Dental Membrane and Bone Graft Substitutes Market Outlook:

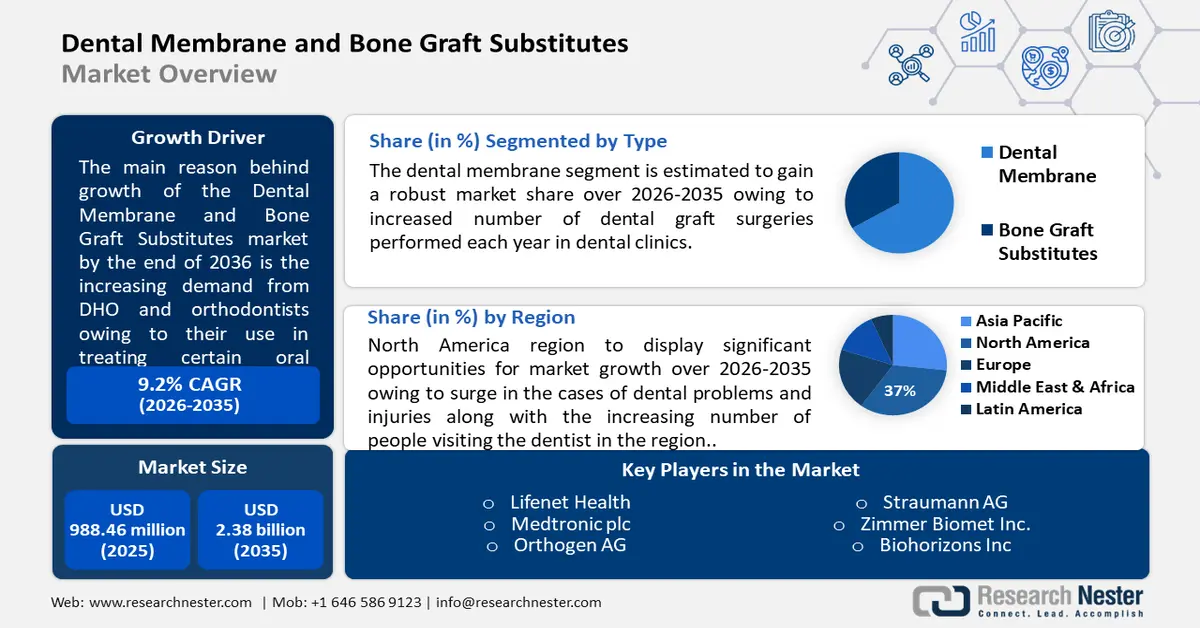

Dental Membrane and Bone Graft Substitutes Market size was valued at USD 988.46 million in 2025 and is set to exceed USD 2.38 billion by 2035, expanding at over 9.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of dental membrane and bone graft substitutes is estimated at USD 1.07 billion.

In November 2024, the World Health Organization stated that oral diseases are the most commonly recorded noncommunicable diseases that affect nearly half of the world’s overall population. It further states that in 2022, 3.5 billion people worldwide were affected by oral diseases, with 3 out of 4 people from the middle-income countries. Nearly 2 billion people suffered from permanent teeth caries and 514 million children were recorded suffering from primary teeth caries. Increasing awareness of oral health, escalating oral disease, increased research and development (R&D) operations along with increased use of resorbable dental membranes and bone graft biomaterials expected to fuel the market over the forecast period.

As per WHO 2022, global average incidence of complete tooth loss is estimated at almost 7% globally, among people above 20 years of age. The worldwide population aged 60 years or older witnesses a much higher prevalence of 23%. This is further boosting the dental membrane and bone graft substitutes market. Other significant growth drivers include rising dental implant procedures, advancements in biomaterials, and increasing awareness about oral health. Furthermore, the adoption of 3D printing technology to create customised graft materials and membranes is gaining traction, offering personalized treatment solutions.

Key Dental Membrane and Bone Graft Substitutes Market Insights Summary:

Regional Highlights:

