DC Circuit Breaker Market Outlook:

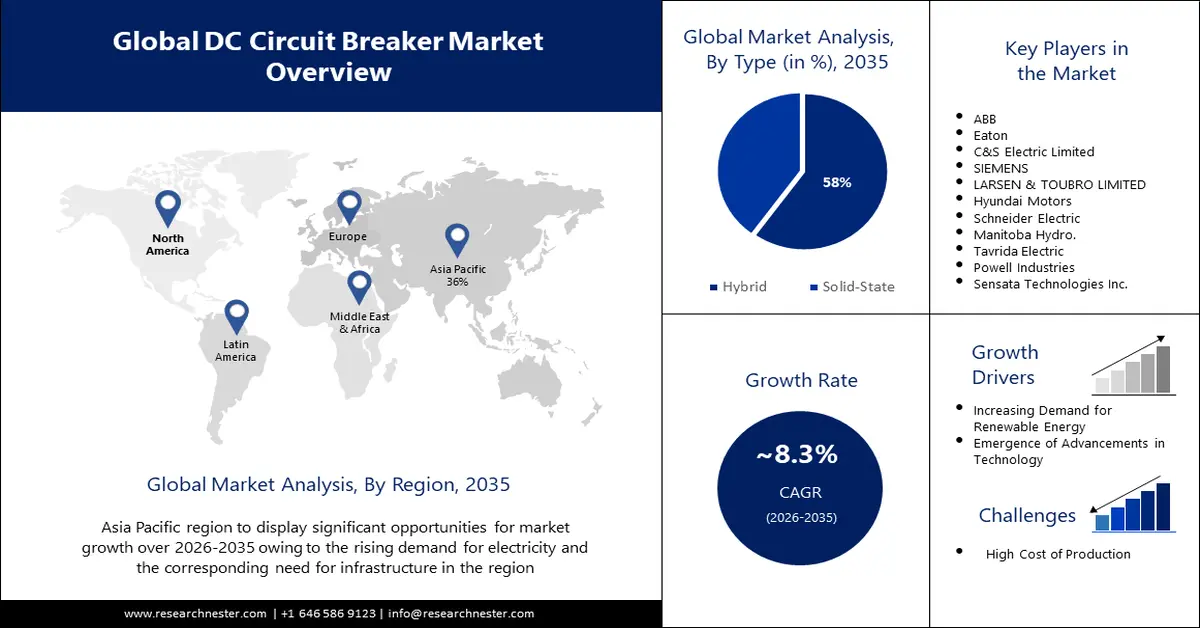

DC Circuit Breaker Market size was over USD 4.91 billion in 2025 and is anticipated to cross USD 10.9 billion by 2035, growing at more than 8.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of DC circuit breaker is assessed at USD 5.28 billion.

As the use of energy sources, energy storage systems and electric vehicles continues to rise, there is an increasing need, for DC power systems. DC circuit breakers are essential components of these power systems, as they are needed to safely control and protect them.

Data centers and telecommunication facilities heavily rely on DC power distribution systems. DC circuit breakers are essential for maintaining the safety and reliability of these infrastructures. These breakers serve as a means of safeguarding the systems against faults or overloads. They have the ability to promptly detect and respond to any fluctuations, in the power distribution thereby ensuring the ongoing safety and functionality of the system.

Key DC Circuit Breaker Market Insights Summary:

Regional Highlights:

