Dental Fluoride Treatment Market Outlook:

Dental Fluoride Treatment Market size was valued at USD 15.72 billion in 2025 and is expected to reach USD 28.15 billion by 2035, registering around 6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of dental fluoride treatment is evaluated at USD 16.57 billion.

Increasing incidences of dental diseases such as tooth decay and cavities, particularly among children, are creating a demanding consumer base for the dental fluoride treatment market. According to WHO, more than 3.5 billion people across the world were reported to have oral diseases till November 2024. The report further estimated the global number of adults and children, suffering from tooth caries in permanent and primary teeth to be 2.0 billion and 514.0 million respectively. The efficiency of fluoride-based products in remineralizing tooth enamel and preventing acid attacks is gaining traction in the current oral health industry. This is further inflating adoption in this field and inspiring pharma companies to engage their resources.

Thus, the emphasizing burden of such untreated caries is becoming a public health concern globally, as they may impact the overall well-being of an individual. This is dragging the focus of international medical authorities to cultivate sufficient effective solutions, fueling the dental fluoride treatment market. Although the retail value of these offerings varies according to availability, components, and type, the organizations are accumulatively putting efforts into setting a standard payer’s pricing to make them more accessible.

Payer's pricing for FV applications in rural areas of China (in 36 months)

|

Divisions of Expense |

Pricing (USD) |

|

Dentist Applying FV |

2,649.3 |

|

Dentist Performing an Oral Exam |

650.5 |

|

Oral Health Education |

122.4 |

|

CDC Staff |

385.7 |

|

Fluoride Varnish |

2,914.7 |

|

Oral Examination Supplies |

457.5 |

|

Toothpaste and Toothbrushes |

3,529.3 |

|

Total Costs |

10,709.7 |

Source: 2024 NLM Study

In search of cost-effectiveness, the NLM ran this study on the benefits and possibilities of fluoride varnish (FV) in preventing caries in Guangxi, China, in May 2024. The study lastly concludes the cost per child to be USD 16.5, after applying a standard discount rate of 3.0%, with a cost-benefit ratio of 1.7 USD benefits per 1.0 USD. Such clinical evidence concludes fluoride-related products to be a suitable and affordable option for children from economically constrained rural areas, presenting prominent evidence of increased accessibility in the dental fluoride treatment market.

Key Dental Fluoride Treatment Market Insights Summary:

