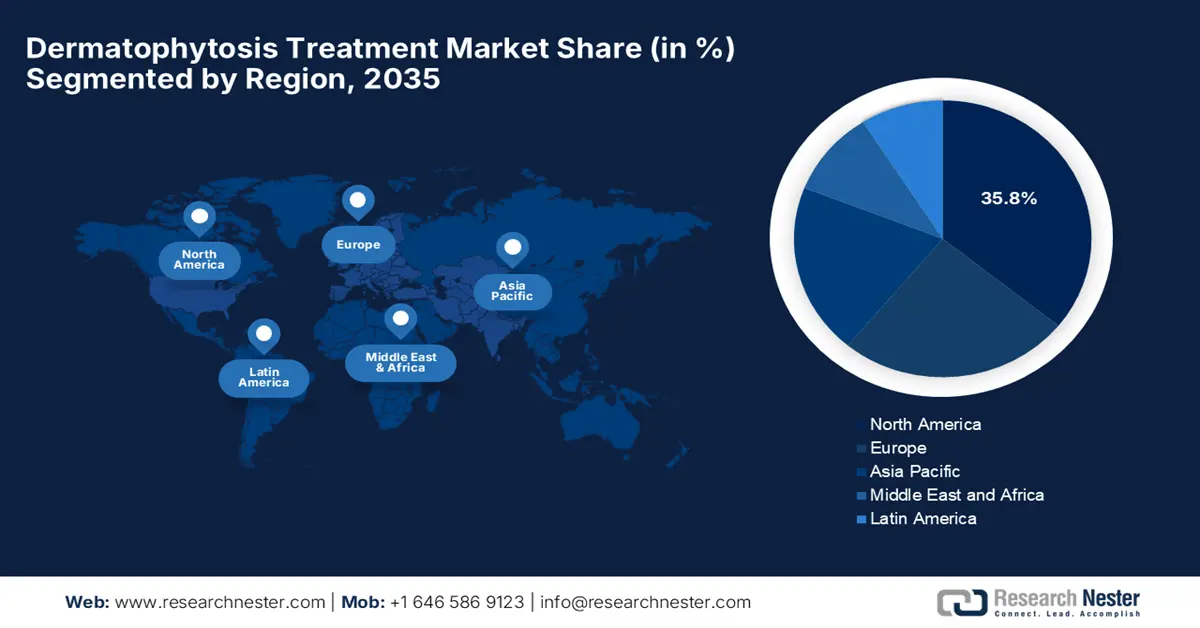

Dermatophytosis Treatment Market - Regional Analysis

North America Market Insights

The North America is anticipated to register the highest revenue share of 35.8% in the dermatophytosis treatment market by the end of 2035. The growth of the market is driven by the rising fungal disease expenditures and the rapid adoption of government-backed healthcare facilities. Testifying at the NIH in June 2025 revealed that the economic burden of fungal diseases in the U.S. is estimated at USD 19.4 billion on a yearly basis, which includes USD 13.4 billion in direct medical costs from hospitalizations and outpatient visits, highlighting the urgent need for improved fungal disease surveillance and treatment.

There has been increased awareness and exhaustive campaigns for the treatments in the U.S., which have catalyzed the growth of the dermatophytosis treatment market. In this regard, the CDC in June 2025 reported that Fungal Disease Awareness Week 2025, which took place in September, aims to raise public and healthcare provider awareness about the growing impact of fungal infections, which are often underdiagnosed and mistreated. The initiative also emphasizes the urgent need for better prevention, diagnosis, and research, hence denoting a positive market opportunity.

Canada in the dermatophytosis treatment market is experiencing steady growth backed by the presence of key pioneers and healthcare professionals in the country, who are focusing on developing and adopting innovative treatment options with the support of governing bodies. For instance, in January 2024, Medexus Pharmaceuticals notified that Health Canada has accepted for review its new drug submission for a topical terbinafine hydrochloride nail lacquer, for treating fungal nail infections, marking a significant step toward expanding treatment options for people dealing with dermatophytosis-related conditions.