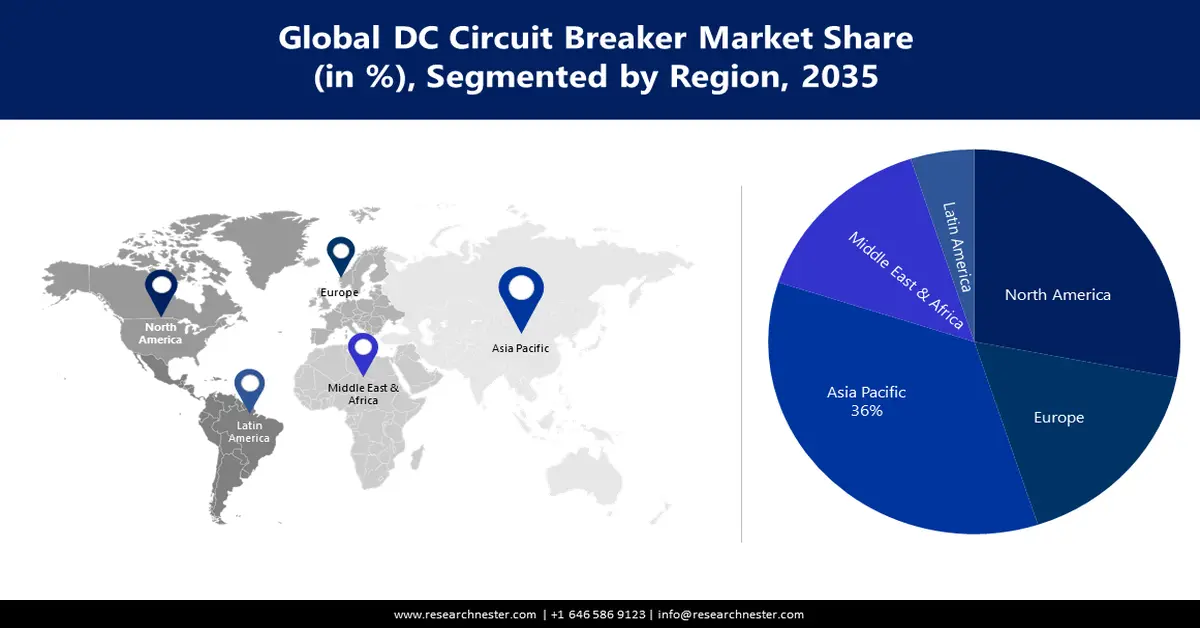

- Asia Pacific DC circuit breaker market is projected to capture a 36% share by 2035, driven by rising electricity demand and large-scale energy projects like Golmud Solar CSP Power Plant.

- North America market is anticipated to achieve a 28% share by 2035, driven by expansion of infrastructure, renewable energy adoption, and government energy efficiency programs.

Segment Insights:

- The solid-state segment in the dc circuit breaker market is projected to capture a 58% share by 2035, influenced by the adoption of solid-state breakers in EVs and industrial applications.

- The medium voltage segment in the dc circuit breaker market is expected to secure a 47% share by 2035, fueled by growing electricity needs in homes, businesses, and industries.

Key Growth Trends:

- Emergence of Advancements in Technology

- Increasing focus on Safety Concerns

Major Challenges:

- High Cost of Production

- Lack of standardization in the industry

Key Players: ABB, Eaton, C&S Electric Limited, SIEMENS, LARSEN & TOUBRO LIMITED, Hyundai Motors, Schneider Electric, Manitoba Hydro., Tavrida Electric, Powell Industries, Sensata Technologies Inc.

Global DC Circuit Breaker Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 4.91 billion

- 2026 Market Size: USD 5.28 billion

- Projected Market Size: USD 10.9 billion by 2035

- Growth Forecasts: 8.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (36% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 11 September, 2025

DC Circuit Breaker Market Growth Drivers and Challenges:

Growth Drivers

- Increasing Demand for Renewable Energy- The demand for renewable energy has been steadily rising in recent years with more countries and companies making commitments to reduce their environmental impact. It is evident that renewable energy sources are projected to contribute 95% of the global power capacity growth by 2026.

Consequently, there is an increased requirement for DC circuit breakers in power distribution systems that rely on wind power. DC circuit breakers play a role in managing electricity flow within these systems ensuring protection, against overloads and short circuits.

- Emergence of Advancements in Technology: The field of power distribution has undergone a transformation due to the rapid advancements in technology. This progress has given rise, to the creation of DC circuit breakers that are highly sophisticated. These circuit breakers have been specifically designed to meet the evolving requirements of power systems offering improved levels of safety and reliability. For instance, the application of solid state technology in DC circuit breakers. Unlike the electromechanical circuit breakers that depend on movable components to interrupt the current flow solid state circuit breakers utilize semiconductor devices to achieve the identical outcome. This enables more accurate operation along with enhanced durability, against regular usage.