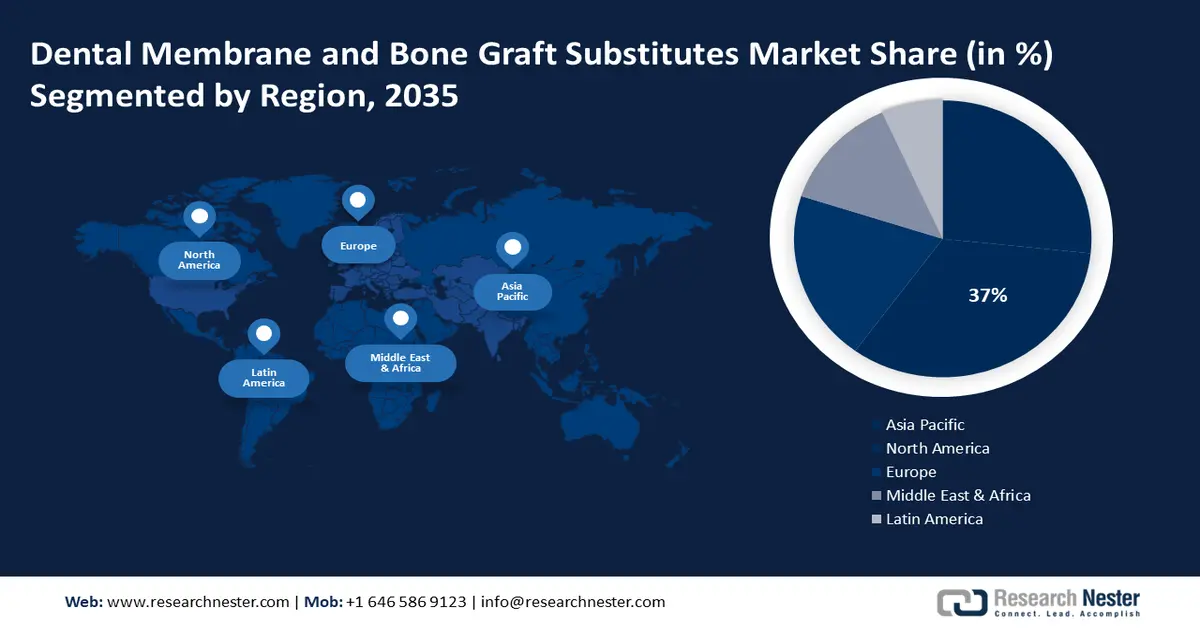

- North America’s dental membrane and bone graft substitutes market will secure around 37% share by 2035, driven by increased dental visits, aging population, and use of bone graft substitutes.

- Europe market will exhibit noteworthy growth during the forecast timeline, attributed to a developed healthcare system and increased dental surgeries.

Segment Insights:

- The dental membrane segment in the dental membrane and bone graft substitutes market is forecasted to secure the largest share by 2035, driven by its vital role in GBR and GTR procedures, and preference for resorbable membranes.

- The dental clinics segment in the dental membrane and bone graft substitutes market is expected to hold the largest share by 2035, attributed to availability of advanced technologies and personalized care.

Key Growth Trends:

- Increasing elderly population around the world

- Increasing spending on dental services and rising per capita income

Major Challenges:

- Higher cost associated with bone graft surgeries

- Complications involved in bone grafting procedures

Key Players: Dentsply Sirona, Straumann AG, Zimmer Biomet Inc., Biohorizons Inc, Geistlich Pharma Ag, Rti Surgicals, Dentium Co, Ltd., Lifenet Health, Medtronic plc, Orthogen AG.

Global Dental Membrane and Bone Graft Substitutes Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 988.46 million

- 2026 Market Size: USD 1.07 billion

- Projected Market Size: USD 2.38 billion by 2035

- Growth Forecasts: 9.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (37% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, France

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 9 September, 2025

Dental Membrane and Bone Graft Substitutes Market Growth Drivers and Challenges:

Growth Drivers

-

Increasing elderly population around the world: Oral health problems are more prevalent in older adults. A greater number of older people suffer from dental diseases, such as edentulism. As per the United Nations article published in 2024, during the mid-2030s, 265 million individuals aged 80 and older will outnumber the infants. It further states that the 65 and older population worldwide is anticipated to surpass the under 18 population, and reach 2.2 billion by the late 2070s. The escalating elderly population is expected to drive the global dental membrane and bone graft substitutes market size during the forecast period significantly.

-

Increasing spending on dental services and rising per capita income: According to the American Dental Association, in 2024, national dental spending in 2023 was registered USD 174 billion, growing by USD 4 billion, which is a 2.5% increase from 2022. Moreover, according to the Bureau of Economic Analysis, GDP increased at an annual rate of 3.3% in the fourth quarter of 2023. Furthermore, disposable personal income in the U.S. increased up to USD 211.7 billion, or 4.2%, in the fourth quarter, compared with an increase of $143.5 billion, or 2.9 percent, in the third quarter.

Challenges

-

Higher cost associated with bone graft surgeries: Autografts are only used for very minor bone abnormalities owing to their higher surgical expenses and greater surgical risks, such as excessive bleeding, infection, inflammation, and discomfort. According to NLM May 2021, 2.2 million bone transplant surgeries are projected to be conducted yearly globally, costing an estimated USD 664 million by 2021, with the number of surgical procedures for treating bone abnormalities predicted to increase by almost 13% annually.

