Global Data Center Market

- An Outline of the Global Data Center Market

- Market Definition

- Market Segmentation

- Assumptions and Abbreviations

- Research Methodology & Approach

- Secondary Research

- Primary Research

- Data Triangulation

- SPSS Methodology

- Executive Summary

- Market Opportunities

- Market Drivers

- Major Roadblocks

- Trends

- Government Regulation

- Upcoming Technologies

- Risk Analysis

- Price Benchmarking

- Comparative Analysis of the Current Technologies

- Supply Chain

- Industry Growth Outlook

- SWOT Analysis on the Data Center Market

- Startup Analysis

- Regional Demand

- Regional & Country Level Analysis on Power Capacity, Number of Racks, and Area

- Recent News on Data Center Market

- Acquisition Analysis

- Investment Analysis

- Analysis of Strategic Initiative Adopted by Key Players

- Integration of Advanced Technology in Data Center Market

- Policies Analysis

- Facility Analysis

- Analysis of Advanced Technology and Solutions

- Comparative Feature Analysis

- Competitive Positioning

- Competitive Model

- Company Market Share

- Business Profile of Key Enterprise

- Amazon Web Services, Inc.

- Microsoft

- Equinix, Inc.

- Alibaba Cloud

- Digital Realty

- NTT DATA Group Corporation

- Fujitsu

- Cisco Systems, Inc.

- Rackspace Technology

- Google Cloud

- CyrusOne

- AT TOKYO Corporation

- Hewlett Packard Enterprise Development LP

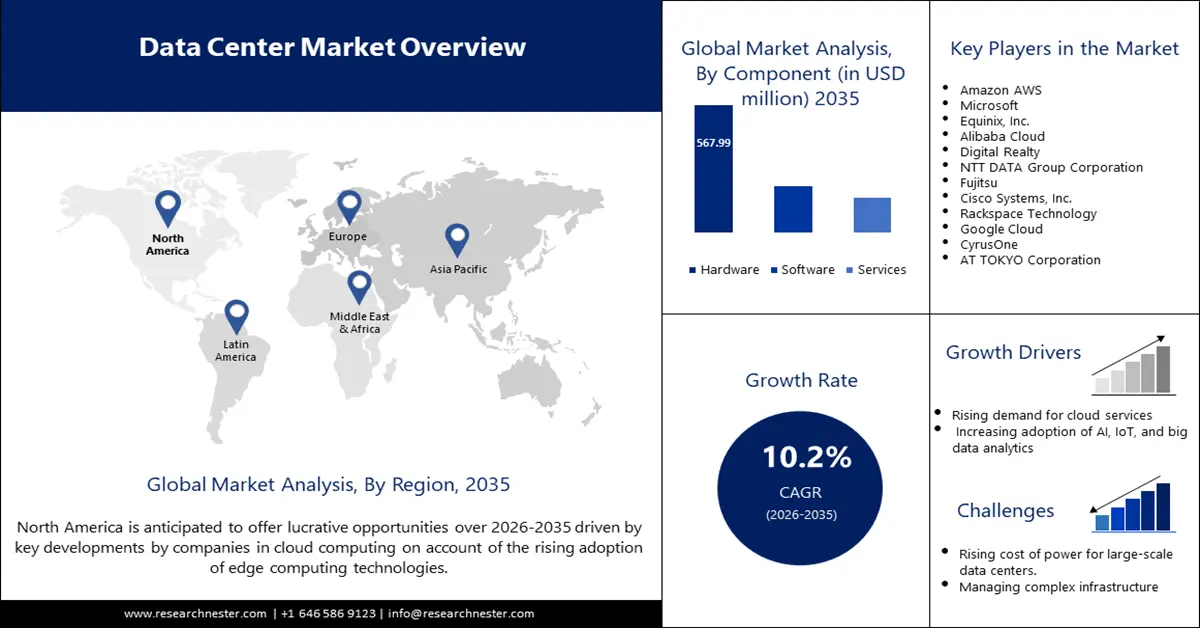

- Global Data Center Market Outlook

- Market Overview

- Market Revenue by Value (USD Billion) and Compound Annual Growth Rate (CAGR)

- Global Data Center Market Segmentation Analysis (2025-2037)

- By Component

- Hardware, Market Value (USD Billion), and CAGR, 2025-2037F

- Software, Market Value (USD Billion), and CAGR, 2025-2037F

- Services, Market Value (USD Billion), and CAGR, 2025-2037F

- By Type

- Enterprise Data Centers, Market Value (USD Billion), and CAGR, 2025-2037F

- Managed Services Data Centers, Market Value (USD Billion), and CAGR, 2025-2037F

