Dental Simulator Market Outlook:

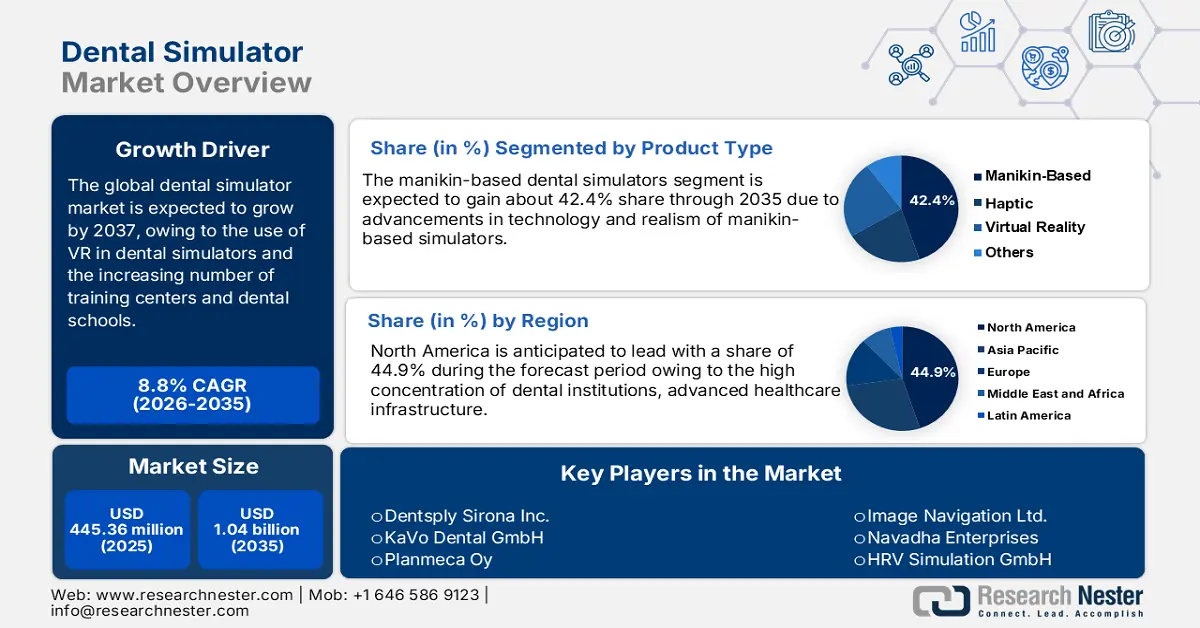

Dental Simulator Market size was over USD 445.36 million in 2025 and is anticipated to cross USD 1.04 billion by 2035, witnessing more than 8.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of dental simulator is assessed at USD 480.63 million.

The dental simulator market is anticipated to significantly expand during the forecast period owing to technological developments in dental simulators and rising demand for high-fidelity and digitally integrated training tools. Traditionally, dental education depended heavily on live patient interactions and basic mannequin models but the increase of innovative simulators has transformed how practitioners and students are trained in realistic and controlled environments. These innovations help bridge the gap between practical experience and theoretical learning which offers a dynamic and hands-on approach to master dental techniques. For example, in May 2022, Align Technology presented the next-generation patient communication tool Invisalign Outcome Simulator Pro. This device is designed to demonstrate to patients their potential new smile after Invisalign treatment. It uses innovative algorithms to generate realistic simulations, supporting patient education and treatment acceptance.

Key Dental Simulator Market Insights Summary:

Regional Highlights:

