Data Center Storage Market Outlook:

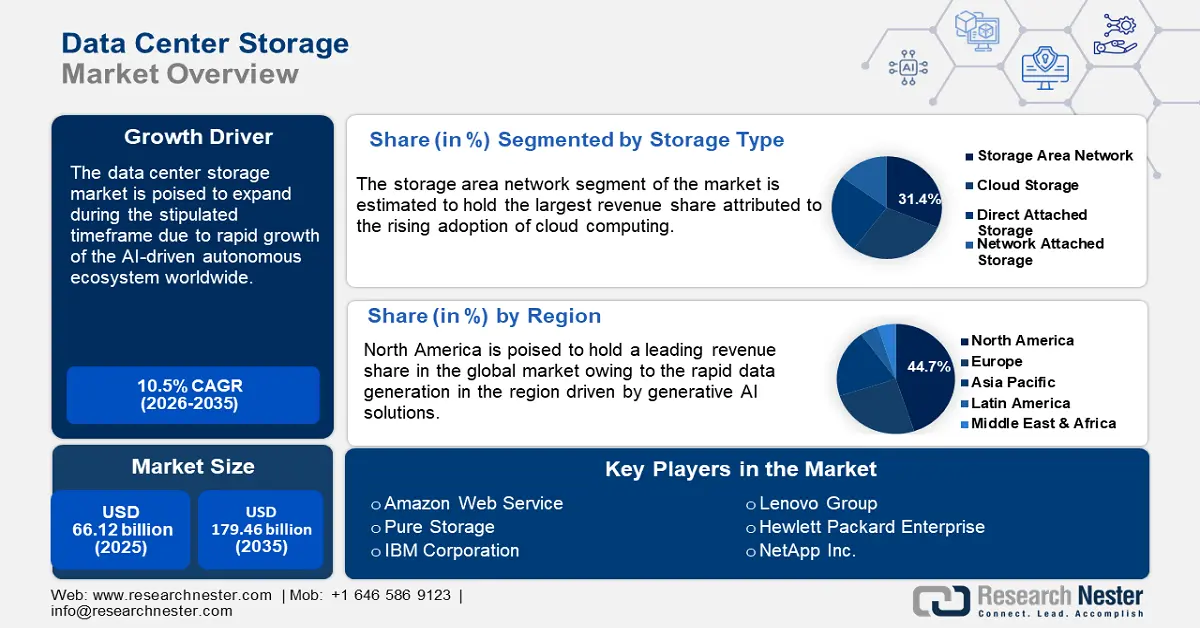

Data Center Storage Market size was over USD 66.12 billion in 2025 and is poised to exceed USD 179.46 billion by 2035, growing at over 10.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of data center storage is estimated at USD 72.37 billion.

The escalating demand for scalable, high-performance infrastructure to support advanced workloads stemming from artificial intelligence (AI) and machine learning (ML), real-time analytics, etc. The trends highlight the replacement of traditional storage solutions with advanced systems such as all-flash and hybrid storage. Moreover, innovations such as non-volatile memory express (NVMe) and software-defined storage (SDS) architectures are rapidly gaining traction. Throughout the forecast period, a key factor in the application of advanced data center storage solutions will be to mitigate energy consumption. The table below highlights the data center energy consumption forecast in the backdrop of worldwide trends to bolster efficient energy usage.

Data Center Energy Consumption Forecast

|

Particulars |

Details |

|

Global electricity consumption of data centers in 2024 |

1% |

|

Annual electricity consumption of data centers in 2024 |

Half of the electricity consumption in comparison to household IT appliances such as computers, phones, and TVs. |

|

Data Center Electricity Consumption by 2030 |

Estimated 5% growth |

Source: International Energy Agency

The advancements in data center storage can significantly reduce energy consumption which is expected to be a key factor in rising investments in data center storage solutions. The data center storage market benefits from digitalization mandates with governments and corporations modernizing IT ecosystems to keep pace with hybrid cloud adoption trends. The table below highlights the top 5 countries in the United Nations E-Government Survey – Accelerating Digital Transformation for Sustainable Development 2024, and the rapid integration of digital government in these countries provides lucrative opportunities to supply data center storage solutions.