- Colocation Data Centers, Market Value (USD Billion), and CAGR, 2025-2037F

- Cloud-based Data Centers, Market Value (USD Billion), and CAGR, 2025-2037F

- Edge Data Centers, Market Value (USD Billion), and CAGR, 2025-2037F

- Hyperscale Data Centers, Market Value (USD Billion), and CAGR, 2025-2037F

- By Infrastructure

- Tier I, Market Value (USD Billion), and CAGR, 2025-2037F

- Tier II, Market Value (USD Billion), and CAGR, 2025-2037F

- Tier III, Market Value (USD Billion), and CAGR, 2025-2037F

- Tier IV, Market Value (USD Billion), and CAGR, 2025-2037F

- By Design

- Traditional, Market Value (USD Billion), and CAGR, 2025-2037F

- Modular/ Containerization, Market Value (USD Billion), and CAGR, 2025-2037F

- By End user

- BFSI, Market Value (USD Billion), and CAGR, 2025-2037F

- Telecommunication, Market Value (USD Billion), and CAGR, 2025-2037F

- Healthcare, Market Value (USD Billion), and CAGR, 2025-2037F

- Retail & E-commerce, Market Value (USD Billion), and CAGR, 2025-2037F

- Entertainment & Media, Market Value (USD Billion), and CAGR, 2025-2037F

- Energy, Market Value (USD Billion), and CAGR, 2025-2037F

- Others, Market Value (USD Billion), and CAGR, 2025-2037F

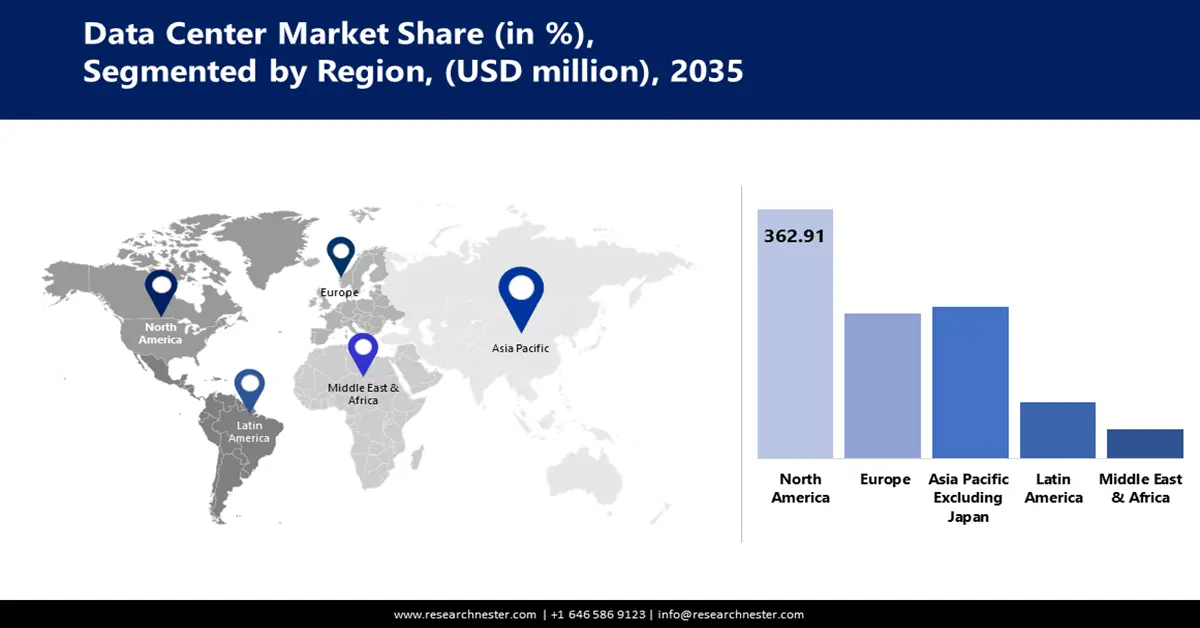

- By Region

- North America, Market Value (USD Billion), and CAGR, 2025-2037F

- Europe, Market Value (USD Billion), and CAGR, 2025-2037F

- Asia Pacific Excluding Japan, Market Value (USD Billion), and CAGR, 2025-2037F

- Japan, Market Value (USD Billion), and CAGR, 2025-2037F

- Latin America, Market Value (USD Billion), and CAGR, 2025-2037F

- Middle East and Africa, Market Value (USD Billion), and CAGR, 2025-2037F

- By Component

- Cross Analysis of Component W.R.T. End user (USD Billion), 2025-2037

- North America Data Center Market Outlook

- Market Overview

- Market Revenue by Value (USD Billion), and Compound Annual Growth Rate (CAGR)

- North America Data Center Market Segmentation Analysis (2025-2037)

- By Component

- Hardware, Market Value (USD Billion), and CAGR, 2025-2037F

- Software, Market Value (USD Billion), and CAGR, 2025-2037F

- Services, Market Value (USD Billion), and CAGR, 2025-2037F

- By Type

- Enterprise Data Centers, Market Value (USD Billion), and CAGR, 2025-2037F

- Managed Services Data Centers, Market Value (USD Billion), and CAGR, 2025-2037F

- Colocation Data Centers, Market Value (USD Billion), and CAGR, 2025-2037F

- Cloud-based Data Centers, Market Value (USD Billion), and CAGR, 2025-2037F

- Edge Data Centers, Market Value (USD Billion), and CAGR, 2025-2037F

- Hyperscale Data Centers, Market Value (USD Billion), and CAGR, 2025-2037F

- By Infrastructure

- Tier I, Market Value (USD Billion), and CAGR, 2025-2037F

- Tier II, Market Value (USD Billion), and CAGR, 2025-2037F

- Tier III, Market Value (USD Billion), and CAGR, 2025-2037F

- Tier IV, Market Value (USD Billion), and CAGR, 2025-2037F

- By Design

- Traditional, Market Value (USD Billion), and CAGR, 2025-2037F

- Modular/ Containerization, Market Value (USD Billion), and CAGR, 2025-2037F

- By End user

- BFSI, Market Value (USD Billion), and CAGR, 2025-2037F

- Telecommunication, Market Value (USD Billion), and CAGR, 2025-2037F

- Healthcare, Market Value (USD Billion), and CAGR, 2025-2037F

- Retail & E-commerce, Market Value (USD Billion), and CAGR, 2025-2037F

- Entertainment & Media, Market Value (USD Billion), and CAGR, 2025-2037F

- Energy, Market Value (USD Billion), and CAGR, 2025-2037F

- Others, Market Value (USD Billion), and CAGR, 2025-2037F

- By Country

- US, Market Value (USD Billion), and CAGR, 2025-2037F

- Canada, Market Value (USD Billion), and CAGR, 2025-2037F

- By Component

- North America Data Center Market Outlook

- Cross Analysis of Component W.R.T. End user (USD Billion), 2025-2037

- Europe Data Center Market Outlook

- Market Overview

- Market Revenue by Value (USD Billion), and Compound Annual Growth Rate (CAGR)

- Europe Data Center Market Segmentation Analysis (2025-2037)

- By Component

- Hardware, Market Value (USD Billion), and CAGR, 2025-2037F

- Software, Market Value (USD Billion), and CAGR, 2025-2037F

- Services, Market Value (USD Billion), and CAGR, 2025-2037F

- By Type

- Enterprise Data Centers, Market Value (USD Billion), and CAGR, 2025-2037F

- Managed Services Data Centers, Market Value (USD Billion), and CAGR, 2025-2037F

- Colocation Data Centers, Market Value (USD Billion), and CAGR, 2025-2037F

- Cloud-based Data Centers, Market Value (USD Billion), and CAGR, 2025-2037F

- Edge Data Centers, Market Value (USD Billion), and CAGR, 2025-2037F

- Hyperscale Data Centers, Market Value (USD Billion), and CAGR, 2025-2037F

- By Infrastructure

- Tier I, Market Value (USD Billion), and CAGR, 2025-2037F

- Tier II, Market Value (USD Billion), and CAGR, 2025-2037F

- Tier III, Market Value (USD Billion), and CAGR, 2025-2037F

- Tier IV, Market Value (USD Billion), and CAGR, 2025-2037F

- By Design

- Traditional, Market Value (USD Billion), and CAGR, 2025-2037F

- Modular/ Containerization, Market Value (USD Billion), and CAGR, 2025-2037F

- By End user

- BFSI, Market Value (USD Billion), and CAGR, 2025-2037F

- Telecommunication, Market Value (USD Billion), and CAGR, 2025-2037F

- Healthcare, Market Value (USD Billion), and CAGR, 2025-2037F

- Retail & E-commerce, Market Value (USD Billion), and CAGR, 2025-2037F

- Entertainment & Media, Market Value (USD Billion), and CAGR, 2025-2037F

- Energy, Market Value (USD Billion), and CAGR, 2025-2037F

- Others, Market Value (USD Billion), and CAGR, 2025-2037F

- By Country

- UK, Market Value (USD Billion), and CAGR, 2025-2037F

- Germany, Market Value (USD Billion), and CAGR, 2025-2037F

- France, Market Value (USD Billion), and CAGR, 2025-2037F

- Italy, Market Value (USD Billion), and CAGR, 2025-2037F

- Spain, Market Value (USD Billion), and CAGR, 2025-2037F

- BENELUX, Market Value (USD Billion), and CAGR, 2025-2037F

- Poland, Market Value (USD Billion), and CAGR, 2025-2037F

- Russia, Market Value (USD Billion), and CAGR, 2025-2037F

- Rest of Europe, Market Value (USD Billion), and CAGR, 2025-2037F

- By Component

- Europe Data Center Market Outlook

- Cross Analysis of Component W.R.T. End user (USD Billion), 2025-2037

- Asia Pacific Excluding Japan Data Center Market Outlook

- Market Overview

- Market Revenue by Value (USD Billion), and Compound Annual Growth Rate (CAGR)

- Asia Pacific Excluding Japan Data Center Market Segmentation Analysis (2025-2037)

- By Component

- Hardware, Market Value (USD Billion), and CAGR, 2025-2037F

- Software, Market Value (USD Billion), and CAGR, 2025-2037F

- Services, Market Value (USD Billion), and CAGR, 2025-2037F

- By Type

- Enterprise Data Centers, Market Value (USD Billion), and CAGR, 2025-2037F

- Managed Services Data Centers, Market Value (USD Billion), and CAGR, 2025-2037F

