Data Management Platform Market Outlook:

Data Management Platform Market size was over USD 3.38 billion in 2025 and is poised to exceed USD 11.89 billion by 2035, witnessing over 13.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of data management platform is estimated at USD 3.79 billion.

Data management platforms (DMPs) have been one of the crucial tools that have made data-driven decision-making more viable in this contemporary landscape. It allows an organization to gather and process large volumes of data coming from varied sources. Increasing digital data and the rise in importance of personalized marketing and customer engagement have greatly spurred the need for strong DMPs. These systems make easy the combining of first-party, second-party, and third-party data to be able to allow businesses to create all-around customer profiles from which they will draw action insights. For instance, in September 2024, Oracle released new features for the Fusion Cloud Customer Experience and the Unity Customer Data Platform. Oracle CX users can analyze customer profiles to build B2B buying teams for customers, using generative AI tools.

Moreover, the data management platform market growth includes advanced analytics and machine learning, hence a complete revamping in real-time processing of data as well as doing predictive models. This digital transformation goes beyond the enhancement of accuracy in marketing strategy but also makes better customer experiences through communicated approaches. For instance, in March 2022, according to the reports of the Artificial Intelligence Index Report, 103% more money was invested in the private investment of AI and AI-related startups in 2021 (totaling USD 93.5 billion) than in 2020. Consequently, an abundance of data, technological advancements, and regulatory requirements have driven dramatic growth in the DMP sector.

Key Data Management Platform Market Insights Summary:

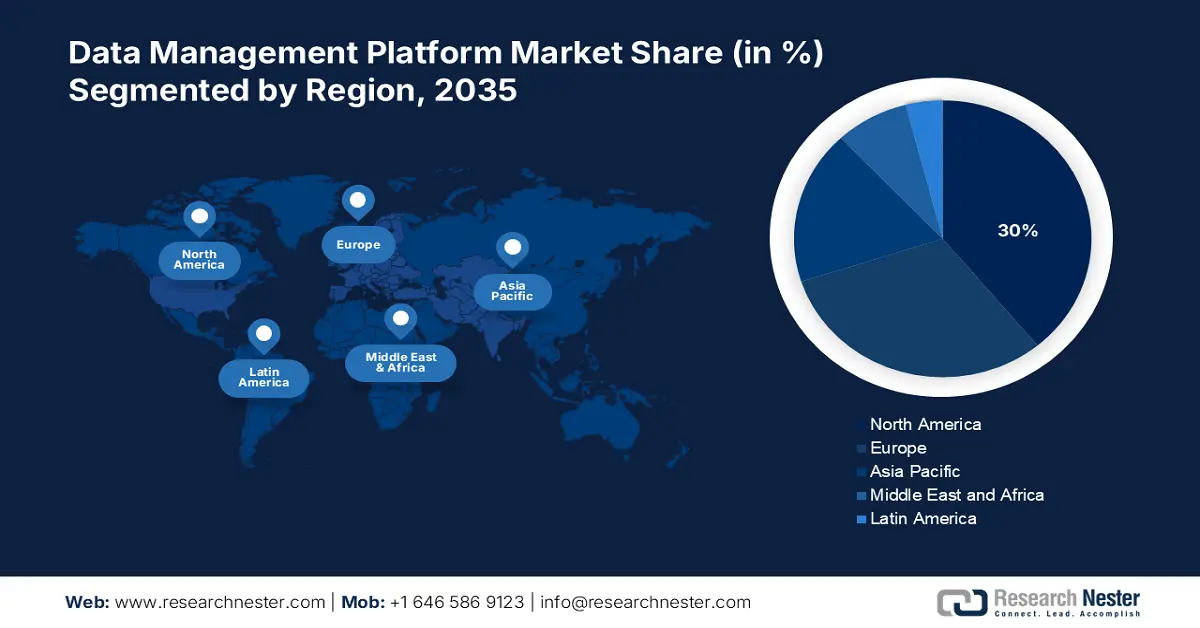

Regional Highlights:

- North America’s 30% share in the data management platform market is driven by demand for low latency data tools, sustaining growth through 2026–2035.

- Asia Pacific's Data Management Platform Market is forecasted to grow rapidly by 2035, driven by demand in sectors like aerospace, healthcare, and telecom.