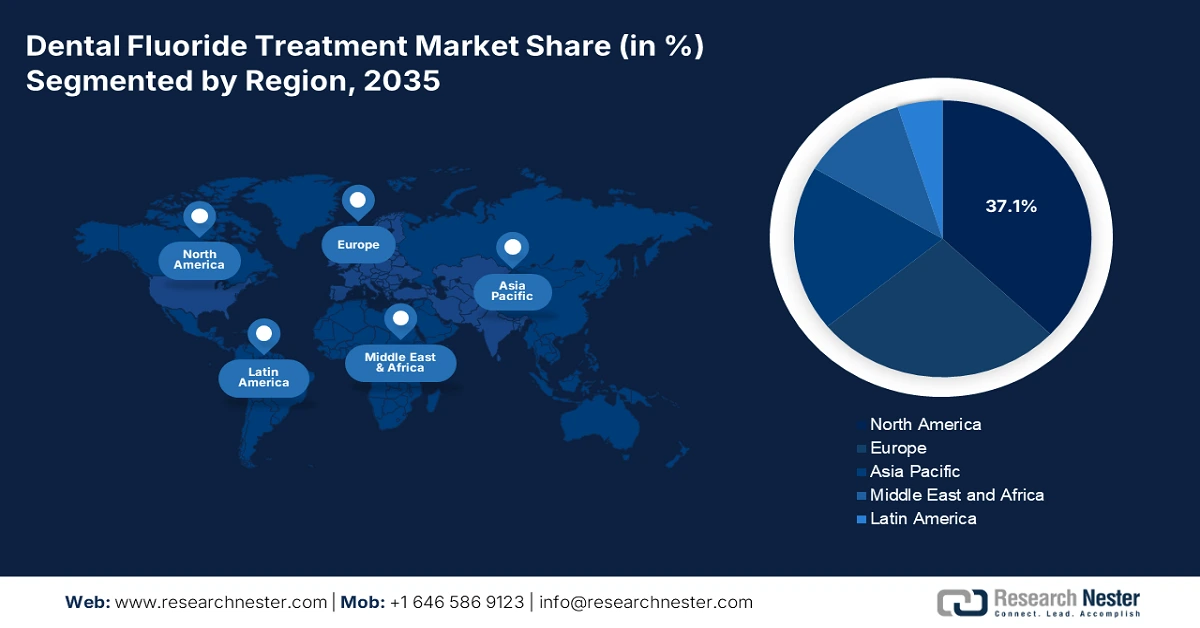

Regional Highlights:

- North America leads the Dental Fluoride Treatment Market with a 37.10% share, supported by the large consumer base and rising knowledge about the benefits of fluoride treatments, fostering growth by 2035.

- The Asia Pacific region is poised for the fastest growth in the Dental Fluoride Treatment Market from 2026 to 2035, driven by the increasing incidences of oral health problems, particularly caries.

Segment Insights:

- The Toothpaste Product segment is projected to capture over 44.2% market share by 2035, driven by its crucial role in daily oral care routines, supported by clinical evidence of its effectiveness in reducing caries and its affordability.

- Homecare End Use segment is anticipated to hold the largest share by 2035, driven by the widespread availability of topical products like toothpaste and rinse, alongside growing global adoption of personal care products.

Key Growth Trends:

- Rising awareness about oral health

- Advancements and expansion of the dental industry

Major Challenges:

- Concern about adverse reactions and environmental impact

- Complexity in attaining compliance with regulations

- Key Players: Colgate-Palmolive Company, 3M Company, Ultradent Products Inc., Oral Science, Credentis AG.

Global Dental Fluoride Treatment Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 15.72 billion

- 2026 Market Size: USD 16.57 billion

- Projected Market Size: USD 28.15 billion by 2035

- Growth Forecasts: 6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (37.1% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, United Kingdom, France

- Emerging Countries: China, India, Brazil, Mexico, Russia

Last updated on : 13 August, 2025

Dental Fluoride Treatment Market Growth Drivers and Challenges:

Growth Drivers

- Rising awareness about oral health: The collaborative efforts from several public and private organizations to educate people about preventive measures and available treatments are raising demand in the dental fluoride treatment market. As more habitats develop knowledge about the importance of maintaining oral health through campaigns and educational programs, the engagement and investment in this sector increase by captivating a larger audience. For instance, in March 2024, Cornwall Council initiated three child oral health programs, in collaboration with Smile Together Dental CIC and Peninsula Dental Social Enterprise. This initiative was intended to orient around the promotion and education on fluoride varnish.

- Advancements and expansion of the dental industry: Increasing involvement of institutes and pharma companies in extensive R&D is evolving the properties and formulations of the offerings from the dental fluoride treatment market. This tendency is intended to fulfill the urge to innovate a more effective and accessible line of products to meet a maximum range of consumer needs. For instance, in March 2024, a team of researchers at NYU College of Dentistry identified the potential of silver diamine fluoride (SDF) in fighting cavities while being inexpensive. This conclusion was determined by an observation conducted on over 4,000 elementary school students for four years. These efforts conjugately amplify adoption in this category.

Challenges

- Concern about adverse reactions and environmental impact: The risk of toxicity in using the products from the dental fluoride treatment market may create resistance among consumers from investing. Despite the benefits and affordability, public safety concerns, particularly for children, may limit the widespread adoption. In addition, the long-term impact of fluoride on ecosystems with wide exposure to water supplies has the potential to discourage companies and people, who are more prone to sustainability, from involving. Moreover, the negative influence of public perception may hinder growth in this sector.