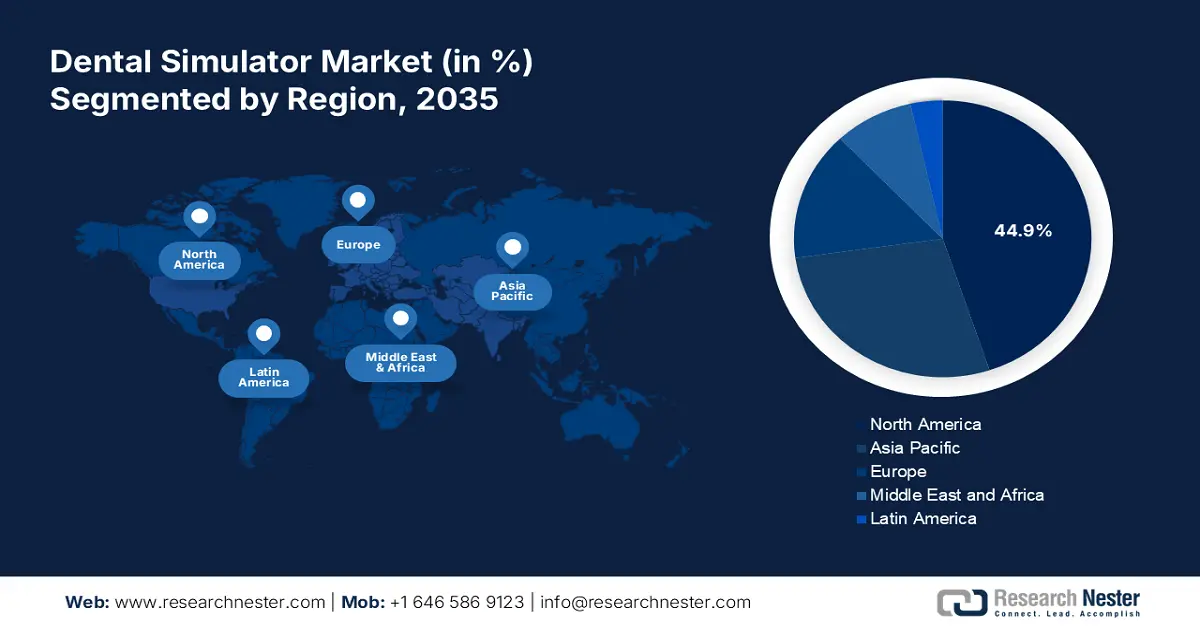

- Across 2026-2035, North America is anticipated to secure a 44.9% share of the dental simulator market by 2035, underpinned by the strong presence of key market players and expanding healthcare expenditure in the region.

- Over the forecast period, Asia Pacific is expected to post a stable CAGR, supported by expanding simulation-based dental education and increasing adoption of dental tool manufacturing facilities in the region.

Segment Insights:

- By 2035, the manikin-based dental simulators segment is projected to account for over 42.4% share of the dental simulator market, bolstered by its ability to provide realistic and risk-free hands-on training.

- By 2035, the dental training & education segment is expected to capture more than 74.8% share, fueled by growing interest in technology-enhanced dental learning systems.

Key Growth Trends:

- Utilization of virtual reality (VR) in dental simulators

- Growing number of training centers and dental schools

Major Challenges:

- Regulatory problems

Key Players: Dentsply Sirona Inc., KaVo Dental GmbH, Planmeca Oy, Image Navigation Ltd., Navadha Enterprises, and HRV Simulation GmbH.

Global Dental Simulator Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 445.36 million

- 2026 Market Size: USD 480.63 million

- Projected Market Size: USD 1.04 billion by 2035

- Growth Forecasts: 8.8%

Key Regional Dynamics:

- Largest Region: North America (44.9% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Mexico, Australia

Last updated on : 2 December, 2025

Dental Simulator Market - Growth Drivers and Challenges

Growth Drivers

-

Utilization of virtual reality (VR) in dental simulators: Virtual reality transforms how dental professionals are trained. VR-based dental simulators have underscored their usefulness and appeal in education settings. For example, in September 2021, Virteasy Dental developed a VR simulator that allows users to engage in several dental procedures to provide real-time feedback on performance. This interactivity not only helps in skill acquisition but also enhances critical thinking and decision-making abilities through simulated procedures. The immersive nature of VR, assists students in visualizing the procedure from various angles, understanding the anatomy and mechanics involved more deeply.

- Growing number of training centers and dental schools: The demand for well-trained dental professionals has resulted in increased focus on improving dental healthcare standards internationally. Stimulators offer consistent, safe, and repeatable training environments important for honing practical skills without the risk of patient harm. As the number of dental programs increases particularly in emerging markets, training centers and dental schools are gradually investing in innovative simulators to meet the needs of modern dental education. In August 2023, UT Health San Antonio launched a Dental Hygiene program at UT Center in Laredo, addressing substantial gaps in oral health care needs within the community while increasing local job opportunities in a high-demand field.

Challenges

-

Regulatory problems: The U.S. FDA and the European Medicines Agency (EMA) regulate medical simulators and mandate manufacturers to validate their technology thoroughly before entering the market. These regulatory challenges not only extend the time to market but can also pose entry blocks for smaller companies with restricted resources. Moreover, regional differences in regulations create an uneven playing field making it tough for manufacturers to launch universal complaint simulators, particularly in developing markets where regulatory infrastructure may vary.

