Data Center Services Market Outlook:

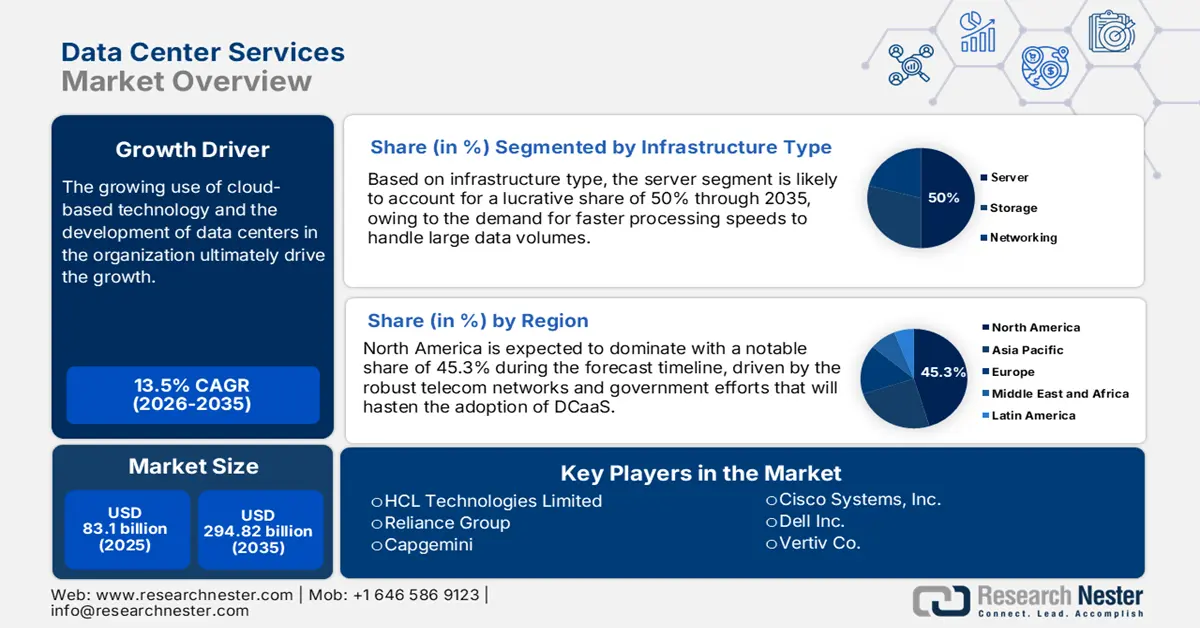

Data Center Services Market size was over USD 83.1 billion in 2025 and is poised to exceed USD 294.82 billion by 2035, growing at over 13.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of data center services is evaluated at USD 93.2 billion.

The market has been in keen expansion due to the combination of advancing technologies and shifting business demands. The rapid expansion of 5G networks increases edge computing demand, necessitating a decentralized nature of data centers to support low-latency processing at the network edge. For instance, in September 2024, the expansion of T-Mobile to its flagship data center in Prague began. The operator is currently setting up a photovoltaic power plant on the grounds of the new facility and plans to install a Private 5G network within the data center.

The market is growing as a result of the growing trend of moving from physical infrastructure to the cloud, the introduction of new technologies such as artificial intelligence (AI), instant service, and startup-friendly prices, as well as improved security and updates with new technologies. For instance, in September 2024, Nokia introduced the most advanced data center automation platform in the industry, designed with AI capabilities. This approach seeks to eliminate human error in network operations to minimize service outages and network disruptions. It is anticipated that cloud computing will become more and more popular. All these factors are changing the shape of the future global data center services market into a pathway to new opportunities for innovation and growth.

Key Data Center Services Market Insights Summary:

Regional Highlights:

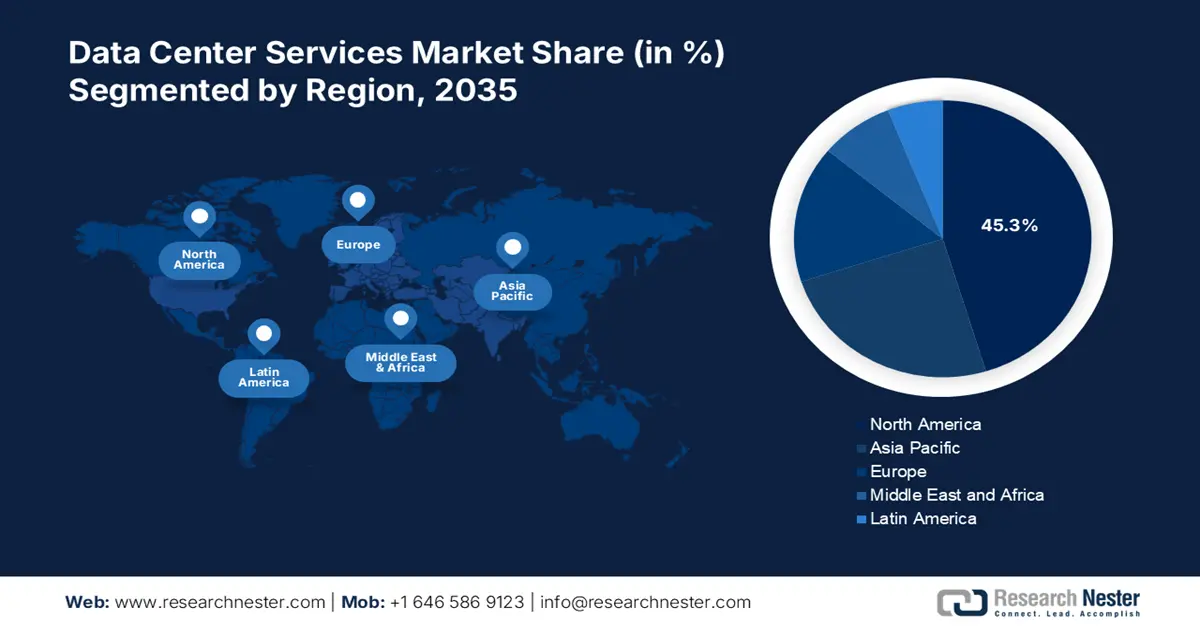

- North America data center services market will hold around 45.30% share by 2035, driven by advanced infrastructure and demand for real-time data processing.

- Asia Pacific market will grow rapidly by 2035, driven by digitalization and government-backed infrastructure.

Segment Insights:

- The server segment in the data center services market is expected to capture a 50% share by 2035, driven by the need for scalable, high-performance infrastructure.

- The large organization segment in the data center services market is expected to maintain a dominant share from 2026-2035, influenced by the need for robust IT infrastructure to manage massive data and mission-critical operations.

Key Growth Trends:

- Cloud adoption and hybrid IT

- Demand for data-intensive applications

Major Challenges:

- Data security and cyber threats

- High capital expenditure and operational costs

Key Players: AWS, Reliance Group, Capgemini, HCL Technologies Limited, Cisco Systems, Inc., Dell Inc., Vertis Co., Equinix, Inc., Schneider Electric SE, ECL, Varanium.

Global Data Center Services Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 83.1 billion

- 2026 Market Size: USD 93.2 billion

- Projected Market Size: USD 294.82 billion by 2035

- Growth Forecasts: 13.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (45.3% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, United Kingdom, China, Netherlands

- Emerging Countries: China, India, Brazil, Mexico, Singapore

Last updated on : 8 September, 2025

Data Center Services Market Growth Drivers and Challenges:

Growth Drivers

-

Cloud adoption and hybrid IT: A shift towards cloud computation presents an opportunity for organizations to optimize operational efficiency while managing rapidly changing workloads. For instance, in August 2024, to modernize and revamp the IT infrastructure, Wipro Limited announced a partnership with JLP. Through a strategic cloud transformation of their X86 platform, the Wipro FullStride Cloud team will work with JLP and Google Cloud to increase their agility, optimize operating costs, and streamline business processes. Hybrid IT will enable organizations to integrate the advantages of on-demand cloud resources and improve business continuity in a fast-evolving, highly competitive digital landscape.

-

Demand for data-intensive applications: The demand for data-intensive applications pushes businesses to seek high-tech such as AI, big data analytics, and IoT. The key reason for organizations seeking to process and analyze vast amounts of data in real-time with actionable insights for decision-making. For instance, in November 2024, to provide the maximum system acceleration for data-intensive workloads, AMD unveiled the AMD Versal Premium Series Gen 2, an adaptive SoC platform. High-performance computing infrastructure and scalable storage also drive demand for data-intensive applications. These demanding requirements prompt businesses to spend more on advanced data centers that can host these intense workloads efficiently and securely.

Challenges

-

Data security and cyber threats: The biggest threat in the data center services market is rising data security and cyber threats, increasing the risks of data breach, hacking, and ransomware attacks. The rising sophistication of cybercriminals and the attack surface is brought by greater penetration of cloud services, remote work, and interconnected devices. As data centers hold sensitive information in several industries, it is complex to continuously be updated with state-of-the-art security measures, including encryption, access controls, and monitoring systems. To handle ongoing threats and comply with tight regulatory requirements on data protection pose a significant challenge.

-

High capital expenditure and operational costs: An enormous challenge in the data center services market is high capex and operational costs. The highest investment is on infrastructure, technology, and maintenance, which primarily causes problems for considerable investment. In addition, to create and maintain cutting-edge facilities to match the increasing demand for high-performance computing, storage, and energy efficiency. Operational expenses, such as energy in cooling and power, as well as the cost of specialized technical labor, can also be critical for profitability, particularly when customers require very reliable and scalable services.

