DC Microgrid Market Outlook:

DC Microgrid Market size was over USD 8.73 billion in 2025 and is anticipated to cross USD 51.84 billion by 2035, growing at more than 19.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of DC microgrid is estimated at USD 10.26 billion.

The rise in the adoption of renewable energy sources such as wind, hydropower, and solar are significantly boosting the DC microgrid market growth. The inherent nature of DC power manages current from renewable sources, effectively mitigating the conversion loss. The residential and commercial spaces are increasingly adopting DC microgrids powered by solar panels. In these technologies, the solar systems directly charge energy storage systems (batteries) or DC loads without the need for an AC-to-DC conversion, making them more efficient and cost-effective.

The increasing prices of fossil fuel energy sources are driving governments across the world to adopt renewable energy sources. For instance, according to the International Energy Agency report, the global renewable energy capacity is set to increase by over 60% from 2020 levels to over 4,800 GW by 2026. Solar photovoltaics (PV) are the powerhouses contributing to the increasing renewable energy capacity. Also, the strict environmental regulations and net-zero carbon emission goals are contributing to the DC microgrid sales growth.

Key DC Microgrid Market Insights Summary:

Regional Highlights:

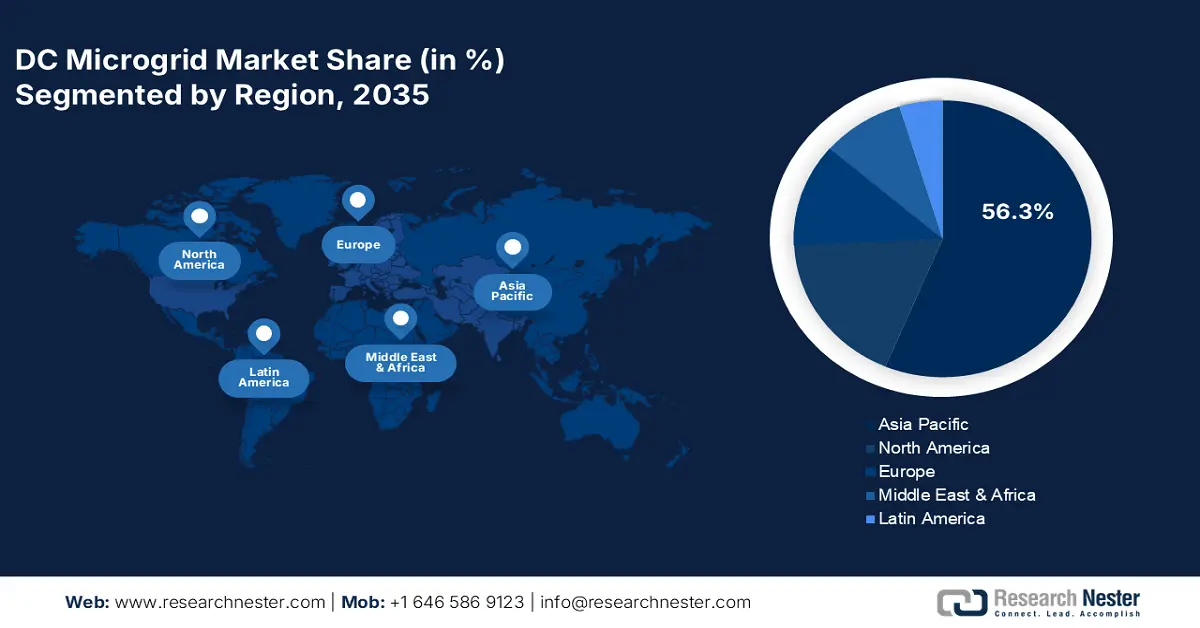

- Asia Pacific dominates the DC microgrid market with a 56.3% share, propelled by swift urban and industrial activities and rising renewable energy adoption, ensuring growth through 2026–2035.

Segment Insights:

- The Grid Connected segment is forecasted to capture a significant share by 2035, propelled by increasing renewable energy integration and system efficiency.

- The Flow Battery segment is poised for substantial growth from 2026-2035, driven by rising demand for energy storage from renewables.