E-Government Survey 2024

|

Name of Country |

EGDI |

|

Denmark |

0.9847 |

|

Estonia |

0.9727 |

|

Singapore |

0.9691 |

|

Republic of Korea |

0.9679 |

|

Iceland |

0.9671 |

Source: UN

Moreover, the World Bank’s Digital Adoption Index of 2023 highlights emerging economies such as Brazil, India, and Indonesia gaining ground in digitalization with national data center ecosystems to reduce reliance on foreign infrastructure. Concurrently, the rise in decentralizing storage demand is pushing vendors to compact solutions for near-source data processing. Collaborative initiatives such as the Open Compute Project (OCP) are fostering cross-country innovation for modular storage designs aligning with next-generation computing trends. For instance, in June 2024, Vertiv announced the launch of a high-density modular data center solution to assist in the deployment of AI computing worldwide. The trends facilitate vendors offering advanced data center storage solutions to expand revenue share by the end of 2037.

Key Data Center Storage Market Insights Summary:

Regional Highlights:

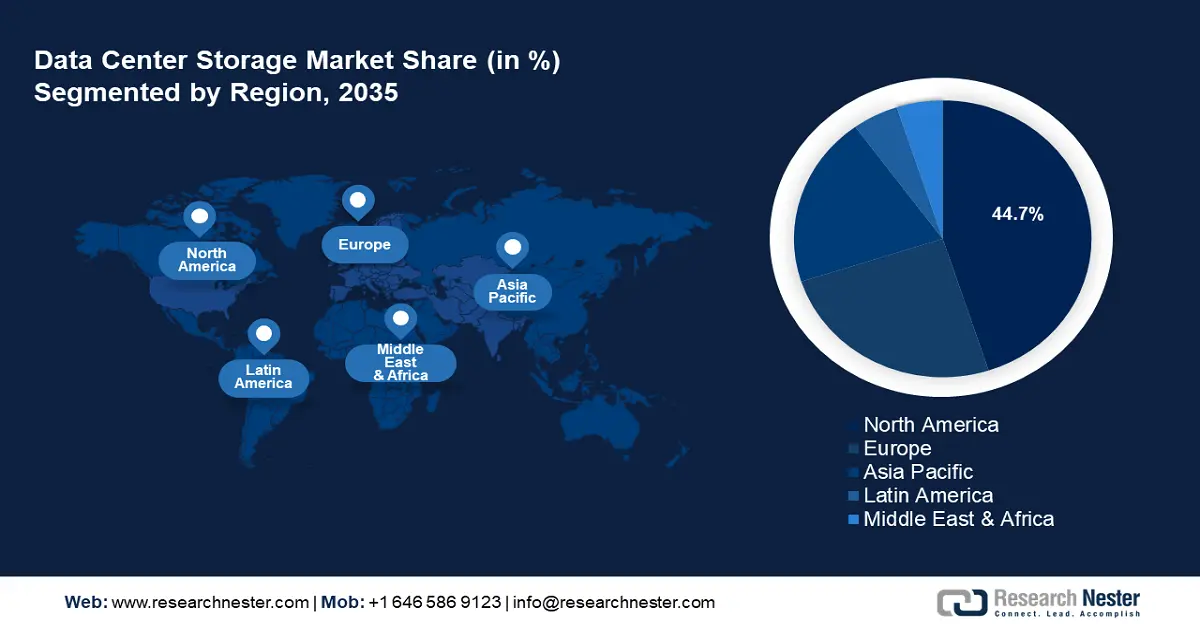

- North America dominates the Data Center Storage Market with a 44.7% share, driven by the rising adoption of AI applications and cloud computing in the region, fostering significant growth through 2026–2035.