Segment Insights:

- The Social Networks segment is expected to experience significant growth from 2026 to 2035, driven by the growing business need to analyze consumer behavior via social interaction data.

- The Ad Agencies segment of the Data Management Platform Market is expected to hold a 37.7% share by 2035, driven by the rising demand for data-driven marketing to maximize ROI.

Key Growth Trends:

- Advancement in big data analytics

- Omnichannel marketing strategies

Major Challenges:

- Data security risks

- Cost of implementation

- Key Players: Adobe Systems Inc., Rocket Fuel INC, Crux Digital INC, Lotame Solutions Inc., Turn INC.

Global Data Management Platform Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.38 billion

- 2026 Market Size: USD 3.79 billion

- Projected Market Size: USD 11.89 billion by 2035

- Growth Forecasts: 13.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (30% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: China, Japan, South Korea, India, Singapore

Last updated on : 13 August, 2025

Data Management Platform Market Growth Drivers and Challenges:

Growth Drivers

- Advancement in big data analytics: The most pivotal stimulator in the data management platform market is the ever-increasing demand for personalized customer experiences using sophisticated analytics to create detailed customer profiles. For instance, in May 2023, Microsoft introduced Microsoft Fabric, a pioneering platform that integrates its assortment of data management, analytics, and machine learning tools into a unified and comprehensive solution. It is built on the advanced OneLake data lake, which is currently in preview. It also allows users to effortlessly access data from both Amazon S3 and Google Cloud.

- Omnichannel marketing strategies: Marketing strategies in the data management platform market have become an essential element. It allows organizations to provide smooth and integrated customer experiences across numerous touchpoints and develop unified customer profiles based on data coming from various digital platforms. For instance, in May 2024, Salesforce unveiled additional features of its Service Cloud Digital Engagement software. The new improvements are built on its Einstein 1 Platform which allows contact centers to consolidate unstructured conversational data coming from varied digital channels, departments, and devices under one platform. Thus, DMPs play a critical role in creating brand loyalty.

Challenges

- Data security risks: A major challenge in the data management platform market, is concern over the safety of data as most organizations rely on these systems to store and process sensitive customer information. The emphasis is laid on data privacy and regulation compliance, which forces business entities to take strong security measures for the protection of breaches and unauthorized access. As people begin to understand their rights towards data, organizations are now compelled to place data security at the core of their DMP strategy to build trust, stay compliant, and protect the competitive edge in a world driven by data.

- Cost of implementation: A prime challenge in the data management platform market, is the initial cost as organizations must allocate tremendous financial resources to acquire and integrate these complex systems while maintaining them. Nevertheless, to meet the growing need for better customer experience through personalization businesses need to invest in DMPs to effectively harness data. To reap long-term value through an improvement in customer interaction and revenue growth due to a well-implemented DMP, organizations are driven to handle the initial cost barriers by capitalizing on the transformative power of data management.

Data Management Platform Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

13.4% |

|

Base Year Market Size (2025) |

USD 3.38 billion |

|

Forecast Year Market Size (2035) |

USD 11.89 billion |

|

Regional Scope |

|

Data Management Platform Market Segmentation:

End user (Ad Agencies, Marketers, Publishers)

Ad agencies segment is expected to dominate around 37.7% data management platform market share by the end of 2035. The demand for data-driven marketing solutions is rising, as brands are increasingly inclined to maximize their advertising spend with increased ROI. For instance, in September 2022, Amazon added a new feature, Manage Your Experiments. It is a seller tool that optimizes content on product detail pages to drive higher conversion rates and boost sales by 25%. Amazon further enhanced the product opportunity explorer and search analytics dashboard with new capabilities to help brands analyze marketing campaigns. Thus, by using DMPs, ad agencies can aggregate and analyze huge chunks of consumer data, and thus create highly personalized marketing strategies that resonate with certain audiences.

Data Sources (Web Analytics Tools, Mobile Web, Mobile Apps, CRM Data, POS Data, Social Network)

Social networks are experiencing significant growth in the data management platform market, whereby rich and diverse user content allows access from businesses through usage. The key that stimulates social media analytics arises from an increased recognition across businesses of understanding consumer behavior as well as preferences through social interaction. For instance, in March 2022, Brandwatch announced the acquisition of Paladin. With this acquisition, Brandwatch allowed for full influencer marketing functionality to be incorporated into its product suite which allowed brands to connect with consumers appropriately. By integrating social network data into DMPs, organizations can get actionable insights that inform targeted marketing strategies, foster brand engagement, and drive customer loyalty.