Key Growth Trends:

- Smart technologies boosting DC microgrid sales

- High EV adoption fuels DC microgrid charging technology demand

Major Challenges:

- High capital investment

- Compatibility issues

- Key Players: AEG International, ARDA Power, ABB Ltd, and Eaton Corporation.

Global DC Microgrid Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 8.73 billion

- 2026 Market Size: USD 10.26 billion

- Projected Market Size: USD 51.84 billion by 2035

- Growth Forecasts: 19.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (56.3% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, Germany, South Korea

- Emerging Countries: China, India, Japan, South Korea, Australia

Last updated on : 14 August, 2025

DC Microgrid Market Growth Drivers and Challenges:

Growth Drivers

-

Smart technologies boosting DC microgrid sales: The integration of smart technologies such as artificial intelligence, machine learning, and the Internet of Things (IoT) into DC microgrids is enhancing their efficiency, cost-effectiveness, and grid management. Smart technologies bring real-time monitoring, predictive analysis, automation, and optimization for effective decision-making. Data analytics and machine learning algorithms enable DC microgrid operators to optimize power distribution based on the current demand, environmental/weather conditions, and available renewable resources.

Furthermore, IoT sensors monitor several parameters including voltage, temperature, and current aiding operators to spot inefficiencies or potential issues quickly. Such advanced features are not only enhancing the performance of the DC microgrids but also significantly contributing to their sales growth. -

High EV adoption fuels DC microgrid charging technology demand: The rising popularity of electric vehicles is creating a profitable landscape for DC microgrid manufacturers. DC microgrids are effective in providing a reliable and efficient power supply for EV charging infrastructure, especially in off grid or remote locations. As EV ownership increases, the demand for next-gen DC microgrid-changing technology is set to boom. For instance, according to the International Energy Agency (IEA), electric vehicle (EV) sales reached 14 million in 2023, and almost 1 in 5 cars sold were electric. Furthermore, 95% of all sales were from China, Europe, and the U.S.

Challenges

-

High capital investment: DC microgrids offer long-term cost savings and energy efficiency but the initial investment costs are substantial. For installing advanced DC microgrid technology the presence of next-gen infrastructure is necessary, the complex technology cannot be integrated with conventional infrastructure, which adds up to the overall cost. Furthermore, the high costs of specialized devices such as converters, controllers, and energy storage devices essential in the working of DC microgrids, increase the overall infrastructural costs, hampering the DC microgrid market growth to some extent.

-

Compatibility issues: DC microgrids are mostly designed for off grid and islanded modes or as a part of larger hybrid systems. Connecting DC microgrids to conventional AC grid infrastructure poses compatibility challenges. Thus, the complex and costly transition between DC and AC grids can limit DC microgrid adoption rates.

DC Microgrid Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

19.5% |

|

Base Year Market Size (2025) |

USD 8.73 billion |

|

Forecast Year Market Size (2035) |

USD 51.84 billion |

|

Regional Scope |

|

DC Microgrid Market Segmentation:

Connectivity (Grid Connected, Off Grid)

Grid connected segment is anticipated to dominate around 75.1% DC microgrid market share by the end of 2035. Grid connected means the renewable energy source such as the solar system is associated with the local utility’s grid. This connectivity is often employed by the residential sector where solar panels produce varying energy (over or low), where the utility system acts as an effective battery space. The grid-connected DC microgrids also reduce the need for conversion, which leads to low energy losses and high system efficiency. Furthermore, as the need for renewable energy generation increases, the demand for grid-connected systems that can seamlessly connect to and manage these sources rises.

Storage Device (Lithium-ion, Lead Acid, Flow Battery, Flywheels, Others)

Flow battery segment in the DC microgrid market is set to observe more than 23.5% growth through 2035. The growing deployment of high-efficiency power generation sources such as solar and wind drives a high need for energy storage systems to address intermittency. DC microgrid flow batteries are effective in storing and dispatching energy, which highlights them as a reliable and grid stable energy storage system for high-efficiency power generation sources. Ongoing technological advancements are enhancing the performance of DC microgrid flow batteries and leading to cost reduction due to scalability, modularity, and lower maintenance.