- Colocation Data Centers, Market Value (USD Billion), and CAGR, 2025-2037F

- Cloud-based Data Centers, Market Value (USD Billion), and CAGR, 2025-2037F

- Edge Data Centers, Market Value (USD Billion), and CAGR, 2025-2037F

- Hyperscale Data Centers, Market Value (USD Billion), and CAGR, 2025-2037F

- By Infrastructure

- Tier I, Market Value (USD Billion), and CAGR, 2025-2037F

- Tier II, Market Value (USD Billion), and CAGR, 2025-2037F

- Tier III, Market Value (USD Billion), and CAGR, 2025-2037F

- Tier IV, Market Value (USD Billion), and CAGR, 2025-2037F

- By Design

- Traditional, Market Value (USD Billion), and CAGR, 2025-2037F

- Modular/ Containerization, Market Value (USD Billion), and CAGR, 2025-2037F

- By End user

- BFSI, Market Value (USD Billion), and CAGR, 2025-2037F

- Telecommunication, Market Value (USD Billion), and CAGR, 2025-2037F

- Healthcare, Market Value (USD Billion), and CAGR, 2025-2037F

- Retail & E-commerce, Market Value (USD Billion), and CAGR, 2025-2037F

- Entertainment & Media, Market Value (USD Billion), and CAGR, 2025-2037F

- Energy, Market Value (USD Billion), and CAGR, 2025-2037F

- Others, Market Value (USD Billion), and CAGR, 2025-2037F

- By Country

- China, Market Value (USD Billion), and CAGR, 2025-2037F

- India, Market Value (USD Billion), and CAGR, 2025-2037F

- Indonesia, Market Value (USD Billion), and CAGR, 2025-2037F

- South Korea, Market Value (USD Billion), and CAGR, 2025-2037F

- Malaysia, Market Value (USD Billion), and CAGR, 2025-2037F

- Australia, Market Value (USD Billion), and CAGR, 2025-2037F

- Singapore, Market Value (USD Billion), and CAGR, 2025-2037F

- Vietnam, Market Value (USD Billion), and CAGR, 2025-2037F

- New Zealand, Market Value (USD Billion), and CAGR, 2025-2037F

- Rest of Asia Pacific Excluding Japan, Market Value (USD Billion), and CAGR, 2025-2037F

- By Component

- Asia Pacific Excluding Japan Data Center Market Outlook

- Cross Analysis of Component W.R.T. End user (USD Billion), 2025-2037

- China Data Center Market Outlook

- Market Overview

- Market Revenue by Value (USD Billion), and Compound Annual Growth Rate (CAGR)

- China Data Center Market Segmentation Analysis (2025-2037)

- By Component

- Hardware, Market Value (USD Billion), and CAGR, 2025-2037F

- Software, Market Value (USD Billion), and CAGR, 2025-2037F

- Services, Market Value (USD Billion), and CAGR, 2025-2037F

- By Type

- Enterprise Data Centers, Market Value (USD Billion), and CAGR, 2025-2037F

- Managed Services Data Centers, Market Value (USD Billion), and CAGR, 2025-2037F

- Colocation Data Centers, Market Value (USD Billion), and CAGR, 2025-2037F

- Cloud-based Data Centers, Market Value (USD Billion), and CAGR, 2025-2037F

- Edge Data Centers, Market Value (USD Billion), and CAGR, 2025-2037F

- Hyperscale Data Centers, Market Value (USD Billion), and CAGR, 2025-2037F

- By Infrastructure

- Tier I, Market Value (USD Billion), and CAGR, 2025-2037F

- Tier II, Market Value (USD Billion), and CAGR, 2025-2037F

- Tier III, Market Value (USD Billion), and CAGR, 2025-2037F

- Tier IV, Market Value (USD Billion), and CAGR, 2025-2037F

- By Design

- Traditional, Market Value (USD Billion), and CAGR, 2025-2037F

- Modular/ Containerization, Market Value (USD Billion), and CAGR, 2025-2037F

- By End user

- BFSI, Market Value (USD Billion), and CAGR, 2025-2037F

- Telecommunication, Market Value (USD Billion), and CAGR, 2025-2037F

- Healthcare, Market Value (USD Billion), and CAGR, 2025-2037F

- Retail & E-commerce, Market Value (USD Billion), and CAGR, 2025-2037F

- Entertainment & Media, Market Value (USD Billion), and CAGR, 2025-2037F

- Energy, Market Value (USD Billion), and CAGR, 2025-2037F

- Others, Market Value (USD Billion), and CAGR, 2025-2037F

- By Component

- India Data Center Market Outlook

- Market Overview

- Market Revenue by Value (USD Billion), and Compound Annual Growth Rate (CAGR)

- India Data Center Market Segmentation Analysis (2025-2037)

- By Component

- Hardware, Market Value (USD Billion), and CAGR, 2025-2037F

- Software, Market Value (USD Billion), and CAGR, 2025-2037F

- Services, Market Value (USD Billion), and CAGR, 2025-2037F

- By Type

- Enterprise Data Centers, Market Value (USD Billion), and CAGR, 2025-2037F

- Managed Services Data Centers, Market Value (USD Billion), and CAGR, 2025-2037F

- Colocation Data Centers, Market Value (USD Billion), and CAGR, 2025-2037F

- Cloud-based Data Centers, Market Value (USD Billion), and CAGR, 2025-2037F

- Edge Data Centers, Market Value (USD Billion), and CAGR, 2025-2037F

- Hyperscale Data Centers, Market Value (USD Billion), and CAGR, 2025-2037F

- By Infrastructure

- Tier I, Market Value (USD Billion), and CAGR, 2025-2037F

- Tier II, Market Value (USD Billion), and CAGR, 2025-2037F

- Tier III, Market Value (USD Billion), and CAGR, 2025-2037F

- Tier IV, Market Value (USD Billion), and CAGR, 2025-2037F

- By Design

- Traditional, Market Value (USD Billion), and CAGR, 2025-2037F

- Modular/ Containerization, Market Value (USD Billion), and CAGR, 2025-2037F

- By End user

- BFSI, Market Value (USD Billion), and CAGR, 2025-2037F

- Telecommunication, Market Value (USD Billion), and CAGR, 2025-2037F

- Healthcare, Market Value (USD Billion), and CAGR, 2025-2037F

- Retail & E-commerce, Market Value (USD Billion), and CAGR, 2025-2037F

- Entertainment & Media, Market Value (USD Billion), and CAGR, 2025-2037F

- Energy, Market Value (USD Billion), and CAGR, 2025-2037F

- Others, Market Value (USD Billion), and CAGR, 2025-2037F

- By Component

- Indonesia Data Center Market Outlook

- Market Overview

- Market Revenue by Value (USD Billion), and Compound Annual Growth Rate (CAGR)

- Indonesia Data Center Market Segmentation Analysis (2025-2037)

- By Component

- Hardware, Market Value (USD Billion), and CAGR, 2025-2037F

- Software, Market Value (USD Billion), and CAGR, 2025-2037F

- Services, Market Value (USD Billion), and CAGR, 2025-2037F

- By Type

- Enterprise Data Centers, Market Value (USD Billion), and CAGR, 2025-2037F

- Managed Services Data Centers, Market Value (USD Billion), and CAGR, 2025-2037F

