Demulsifier Market Outlook:

Demulsifier Market size was over USD 2.58 billion in 2025 and is anticipated to cross USD 3.75 billion by 2035, growing at more than 3.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of demulsifier is assessed at USD 2.67 billion.

The market is witnessing robust growth, driven by the increasing global demand for oil and gas. In 2025, the U.S. Energy Information Administration reported a rise in global oil production by 1.4 billion barrels per day, indicative of heightened exploration and production efforts, particularly in areas like the U.S., the Middle East, and offshore locations. As oilfield operators strive to maximize yields and improve processing efficiency, demulsifiers play a vital role by enabling effective separation of water from crude oil, an essential process in enhancing overall recovery rates.

Amid this growing demand, the demulsifier market is undergoing a notable transformation toward sustainability. The environmental drawbacks of traditional chemical demulsifiers have prompted a shift toward biodegradable and non-toxic alternatives. Increasing awareness of environmental issues and stricter regulatory frameworks are compelling manufacturers to innovate and develop eco-friendly formulations that align with sustainability goals without compromising performance. These advanced demulsifiers are engineered to operate across diverse pressure and temperature ranges, making them suitable for challenging environments such as deep-water and offshore drilling operations.

The U.S. Environmental Protection Agency (EPA) reported a reduction in offshore chemical discharge limits by 2023, further pushing the adoption of green technologies. In response, companies like Clariant have developed environmentally friendly demulsifier solutions that comply with global environmental standards while maintaining high separation efficiency. Their sustainable product line showcases how innovation is aligning operational efficiency with ecological responsibility, setting new benchmarks in oilfield chemical applications. This shift underscores a broader industry trend toward environmentally sound operations, where performance and sustainability are increasingly intertwined in product development and oilfield practices.

Key Demulsifier Market Insights Summary:

Regional Highlights:

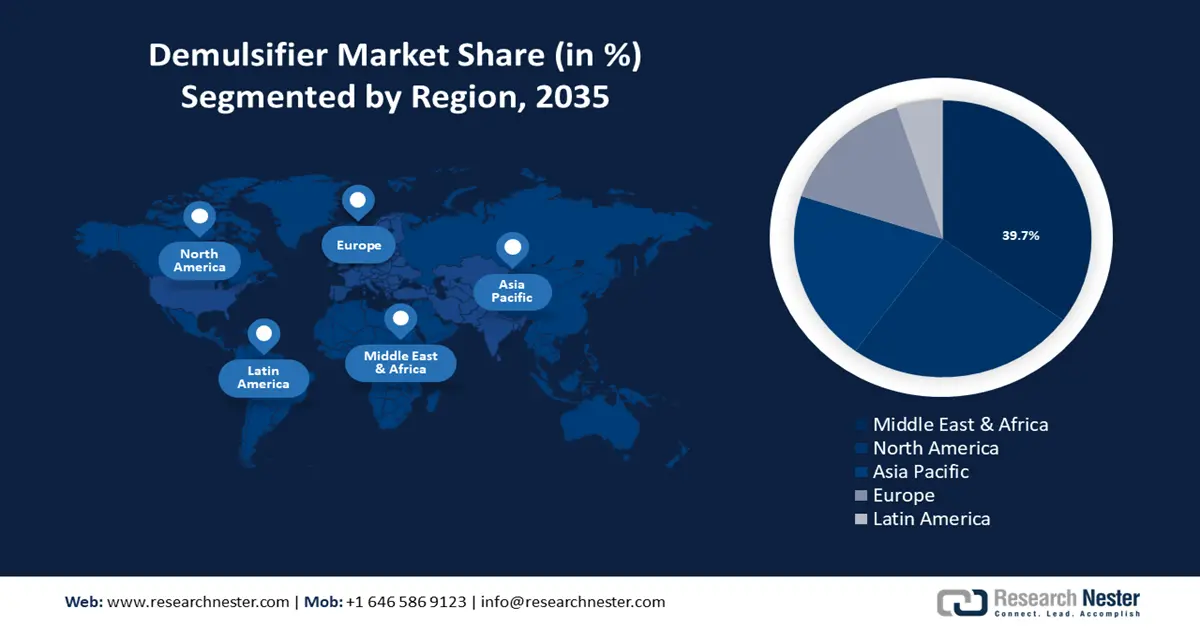

- The Middle East & Africa demulsifier market is projected to capture a 39.70% share by 2035, driven by high oil and gas production capacity.

Segment Insights:

- The oil soluble demulsifiers segment in the demulsifier market is projected to hold a dominant 70.4% share by 2035, driven by high effectiveness in separating water from crude oil, especially in harsh environments.

Key Growth Trends:

- Rising usage of demulsifier in food & beverage and mining sector

- Growing demand for fuel-efficient automobiles and industrialization

Major Challenges:

- Restricting toxic chemicals to manufacture demulsifiers

- Stringent regulations imposed by governments

Key Players: Momentive, Schlumberger Limited, Clariant Switzerland, Dow Chemical Company, Halliburton, Akzo Nobel N.V., Clariant, Baker Hughes, Croda International Plc..