Our in-depth analysis of the global market includes the following segments:

|

Data Types |

|

|

Data Sources |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Data Management Platform Market Regional Analysis:

North America Market Statistics

North America in data management platform market is estimated to account for significant revenue share of 30% by the end of 2035. The rising need for data management tools is driven by the attributes of lower latency and bandwidth utilization. In addition, the data processing and analysis are done at the network edge in cases of applications requiring real-time insights and actions. Thus, the increasing adoption and greed to meet the needs of competitive edge companies are advancing their technologies around big data analytics.

The data management platform market will expand at a noteworthy pace in the U.S. during the projected timeline, owing to the conducive ecosystem that is created due to the presence of well-established tech-savvy players that integrate data management tools. For instance, in November 2024, Snowflake announced that it had entered into a definitive agreement to acquire Datavolo, to rapidly accelerate the creation, management, and observability of multimodal data pipelines for enterprise AI1. With this acquisition, Snowflake will deepen its service in the 'bronze layer' of the data lifecycle and integrate all of its enterprise systems with Snowflake's unified platform.

The landscape in the data management platform market in Canada is fostering by the rising spark of AI-driven capabilities across the country. The companies are continuously focusing on improving their operational efficacy in managing big data and its heterogeneity. For instance, in March 2022, Vantage Data Centers announced it would invest an additional USD 630 million to rapidly scale its Canada operations. It included the development of a third campus in Montreal and the expansion of two existing campuses in Montreal and Quebec City.

Asia Pacific Market Analysis

The Asia Pacific is evolving rapidly in the data management platform market to help its technological ecosystem grow robustly. The region is witnessing an increasing need for data analytics management tools across diverse applications such as aerospace, healthcare, government, military, and Telecom. In addition, rising attentiveness toward benefits related to enterprise data management has encouraged companies to implement it more readily.

India is remarkably growing in the data management platform market driven by initiatives that local governments or agencies are implementing. This assistance helps to streamline their operations and complex data sets to drive valuable insights. For instance, in July 2023, the Reserve Bank of India introduced CIMS as a measure to strengthen the efficacy and efficiency of its regulatory reporting system. Through the cloud-based CIMS technology, banks, as well as other regulated entities, can submit their regulatory reports online.

China is experiencing substantial growth in the data management platform market owing to the advancements in technologies to reap better and more efficient data-driven results. For instance, in October 2022, KAWO incorporated a new feature on its platform, called the 'Data Center'. This is an innovative function that will use several metrics to help users monitor their performance across various popular platforms. Furthermore, the increasing need to gather data from various sources, such as POS data, CRM data, Mobile web & Apps, web analytics tools, and social networks is developing the data management platform market in the country.

Key Data Management Platform Market Players:

- Oracle Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- KBM group LLC

- Adobe Systems Inc

- Rocket fuel INC

- Crux digital INC

- Lotame solutions inc

- Turn INC

- Neustar INC

- SAS institute

- SAP SE

- Cloudera INC

The company landscape in the data management platform market constitutes a vibrant startup ecosystem across the globe. It comprises startups, well-established technological players, and innovative enterprises that tailor solutions for customers' needs in the market. Such a market is likely to build strong competition and update and implement new advances in product offerings time and again. For instance, in March 2021, Microsoft Corporation partnered with Schlumberger Limited to deploy enterprise data management solutions in the energy sector. The firm is to help the energy sector through digital transformation by making available its data and offering all-inclusive AI to enable data management.

Here's the list of some key players:

Recent Developments

- In August 2024, Lumen combined its on-premises data and warehouses with Informatica to develop a central platform for data to resolve several data and IT challenges. Moreover, it has successfully modernized the PowerCenter workloads to Informatica’s Intelligent Data Management Cloud (IDMC) platform.

- In May 2023, Informatica announced that its AI-powered data management platform, Intelligent Data Management Cloud (IDMC), was now available in the Amazon Web Services (AWS). This helps customers in cloud modernization and gives access to data.

- Report ID: 6875

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Data Management Platform Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.