- Colocation Data Centers, Market Value (USD Billion), and CAGR, 2025-2037F

- Cloud-based Data Centers, Market Value (USD Billion), and CAGR, 2025-2037F

- Edge Data Centers, Market Value (USD Billion), and CAGR, 2025-2037F

- Hyperscale Data Centers, Market Value (USD Billion), and CAGR, 2025-2037F

- By Infrastructure

- Tier I, Market Value (USD Billion), and CAGR, 2025-2037F

- Tier II, Market Value (USD Billion), and CAGR, 2025-2037F

- Tier III, Market Value (USD Billion), and CAGR, 2025-2037F

- Tier IV, Market Value (USD Billion), and CAGR, 2025-2037F

- By Design

- Traditional, Market Value (USD Billion), and CAGR, 2025-2037F

- Modular/ Containerization, Market Value (USD Billion), and CAGR, 2025-2037F

- By End user

- BFSI, Market Value (USD Billion), and CAGR, 2025-2037F

- Telecommunication, Market Value (USD Billion), and CAGR, 2025-2037F

- Healthcare, Market Value (USD Billion), and CAGR, 2025-2037F

- Retail & E-commerce, Market Value (USD Billion), and CAGR, 2025-2037F

- Entertainment & Media, Market Value (USD Billion), and CAGR, 2025-2037F

- Energy, Market Value (USD Billion), and CAGR, 2025-2037F

- Others, Market Value (USD Billion), and CAGR, 2025-2037F

- By Component

- South Korea Data Center Market Outlook

- Market Overview

- Market Revenue by Value (USD Billion), and Compound Annual Growth Rate (CAGR)

- South Korea Data Center Market Segmentation Analysis (2025-2037)

- By Component

- Hardware, Market Value (USD Billion), and CAGR, 2025-2037F

- Software, Market Value (USD Billion), and CAGR, 2025-2037F

- Services, Market Value (USD Billion), and CAGR, 2025-2037F

- By Type

- Enterprise Data Centers, Market Value (USD Billion), and CAGR, 2025-2037F

- Managed Services Data Centers, Market Value (USD Billion), and CAGR, 2025-2037F

- Colocation Data Centers, Market Value (USD Billion), and CAGR, 2025-2037F

- Cloud-based Data Centers, Market Value (USD Billion), and CAGR, 2025-2037F

- Edge Data Centers, Market Value (USD Billion), and CAGR, 2025-2037F

- Hyperscale Data Centers, Market Value (USD Billion), and CAGR, 2025-2037F

- By Infrastructure

- Tier I, Market Value (USD Billion), and CAGR, 2025-2037F

- Tier II, Market Value (USD Billion), and CAGR, 2025-2037F

- Tier III, Market Value (USD Billion), and CAGR, 2025-2037F

- Tier IV, Market Value (USD Billion), and CAGR, 2025-2037F

- By Design

- Traditional, Market Value (USD Billion), and CAGR, 2025-2037F

- Modular/ Containerization, Market Value (USD Billion), and CAGR, 2025-2037F

- By End user

- BFSI, Market Value (USD Billion), and CAGR, 2025-2037F

- Telecommunication, Market Value (USD Billion), and CAGR, 2025-2037F

- Healthcare, Market Value (USD Billion), and CAGR, 2025-2037F

- Retail & E-commerce, Market Value (USD Billion), and CAGR, 2025-2037F

- Entertainment & Media, Market Value (USD Billion), and CAGR, 2025-2037F

- Energy, Market Value (USD Billion), and CAGR, 2025-2037F

- Others, Market Value (USD Billion), and CAGR, 2025-2037F

- Australia Data Center Market Outlook

- Market Overview

- Market Revenue by Value (USD Billion), and Compound Annual Growth Rate (CAGR)

- Australia Data Center Market Segmentation Analysis (2025-2037)

- By Component

- Hardware, Market Value (USD Billion), and CAGR, 2025-2037F

- Software, Market Value (USD Billion), and CAGR, 2025-2037F

- Services, Market Value (USD Billion), and CAGR, 2025-2037F

- By Type

- Enterprise Data Centers, Market Value (USD Billion), and CAGR, 2025-2037F

- Managed Services Data Centers, Market Value (USD Billion), and CAGR, 2025-2037F

- Colocation Data Centers, Market Value (USD Billion), and CAGR, 2025-2037F

- Cloud-based Data Centers, Market Value (USD Billion), and CAGR, 2025-2037F

- Edge Data Centers, Market Value (USD Billion), and CAGR, 2025-2037F

- Hyperscale Data Centers, Market Value (USD Billion), and CAGR, 2025-2037F

- By Infrastructure

- Tier I, Market Value (USD Billion), and CAGR, 2025-2037F

- Tier II, Market Value (USD Billion), and CAGR, 2025-2037F

- Tier III, Market Value (USD Billion), and CAGR, 2025-2037F

- Tier IV, Market Value (USD Billion), and CAGR, 2025-2037F

- By Design

- Traditional, Market Value (USD Billion), and CAGR, 2025-2037F

- Modular/ Containerization, Market Value (USD Billion), and CAGR, 2025-2037F

- By End user

- BFSI, Market Value (USD Billion), and CAGR, 2025-2037F

- Telecommunication, Market Value (USD Billion), and CAGR, 2025-2037F

- Healthcare, Market Value (USD Billion), and CAGR, 2025-2037F

- Retail & E-commerce, Market Value (USD Billion), and CAGR, 2025-2037F

- Entertainment & Media, Market Value (USD Billion), and CAGR, 2025-2037F

- Energy, Market Value (USD Billion), and CAGR, 2025-2037F

- Others, Market Value (USD Billion), and CAGR, 2025-2037F

- By Component

- South Korea Data Center Market Outlook

- Market Overview

- Market Revenue by Value (USD Billion), and Compound Annual Growth Rate (CAGR)

- South Korea Data Center Market Segmentation Analysis (2025-2037)

- By Component

- Hardware, Market Value (USD Billion), and CAGR, 2025-2037F

- Software, Market Value (USD Billion), and CAGR, 2025-2037F

- Services, Market Value (USD Billion), and CAGR, 2025-2037F

- By Type

- Enterprise Data Centers, Market Value (USD Billion), and CAGR, 2025-2037F

- Managed Services Data Centers, Market Value (USD Billion), and CAGR, 2025-2037F

- Colocation Data Centers, Market Value (USD Billion), and CAGR, 2025-2037F

- Cloud-based Data Centers, Market Value (USD Billion), and CAGR, 2025-2037F

- Edge Data Centers, Market Value (USD Billion), and CAGR, 2025-2037F

- Hyperscale Data Centers, Market Value (USD Billion), and CAGR, 2025-2037F

- By Infrastructure

- Tier I, Market Value (USD Billion), and CAGR, 2025-2037F

- Tier II, Market Value (USD Billion), and CAGR, 2025-2037F

- Tier III, Market Value (USD Billion), and CAGR, 2025-2037F

- Tier IV, Market Value (USD Billion), and CAGR, 2025-2037F

- By Design

- Traditional, Market Value (USD Billion), and CAGR, 2025-2037F

- Modular/ Containerization, Market Value (USD Billion), and CAGR, 2025-2037F

- By End user

- BFSI, Market Value (USD Billion), and CAGR, 2025-2037F

- Telecommunication, Market Value (USD Billion), and CAGR, 2025-2037F

- Healthcare, Market Value (USD Billion), and CAGR, 2025-2037F

- Retail & E-commerce, Market Value (USD Billion), and CAGR, 2025-2037F

- Entertainment & Media, Market Value (USD Billion), and CAGR, 2025-2037F

- Energy, Market Value (USD Billion), and CAGR, 2025-2037F

- Others, Market Value (USD Billion), and CAGR, 2025-2037F

- By Component

- Malaysia Data Center Market Outlook

- Market Overview

- Market Revenue by Value (USD Billion), and Compound Annual Growth Rate (CAGR)

