensive range of products for satisfying various consumer needs and preferences.

Key Dermocosmetics Market Insights Summary:

Regional Highlights:

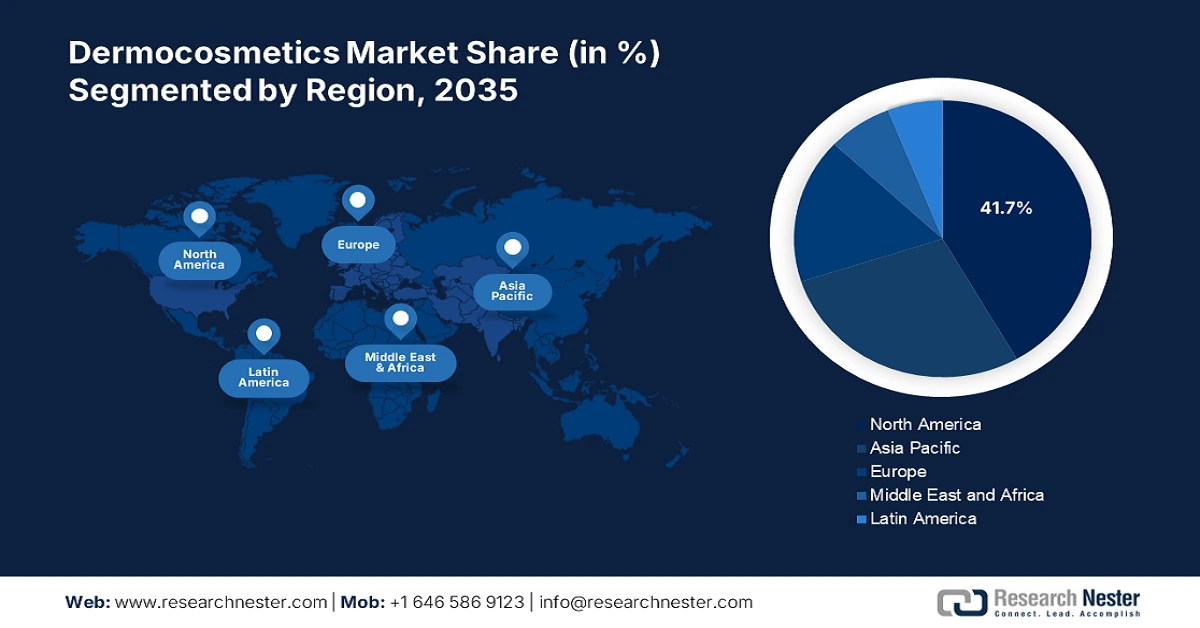

- North America dominates the Dermocosmetics Market with a 41.7% share, propelled by adoption of AI-powered personalized skincare and rising teledermatology trends, ensuring robust growth through 2035.

- The Asia Pacific dermocosmetics market is forecasted for rapid growth through 2035, attributed to rising adoption of skin and hair care products and increased brand penetration.

Segment Insights:

- The Skin Care segment is projected to experience robust growth from 2026 to 2035, fueled by increasing consumer focus on skin health and innovative solutions for diverse skin concerns.

Key Growth Trends:

- Product innovation and research

- Rising demand for personalized products

Major Challenges:

- Consumer expectations and trends

- Ingredient sourcing and supply chain issues

- Key Players: Procter & Gamble, L’Oréal Groupe, Unilever PLC, Avon Products, Inc., Lotus Herbals Pvt. Ltd., VLCC Health Care Limited, Himalaya Global Holdings Ltd.

Global Dermocosmetics Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 74.14 billion

- 2026 Market Size: USD 81.01 billion

- Projected Market Size: USD 197.61 billion by 2035

- Growth Forecasts: 10.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (41.7% Share by 2035)

- Fastest Growing Region: Asia-Pacific

- Dominating Countries: United States, France, Germany, Japan, South Korea

- Emerging Countries: China, India, Brazil, Mexico, Singapore

Last updated on : 13 August, 2025

Dermocosmetics Market Growth Drivers and Challenges:

Growth Drivers

- Product innovation and research: A significant propelling growth factor within the dermocosmetics market is the consumers who are increasingly seeking targeted solutions for specific skin concerns. Thus, companies are compelled to research and develop advanced formulations that address these needs. For instance, in May 2022, Kim Kardashian launched SKKN BY KIM in collaboration with Coty Inc. SKKN BY KIM is a clinically proven skincare solution that helps the skin to support its natural abilities and revitalize the complexion. In addition, the integration of emerging cutting-edge technologies of skincare gives the brands some edge over their competitors, therefore, the expansion in markets is highly facilitated.

