Data Destruction Service Market Outlook:

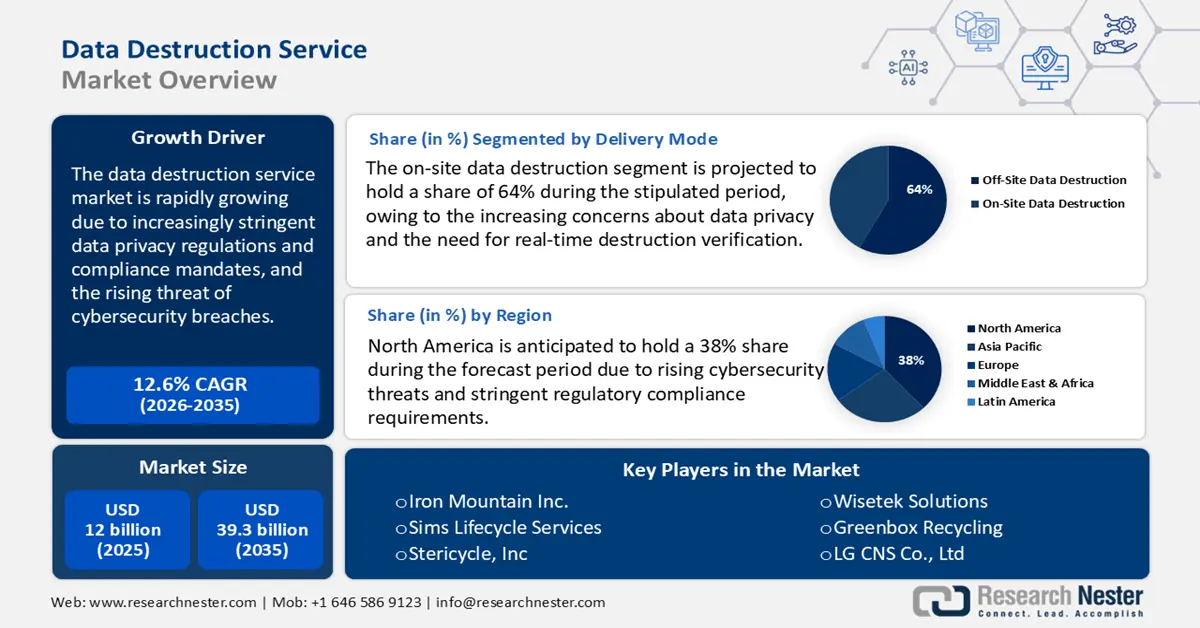

Data Destruction Service Market size was valued at USD 12 billion in 2025 and is projected to reach USD 39.3 billion by the end of 2035, rising at a CAGR of 12.6% during the forecast period, i.e., 2026-2035. In 2026, the industry size of data destruction service is assessed at USD 13.5 billion.

The global market is mainly driven by increasing stringent data privacy regulations and compliance mandates. The regulatory environment has grown significantly more complex and rigorous in recent years, particularly concerning the handling, retention, and destruction of sensitive data. Legislation such as the General Data Protection Regulation (GDPR) in the European Union, the California Consumer Privacy Act (CCPA) and Health Insurance Portability and Accountability Act (HIPAA) in the United States, and the Digital Personal Data Protection Act (DPDP Act) introduced in India in 2023, all place strict obligations on organizations regarding how data is stored, processed, and securely destroyed after its intended use.

|

GDPR Fines and Penalties |

|

|

Violation Category |

Fine Amount |

|

Less Severe Violations (Art. 83(4) GDPR) |

Up to €10 million or up to 2% of global annual turnover (whichever is higher) |

|

Severe Violations (Art. 83(5) GDPR) |

Up to €20 million or up to 4% of global annual turnover (whichever is higher) |

Source: GDPR

These regulatory frameworks have pushed organizations to execute secure data disposal methods to avoid legal penalties and reputational damage. These regulations often mandate that data must be irretrievably destroyed when it is no longer needed, creating the need for certified data destruction providers who can verify and audit destruction processes. A recent example of regulatory enforcement happened in May 2023, when Meta Platforms Inc. was fined USD 1.30 billion by the Irish Data Protection Commission (DPC) for breaching GDPR rules related to unlawful cross-border transfers of European user data to the U.S.