- Malaysia Data Center Market Segmentation Analysis (2025-2037)

- By Component

- Hardware, Market Value (USD Billion), and CAGR, 2025-2037F

- Software, Market Value (USD Billion), and CAGR, 2025-2037F

- Services, Market Value (USD Billion), and CAGR, 2025-2037F

- By Type

- Enterprise Data Centers, Market Value (USD Billion), and CAGR, 2025-2037F

- Managed Services Data Centers, Market Value (USD Billion), and CAGR, 2025-2037F

- Colocation Data Centers, Market Value (USD Billion), and CAGR, 2025-2037F

- Cloud-based Data Centers, Market Value (USD Billion), and CAGR, 2025-2037F

- Edge Data Centers, Market Value (USD Billion), and CAGR, 2025-2037F

- Hyperscale Data Centers, Market Value (USD Billion), and CAGR, 2025-2037F

- By Infrastructure

- Tier I, Market Value (USD Billion), and CAGR, 2025-2037F

- Tier II, Market Value (USD Billion), and CAGR, 2025-2037F

- Tier III, Market Value (USD Billion), and CAGR, 2025-2037F

- Tier IV, Market Value (USD Billion), and CAGR, 2025-2037F

- By Design

- Traditional, Market Value (USD Billion), and CAGR, 2025-2037F

- Modular/ Containerization, Market Value (USD Billion), and CAGR, 2025-2037F

- By End user

- BFSI, Market Value (USD Billion), and CAGR, 2025-2037F

- Telecommunication, Market Value (USD Billion), and CAGR, 2025-2037F

- Healthcare, Market Value (USD Billion), and CAGR, 2025-2037F

- Retail & E-commerce, Market Value (USD Billion), and CAGR, 2025-2037F

- Entertainment & Media, Market Value (USD Billion), and CAGR, 2025-2037F

- Energy, Market Value (USD Billion), and CAGR, 2025-2037F

- Others, Market Value (USD Billion), and CAGR, 2025-2037F

- By Component

- Singapore Data Center Market Outlook

- Market Overview

- Market Revenue by Value (USD Billion), and Compound Annual Growth Rate (CAGR)

- Singapore Data Center Market Segmentation Analysis (2025-2037)

- By Component

- Hardware, Market Value (USD Billion), and CAGR, 2025-2037F

- Software, Market Value (USD Billion), and CAGR, 2025-2037F

- Services, Market Value (USD Billion), and CAGR, 2025-2037F

- By Type

- Enterprise Data Centers, Market Value (USD Billion), and CAGR, 2025-2037F

- Managed Services Data Centers, Market Value (USD Billion), and CAGR, 2025-2037F

- Colocation Data Centers, Market Value (USD Billion), and CAGR, 2025-2037F

- Cloud-based Data Centers, Market Value (USD Billion), and CAGR, 2025-2037F

- Edge Data Centers, Market Value (USD Billion), and CAGR, 2025-2037F

- Hyperscale Data Centers, Market Value (USD Billion), and CAGR, 2025-2037F

- By Infrastructure

- Tier I, Market Value (USD Billion), and CAGR, 2025-2037F

- Tier II, Market Value (USD Billion), and CAGR, 2025-2037F

- Tier III, Market Value (USD Billion), and CAGR, 2025-2037F

- Tier IV, Market Value (USD Billion), and CAGR, 2025-2037F

- By Design

- Traditional, Market Value (USD Billion), and CAGR, 2025-2037F

- Modular/ Containerization, Market Value (USD Billion), and CAGR, 2025-2037F

- By End user

- BFSI, Market Value (USD Billion), and CAGR, 2025-2037F

- Telecommunication, Market Value (USD Billion), and CAGR, 2025-2037F

- Healthcare, Market Value (USD Billion), and CAGR, 2025-2037F

- Retail & E-commerce, Market Value (USD Billion), and CAGR, 2025-2037F

- Entertainment & Media, Market Value (USD Billion), and CAGR, 2025-2037F

- Energy, Market Value (USD Billion), and CAGR, 2025-2037F

- Others, Market Value (USD Billion), and CAGR, 2025-2037F

- By Component

- New Zealand Data Center Market Outlook

- Market Overview

- Market Revenue by Value (USD Billion), and Compound Annual Growth Rate (CAGR)

- New Zealand Data Center Market Segmentation Analysis (2025-2037)

- By Component

- Hardware, Market Value (USD Billion), and CAGR, 2025-2037F

- Software, Market Value (USD Billion), and CAGR, 2025-2037F

- Services, Market Value (USD Billion), and CAGR, 2025-2037F

- By Type

- Enterprise Data Centers, Market Value (USD Billion), and CAGR, 2025-2037F

- Managed Services Data Centers, Market Value (USD Billion), and CAGR, 2025-2037F

- Colocation Data Centers, Market Value (USD Billion), and CAGR, 2025-2037F

- Cloud-based Data Centers, Market Value (USD Billion), and CAGR, 2025-2037F

- Edge Data Centers, Market Value (USD Billion), and CAGR, 2025-2037F

- Hyperscale Data Centers, Market Value (USD Billion), and CAGR, 2025-2037F

- By Infrastructure

- Tier I, Market Value (USD Billion), and CAGR, 2025-2037F

- Tier II, Market Value (USD Billion), and CAGR, 2025-2037F

- Tier III, Market Value (USD Billion), and CAGR, 2025-2037F

- Tier IV, Market Value (USD Billion), and CAGR, 2025-2037F

- By Design

- Traditional, Market Value (USD Billion), and CAGR, 2025-2037F

- Modular/ Containerization, Market Value (USD Billion), and CAGR, 2025-2037F

- By End user

- BFSI, Market Value (USD Billion), and CAGR, 2025-2037F

- Telecommunication, Market Value (USD Billion), and CAGR, 2025-2037F

- Healthcare, Market Value (USD Billion), and CAGR, 2025-2037F

- Retail & E-commerce, Market Value (USD Billion), and CAGR, 2025-2037F

- Entertainment & Media, Market Value (USD Billion), and CAGR, 2025-2037F

- Energy, Market Value (USD Billion), and CAGR, 2025-2037F

- Others, Market Value (USD Billion), and CAGR, 2025-2037F

- By Component

- Vietnam Data Center Market Outlook

- Market Overview

- Market Revenue by Value (USD Billion), and Compound Annual Growth Rate (CAGR)

- Vietnam Data Center Market Segmentation Analysis (2025-2037)

- By Component

- Hardware, Market Value (USD Billion), and CAGR, 2025-2037F

- Software, Market Value (USD Billion), and CAGR, 2025-2037F

- Services, Market Value (USD Billion), and CAGR, 2025-2037F

- By Type

- Enterprise Data Centers, Market Value (USD Billion), and CAGR, 2025-2037F

- Managed Services Data Centers, Market Value (USD Billion), and CAGR, 2025-2037F

