DC Servo Motors and Drives Market Outlook:

DC Servo Motors and Drives Market size was valued at USD 5.18 billion in 2025 and is likely to cross USD 10.48 billion by 2035, expanding at more than 7.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of DC servo motors and drives is assessed at USD 5.52 billion.

The DC servo motors and drives market is expanding due to the increased automation in energy-intensive industries and the development of improved products and technologies to adapt to changing user needs. Globally, about 74% of energy and utility organizations have adopted or are considering implementing artificial intelligence (AI) and automation in their operations. In the energy sector, automation dramatically boosts production and operational efficiency while providing businesses more control. Energy firms can streamline operations, decrease manual intervention, and minimize errors by automating regular tasks and procedures.

Key DC Servo Motors and Drives Market Insights Summary:

Regional Highlights:

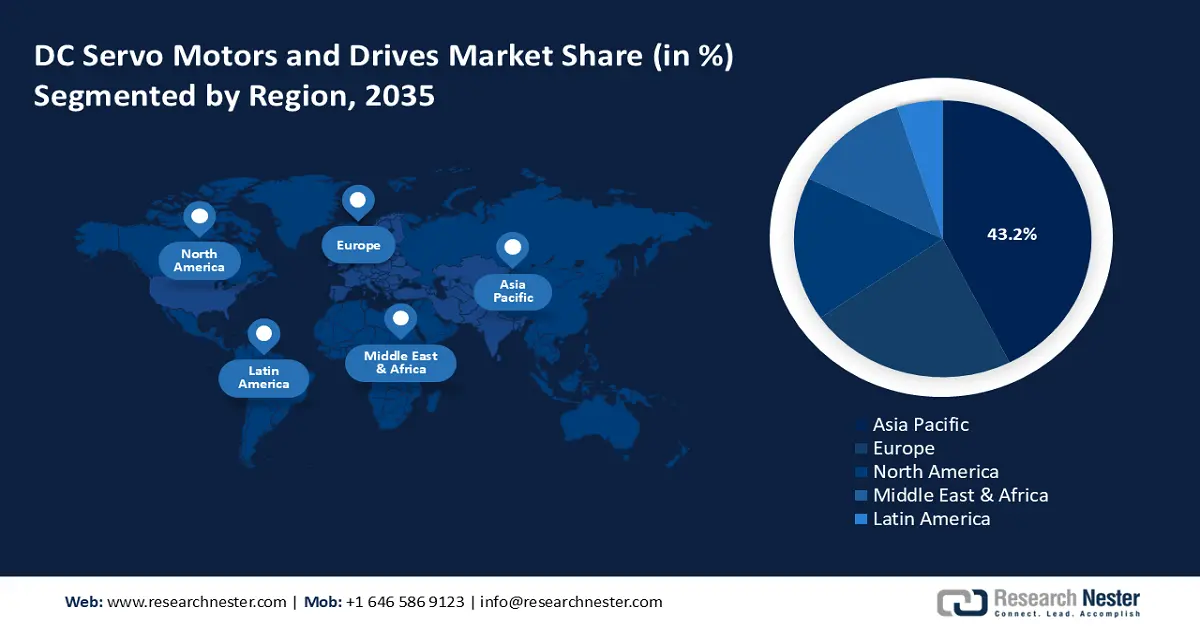

- Asia Pacific DC servo motors and drives market will account for 43.20% share by 2035, fueled by rapidly expanding population, investments in energy-intensive industries, and emphasis on energy demand.

Segment Insights:

- The analog segment in the dc servo motors and drives market is projected to hold a significant share by 2035, driven by increasing automation demands requiring precision and reliability in manufacturing and robotics.

Key Growth Trends:

- Increased investment in infrastructure

- Shift towards smart manufacturing solutions

Major Challenges:

- Availability of alternatives

- Intense Competition

Key Players: Allient Inc., Applied Motion Products, Inc., AXOR IND. S.a.s, Bosch Rexroth Corporation, Ingenia Cat S.L.U., JVL A/S, Kollmorgen, Leadshine, Shenzhen Jiayu Mechatronic Co., Ltd., Siemens AG.