- Rising demand for personalized products: Rising demand for individualized products would also lead to a continued growth momentum for the dermocosmetics market, which will signal mass personalization in consumer markets. For instance, in July 2024, Kosé teamed up with I Peace, Inc. and Reju, Inc. to create customized beauty products that include iPSF. It has an induced pluripotent stem [iPS] cell extract from customers' blood-drawn cells. This process will allegedly fine-tune dosages and textures for each consumer. This has made companies adopt advanced technologies to formulate customized compositions that enhance the efficiency and satisfaction of their products.

Challenges

- Consumer expectations and trends: A crucial hurdle for brands to stay relevant in the rapidly evolving dermocosmetics market is consumer expectations and dynamic trends. More informed and discerning consumers look for products that bring efficacy but also meet some of their values, such as sustainability, ethical sourcing, and transparency in ingredient formulation. This shift requires companies to invest in research and development to innovate and adapt their offerings, and also to enhance their marketing strategies in communicating the benefits and integrity of their products. Therefore, being in tune with these dynamic consumer preferences it seems complex for brands looking to build loyalty and grow in a crowded marketplace.

- Ingredient sourcing and supply chain issues: The strict quality controls during the sourcing of raw materials for naturally derived products while applying environmentally friendly practices toward effectiveness and safety is a challenge in the dermocosmetics market. Moreover, the global supply chain causes vulnerability in terms of availability fluctuation and pricing variation, legal compliance, and ethical sourcing. As consumer discernment towards ingredient transparency and sustainability continues to be an issue, dermocosmetic companies find it difficult to make it through these vulnerabilities to hold onto competitive advantage while respecting the industry standard and meeting the expectations of consumers.

Dermocosmetics Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

10.3% |

|

Base Year Market Size (2025) |

USD 74.14 billion |

|

Forecast Year Market Size (2035) |

USD 197.61 billion |

|

Regional Scope |

|

Dermocosmetics Market Segmentation:

Product (Skin Care, Hair Care)

In dermocosmetic market, skin care segment is poised to capture around 66.2% revenue share by the end of 2035. It is driven primarily by the escalating consumer focus on skin health and wellness. The insight into the role of environmental factors as well as lifestyle choices and their influence on the development of skin conditions has increased. For instance, in January 2023, L'Oréal unveiled the brow care and skin supplements and promoted them during the annual CES tradeshow of the Consumer Technology Association. This shift has left the brands to innovate incessantly by formulating advanced products that satisfy diverse concerns of the skin, which in turn places the skincare segment at the very forefront of the growth of the overall dermocosmetics market.

Distribution Channel (Supermarket and Hypermarket, Pharmacies and Drug Stores, Online e-commerce Channels, Other Distribution Channels)

The pharmacies and drug store segment is emerging as one of the most prominent channels for the distribution of dermocosmetics, largely driven by consumer trends of preferring accessible and trustworthy retail environments. For instance, in February 2022, SkinCeuticals launched SkinCeuticals SkinLab by Barba Skin Clinic. This skin lab was launched in association with board-certified dermatologist Dr. Alicia Barba with a vision to provide a combination of dermatological services by using science-backed clinical-grade skincare products. Such one-stop shopping for prescription and dermocosmetics boosts consumer confidence and increases the opportunities for impulse buying. Thus, the market is supported by the inherent credibility of pharmacy outlets where the consumer's primary intention lies on specific dermatology-based skincare products.

Our in-depth analysis of the global dermocosmetics market includes the following segments:

|

Product |

|

|

Distribution Channel |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Dermocosmetics Market Regional Analysis:

North America Market Statistics

By 2035, North America dermocosmetics market is set to capture over 41.7% revenue share attributable to innovations including artificial intelligence and data analytics. It empowers brands to personalize solutions related to skin type and issue, making these solutions far more effective and satisfactory for users. In addition, the rising trend of teledermatology and virtual consultations has opened up access to professional skincare advice, enabling consumers to make informed decisions regarding their dermocosmetic purchases.

