Denture Adhesive Market Outlook:

Denture Adhesive Market size was valued at USD 2.41 billion in 2025 and is likely to cross USD 4.24 billion by 2035, registering more than 5.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of denture adhesive is assessed at USD 2.54 billion.

Rising awareness about the health benefits of maintaining good oral hygiene is the major growth factor of the denture adhesive market. In addition, the advancements in dentistry are influencing more people to invest in dental care. Moreover, the improved oral health due to the restoration procedures is inflating demand for crucial components such as dentures and adhesives. According to 2022 OEC data, the worldwide trade of dental products including adhesive paste and powders reached USD 6.3 billion. The global exports of the same products were carried out by manufacturing giants such as China, Germany, the U.S., Poland, and Thailand.

The global landscape of the denture adhesive market presents a wide range of variety in the form and efficacy of the products. Many manufacturers are driving this diversification further by innovating more efficient and durable components, igniting adoption among consumers. Broadened applications and types of adhesives such as powders, pastes, and strips are being introduced to serve the specific needs and oral conditions of the patients. For instance, in September 2023, Pac-Dent launched a versatile light-cured dental adhesive, Rodin Bond to offer better bond strength and cutting-edge glass filler technology.

Key Denture Adhesive Market Insights Summary:

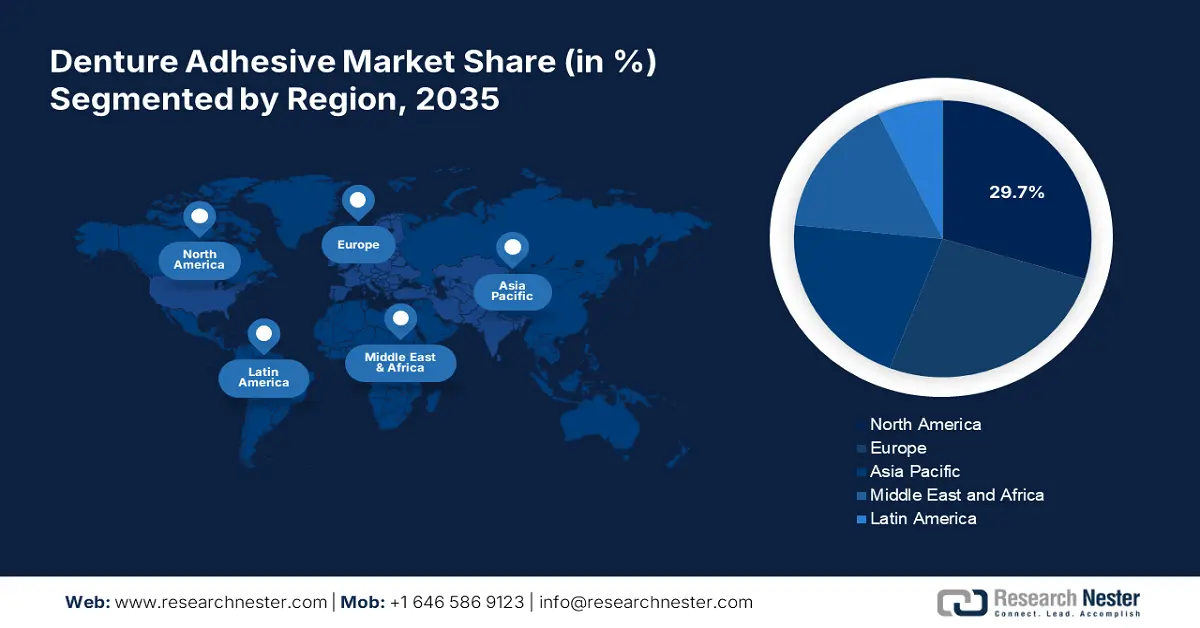

Regional Highlights:

- North America's 29.7% share in the denture adhesive market is fueled by a mature dental market, product innovation, and a robust distribution network across dental clinics, supporting growth through 2035.

- The Asia Pacific denture adhesive market is anticipated to experience rapid growth through 2035, fueled by improving oral healthcare infrastructure, product standardization, and rising dental restoration demand.

Segment Insights:

- The Pit & Fissure segment is anticipated to secure a 34.20% share by 2035, driven by rising demand for adhesives addressing dental hygiene in complex morphologies.