Global DC Servo Motors and Drives Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 5.18 billion

- 2026 Market Size: USD 5.52 billion

- Projected Market Size: USD 10.48 billion by 2035

- Growth Forecasts: 7.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (43.2% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, South Korea

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 18 September, 2025

DC Servo Motors and Drives Market Growth Drivers and Challenges:

Growth Drivers

- Increased investment in infrastructure: Growing infrastructure expenditures have raised the need for HVAC systems, which are essential for maximizing energy output in various applications. Energy-efficient heating, ventilation, and air conditioning (HVAC) systems are essential for maintaining indoor comfort, cutting energy use, and minimizing environmental effects, which makes them a crucial component of sustainable urbanization. According to a report published on Capital project and infrastructure spending Outlook to 2025, it has been stated that global infrastructure spending is expected to have increased from USD 4 trillion in 2012 to over USD 9 trillion annually. Investment is anticipated to reach over USD 78 trillion between 2014 and 2025. As infrastructure technologies advance, consumers seek units with greater resistance and control, and efficiency expectations shift, the business landscape is expected to experience significant change.

- Shift towards smart manufacturing solutions: The DC servo motors and drives market is expanding due to the growing technological breakthroughs in industrial automation and government regulations promoting environmental sustainability. For instance, The Green Credit Rules, 2023 were formally released by the Ministry of Environment, Forests, and Climate Change to support the Green Credit Program, which uses a market-driven strategy to support sustainability and environmental preservation. The industrial automation sector is witnessing a surge in smart manufacturing, and this, coupled with the growing demand for dependable and effective motor control solutions in energy-intensive sectors, is expected to enhance the industry environment.

- Increased adoption of Industry 4.0 and Industrial Internet of Things (IIoT): To streamline business operations and boost productivity, many companies are switching from standard DC motors to DC servo motors and drives. The emergence of Industry 4.0, characterized by its emphasis on automation, data exchange, and digitalization, has presented servo motors and drives market participants with various prospects. According to a 2022 survey report on Industry 4.0 adoption, a staggering 72% of the respondents are implementing their Industry 4.0/Smart Factory, with many initiatives in progress and some already completed. The synergy between servo motors and technologies such as AI and machine learning enhances process optimization and productivity.

Challenges

- Availability of alternatives: The advent of inexpensive, low-quality motors threatens well-established, high-quality manufacturers, putting pressure on them to improve their products or risk losing customers. Due to a possible reduction in consumer trust, these motors are not expected to be widely adopted across a range of industries. Therefore, the availability of these alternatives may hinder the DC servo motors and drivers market.

- Intense Competition: The increased competition that inferior alternatives pose to established firms negatively impacts market share and profitability. To address this issue, DC motor manufacturers need to prioritize strict quality control procedures, inform customers about the long-term advantages of their premium products, and enforce industry norms to maintain the integrity of the market.

DC Servo Motors and Drives Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

7.3% |

|

Base Year Market Size (2025) |

USD 5.18 billion |

|

Forecast Year Market Size (2035) |

USD 10.48 billion |

|

Regional Scope |

|

DC Servo Motors and Drives Market Segmentation:

Category Segment Analysis

Analog segment is anticipated to capture DC servo motors and drives market share of around 56.7% by the end of 2035. The segment’s growth can be attributed to the increasing automation in the manufacturing sector, driven by the necessity for precise control and reliability in applications such as robotics, CNC machines, and conveyor systems. Technological advancements, including improved performance and cost efficiency, are hastening the adoption of these systems across various applications, including aerospace and automotive, due to their requirement for high-precision and high-speed operations.

For instance, in 2022, Baumuller launched the new generation of b maXX 6000 servo controllers for optimum scalability and increased performance. The improved performance is ensured by recently developed safety features that reduce machine cycle times. However, the servo drive is capable of much more; it may be utilized as a sensor or sensor hub and provides cloud-based IoT connectivity that is expandable, for example, through an edge PC.