-

Complications involved in bone grafting procedures: Common issues include graft rejection, infection, excessive bleeding, and delayed healing, which can compromise the success of the procedure. Additionally, poor bone integration, nerve damage, and allergic reactions to graft materials further complicate the treatment process. The high cost of bone grafting procedures and the need for multiple surgeries in some cases can deter patients from opting for these treatments.

Dental Membrane and Bone Graft Substitutes Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

9.2% |

|

Base Year Market Size (2025) |

USD 988.46 million |

|

Forecast Year Market Size (2035) |

USD 2.38 billion |

|

Regional Scope |

|

Dental Membrane and Bone Graft Substitutes Market Segmentation:

Type Segment Analysis

The dental membrane segment captured the largest market size in the global dental membrane and bone graft substitutes market, owing to the increased number of dental graft surgeries performed each year in dental clinics. Dental membrane segment growth is further attributed to its critical role in guided bone regeneration (GBR) and guided tissue regeneration (GTR). The increasing preference for resorbable membranes over non-resorbable ones, owing to their biocompatibility, convenience, and reduced need for secondary surgeries, is driving market growth.

End-user Segment Analysis

The dental clinics segment is expected to achieve the largest market share by 2035. This can be owed to the fact that dentists are usually well equipped to perform various dental treatments and operations in their clinics. For instance, the NLM May 2022, stated there were over 200,000 dentists in the U.S. in 2022. The increasing preference for specialized dental care, availability of advanced technologies, and personalized patient care in clinics further boosts their demand. Additionally, the growing number of independent dental clinics and chain clinics globally contributes to the segment’s dominance.

Our in-depth analysis of the global dental membrane and bone graft substitutes market includes the following segments:

|

By Type |

|

|

By Material |

|

|

By Product Type |

|

|

By Application |

|

|

By End-User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Dental Membrane and Bone Graft Substitutes Market Regional Analysis:

North American Market Insights

North America industry is anticipated to dominate the majority revenue share of 37% by 2035, owing to the surge in the cases of dental problems and injuries along with the increasing number of people visiting the dentist in the region. Moreover, the availability of surgeons, an increase in the number of geriatric patients suffering from dental problems, and the increasing use of bone graft substitutes are projected to drive market growth in the region during the forecast period.

The U.S. dental membrane and bone graft substitutes market is driven by the high prevalence of dental disorders. Rising awareness about oral health, coupled with favourable reimbursement policies and the growing adoption of biocompatible graft materials is also supporting the growth. Additionally, technological advancements and presence of key players are contributing to further market expansion. In October 2022, Geistlich announced the acquisition of Lynch Biologics, LLC, intending to strengthen its position in the U.S. Such market activities are creating a competitive space in the country, inviting more players for growth.

Europe Market Insights

The market in Europe is estimated to witness noteworthy growth over the forecast period owing to a developed healthcare system and rising government spending on dental treatment, in the region. The region’s market expansion is also attributable to the presence of numerous pharmaceutical and biotechnology companies launching new products, an increase in the volume of surgeries, and growing public knowledge about periodontology. In January 2023, Nobel Biocare launched creos syntogain, expanding its portfolio of regenerative solutions distributed under the creos brand.

France market is witnessing steady growth owing to supportive government policies, along with availability of advanced dental treatments. Moreover, the growing number of dental clinics and increasing investments in oral healthcare infrastructure further strengthen the country’s position in the global market and showcase a promising expansion during the forecast period.

Dental Membrane and Bone Graft Substitutes Market Players:

- Dentsply Sirona

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Straumann AG

- Zimmer Biomet Inc.

- Biohorizons Inc

- Geistlich Pharma Ag

- Rti Surgicals

- Dentium Co, Ltd.

- Lifenet Health

- Medtronic plc

- Orthogen AG

The dental membrane and bone graft substitutes market companies are engaging in several ongoing trends, including development of bioresorbable membranes and synthetic bone graft substitutes that promote natural bone regeneration while minimizing surgical interventions. Companies are also investing in regenerative medicine-based products, such as growth-factor-infused membranes, to improve clinical outcomes. Some of the companies participating in the market include:

Recent Developments

- In February 2025, Geistlich announced a strategic investment in ReOss Ltd., intending to secure exclusive marketing and distribution rights globally for the chief product Yxoss CBR and their pipeline technologies.

- In April 2023, ZimVie Inc. announced the two new additions, RegenerOss CC Allograft Particulate, and RegenerOss Bone Graft Plug, to its biomaterials portfolio which was made available across North America.

- In May 2022, Straumann AG announced the acquisition of PlusDental, which is a Europe-based provider of orthodontic treatment solutions, intending to accelerate Straumann AG’s expansion in countries including the UK, Netherlands, and Sweden.

- Report ID: 4273

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Dental Membrane and Bone Graft Substitutes Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.