In Canada, growth in the dermocosmetics market is growing rapidly and largely due to the shift towards utilization of environmentally friendly ingredients. For instance, in June 2022, L'Oréal Canada Consumer Products Division teamed up with retail store London Drugs and waste management company TerraCycle to allow Canadians to recycle their empty cosmetics products at all London Drugs outlets across the country. Once collected, TerraCycle will break the waste down, separate it by material, and convert it into reusable recyclable forms.

The most significant growth driver in the U.S. dermocosmetics market is the growing demand for scientifically-backed formulations addressing specific skin concerns. Such an increase in the cases or incidence of diseases will lead to the increased consumption of body care products including skin cleansers, topical sebum controllers, sunscreens, and other products over the forecasted period. For instance, in August 2023, according to the data published in the National Library of Medicine, acne vulgaris is the most common skin disease that occurs in adolescents and young adults, with a prevalence rate estimated in the range of 35.0% to 90.0% in the U.S.

Asia Pacific Market Analysis

The Asia Pacific dermocosmetics market is growing rapidly primarily due to the robust population adopting skin and hair care products as well as the increasing penetration of major players in the region. Various research institutes and market players have been mounting efforts to increase healthy skin health awareness. These products are formulated to preserve the health and beauty of the skin and hair. Increasing awareness will eventually enhance the adoption of products, propelling market growth.

In India, the dermocosmetics market is growing hugely, with increasing urbanization and rising consumer disposable incomes contributing to a rise in personal grooming and skin care. The greater influence of traditional Ayurvedic and herbal formulations is a major driver of this growth. Indian consumers will always seek more natural and holistic solutions to maintaining healthy skin. For instance, in August 2022, OrgaGlo ventured into the personal care and cosmetics segment in India. It launched vegan skin and hair care products made with the finest quality natural ingredients. The India dermocosmetics landscape is uniquely positioned to leverage its rich heritage of herbal knowledge while embracing innovation, creating a dynamic market environment that caters to diverse consumer needs.

In China, the dermocosmetics market is witnessing substantial growth, significantly driven by the rapid expansion of the e-commerce sector and the increasing adoption of digital platforms for beauty product discovery and purchase. For instance, in March 2022, Florasis launched a 5-Year Eastern Beauty R&D Plan, investing more than USD 138.3 million. Eastern makeup research and product development focus on AI management of raw materials and supply chains, high-quality green cosmetics packaging materials, and visual and spatial structure research. China is now an emerging, dynamic, and changing market in the global dermocosmetics market, where consumer preference is increasingly being influenced by digital engagement and efficacy.

Key Dermocosmetics Market Players:

- Procter & Gamble

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- L’Oréal Groupe

- Unilever PLC

- Johnson & Johnson

- Amorepacific

- Beiersdorf Aktiengesellschaft

- Kanebo Cosmetics Inc.

- Avon Products, Inc.

- Lotus Herbals Pvt. Ltd.

- VLCC Health Care Limited

- Himalaya Global Holdings Ltd.

- Pierre Fabre

The company landscape in the dermocosmetics market is rapidly changing. The expansions, clinical trials, and scientific validation make their products more unique in the crowded market. Additionally, partnerships with dermatologists and skincare professionals to strengthen distribution channels enabling companies to tap into expert knowledge for their product development and marketing activities. For instance, in September 2023, L'Oreal, the French personal care company, announced that it is entering the Indian dermocosmetic market and has launched L'Oral Dermatological Beauty, or LDB, in the country. LDB, a new division for the Indian market, will bring products to dermatologists, patients, and consumers.

Here's the list of some key players:

Recent Developments

- In April 2024, Dow unveiled three concept collections for a complete skin, make-up, and hair care routine, under DOWSIL products. With the product launch, it also promoted skin and scalp wellness through skin microbiome-friendly certified ingredients, which are the pioneering carbon-neutral silicone elastomer blends.

- In April 2023, the Pierre Fabre group acquired the brand It is the very first French dermo-cosmetic brand for patients suffering from side effects of cancer treatment. This acquisition aimed at providing the first range of skin, scalp, and nail care products developed in partnership with oncologists and dermatologists to help counteract the effects of cancer treatments.

- Report ID: 6868

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Dermocosmetics Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.