- Complexity in attaining compliance with regulations: Obtaining approval from different regional regulatory frameworks may become a challenge for applicants from the dental fluoride treatment market. Due to having involvement with toxification, launching new commodities may face stringency from the environmental and health regulations, hindering the field’s expansion. This issue requires rigorous research and improvisation in formulations to be resolved. The way to simplify the clearance process for full-fledged commercialization and adoption is R&D, which is capable of mitigating the pollutant properties of these offerings.

Dental Fluoride Treatment Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6% |

|

Base Year Market Size (2025) |

USD 15.72 billion |

|

Forecast Year Market Size (2035) |

USD 28.15 billion |

|

Regional Scope |

|

Dental Fluoride Treatment Market Segmentation:

Product (Toothpaste, Varnish, Gel, Mouth Rinse, Supplements, Others)

Toothpaste segment is set to capture over 44.2% dental fluoride treatment market share by 2035. As this product has become a crucial part of the oral care routine, its contribution to the revenue has become larger in portion. In addition, the convenience of self-application makes it a target segment for companies. According to a report from the government of the UK, published in November 2021, brushing with fluoride toothpaste (FT) twice daily can reduce the risk of developing caries by 14.0%, in comparison to brushing once a day. On the other hand, a 2023 NLM study showed that 95% of the total Swedish adults with good oral practice use FT. Thus, these clinical pieces of evidence and affordability are driving demand for this topical commodity in this field.

End user (Dental Clinics, Hospitals, Homecare)

In terms of end user, the homecare segment is poised to capture the largest share of the dental fluoride treatment market throughout the assessed period. The general availability of topical products such as toothpaste, rinse, and gel is a major reason behind the segment’s growth. The oral rinse industry is anticipated to record significant revenue share during the forecast period. The enlarging scenario of topical oral care solutions is also indicated by the optimum adoption of personal care essentials.

Our in-depth analysis of the global dental fluoride treatment market includes the following segments:

|

Product |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Dental Fluoride Treatment Market Regional Analysis:

North America Market Analysis

North America in dental fluoride treatment market is poised to capture over 37.1% revenue share by 2035. This region is filled with global leaders in this sector, who are generating remarkable revenue in every fiscal year. The large consumer base and rising knowledge about the benefits of FTs in retaining dental health are making this region an attractive landscape for dedicated companies. According to 2023 OEC data, the U.S. was the largest importer of oral & dental hygiene preparations such as toothbrushes and toothpaste, accounting for USD 189.0 million. Besides, Canada also secured an import value of USD 75.2 million in the same year. Additionally, the U.S. exported USD 249.0 million worth of the same pipeline in 2023. These figures testify to the assurance of growth in North America.

The U.S. marketplace is highly influenced by high-quality healthcare practice and clinical discoveries. The business atmosphere of this country has become more favorable due to the positive support from regulatory bodies. This fosters a great scope of development for both domestic and global pioneers. For instance, in October 2024, Kettenbach Dental introduced a new genre of FVs, Profisil, for all categories of end users in this field. The innovative gel-based varnish features an anti-allergenic formula and is used after a professional tooth cleaning and for hypersensitive teeth. Such groundbreaking results of continuous R&D are further encouraging more manufacturers to invest in the dental fluoride treatment market.

Canada is pledging the dental fluoride treatment market with the growing government and private expenditure on oral healthcare. The country’s significant spending on acquiring essential commodities to supply the well-aware population is an indication of the sector’s potential. According to a 2023 OEC report, Canada ranked among the top importers of dental products including hygiene preparations in the world with a value of USD 273.0 million. Additionally, the government-assured reimbursement policies are also contributing to maximum adoption. For instance, in 2023, the Canadian Dental Care Plan (CDCP) for children up to 18 years, seniors, and specially challenged people was commenced by the national budget with an outlay of USD 13.0 billion over 5 years.