Dental Simulator Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

8.8% |

|

Base Year Market Size (2025) |

USD 445.36 million |

|

Forecast Year Market Size (2035) |

USD 1.04 billion |

|

Regional Scope |

|

Dental Simulator Market Segmentation:

Product Type Segment Analysis

Manikin-based dental simulators segment is set to capture over 42.4% dental simulator market share by 2035. Manikin-based dental simulators offer a realistic and safe environment for students to practice numerous procedures which allows hands-on learning without the risk of hurting real patients. For example, in March 2021, Universal Simulation UK announced the world’s first portable haptic and VR simulator for dentists and practitioners. This invention is designed to support learners who are isolated, or unable to come to the university physically can continue practicing patient treatments virtually, at any time from the comfort of their hometowns.

Application Segment Analysis

Dental training & education segment is projected to capture over 74.8% dental simulator market share by 2035. Many dental graduates globally are gaining interest in new approaches to dentistry education using suitable dental simulation units. New leanings and technology are constantly coming up with changes in education systems and bringing ideas such as simulation tools. For example, in December 2020, 123Dentist donated USD 1.25 million to build a new simulation and digital dentistry laboratory for the University of British Columbia (UBC). The UBC has set new laboratory to change dental education with state-of-the-art technology and allow students to learn complex clinical procedures with technologically innovative patient simulators.

Our in-depth analysis of the dental simulator market includes the following segments:

|

Product Type |

|

|

Application |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Dental Simulator Market - Regional Analysis

North America Market Insights

North America industry is set to dominate majority revenue share of 44.9% by 2035, driven by the presence of key market players and the increase in healthcare spending in the region. Moreover, factors such as high healthcare IT expenditure, extensive use of technologically innovative models in dental schools, and rising awareness of simulation studies within the dental community are projected to drive the region's growth.

In the U.S, the dental simulator market is expected to account for a significant share between 2026 and 2035 owing to rising healthcare spending and increasing product launches. According to the American Medical Association, healthcare spending reached USD 4.3 trillion per capita in 2021.

The dental simulator market in Canada has also steadily expanded over the years owing to a high focus on improving healthcare infrastructure and rising investments in R&D activities. For instance, Overjet, a top player offering AI solutions in the dental industry in China, announced its expansion in Canada to improve oral health.

Asia Pacific Market Insights

Asia Pacific dental simulator market is projected to experience a stable CAGR during the forecast period owing to the improving penetration of simulation education in dental practices and rising adoption of dental tool manufacturing facilities in the region. Moreover, growing investments in the dental healthcare sector in countries such as China, South Korea, India, and Japan, among other regions are also projected to augment the region’s growth.

In China, the market is expected to account for significant market growth by the end of 2035 owing to rising healthcare expenditure, high disposable income, and rising adoption of advanced tools and technologies in dental clinics and institutes. Moreover, rising product approvals is expected to boost dental simulator market growth going ahead. For instance, in September 2024, Linden Capital Partners announced that it had received regulatory support from the National Medical Products Administration (NMPA) for its new crosslinked bioresorbable collagen dental membrane designed for use in oral surgical procedures.

In Japan, the increasing emphasis on technological developments drives the adoption of innovative dental simulators, including features such as virtual reality and real-time feedback that provide students or learners with an immersive experience.

Dental Simulator Market Players:

- Dentsply Sirona Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- KaVo Dental GmbH

- Planmeca Oy

- Image Navigation Ltd.

- Navadha Enterprises

- HRV Simulation GmbH

The global dental simulator market is extremely competitive, including key players operating at global and regional levels. Companies such as Dentsply Sirona Inc., Nissin Dental Products, and KaVo Dental are some of the top players focusing on partnerships or collaboration with educational institutes and expanding their portfolio to meet the increasing demand for complete training tools. Here are some leading players in the dental simulator market:

Recent Developments

- In October 2023, Denti.AI announced the US Food and Drug Administration (FDA) clearance for Denti.AI Detect, a software driven by artificial intelligence (AI) that can identify dental diseases, missing teeth, along with intra and extraoral dental radiography and charting automation.

- In February 2023, Stratasys Ltd. announced TrueDent the first monolithic, 3D-printed permanent dentures product. By using this product, laboratories may generate gums that are permanent, realistic-looking, and precise in terms of tint, tooth anatomy, and translucency in a single constant print.

- In January 2022, Dentsply Sirona Inc. announced a partnership with the University of Toulouse in France to incorporate the company’s innovative simulation units as preclinical laboratory equipment. This collaboration aimed to improve the educational experience for dental students by providing them with access to cutting-edge dental simulators that exactly replicate real-world clinical scenarios.

- Report ID: 6634

- Published Date: Dec 02, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Dental Simulator Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.