Key Growth Trends:

- Improved denture functions

- Increasing oral care expenditures

Major Challenges:

- High cost of dental procedures

- Lack of developmental initiatives

- Key Players: 3M, Ultradent Products, Inc., Dentsply Sirona Inc., Procter & Gamble Co., GlaxoSmithKline Plc., Johnson & Johnson Services Inc., Ivoclar Vivadent AG, Colgate-Palmolive Company, Vista Apex.

Global Denture Adhesive Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.41 billion

- 2026 Market Size: USD 2.54 billion

- Projected Market Size: USD 4.24 billion by 2035

- Growth Forecasts: 5.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (29.7% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, United Kingdom, France

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 13 August, 2025

Denture Adhesive Market Growth Drivers and Challenges:

Growth Drivers

- Improved denture functions: With the proven benefits of improving patient comfort and denture lifespan, the interest of consumers to incorporate these products in the process is growing. Dentists are increasingly preferring to invest in the denture adhesive market to elevate patient satisfaction. Its contribution to better outcomes due to having the capability to reduce clinical and technical errors is attracting more investments in this sector. According to a study conducted by NLM, in December 2023, usage of adhesives for completely edentulous patients resulted in a higher 100-mm visual analog scale (VAS) score. The study results indicated an enhanced quality of life in those patients.

- Increasing oral care expenditures: Emerging economies are more likely to be aware and proactive about the adoption of the denture adhesive market. Increased disposal income of these populations is making them able to spend on personal care, particularly in maintaining oral health. They seek high-quality products for every dental procedure, creating a scope of development and innovation in this sector. According to an NLM article published in November 2020, the total expenditure on dental health from 32 OECD countries reached USD 316 billion in the same year. The report further projected it to gain USD 434 billion in 2030 and USD 594 billion in 2040.

Challenges

- High cost of dental procedures: Dental check-ups and proceedings are expensive, which may limit adoption in the denture adhesive market. Price-sensitive landscapes may become less optimistic about investing in this sector due to the volatility in price and availability of products. Variations of effectiveness with respect to oral health conditions and changing consumer behavior can also affect the demand, diluting interest in participation. The uncertainty may further result in the failure of these products to compete with other available alternatives in pricing.

- Lack of developmental initiatives: The ever-changing dynamics of the denture adhesive market can become difficult for companies to cope with. They may lose interest in developing more advanced products due to the declining support of the regulatory framework. The delayed approvals and additional production costs can further discourage them from investing or participating in R&D projects. This may restrict the progress of this sector by limiting the scope of new products. Moreover, strict regulations about product safety and effectiveness can hinder new market debuts.

Denture Adhesive Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.8% |

|

Base Year Market Size (2025) |

USD 2.41 billion |

|

Forecast Year Market Size (2035) |

USD 4.24 billion |

|

Regional Scope |

|

Denture Adhesive Market Segmentation:

Application (Dentures, Pit & Fissure, Restorative)

Based on applications, the pit & fissure segment is predicted to account for denture adhesive market share of around 34.2% by 2035. This segment is witnessing significant growth due to the inflating demand for specific adhesives to address the issues with dental hygiene for patients with complex morphology or denture surfaces. Pit and fissure sealants are specifically designed to offer prevention from caries development due to plaque accumulation, making them preferable for the aging population. For instance, in August 2021, ICPA launched a denture management package, Replay Kit for elderly patients. The kit contains a Denture Storewell, Clinsodent Tablets, Clinsodent Brush, and Fixon Denture Adhesive Cream for easy and regular denture maintenance and hygiene routine.

Product Type (Cream/Paste, Powder)

In terms of product type, the denture adhesive market is expected to witness remarkable progress in the cream/paste segment by the end of 2035. This form of dental sealant is highly desirable for denture wearers due to improved retention, flexibility, and comfort. Its effectiveness in complex denture surface area makes it stand out in this competitive landscape. Many adhesives are now being formulated to offer ease of application with waterproof characteristics. For instance, in September 2023, a new bio-based glue formulation was introduced by researchers at Purdue University, which can build a stronger bond underwater. Properties of this sustainable adhesive is a perfect fit for restorations in various applications such as dentures in different wet conditions and surfaces.

