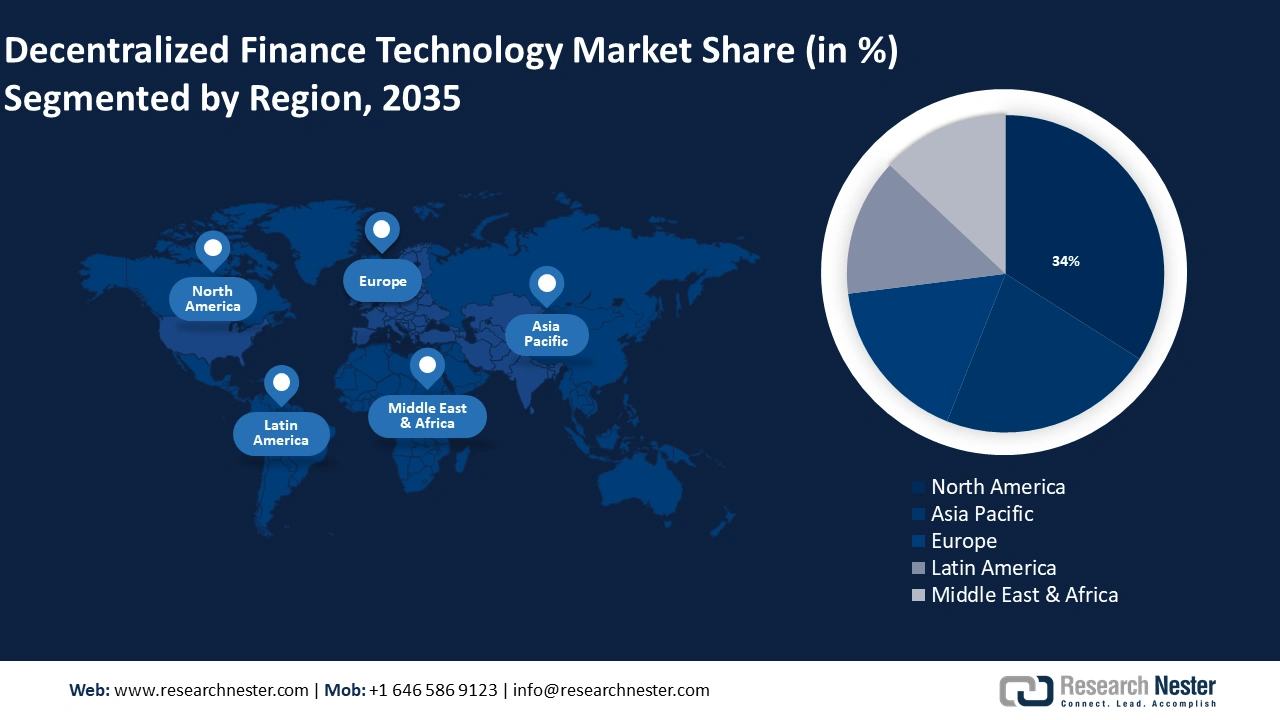

Decentralized Finance Market Regional Analysis:

North American Market Insights

The North America region is predicted to account for 34% share of the decentralized finance market by the end of 2035. The market growth in the region is also expected on account of the rising demand for DeFi applications in the region. As Decentralized Finance eliminates the requirement for a centralized finance paradigm and everyone anywhere can access financial services. Moreover, due to the increasing adoption, cryptocurrency has also increased the need for DeFi applications in the region. Studies show that approximately 46 million Americans (roughly 22% of the adult population) own a share of Bitcoin. Furthermore, the presence of key market players such as Blockchain App Factory, SDLCCorp, ScienceSoft, Uniswap and rising number of strategic initiatives such as Canadian Blockchain Research Institute and government support for blockchain projects are also expected to fuel the market revenue growth of this region during the forecast period. Additionally, the region benefits from a tech-savvy population, high internet penetration, and a strong culture of entrepreneurship, which further accelerates the adoption of decentralized financial solutions. Overall, these factors drive the expansion of the DeFi market across North America.

APAC Market Insights

The Asia Pacific decentralized finance market is estimated to be the second largest, registering a share of about 22% by the end of 2035. The market’s expansion of Decentralized Finance in the region can be attributed majorly to the leading fintech hubs in the region like South Korea, India, China, Japan, Singapore, and the Philippines. According to research, South Korea's fintech acceptance rate has reached 67% of the country's digitally active adults. In addition to that, India solidified its place as a prominent player on the global stage, placing third internationally in 2023 for fintech startup investment. Furthermore, progressive regulatory frameworks like the Monetary Authority of Singapore's (MAS) fintech regulatory sandbox and the establishment of the Singapore Fintech Association contribute to the flourishing DeFi ecosystem in the region. Additionally, the region benefits from the high adoption of blockchain technology. For instance, the number of registered blockchain-related enterprises in China is expected to reach 33,700 by 2022. The vibrant startup ecosystems, strategic geographic positions, and growing investor interest in Decentralized Finance projects serve as key drivers of DeFi market growth in the Asia-Pacific region.