Global Demulsifier Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.58 billion

- 2026 Market Size: USD 2.67 billion

- Projected Market Size: USD 3.75 billion by 2035

- Growth Forecasts: 3.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Middle East & Africa (39.7% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Saudi Arabia, China, United Arab Emirates, Germany

- Emerging Countries: China, India, Brazil, Mexico, Malaysia

Last updated on : 8 September, 2025

Demulsifier Market Growth Drivers and Challenges:

Growth Drivers

- Rising usage of demulsifier in food & beverage and mining sector: The growing application of demulsifiers in the food & beverage and mining industries is emerging as a significant driver for demulsifier market expansion. In the food sector, demulsifiers play a critical role in ensuring the purity and quality of edible oils, such as vegetable and other food-grade oils, by effectively separating water and impurities. This is increasingly important as consumer preferences shift toward healthier food options and regulatory bodies enforce stricter quality and safety standards. According to the U.S. Department of Agriculture (USDA), the global vegetable oil market reached approximately 213 million metric tons in 2022, with a projected annual growth rate of 4%, underscoring the rising demand for refined and high-quality oils.

Dow Inc. is a leading example of a company providing specialized demulsifier solutions. Dow offers a range of food-grade processing aids, including demulsifiers designed to enhance the separation and purification of vegetable and edible oils. Their products help ensure consistency, purity, and compliance with food safety regulations, aligning with the rising global demand for high-quality, refined oils. Dow’s solutions are engineered to meet strict regulatory requirements while supporting efficiency in large-scale food processing operations, reflecting the industry's growing emphasis on both performance and sustainability.

In the mining industry, demulsifiers are crucial in separating emulsified water and hydrocarbons during mineral extraction processes. These emulsions, if left untreated, hinder extraction efficiency and raise processing costs. A notable company providing demulsifier solutions for the mining industry is Imperial Oilfield Chemicals focuses on producing demulsifiers that are specifically engineered to separate water-in-oil emulsions in mining activities. Their products are tailored to enhance the efficiency of mineral extraction processes by facilitating the separation of water from crude oil and other hydrocarbons. ICPL emphasizes the use of cutting-edge technology and rigorous quality control to ensure the effectiveness and consistency of its demulsifier products. By offering both water-soluble and oil-soluble demulsifiers, ICPL addresses the diverse needs of the mining industry, contributing to more sustainable and cost-effective operations. - Growing demand for fuel-efficient automobiles and industrialization: The demulsifier market is experiencing substantial growth, driven by the increasing demand for fuel-efficient automobiles, rapid industrialization, and the continued exploration of new oil reserves. Emulsion formation during oil extraction poses significant challenges for processing, necessitating effective chemical separation solutions. Demulsifiers play a crucial role in breaking these emulsions, converting crude oil into usable petroleum products efficiently. As global energy demands rise, particularly in fast-growing economies such as India and China, there is a need for demulsifiers in refining, power generation, and automotive sectors.

According to the U.S. Energy Information Administration, global daily consumption of liquid petroleum rose from an average of 97.4 million barrels in 2021 to 101.5 million in 2023, reflecting the surging demand for fuels derived from crude oil. Additionally, new oil field discoveries, such as those recently announced by Saudi Aramco, are expected to boost crude oil production capacity, further accelerating the need for demulsifiers.

An instance of market innovation is Halliburton, which offers high-performance demulsifier solutions tailored to diverse oilfield conditions. Their advanced formulations help optimize separation efficiency while aligning with environmental regulations, supporting both operational performance and sustainability.

Challenges

- Restricting toxic chemicals to manufacture demulsifiers: The restriction on toxic chemicals traditionally used in demulsifier manufacturing presents a notable challenge to market growth. Regulatory bodies are increasingly enforcing stringent environmental and safety standards, limiting the use of non-biodegradable and hazardous substances. This shift compels manufacturers to invest in the development of eco-friendly alternatives, which often involve higher production costs and longer development cycles. As companies transition to greener formulations, the availability and performance of demulsifiers may be temporarily affected, potentially slowing market expansion. This regulatory pressure, while encouraging sustainability, introduces complexities that could hinder short-term growth in the demulsifier market.

- Stringent regulations imposed by governments: Stringent government regulations on the use of toxic chemicals in demulsifiers are expected to hinder market growth. While traditional chemical demulsifiers, such as those containing polymer surfactants like polypropylene and polyoxymethylene, are effective in treating water-in-oil emulsions, they pose significant environmental risks. These formulations often include harmful compounds such as methylbenzene, which can contaminate marine ecosystems when separated water is discharged into the sea. In response, regulatory authorities have enforced strict limitations on the use of such substances, compelling manufacturers to seek safer alternatives. This transition may increase production costs and slow market expansion in the short term.