- Europe's Data Center Storage Market holds the second-largest share and is projected to grow through 2026–2035, driven by digital transformation and GDPR regulations.

Segment Insights:

- The Storage Area Network (SAN) segment is poised for substantial growth by 2035, driven by rapid adoption of cloud computing and advancements like NVMe over Fabrics.

Key Growth Trends:

- Expansion of AI-driven autonomous ecosystem

- Growth of sovereign cloud initiatives

Major Challenges:

- Bottlenecks in power infrastructure

- Disruptions in the supply chains

- Key Players: Amazon Web Services, Pure Storage, IBM Corporation, Lenovo Group, Hewlett Packard Enterprise (HPE), Dell Technologies, Hitachi Vantara LLC, Huawei Technologies Co., Ltd., NetApp Inc., Cisco Systems Inc., Oracle Corporation, Nutanix, Fujitsu Limited.

Global Data Center Storage Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 66.12 billion

- 2026 Market Size: USD 72.37 billion

- Projected Market Size: USD 179.46 billion by 2035

- Growth Forecasts: 10.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (44.7% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 13 August, 2025

Data Center Storage Market Growth Drivers and Challenges:

Growth Drivers

- Expansion of AI-driven autonomous ecosystem: The data center storage market benefits from the proliferation of autonomous systems, spanning self-driving vehicles, drones, industrial robotics, etc., generating a substantial volume of data. The rising data generation necessitates low-latency storage solutions. The National Institute of Standards and Technology (NIST) highlights that autonomous systems require sub-millisecond data access speeds, driving the adoption of storage-class memory (SCM) and persistent memory modules. Additionally, the World Economic Forum (WEF) has identified autonomous manufacturing systems as key pillars of Industry 4.0 initiatives. The trends highlight growing opportunities for vendors and robotics firms to co-develop tailored solutions.

- Growth of sovereign cloud initiatives: An emerging driver of the data center storage market is the stringent data localization laws worldwide to ensure that citizen data remains within the national borders, spurring the demand for localized data center storage infrastructure. The trends bode well for domestic vendors offering data center storage solutions in lucrative local markets. The Gaia-X project of the European Union (EU) mandates interoperable storage systems that comply with GDPR and regional cybersecurity standards. In India, the Digital Personal Data Protection Act, of 2023, requires domestic storage solutions for sensitive user data which has bolstered investments in tier III/IV data centers with modular storage capabilities.

Additionally, investors are poised to find opportunities in the emerging data center storage markets in Africa and Saudi Arabia which are leveraging sovereign cloud policies to reduce dependency on foreign hyperscalers. The regulations have ensured the reshaping of global storage supply chains by favoring vendors with regional compliance expertise. - Emergence of hyper-converged infrastructure (HCI): The rise of HCI has transformed the data center storage landscape. HCI integrates storage, computing, and networking into a single system which boosts scalability. Moreover, the consolidation reduces the hardware requirement making it an attractive option for businesses seeking storage solutions. The growth in the adoption of HCI is expected to drive further investments in advanced storage technologies. Recent advancements include Microsoft’s announcement in January 2025 of the availability of Azure Stack HCI is now part of Azure Local. Furthermore, the U.S. Department of Energy (DOE) has highlighted the role of HCI in federal IT modernization while the World Bank identifies HCI as a cost-effective solution for SMEs to adopt cloud-native applications.

Challenges

- Bottlenecks in power infrastructure: The rapid expansion of data centers has led to challenges in power infrastructure. In emerging economies, the existing power grid may face challenges in meeting the high energy demands of new data center facilities. Such a challenge can delay project development whilst adding to operational costs. To address the issues, operators are seeking co-located energy resources.

- Disruptions in the supply chains: The rising demand for data center capacity has strained the supply chain, leading to delays in the trade of essential materials and equipment. Factors disrupting the supply chains are global economic fluctuations, geopolitical tensions, and material shortages. To successfully mitigate supply chain vulnerabilities, operators can invest in strategic partnerships to diversify the supplier base.