- Increasing focus on Safety Concerns: With the increasing use of DC power distribution systems it's crucial to address safety concerns associated with these systems. Unlike AC power systems that naturally extinguish arcs, DC power systems can sustain arcs for longer durations posing potential risks if not properly handled. For instance, in the transportation industry electric vehicles rely on DC circuit breakers to safeguard high voltage battery. In the event of a short circuit or fault, the circuit breaker promptly interrupts the flow preventing battery damage and minimizing the chances of fire or explosion.

Challenges

- High Cost of Production: Due to the complexity and precision required in manufacturing these breakers, they can be expensive to produce. This can make it difficult for smaller companies to enter the market and compete with larger, established players.

- Contact wear can increase with DC circuit breakers when compared with AC circuit breakers, affecting their lifespan and reliability

- Lack of standardization in the industry

DC Circuit Breaker Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

8.3% |

|

Base Year Market Size (2025) |

USD 4.91 billion |

|

Forecast Year Market Size (2035) |

USD 10.9 billion |

|

Regional Scope |

|

DC Circuit Breaker Market Segmentation:

Voltage Segment Analysis

The medium voltage segment is estimated to hold 47% share of the global DC circuit breaker market in the year 2035. The rise in segment growth can be attributed to the growing need for electricity in sectors like homes, businesses and industries. Medium voltage circuit breakers are perfect for situations that require power usage, high dependability and long term stability. They are also more affordable than Low Voltage Circuit Breakers, which makes them a preferred option, in industries.

Type Segment Analysis

DC circuit breaker market from the solid state segment is estimated to gain the significant share of about 58% in the year 2035. The rise in segment growth can be credited to the growing adoption of state circuit breakers in electric vehicles and industrial applications. These circuit breakers are preferred due to their performance quick response time, high reliability and eco friendliness.

Moreover, governments and regulatory agencies are increasingly emphasizing energy efficiency, reducing energy consumption, which is anticipated to spur the demand, for solid state circuit breakers.

Our in-depth analysis of the global DC circuit breaker market includes the following segments:

|

Voltage |

|

|

Type |

|

|

Insulation |

|

|

End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

DC Circuit Breaker Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is predicted to account for largest revenue share of 36% by 2035 due to the rising demand for electricity and the corresponding need for infrastructure. From April20 to October20 the electricity demand in the Asia Pacific region exceeded that of the period in 2019 with a notable increase of 6% in October 2020.

Furthermore, China has ongoing projects that are expected to drive up their demand for DC circuit breakers. For instance, Qinghai New Energy Group Co Ltd announced in July 2021 that they have commenced construction on the Golmud Solar CSP Power Plant with a capacity of 3.3 GW, which is projected to be operational, by 2024. With such a large scale project underway China will likely require an increased number of DC circuit breakers to effectively manage their system with safety and efficiency as top priorities.

North American Market Insights

The North America DC circuit breaker market is estimated to be the second largest, registering a share of about 28% by the end of 2035 mainly due to the expansion of the region's infrastructure the increasing adoption of renewable energy sources and the growing need for reliable power supply.

Furthermore, governments in North America are taking steps to promote energy efficiency and reduce carbon emissions. As an example, the U.S. EPAs ENERGY STAR Program provides information and tools to over 15,000 private and public sector organizations enabling them to choose energy-efficient solutions and best practices. As a result of these initiatives, there is a rising demand, for DC circuit breaker solutions, which is expected to boost the regional market in the upcoming years.

DC Circuit Breaker Market Players:

- ABB

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Eaton

- C&S Electric Limited

- SIEMENS

- LARSEN & TOUBRO LIMITED

- Hyundai Motors

- Schneider Electric

- Manitoba Hydro.

- Tavrida Electric

- Powell Industries

- Sensata Technologies Inc.

Recent Developments

- July 02, 2029: ABB Company demonstrates the potential of an ultra fast high current DC breaker catering to marine applications and beyond. This cutting edge technology enables switching of currents proving advantageous, in the marine industry where currents can reach or exceed 1,000A.

- June 06, 2023: C&S Electric Limited has joined forces with ITI Sector 31 in Noida to create a cutting edge lab dedicated to the development of electronics and digital skills. The primary objective of this collaboration is to provide training and education in the up to date technologies, within the fields of electrical engineering, electronics and digital skills.

- Report ID: 5136

- Published Date: Sep 11, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

DC Circuit Breaker Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.