- Colocation Data Centers, Market Value (USD Billion), and CAGR, 2025-2037F

- Cloud-based Data Centers, Market Value (USD Billion), and CAGR, 2025-2037F

- Edge Data Centers, Market Value (USD Billion), and CAGR, 2025-2037F

- Hyperscale Data Centers, Market Value (USD Billion), and CAGR, 2025-2037F

- By Infrastructure

- Tier I, Market Value (USD Billion), and CAGR, 2025-2037F

- Tier II, Market Value (USD Billion), and CAGR, 2025-2037F

- Tier III, Market Value (USD Billion), and CAGR, 2025-2037F

- Tier IV, Market Value (USD Billion), and CAGR, 2025-2037F

- By Design

- Traditional, Market Value (USD Billion), and CAGR, 2025-2037F

- Modular/ Containerization, Market Value (USD Billion), and CAGR, 2025-2037F

- By End user

- BFSI, Market Value (USD Billion), and CAGR, 2025-2037F

- Telecommunication, Market Value (USD Billion), and CAGR, 2025-2037F

- Healthcare, Market Value (USD Billion), and CAGR, 2025-2037F

- Retail & E-commerce, Market Value (USD Billion), and CAGR, 2025-2037F

- Entertainment & Media, Market Value (USD Billion), and CAGR, 2025-2037F

- Energy, Market Value (USD Billion), and CAGR, 2025-2037F

- Others, Market Value (USD Billion), and CAGR, 2025-2037F

- Rest of Asia Pacific Excluding Japan Data Center Market Outlook

- Market Overview

- Market Revenue by Value (USD Billion), and Compound Annual Growth Rate (CAGR)

- Rest of Asia Pacific Excluding Japan Data Center Market Segmentation Analysis (2025-2037)

- By Component

- Hardware, Market Value (USD Billion), and CAGR, 2025-2037F

- Software, Market Value (USD Billion), and CAGR, 2025-2037F

- Services, Market Value (USD Billion), and CAGR, 2025-2037F

- By Type

- Enterprise Data Centers, Market Value (USD Billion), and CAGR, 2025-2037F

- Managed Services Data Centers, Market Value (USD Billion), and CAGR, 2025-2037F

- Colocation Data Centers, Market Value (USD Billion), and CAGR, 2025-2037F

- Cloud-based Data Centers, Market Value (USD Billion), and CAGR, 2025-2037F

- Edge Data Centers, Market Value (USD Billion), and CAGR, 2025-2037F

- Hyperscale Data Centers, Market Value (USD Billion), and CAGR, 2025-2037F

- By Infrastructure

- Tier I, Market Value (USD Billion), and CAGR, 2025-2037F

- Tier II, Market Value (USD Billion), and CAGR, 2025-2037F

- Tier III, Market Value (USD Billion), and CAGR, 2025-2037F

- Tier IV, Market Value (USD Billion), and CAGR, 2025-2037F

- By Design

- Traditional, Market Value (USD Billion), and CAGR, 2025-2037F

- Modular/ Containerization, Market Value (USD Billion), and CAGR, 2025-2037F

- By End user

- BFSI, Market Value (USD Billion), and CAGR, 2025-2037F

- Telecommunication, Market Value (USD Billion), and CAGR, 2025-2037F

- Healthcare, Market Value (USD Billion), and CAGR, 2025-2037F

- Retail & E-commerce, Market Value (USD Billion), and CAGR, 2025-2037F

- Entertainment & Media, Market Value (USD Billion), and CAGR, 2025-2037F

- Energy, Market Value (USD Billion), and CAGR, 2025-2037F

- Others, Market Value (USD Billion), and CAGR, 2025-2037F

- By Component

- China Data Center Market Outlook

- Japan Data Center Market Outlook

- Market Overview

- Market Revenue by Value (USD Billion), and Compound Annual Growth Rate (CAGR)

- Japan Data Center Market Segmentation Analysis (2025-2037)

- By Component

- Hardware, Market Value (USD Billion), and CAGR, 2025-2037F

- Software, Market Value (USD Billion), and CAGR, 2025-2037F

- Services, Market Value (USD Billion), and CAGR, 2025-2037F

- By Type

- Enterprise Data Centers, Market Value (USD Billion), and CAGR, 2025-2037F

- Managed Services Data Centers, Market Value (USD Billion), and CAGR, 2025-2037F

- Colocation Data Centers, Market Value (USD Billion), and CAGR, 2025-2037F

- Cloud-based Data Centers, Market Value (USD Billion), and CAGR, 2025-2037F

- Edge Data Centers, Market Value (USD Billion), and CAGR, 2025-2037F

- Hyperscale Data Centers, Market Value (USD Billion), and CAGR, 2025-2037F

- By Infrastructure

- Tier I, Market Value (USD Billion), and CAGR, 2025-2037F

- Tier II, Market Value (USD Billion), and CAGR, 2025-2037F

- Tier III, Market Value (USD Billion), and CAGR, 2025-2037F

- Tier IV, Market Value (USD Billion), and CAGR, 2025-2037F

- By Design

- Traditional, Market Value (USD Billion), and CAGR, 2025-2037F

- Modular/ Containerization, Market Value (USD Billion), and CAGR, 2025-2037F

- By End user

- BFSI, Market Value (USD Billion), and CAGR, 2025-2037F

- Telecommunication, Market Value (USD Billion), and CAGR, 2025-2037F

- Healthcare, Market Value (USD Billion), and CAGR, 2025-2037F

- Retail & E-commerce, Market Value (USD Billion), and CAGR, 2025-2037F

- Entertainment & Media, Market Value (USD Billion), and CAGR, 2025-2037F

- Energy, Market Value (USD Billion), and CAGR, 2025-2037F

- Others, Market Value (USD Billion), and CAGR, 2025-2037F

- By Component

- Cross Analysis of Component W.R.T. End user (USD Billion), 2025-2037

- Latin America Data Center Market Outlook

- Market Overview

- Market Revenue by Value (USD Billion), and Compound Annual Growth Rate (CAGR)

- Latin America Data Center Market Segmentation Analysis (2025-2037)

- Component

- Hardware, Market Value (USD Billion), and CAGR, 2025-2037F

- Software, Market Value (USD Billion), and CAGR, 2025-2037F

- Services, Market Value (USD Billion), and CAGR, 2025-2037F

- By Type

- Enterprise Data Centers, Market Value (USD Billion), and CAGR, 2025-2037F

- Managed Services Data Centers, Market Value (USD Billion), and CAGR, 2025-2037F

- Colocation Data Centers, Market Value (USD Billion), and CAGR, 2025-2037F

- Cloud-based Data Centers, Market Value (USD Billion), and CAGR, 2025-2037F

- Edge Data Centers, Market Value (USD Billion), and CAGR, 2025-2037F

- Hyperscale Data Centers, Market Value (USD Billion), and CAGR, 2025-2037F

- By Infrastructure

- Tier I, Market Value (USD Billion), and CAGR, 2025-2037F

- Tier II, Market Value (USD Billion), and CAGR, 2025-2037F

- Tier III, Market Value (USD Billion), and CAGR, 2025-2037F

- Tier IV, Market Value (USD Billion), and CAGR, 2025-2037F

- By Design

- Traditional, Market Value (USD Billion), and CAGR, 2025-2037F

- Modular/ Containerization, Market Value (USD Billion), and CAGR, 2025-2037F

- By End user

- BFSI, Market Value (USD Billion), and CAGR, 2025-2037F

- Telecommunication, Market Value (USD Billion), and CAGR, 2025-2037F

- Healthcare, Market Value (USD Billion), and CAGR, 2025-2037F

- Retail & E-commerce, Market Value (USD Billion), and CAGR, 2025-2037F

- Entertainment & Media, Market Value (USD Billion), and CAGR, 2025-2037F

- Energy, Market Value (USD Billion), and CAGR, 2025-2037F

- Others, Market Value (USD Billion), and CAGR, 2025-2037F

- By Country

- Brazil, Market Value (USD Billion), and CAGR, 2025-2037F

- Argentina, Market Value (USD Billion), and CAGR, 2025-2037F

- Mexico, Market Value (USD Billion), and CAGR, 2025-2037F

- Rest of Latin America, Market Value (USD Billion), and CAGR, 2025-2037F

- Component

- Latin America Data Center Market Outlook

- Cross Analysis of Component W.R.T. End user (USD Billion), 2025-2037

- Middle East & Africa Data Center Market Outlook

- Market Overview

- Market Revenue by Value (USD Billion), and Compound Annual Growth Rate (CAGR)