Data Center Storage Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

10.5% |

|

Base Year Market Size (2025) |

USD 66.12 billion |

|

Forecast Year Market Size (2035) |

USD 179.46 billion |

|

Regional Scope |

|

Data Center Storage Market Segmentation:

Storage Type (Storage Area Network, Cloud Storage, Direct Attached Storage, Network Attached Storage)

Storage area network (SAN) segment is set to capture data center storage market share of around 31.4% by the end of 2035. A major factor assisting the segment’s profitability is the rapid adoption of cloud computing. Organizations require scalable and secure storage infrastructures to support cloud-based applications. Additionally, advancements such as Non-Volatile Memory Express (NVMe) over Fabrics have improved SAN performance, which positions it as the preferred choice in modern data centers. Throughout the forecast period of the data center storage market’s analysis, SANs are predicted to offer greater lucrative opportunities for vendors and investors. Moreover, the rapid AI adoption rates are expected to remain a key factor in the adoption of SANs.

Current and Future AI-Adoption Rates by Sectors (U.S.)

|

Sector |

Current Adoption Rate (2023) |

Forecasted Adoption Rate (Till 2024) |

|

Information |

13.8% |

21.8% |

|

Professional, Technical, and Scientific Services |

9.1% |

15.2% |

|

Accommodation and Food Services |

1.2% |

2.3% |

|

Construction |

1.2% |

2.0% |

Source: The U.S. Census Bureau

The cloud storage segment is expected to expand during the stipulated timeframe. A major factor is the growing adoption of cloud storage solutions by data centers to leverage cost-effectiveness and scalability. With more businesses continuing to prioritize digital transformation, the reliance on cloud storage solutions is expected to intensify, solidifying its role in data center architectures. Recent news from the segment is the collaboration between Flexential and Lonestar to support the first commercial data center in space announced in January 2025, and by supporting Lonestar’s space-based data center initiative, the former seeks to create new avenues for data storage and disaster recovery.

Application (Backup & Recovery, Big Data Analytics, Archiving, Virtualization)

The backup & recovery segment of the data center storage market is positioned to increase the rate of application for data storage solutions. The increasing growth in cyber threats has driven the application of backup and recovery in data center storage solutions. Ransomware resilience has emerged as a top priority with organizations like the Cybersecurity and Infrastructure Security Agency (CISA) advocating air-gapped backups for rapid recovery of critical infrastructure. In the healthcare sector, HIPAA-compliant backup solutions for the U.S. data center storage market are mandated to protect patient data, leveraging blockchain-based audit trails. In March 2024, Motion Picture Industry Pension and Health Plans (MPI) announced leveraging Pure Storage’s data storage solution to achieve 10 times faster recovery time, and the success highlights the importance of backup & recovery solutions for various enterprises.

Our in-depth analysis of the global data center storage market includes the following segments:

|

Storage Type |

|

|

Application |

|

|

Deployment Model |

|

|

End-user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Data Center Storage Market Regional Analysis:

North America Market Forecast

North America in data center storage market is expected to hold over 44.7% revenue share by the end of 2035, owing to the rising adoption of AI applications and cloud computing in the region. The digital transformation initiatives across various industries in North America necessitate the supply of advanced storage solutions that can handle large data volumes with efficiency. Cross-border data sovereignty agreements such as the U.S.-Mexico-Canada Digital Trade provisions have further shaped storage strategies to comply with regional regulations. Moreover, the IEA reported a massive surge in data center investments in the U.S. between 2024 to 2024.

The U.S. data center storage market is projected to hold a leading share in North America. Trends indicate that edge storage is redefined as 5G-enabled micro-modular data centers to process IoT data locally. Moreover, hyperscalers such as Meta and Google are deploying petabyte-scale object storage and liquid-cooled HDDs to manage power-intensive AI training clusters. The dual focus on AI scalability and regulatory compliance positions the U.S. as a leader in high-performance cyber-resilient storage infrastructure. In September 2024, Wasabi Technologies announced a partnership with Grass Valley to provide the former’s cloud storage solutions to the latter’s customer base, which is an indication of the profitable opportunities in the region for storage solutions.