Data Center Services Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

13.5% |

|

Base Year Market Size (2025) |

USD 83.1 billion |

|

Forecast Year Market Size (2035) |

USD 294.82 billion |

|

Regional Scope |

|

Data Center Services Market Segmentation:

Infrastructure Type Segment Analysis

In data center services market, server segment is projected to account for revenue share of around 50% by 2035. Their dominance is primarily attributed to the support required by businesses for a large number of applications that need a mighty, scalable, and reliable server infrastructure. For instance, in October 2024, Dell Technologies launched a new line of integrated rack-scalable systems, Rack 7000 (IR7000) server, storage, and data management innovations in the Dell AI factory. Thus, servers act as the backbone, offering high-performance computing, large-scale data storage, and efficient management of workloads, which makes them indispensable in today's modern data center environments.

Organization Size Segment Analysis

The large organization segment is expected to dominate the data center services market attributable to the vast IT infrastructure that is needed to process massive amounts of data. It necessitates strong, scalable data center solutions to ensure business continuity and support for mission-critical applications. For instance, in September 2024, Princeton Digital Group sealed an agreement to build three more data centers outside Mumbai, India. Under this alliance, Mindspace REIT will develop data centers for PDG with an additional 1 million sq ft, the new constructions will be integrated into the larger 50-acre campus. The financial capabilities of companies further help in repositioning them as the key growth engine of market requirements.

Our in-depth analysis of the market includes the following segments:

|

Infrastructure Type |

|

|

Organization Size |

|

|

Vertical |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Data Center Services Market Regional Analysis:

North America Market Insights

North America industry is likely to dominate majority revenue share of 45.3% by 2035. The growth is stimulated owing to the advanced technologies integrated into the state-of-the-art infrastructure. In addition, the strong existence of key players meeting the growing demand for data storage and real-time processing is assisting the market to flourish clubbed with a supportive regulatory environment.

The major characteristic of the Canada landscape for the market is the expansion of services in the country. For instance, in June 2024, Telehouse Canada announced the opening of its first three data centers in downtown Toronto. It has planned to grow the ecosystem of carriers considerably and enlarge its spaces to power the digital transformation of Canada and propagate high-speed Internet across the nation.

The U.S. utilities are inking concrete supply deals with data-center operators seeking more power amid a boom in artificial intelligence, paving the way for higher sales and profit in the coming quarters. For instance, in May 2024, a report published by Goldman Sachs that data centers will consume 8% of the power used by the US in 2030, compared to 3% in 2022. The US utilities would need to invest around USD 50 billion in new generation capacity only to meet the power demand of data centers alone.

Asia Pacific Market Insights

Asia Pacific is the most rapidly growing region in the data center services market, driven by the shift towards digitalization across various sectors. This demands the need for data centers in the region to render reliable and efficient services. In addition, the local government that promotes digital infrastructure through its initiatives and programs helps in upscaling the data center services in the region.

The primary growth driver for the market in China is the local government initiative. For instance, in October 2024, through a new pilot program of local government that embraces the ease of the restriction of 100% foreign ownership in data centers and value-added telecom services in Beijing, Shanghai, Hainan, and Shenzhen. This marks a big shift in investment opportunities for multinational companies within the tech sector.

India is rapidly transforming from an emerging market into a developed one, and digital technology is in the vanguard of this revolution. It accelerates economic growth across all industries and functions as a foundation for better public services. For instance, in May 2024, India’s data center sector is likely to witness outstanding growth, with an addition of 791 MW of capacity by 2026. The same expansion is likely to fuel 10 million sq. ft. of real estate space, raising investment of USD 5.7 billion.

Data Center Services Market Players:

- AWS

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Reliance Group

- Capgemini

- HCL Technologies Limited

- Cisco Systems, Inc.

- Dell Inc.

- Vertis Co.

- Equinix, Inc.

- Schneider Electric SE

- ECL

- Varanium

The top-notch key players in the market offer scalable, secure, and globally distributed networks. Moreover, providers cater to enterprise desires of housing their infrastructure in third-party data centers. The growing prominence of data security, edge computing, and sustainability promotes companies to embrace green technologies. For instance, in September 2024, Alibaba Cloud unveiled its Green Data Center initiative, utilizing renewable energy sources and advanced cooling technology to minimize carbon emissions. In its Tianjin data center, Tencent is using the full potential of natural cooling and renewable energy sources.

Here’s the list of some key players:

Recent Developments

- In June 2024, Cisco Systems made a breakthrough collaboration with NVIDIA to announce an AI cluster solution, Cisco Nexus HyperFabric for data centers. It combines Cisco's AI-native networking with NVIDIA’s computing and AI software to enable customers to focus on innovation and new revenue opportunities.

- In March 2024, Vast Data announced its new AI Cloud Architecture, NVIDIA Bluefield networking platform, representing unprecedented levels of performance, quality of service, zero-trust security, and space, cost, and power efficiency in the AI factory.

- Report ID: 1501

- Published Date: Sep 08, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Data Center Services Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.