- Middle East & Africa Data Center Market Segmentation Analysis (2025-2037)

- Component

- Hardware, Market Value (USD Billion), and CAGR, 2025-2037F

- Software, Market Value (USD Billion), and CAGR, 2025-2037F

- Services, Market Value (USD Billion), and CAGR, 2025-2037F

- By Type

- Enterprise Data Centers, Market Value (USD Billion), and CAGR, 2025-2037F

- Managed Services Data Centers, Market Value (USD Billion), and CAGR, 2025-2037F

- Colocation Data Centers, Market Value (USD Billion), and CAGR, 2025-2037F

- Cloud-based Data Centers, Market Value (USD Billion), and CAGR, 2025-2037F

- Edge Data Centers, Market Value (USD Billion), and CAGR, 2025-2037F

- Hyperscale Data Centers, Market Value (USD Billion), and CAGR, 2025-2037F

- By Infrastructure

- Tier I, Market Value (USD Billion), and CAGR, 2025-2037F

- Tier II, Market Value (USD Billion), and CAGR, 2025-2037F

- Tier III, Market Value (USD Billion), and CAGR, 2025-2037F

- Tier IV, Market Value (USD Billion), and CAGR, 2025-2037F

- By Design

- Traditional, Market Value (USD Billion), and CAGR, 2025-2037F

- Modular/ Containerization, Market Value (USD Billion), and CAGR, 2025-2037F

- By End user

- BFSI, Market Value (USD Billion), and CAGR, 2025-2037F

- Telecommunication, Market Value (USD Billion), and CAGR, 2025-2037F

- Healthcare, Market Value (USD Billion), and CAGR, 2025-2037F

- Retail & E-commerce, Market Value (USD Billion), and CAGR, 2025-2037F

- Entertainment & Media, Market Value (USD Billion), and CAGR, 2025-2037F

- Energy, Market Value (USD Billion), and CAGR, 2025-2037F

- Others, Market Value (USD Billion), and CAGR, 2025-2037F

- By Country

- GCC, Market Value (USD Billion), and CAGR, 2025-2037F

- Israel, Market Value (USD Billion), and CAGR, 2025-2037F

- South Africa, Market Value (USD Billion), and CAGR, 2025-2037F

- Rest of Middle East & Africa, Market Value (USD Billion), and CAGR, 2025-2037F

- Component

- Middle East & Africa Data Center Market Outlook

- Cross Analysis of Component W.R.T. End user (USD Billion), 2025-2037

- World Economic Outlook

- About Research Nester

Data Center Market Outlook:

Data Center Market size was over USD 432.64 billion in 2025 and is projected to reach USD 1.14 trillion by 2035, growing at around 10.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of data center is evaluated at USD 472.36 billion.

Growth in the data center market can be attributed to rising demand for cloud computing, big data analytics, and growing traction for AI technologies. Due to an increase in remote work, online learning, and virtual entertainment, companies are digitizing their operations, and the need for a robust data storage and processing environment is high. For example, in September 2023, Vantage Data Centers announced a USD 9.2 billion equity investment led by DigitalBridge Group and Silver Lake. This investment will help Vantage build more capacity to meet the increasing demand it faces because of the surge in cloud and AI services across the globe.

Policies from governments around the world toward enhancing digital infrastructure also contribute to the growth of data center demand. For example, the Government of India incentivizes the creation of data centers within the country through many policies and steps to maximize connectivity, as it ensures reliable power access. According to the Digital Personal Data Protection Act 2023, the establishment of local data centers creates a high demand in the data center market. The government’s commitment to enabling an environment for data centers to thrive is further manifested through acts like creating Data Center Economic Zones and facilitating investments in this vital infrastructure.

Key Data Center Market Insights Summary:

Regional Highlights:

- North America data center market will hold more than 37.20% share by 2035, driven by high demand for cloud services, AI technologies, and the need for advanced infrastructure.

- Asia Pacific market will exhibit substantial growth from 2026 to 2035, driven by the rise in internet penetration, digital transformation, and government support for technology infrastructure.

Segment Insights:

- The hardware segment in the data center market is projected to hold a 58.80% share by 2035, driven by advancements in server technologies and increased AI application demand.

- The bfsi segment in the data center market is projected to achieve significant growth till 2035, influenced by digitalization of financial services requiring secure and scalable data centers.

Key Growth Trends:

- Cloud computing adoption and digital transformation

- AI and high-performance computing demand

Major Challenges:

- Environmental concerns and regulations

- Disruptions in the supply chain

Key Players: Amazon Web Services, Inc., Microsoft, Equinix, Inc., Alibaba Cloud, Digital Realty, NTT DATA Group Corporation, Fujitsu, Cisco Systems, Inc., Rackspace Technology, Google Cloud, CyrusOne, AT TOKYO Corporation, Hewlett Packard Enterprise Development LP.

Global Data Center Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 432.64 billion

- 2026 Market Size: USD 472.36 billion

- Projected Market Size: USD 1.14 trillion by 2035

- Growth Forecasts: 10.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (37.2% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, Singapore

- Emerging Countries: China, India, Japan, Singapore, Thailand

Last updated on : 17 September, 2025

Data Center Market Growth Drivers and Challenges:

Growth Drivers

- Cloud computing adoption and digital transformation: Cloud computing growth is one of the key reasons for the expansion in the data center market. The adoption of cloud computing solutions increases the need for expandable storage infrastructures. It has also been accelerated by a rise in remote working and digital policies from companies across the globe. For example, Amazon AWS announced an investment of USD 5 billion in Queretaro, Mexico, in March 2024, as the acceleration of cloud adoption across regions, especially in emerging markets, is rising steadily.

- AI and high-performance computing demand: With the rapid growth in AI-driven technologies along with high-performance computing, the data center market players are witnessing new opportunities for growth. AI workloads require unparalleled computing power and infrastructure that keeps data centers running efficiently. For example, Cisco and NVIDIA launched an AI cluster solution in February 2024 to match the growing demand for AI data centers, which enables businesses to manage complex AI and machine learning operations. As a result, the demand for data centers is likely to gain momentum as AI applications increasingly become a part of industries such as healthcare, finance, and manufacturing.

- Data privacy regulations and government initiatives: Increasing data privacy and localization regulations are the other demands for secure and compliant data centers. Governments are guiding and setting stringent regulations to ensure data sovereignty, particularly in departments dealing with sensitive information. For example, in April 2023, the Ministry of Finance of China, along with other regulatory bodies, issued the "Green Data Center" standard to make data management sustainable, which further drives the growth of energy-efficient data centers. Similar regulations are being rolled out across the globe, forcing data center operators to emphasize security as well as sustainability for their operations.