Topical Antifungal Prescribing Statistics for Medicare Part D Beneficiaries - U.S., 2021

|

Category |

Statistic / Value |

|

Total Medicare Part D Beneficiaries (2021) |

48.8 million |

|

Total Topical Antifungal Prescriptions |

6.5 million |

|

Total Cost of Prescriptions |

USD 231 million |

|

Prescription Rate |

1 per 8 beneficiaries |

|

Most Common Drugs (by volume) |

Ketoconazole - 2.4 million (36.6%) |

|

Most Expensive Drugs (average per prescription) |

Efinaconazole – USD 1,035.3 |

|

Least Expensive Drugs (average per prescription) |

Nystatin – USD 25.6 |

|

Topical Antifungal Rx by Provider Type |

Primary Care - 2.6 million (40.0%) |

|

Prescriptions per Provider (average) |

Dermatologists - 87.1 |

|

% of All Prescriptions That Were Clotrimazole-Betamethasone |

0.9 million (14.7%) |

Source: CDC

APAC Market Insights

The Asia Pacific dermatophytosis treatment market is set to witness robust expansion fueled by a surge in infection rates and public awareness. The population density in the urban areas is rising, favoring the development of fungal infections. In February 2025, Kaneka Corporation declared that it is collaborating with Maruho Co., Ltd. to launch Japan’s first-ever domestic Trichophyton antigen test kit, DermaQuick Onychomycosis, targeting early and easy detection of fungal nail infections. The product is especially designed for dialysis patients who are at higher risk due to weakened immunity, thereby improving foot care and infection management.

China’s dermatophytosis treatment market is experiencing rapid growth owing to the progress in diagnostic innovations, including AI-assisted tools in rural clinics, and increasing availability of both topical and oral antifungals. In July 2024, AFT Pharmaceuticals reported that it partnered with Hainan Haiyao Co. Ltd to distribute Crystaderm cream in the country, targeting the large population base with this innovative skin infection treatment. The product reduces the risk of drug-resistant bacteria; hence, it is suitable for standard market growth.

India is also augmenting its strong upliftment in the dermatophytosis treatment market, wherein most of the cases are becoming chronic, recurrent, or severe, often involving extensive areas of skin. Most dermatologists in the country are utilizing combination therapy, performing diagnostic tests such as KOH mounts, and treating for longer durations. Meanwhile, the emergence of natural and herbal remedies as alternative treatment options is also prompting an encouraging business opportunity in the country. Furthermore, the ongoing research and development efforts and consumer preferences are shaping the landscape of dermatophytosis treatment.

Europe Market Insights

The dermatophytosis treatment market in Europe is likely to show notable growth due to growing health awareness and increased investment in antifungal research and development. Moberg Pharma in May 2024 reported that its MOB-015 has received complete national approvals in all 13 participating countries in Europe, marking a major step towards its commercialization. The firm also stated that the product is now available OTC in 7 countries, which include Sweden, Italy, and the Netherlands, and Rx-only in 6, such as France and Spain, with launch already underway in Sweden under the brand name Terclara.

The U.K. has garnered a huge opportunity in the dermatophytosis treatment market owing to the NHS initiatives that emphasize fungal infection prevention and early treatment. In July 2022, NIH reported a genome-wide association study conducted utilizing the country’s Biobank cohort, which identified a genetic link to dermatophytosis, specifically a missense variant in the TINAG gene (rs16885197). It also observed that individuals carrying the minor G allele had a 7.8 times higher risk, hence supporting the role of genetic susceptibility in chronic or recurrent fungal infections.

Spain is emerging in the dermatophytosis treatment market due to its strong focus on treatment guidelines and comparing systemic and topical therapies to better manage recurrent or difficult cases of dermatophytosis. In May 2022, Almirall notified that it successfully initiated a decentralized regulatory procedure in Europe for efinaconazole, targeting mild to moderate fungal nail infections in adults and children, thereby creating an optimistic opportunity for market progression in the country.