APAC Market Statistics

Asia Pacific is estimated to register the fastest growth in the dental fluoride treatment market throughout the assessed timeframe. Increasing incidences of oral health problems, particularly caries, are becoming a major concern for countries such as Japan, China, Philippines, South Korea, and India. This is pushing them to implement adequate preventive and treatment facilities nationwide, equipped with a complete set of essentials including hygiene preparations. For instance, in January 2025, the Philippine Health Insurance Corporation (PhilHealth) extended the coverage of its health packages by offering additional benefits for various medical departments such as preventive oral health services, including fluoride varnish application. This signifies the growing demand for these substances.

2023 import statistics for fluorides in selected APAC countries

|

Destination |

Import Value (USD million) |

|

Japan |

155.0 |

|

South Korea |

151.0 |

|

China |

97.2 |

Source: 2023 OEC data

China holds an excellence in healthcare manufacturing capacity, which empowers its presence in the global dental fluoride treatment market. Besides having a domestic urge, the country has drafted an ambitious plan to become the largest production house for every medical category. For instance, China ranked among the top producers of dental products by securing an export value of USD 598.0 million in 2023, as per OEC data. The country is also a large reservoir of essential elements for the manufacturing community in this sector, proving the availability of sufficient raw materials and fostering a profitable marketplace. In this regard, China became the largest supplier of fluoride in the world in 2023, accounting for an export value of USD 571.0 million: 2023 OEC.

India is also emerging as one of the biggest contributors to the dental fluoride treatment market. The emphasized pharmaceutical industry of this country is presenting a great scope for investment by enacting favorable government policies and subsidiary programs. These conjugated efforts are intended to address the increasing prevalence of cavities and serious oral diseases. As per a 2021 NLM report, India witnessed a wide range of dental caries prevalence in different regions, which are: 72.0% in western, 57.0% in northern, 56.0% in central, and 51.0% in southern India. The figures were further followed by 36.0% in eastern India. Further, government initiatives such as the National Oral Health Programme are expanding market exposure by following the objectives to promote public-private partnerships.

Key Dental Fluoride Treatment Market Players:

- Colgate-Palmolive Company

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- 3M Company

- Solventum Corporation

- Dentsply Sirona Inc.

- GC Corporation

- Young Dental

- Ultradent Products Inc.

- The Procter & Gamble Company

- Water Pik, Inc.

- Dental Herb Company

- Premier Dental Products Company

- Oral Science

- Credentis AG

- PreViser Corporation

- Ivoclar Vivadent AG

- Elevate Oral Care, LLC

The global demography of the dental fluoride treatment market is becoming highly competitive and progressive with a strong emphasis on leading pioneers. Their innovative solutions and meticulous R&D involvement are diversifying the range of existing pipelines, that increase accessibility in the marketplace. For instance, in November 2023, Convergent Dental launched Solea Protect, offering inhibition from acid attack and caries development in teeth. The new application is capable of delivering six times greater results when combined with fluoride treatment. Such innovations are enhancing product efficacy, inflating adoption in this field, and enlarging scopes for investment. Such key players in dental fluoride treatment market are:

Recent Developments

- In May 2024, Oral Science started a new era of dental care technology with the launch of Advantage Arrest Silver Diamine Fluoride (SDF) Gel in Canada. The formulation is built with a revolutionary combination of silver diamine fluoride and the precision & ease of a gel, offering ease of application and improved outcomes.

- In April 2024, 3M Company announced the spin-off of its healthcare business, Solventum Corporation, having a pipeline of dental fluoride products. According to the agreement, 3M still held a 19.9% share in the company’s common stock, which is to be monetized in the upcoming 5 years.

- Report ID: 7206

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Dental Fluoride Treatment Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.