Vanadium redox flow batteries are one of the most employed flow batteries owing to their high performance. For instance, in October 2023, i-Battery Energy Technology Co., Ltd announced the launch of its first next-gen Vanadium Redox Flow battery production line in Suzhou, China. The growing popularity of vanadium redox flow batteries is expected to aid this company in earning more through the launch.

Our in-depth analysis of the global DC microgrid market includes the following segments:

|

Connectivity |

|

|

Power Source |

|

|

Storage Device |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

DC Microgrid Market Regional Analysis:

Asia Pacific Market Forecast

Asia Pacific in DC microgrid market is likely to dominate around 56.3% revenue share by the end of 2035. The swift urban and industrial activities are driving a high need for new or upgradation of infrastructures, which is directly influencing the sales of DC microgrids in the region. The increasing employment of renewable energy sources owing to high fossil fuel energy prices is supporting the sales of DC microgrids.

In India, the government is investing heavily in energy-efficient power generation sources such as solar systems, which is creating lucrative opportunities for DC microgrid manufacturers. For instance, according to the India Brand Equity Foundation report, the country invested around USD 1.02 billion for solar power grid infrastructure development in the FY 2024-2025 budget. Also, to align with the COP26 initiative, the Ministry of New and Renewable Energy focuses on the generation of 500 GW of non-fossil-based energy by 2030. All such initiatives are set to significantly increase the adoption of DC microgrids throughout the forecast period.

China is one of the rapidly expanding DC microgrid markets for electric vehicles and this aspect is contributing to the high demand for microgrids. For instance, according to the International Energy Agency report, 60% of new electric cars were registered in China in 2023. DC microgrid charging technology is effective in the efficient charging of electric vehicles. The penetration of electric vehicles and DC-based loads is anticipated to boost the sales of DC microgrids in the country in the coming years.

North America Market Statistics

The North America DC microgrid market is expected to expand at a fast pace during the projected period. The increasing adoption of electric vehicles and high investments in renewable energy sources are fueling the demand for advanced DC microgrids. The U.S. and Canada both are estimated to offer high-potential opportunities for DC microgrid producers in the coming years.

In the U.S. the supportive government solar installation policies in the form of tax credits are encouraging citizens to adopt solar PV for both residential and commercial spaces. For instance, the investment tax credit scheme offers a 30% tax credit to those who install solar PV systems between 2022 and 2032. Such schemes are driving positive investments in the clean energy and microgrid projects in the country contributing to the overall DC microgrid market growth.

Canada is focused on modernizing its electricity grid infrastructure with the installation of renewable energy sources such as solar panels, batteries, wind turbines, and other technologies. This transformation is driving high demand for smart, flexible, and reliable DC microgrids to make energy distribution more efficient. For instance, according to the report by Ressources Naturelles Canada, the government invested around USD 4.5 billion in the Smart Renewables and Electrification Pathways Program (SREPs) to modernize and strengthen the electricity grid through clean sources.

Key DC Microgrid Market Players:

- AEG International

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- ARDA Power

- ABB Ltd

- Eaton Corporation

- Enel X

- EnSync Energy Systems

- PowerSecure, Inc.

- Schneider Electric SE

- SolarWorX

- Schaltbau Group

- Innovenergy

- AMPT

Key players in the DC microgrid are investing heavily in research and development activities to introduce innovative solutions. They are also forming strategic partnerships with other players and collaborating with tech firms to enhance their product offerings. Collaboration with tech firms is enabling DC microgrid market players to develop smart technology-based DC microgrids, which widely attract a tech-savvy customer base. Furthermore, industry giants are entering high-potential marketplaces to cater to a larger customer base to earn high profits.

Some of the key players include:

Recent Developments

- In March 2023, ABB Ltd announced that it entered into a strategic partnership with Direct Energy Partners (DEP), a digital technology start-up to boost the employment of DC microgrids for energy transformation. This move is set to boost ABB’s position in the marketplace.

- In March 2023, Innovenergy and AMPT expanded their partnership in Europe to increase the sales of DConnect. DConnect is a self-regulating DC microgrid that offers high energy efficiency through the mitigation of conversion losses.

- Report ID: 6692

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

DC Microgrid Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.