Demulsifier Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

3.8% |

|

Base Year Market Size (2025) |

USD 2.58 billion |

|

Forecast Year Market Size (2035) |

USD 3.75 billion |

|

Regional Scope |

|

Demulsifier Market Segmentation:

Type Segment Analysis

The oil soluble demulsifiers segment is expected to account for the largest share of the demulsifier market, holding approximately 70.4%. Their dominance is attributed to their high effectiveness in separating water from crude oil, particularly in heavy oil and complex emulsion systems. These demulsifiers are engineered to integrate into the oil phase, facilitating the swift and effective disintegration of water-in-oil emulsions. This function is critical in the oil and gas industry, where effective phase separation is essential to maintain crude oil quality and meet processing standards. Oil-soluble demulsifiers are especially valuable in demanding operational environments such as offshore drilling and unconventional oil extraction, where conditions often involve high temperatures and pressures. Their reliability, compatibility with various crude types, and consistent performance under extreme conditions make them a preferred choice among producers globally.

A leading example is Schlumberger, which offers a range of oil-soluble demulsifiers through its production chemicals division. These demulsifiers are specifically designed to effectively separate water from crude oil in challenging extraction environments such as offshore drilling and unconventional oil production. Schlumberger’s oil-soluble demulsifiers are engineered to perform under high-pressure and high-temperature conditions, ensuring efficient emulsion breaking and improved crude oil quality. Their solutions are widely used by oil and gas producers for their reliability and effectiveness across various oil types and extraction methods.

Application Segment Analysis

Crude oil processing is expected to hold a substantial demulsifier market share during the forecast period, driven by the essential role of demulsifiers in refining operations. The extraction of crude oil often results in stable water-in-oil emulsions, which must be effectively separated to deliver high-quality crude to refineries. As global energy consumption rises, the demand for efficient crude oil treatment intensifies, especially with the growing production of unconventional oil sources that tend to produce more complex emulsions.

Stringent regulations on crude oil quality and environmental impact further emphasize the need for advanced demulsification solutions. This market segment continues to thrive as innovations in demulsifier formulations and application techniques improve separation efficiency, benefiting the overall oil production and refining process. A key example is Baker Hughes, a leading provider of demulsifier solutions for crude oil processing. Their innovative products are designed to handle challenging emulsions, ensuring high-performance separation while complying with environmental and quality standards in oil refining.

Our in-depth analysis of the global market includes the following segments:

|

Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Demulsifier Market Regional Analysis:

Middle East and Africa Market Insights

The Middle East and Africa demulsifier market is poised to hold a 39.7% share by the end of 2035. This dominance is largely attributed to the region's significant oil and gas production capacity, with countries like Saudi Arabia, the United Arab Emirates, and Iraq leading global production. As investment in oil exploration and extraction continues, particularly in challenging offshore and deep-water fields, the need for effective demulsification technologies to treat water-in-oil emulsions has grown. Additionally, stricter environmental regulations and a focus on refining process optimization are further driving demand for demulsifiers.

In South Africa, emerging oil markets such as Nigeria and Angola are also contributing to the region's growth, increasing the domestic demand for demulsifiers in crude oil processing. TotalEnergies is a key player in Africa's demulsifier market, providing innovative chemical solutions for crude oil processing. Operating in several African countries, including Nigeria and Angola, TotalEnergies specializes in offering demulsifiers that efficiently separate water from oil, optimizing production and ensuring compliance with strict environmental regulations.

North America Market Insights

The North American demulsifier market is expected to hold a substantial share in the global market, driven by increasing oil production, refining activities, and advancements in environmental regulations. The U.S. is one of the world's largest oil producers, with shale oil and unconventional oil extraction playing a crucial role. As oil extraction processes result in stable water-in-oil emulsions, the demand for efficient demulsification technologies is high to ensure crude oil quality and meet stringent environmental standards.

Canada, with its substantial oil sands reserves in Alberta, also contributes significantly to the demand for demulsifiers. The complexity of oil sands extraction, combined with the need to treat emulsions and wastewater, further fuels the market for effective demulsifiers. A notable company in this region is Huntsman Corporation, which provides a range of demulsifiers specifically designed for North American oil production. Their products cater to both the U.S. and Canada, offering solutions that meet the high-performance standards required for complex emulsion treatments, ensuring efficient separation in both conventional and unconventional oil fields.

Demulsifier Market Players:

- BASF SE

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Halliburton

- The Momentive

- Schlumberger Limited

- Clariant Switzerland

- The Dow Chemical Company

- Akzo Nobel N.V.

- Clariant

- Baker Hughes

- Croda International Plc

- Ecolab

Key players like BASF, Schlumberger, and Halliburton utilize advanced chemical formulations, including eco-friendly and biodegradable demulsifiers, to meet strict environmental standards. They also focus on innovative application techniques for challenging environments, such as offshore and deep-water drilling, ensuring efficient separation and positioning themselves as market leaders through ongoing R&D.

Recent Developments

- In 2023, Clariant introduced a novel line of environmentally sustainable demulsifiers aimed at improving oil-water separation processes and minimizing ecological impact, particularly suited for offshore applications.

- In 2023, Dow enhanced its product range by launching DOWSIL, a new series of demulsifiers designed to deliver exceptional performance under high-temperature conditions, specifically addressing the requirements of deep-water drilling activities.

- Report ID: 574

- Published Date: Sep 08, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Demulsifier Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.