Our in-depth analysis of the global market includes the following segments:

|

Application |

|

|

Product Type |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Denture Adhesive Market Regional Analysis:

North America Market Analysis

North America in denture adhesive market is likely to hold over 29.7% revenue share by the end of 2035. This region is home to a well-established marketplace for dentistry, creating a lucrative business environment with increased product availability and increasing incidence rate of oral diseases. This is further attracting global leaders to expand their portfolio in this landscape. For instance, in August 2024, Solventum launched a water-based solution, 3M Clinpro Clear Fluoride Treatment to enhance patient comfort by offering smoother application. The innovative formula of the adhesive is specifically designed to target the largest audience of dental professionals in this region.

The U.S. denture adhesive market is projected to generate profitable revenue due to its strong distribution channel across the country. This regional leader is affiliated with a wide network of dental hospitals and clinics, fueling demand in this sector. Many domestic leaders are opting for this landscape to expand their territory of dental solutions. For instance, in April 2023, Myerson chose Henry Schein's Zahn Dental for the distribution of its Trusana Premium Denture System. With this collaboration, Myerson aims to promote its three recently launched products including Trusana Bond Denture Adhesive.

Canada is augmenting the regional denture adhesive market with its beneficial trading culture of the domestic denture industry. The country is garnering opportunities for global participants to expand their business. According to 2022 OEC data, the import value of artificial teeth in Canada accounted for USD 21.9 million, placing it among the top 10 importers in the world. The country also exported USD 10.1 million of such dentures to the U.S., building a healthy and large marketplace for both domestic and foreign leaders. Another 2022 OEC data states, that the country imported USD 250 million worth of dental products such as adhesives.

APAC Market Statistics

Asia Pacific landscape is estimated to experience the fastest growth in the denture adhesive market due to the rising popularity of dental restoration. The efforts to improve the oral healthcare infrastructure in this region are creating a surge for effective and innovative solutions. This is further propelling development in this sector. Many private and government organizations are individually making initiatives to promote adhesive adoption in dental restoration practices by standardizing the products.

The enlarging oral healthcare industry is stimulating the denture adhesive market in India. The governing bodies are also contributing in this manner by issuing new subsidiary policies for clinicians and patients to encourage them to include these products during procedures. According to a report published by the Indian Dental Association, in 2022, India presents great potential to become one of the largest dental marketplaces in the world. It was valued at around USD 2 billion in the same year while having 2,92,000 dental professionals, 317 dental institutes, and over 5,000 dental laboratories.

China is also expected to show promising growth in the denture adhesive market due to its established supply chain and manufacturing forces. The country is fostering a favorable atmosphere for both domestic and international suppliers with high trade values. According to the 2022 OEC data, China ranked among the top exporters of dental products including fixative pastes, powders, and yarn in the world. It secured an export value of USD 569 million of this industry in the same year, having large consumer bases such as the U.S., Germany, the UK, Canada, and France.

Key Denture Adhesive Market Players:

- 3M

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Ultradent Products, Inc.

- Dentsply Sirona Inc.

- Procter & Gamble Co.

- GlaxoSmithKline PLC

- Johnson & Johnson Services Inc.

- Ivoclar Vivadent AG

- Colgate-Palmolive Company

- Vista Apex

- RevBio Inc.

The global denture adhesive market is slowly but steadily shifting towards sustainability in accordance to supply the current demand. Global players are now investing heavily in R&D projects to develop eco-friendly products for their worldwide expansion. They are also focusing on strengthening their foreign relationships to outstretch product reach overseas and adding new assets to their portfolio. For instance, in August 2020, bonyf AG launched a healthy denture adhesive, OlivaFix Gold, containing 0% petrochemicals, zinc, and parabens. This launch was a strategic plan of this Swiss company to captivate the broad marketplace of America. Such key players include:

Recent Developments

- In September 2024, RevBio received an SBIR grant of USD 2.4 million from the NIH for the first-in-human clinical trials of its regenerative bone adhesive for clinical flap fixation. The fund aimed to support the development of a novel dental adhesive bone scaffold product, TETRANITE.

- In June 2024, Dentsply Sirona launched a new universal dental adhesive, Prime&Bond active, with active moisture control to suit both wet and dry dentin. This product's chemical bonding is specially designed to enhance the reliability and strength of dental restorations without compromising simplicity or predictability.

- Report ID: 6957

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Denture Adhesive Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.