Challenges

- Environmental concerns and regulations: Data centers face increasing scrutiny regarding their environmental impact, specifically due to highly consumptive levels of energy and carbon emissions. In the wake of this criticism, different regulatory bodies have implemented a more stringent set of standards for the energy efficiency and sustainability performance of data centers. For example, in April 2023, the European Union passed new legislation that called for a 30% reduction in carbon emissions by the year 2030 from data centers, which further raises the stakes for environmentally friendly operations.

- Disruptions in the supply chain: Supply chain disruption is also one of the major challenges faced by all data center operators, who find it difficult to get vital hardware components and infrastructure materials. These supply chain disruptions create a situation that brings about project delays and higher operational costs. For example, in September 2023, Intel reported ongoing supply chain issues affecting semiconductor production that may limit data center deployments as companies compete to meet rising demand from constrained positions.

Data Center Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

10.2% |

|

Base Year Market Size (2025) |

USD 432.64 billion |

|

Forecast Year Market Size (2035) |

USD 1.14 trillion |

|

Regional Scope |

|

Data Center Market Segmentation:

Component Segment Analysis

Hardware segment is poised to account for data center market share of more than 58.8% by the end of 2035. Growth in this segment is largely based on better performance, efficiency-boosting server technologies, and storage solutions in a variety of applications. Additionally, the deployment of high-performance computing systems in support of AI applications will increase, thus fueling demand for the segment. For example, in May 2023, Dell Technologies introduced its new series of servers for deep learning workloads in AI applications to further solidify its position as a leader in hardware innovation.

End user Segment Analysis

In data center market, banking, financial services, and insurance (BFSI) segment is expected to dominate revenue share of over 33.3% by 2035. In this industry, secure infrastructure with scalability is required to process vast data regarding finances. By promoting online banking, mobile payments, and other related digitalization of financial services, BFSI requires data centers to be able to handle such continuous operations. For example, in April 2024, Microsoft declared an investment of USD 2.9 billion to expand the facility of its data center in Japan to meet the growing requirements from the BFSI sectors for secure cloud solutions.

Our in-depth analysis of the global market includes the following segments:

|

Component |

|

|

Type |

|

|

Infrastructure |

|

|

Design |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Data Center Market Regional Analysis:

North America Market Insights

North America in data center market is anticipated to capture around 37.2% revenue share by the end of 2035, driven by its well-established digital economy based on high demand for cloud services and advanced technological infrastructure. Additionally, AI technologies being increasingly adopted across various industries drive the investment pace in facilities capable of sustaining such innovations. The U.S. and Canada are witnessing rapid surge in the demand for data centers, which is creating significant opportunities for new entrants in the market.

The U.S. continues to be a prominent data center market in North America, with massive investment and development by leading players like AWS, Microsoft, and Google. For example, Microsoft's investment of USD 100 billion in the 'Stargate' AI supercomputer project is under pipeline and expected to be launched by 2028, thereby demonstrating a commitment towards upgrading the data center capabilities in the country to help support next-generation technologies like AI and quantum computing.

The data center market in Canada is recording significant growth due to favorable government policies toward technology investment and sustainability initiatives. Canada has emerged as a lucrative destination for global tech companies that need reliable infrastructure with regulatory support to host their operations. In January 2024, the federal government announced a new program to drive innovation in technology sectors with funding opportunities, particularly in enhancing digital infrastructures such as data centers.

Asia Pacific Market Insights

Asia Pacific region is poised to witness substantial growth through 2035, driven by the increased internet penetration rates and digital transformation efforts across sectors such as healthcare and retail. Moreover, governments in several countries within the region have been extending their support by promoting investments in the technology infrastructure. This, in turn, becomes vital to allow new technologies such as AI and IoT to gain widespread adoption, further driving the market growth in APEJ during the forecast period.

With its robust digital economy and strong data localization rules, China is anticipated to turn into a dominant country in APEJ data center market. Players in the country continue to invest heavily in cloud infrastructure to support the rapidly growing verticals like e-commerce and fintech. Furthermore, major technology companies like Alibaba, Tencent, and Fujitsu are developing their data center capacities to meet the rising demand. In May 2023, ServiceNow, a U.S.-based software company, and Fujitsu signed an agreement to establish the Fujitsu-ServiceNow Innovation Center, which will focus on digital transformation and customer success.

The data center market in India is witnessing steady expansion due to rising mobile internet usage and cloud adoption. Favorable policies by the government are also attracting both domestic and international investments, hence creating a business climate. These articulated policies attract a number of global players to establish a strong foothold in India. With more industries investing to boost digital infrastructure, demand for data centers is anticipated to rise steadily in India. This momentum places India in an important position in the global data center market.

Data Center Market Players:

- Amazon Web Services, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Microsoft

- Equinix, Inc.

- Alibaba Cloud

- Digital Realty

- NTT DATA Group Corporation

- Fujitsu

- Cisco Systems, Inc.

- Rackspace Technology

- Google Cloud

- CyrusOne

- AT TOKYO Corporation

- Hewlett Packard Enterprise Development LP

The competitive outlook in the data center market is dominated by some leading players vying for market share through strategic partnerships and technological innovation. Some of these companies are IBM, Cisco, Amazon Web Services, Microsoft, and Google Cloud, which have been at the forefront in continuously updating their service offerings while expanding their geographical footprint. Furthermore, these players take advantage of the increasing demands for scalable, energy-efficient, and highly secure data center solutions driven by Artificial Intelligence. Moreover, partnerships with regional players further support investments in infrastructure development to meet the increasing demand of emergent data center markets and make necessary adjustments to adapt to emerging industry standards.

In January 2023, CyrusOne acquired an office campus in Frankfurt, Germany, which it intends to refurbish into a large data center campus. Investment group Corum confirmed that it had sold the Europark office complex for EUR 95 million to CyrusOne. The deal cements CyrusOne's position in Europe and reinforces its strategy of expansion in key data center markets where demand for hyperscale data center capacity is already well underway. This development underlines the growing prominence of data centers as companies vie to meet the rising demand for the region's blossoming digital infrastructure.

Here are some leading companies in the data center market:

Recent Developments

In the News

- In August 2024, Google announced a USD 1 billion investment to expand its data center facility in Texas. This expansion is part of Google’s broader strategy to strengthen its cloud infrastructure across the U.S. to meet growing demand for digital services. The investment reflects Google's continued focus on sustainability, with plans to power the facility using renewable energy sources.

- In July 2024, Digital Realty acquired two data centers with a combined capacity of 15MW for USD 200 million from Cyxtera. The acquisition bolsters Digital Realty's footprint in the U.S., enhancing its service offerings for hyperscalers and enterprises. It also strengthens the company’s ability to support the growing demand for edge computing and hybrid cloud solutions.

- In June 2024, Equinix announced its plan to expand into the Philippines by acquiring three data centers from Total Information Management (TIM), a local IT service management company. This acquisition strengthens Equinix’s presence in Southeast Asia, enhancing its global digital infrastructure platform.

- In June 2024, Alibaba Cloud revealed plans to discontinue data center operations from four availability zones in Sydney and Mumbai. The move is part of a strategic realignment, set to take place later this year. This decision reflects Alibaba Cloud's shift toward optimizing its resources and focusing on other key markets.

- Report ID: 6040

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Data Center Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.