Application Segment Analysis

The metal cutting & forming segment in DC servo motors and drives market is poised to garner a notable share in the forecast period. The necessity for precision in metal cutting is driving up demand for modern technical machinery across multiple industries, including iron and steel. This has resulted in an acceleration in product demand. The precision of these units in motion control and speed, as well as their capacity to optimize industrial operations, will significantly impact the business environment. Moreover, the expansion of advanced manufacturing facilities and processes, coupled with the increasing adoption of these units to enhance output, flexibility, and production quality, will continue to shape the dynamics of the industry.

Our in-depth analysis of the DC servo motors and drives market includes the following segments:

|

Category |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

DC Servo Motors and Drives Market Regional Analysis:

APAC Market Insights

By 2035, Asia Pacific DC servo motors and drives market is projected to account for around 43.2% revenue share. The market is growing in the region owing to the rapidly expanding population, thriving investments in energy-intensive industries, and a growing emphasis on improving motor control due to the increasing energy demand. According to the Climate Group, the region, which is home to more than half of the world's population, has grown to be a major economic force. By 2040, energy demand in some of these regions is expected to rise by as much as 80%.

The DC servo motors and drives market is expanding in China due to the increased focus on industrial automation across several industries. The International Federation of Robots stated that China has emerged as the world leader in automation. Industrial robot sales rose by 15-20% annually on average between 2018 and 2020. Furthermore, the industry outlook will be positively impacted by strict laws aimed at increasing energy consumption and efficiency and by the expansion of robots and industrial automation across various industries.

In India, there is a growing momentum in the industrial automation sector toward smart manufacturing and Industry 4.0. For instance, SAMARTH Udyog Bharat 4.0 is an Industry 4.0 effort of the Ministry of Heavy Industry & Public Enterprises, a program on the Enhancement of Competitiveness in the Indian Capital Goods Sector. This is accompanied by a rising demand for dependable and effective motor control solutions in energy-intensive industries, which will complement the industry landscape.

Europe Market Insights

The DC servo motors and drives market will witness huge growth in Europe during the forecast period. The market is growing due to the increasing energy demand, the rise in production and development operations (particularly hydraulic fracturing), the decrease in reliance on coal reserves, and initiatives to promote renewable energy sources that includes solar and wind power. For instance, by 2050, the EU wants to achieve carbon neutrality through the European Carbon Law. A 32% binding minimum target for the proportion of renewable energy in the EU's gross final energy consumption by 2030 is also included in the amended Renewable Energy Directive. Also, in the UK, the increased automation in energy-intensive industries and the development of improved products and technologies to adapt to changing user needs will drive market growth.

Moreover, Germany serves as a manufacturing base for various products in numerous end use industries, including electronics, and the increasing demand for these products will support the adoption of these drives. Also, major businesses in the nation will invest heavily in manufacturing technology, accelerating market growth. According to the International Trade Administration, 84% of German businesses intend to invest USD 10.52 billion a year by 2025 in smart manufacturing technology, with the automobile sector accounting for approximately half of this amount.

DC Servo Motors and Drives Market Players:

- Allient Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Applied Motion Products, Inc.

- AXOR IND. S.a.s

- Bosch Rexroth Corporation

- Ingenia Cat S.L.U.

- JVL A/S

- Kollmorgen

- Leadshine

- Shenzhen Jiayu Mechatronic Co., Ltd.

- Siemens AG

Many manufacturers are vying for market dominance in the fiercely competitive market for DC servo motors and drives due to growing demand and increased technological usage. To keep up with rivals in the industry, the number of well-known companies has increased.

Recent Developments

- In October 2023, Applied Motion Products introduced the MBDV Single and Dual Axis Servo drives, which are DC-powered and can control 8-pole servo motors. This drive solution, when combined with the latest software, Luna, can be a strong tool to use during the development process. Users can also use various monitoring tools, like scope, which allows for four-channel monitoring, parameter tables for quick tweaking, and many others.

- In May 2023, Siemens introduced a new servo drive system suited for a wide range of conventional applications in the battery, electronics, and other sectors. It has a precise servo drive, powerful servo motors, and simple wires that provide excellent dynamic performance.

- Report ID: 6547

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

DC Servo Motors and Drives Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.