The Canada data center storage market is expected to exhibit robust growth by the end of 2035. The rising demand for cloud computing among the SMEs is a major driver of the market. Additionally, the government regulations mandating local data security create unique opportunities for vendors to offer storage solutions that comply with local regulations in the country. Moreover, the growth in investments in AI is prompting the requirement for advanced storage infrastructure. For instance, in December 2024, the government announced the decision to invest around USD 2 billion to build domestic AI computing capacity which is set to usher in a wave of opportunities to offer storage solutions.

Europe Market Forecast

The Europe data center storage market is estimated to hold the second-largest revenue share in the global market. The surge in digital transformation across Europe driven by the proactive steps taken by the EU and local governments has bolstered the demand for advanced solutions and created a burgeoning industry. Additionally, the stringent data protection regulations in the region, such as the General Data Protection Regulation (GDPR) have compelled organizations to invest in secure and compliant storage infrastructures. With the advent of DeepSeek, ChatGPT, Perplexity, and Claude generative AI models intensifying the global AI race, Europe is poised to strengthen investments in the sector, creating a sustained stream of opportunities for businesses offering data center storage solutions. The European Parliament reported that between 2018 and 2023, approximately USD 34.1 billion was invested in EU AI companies, with the investments set to increase by the end of 2035.

The Germany data center storage market is poised to expand throughout the forecast period. The market in Germany is defined by strict data localization laws. The Energy Efficiency Act enforces power limits on storage hardware, driving the adoption of liquid-immersion-cooled NVMe SSDs and low-voltage HDDs. The implementation of Industry 4.0 initiatives is an assisting driver in the data center storage market’s growth. In July 2024, CyrusOne, announced breaking the ground on its newest data center in Germany, in the backdrop of the company increasing investment within the country. With Frankfurt standing out as a key data center hub, owing to its financial importance and the presence of DE-CIX, the demand for data processing and storage solutions is expected to increase.

The France data center storage market is expected to exhibit favorable growth due to rise in opportunities to offer storage solutions in France. Paris has emerged as a significant data center hub, attracting substantial investment to improve storage capacity and infrastructure. Moreover, the France 2030 plan provides for USD 2.15 billion worth of investments in AI by private and public players between 2021 and 2025, which is expected to significantly increase data generation creating a constant demand for advanced storage solutions in the region.

Key Data Center Storage Market Players:

- Amazon Web Services

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Pure Storage

- IBM Corporation

- Lenovo Group

- Hewlett Packard Enterprise (HPE)

- Dell Technologies

- Hitachi Vantara LLC

- Huawei Technologies Co., Ltd.

- NetApp Inc.

- Cisco Systems Inc.

- Oracle Corporation

- Nutanix

- Fujitsu Limited

The data center storage market is projected to expand during the estimated timeline. Key players in the sector are investing to improve the scope of storage solutions catering to the evolving requirements of businesses in various sectors. For instance, Dell Technologies has transformed from a traditional PC maker into a leading AI supercomputer manufacturer capitalizing on the growing demand for AI-driven data processing. In February 2024, Pure Storage, a leading player in the market, announced the revenue report for 2024 highlighting a USD 2.8 billion revenue which is a 3% growth YoY.

Here are some key players in the data center storage market:

Recent Developments

- In January 2025, Pure Storage and Micron announced the expansion of its strategic collaboration. The collaboration is expected to continue the integration of the latter’s NAND technology with the former’s storage solutions and enable high-capacity solutions for hyperscalers.

- In March 2024, NetApp announced the launch of a new leading AFF A-Series system that can power the most demanding IT workloads. NetApp also announced the release of expanded capabilities across its portfolio to assist customers.

- Report ID: 7158

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Data Center Storage Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.