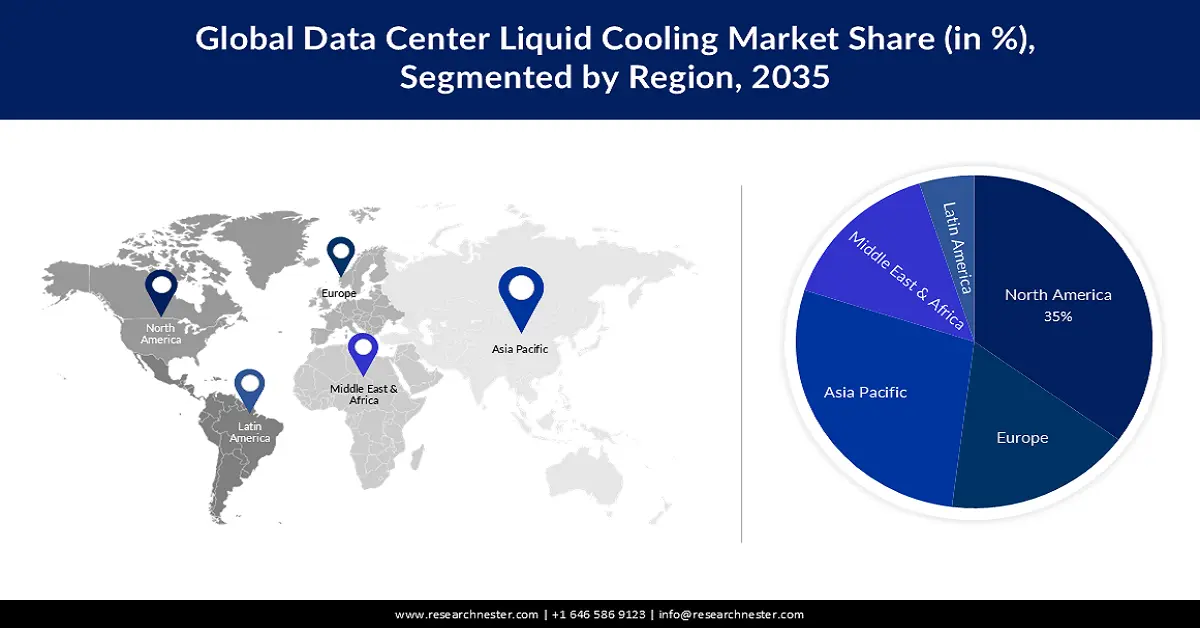

Data Center Liquid Cooling Market Regional Analysis:

North America Market Insights

North America data center liquid cooling market is set to hold revenue share of over 38.6% by the end of 2035. This growth is driven by the regional demand fueled by AI computing, the growing power densities, and the need to cool the data centers. In the case of increasing heat loads, immersion cooling, as well as direct-to-chip solutions, become crucial for data centers. In January 2025, Amazon Web Services (AWS) announced to invest USD11 billion in data centers in Georgia to promote cloud computing, artificial intelligence, and efficient cooling. This move signifies the state as an ideal technology hub, which strengthens North America position in cutting-edge data center solutions and liquid cooling technology.

The U.S. holds the largest share of the North America data center liquid cooling market owing to high investment in hyperscale data centers, government policies regarding energy efficiency, and the use of artificial intelligence. Some of the major technology markets, such as California, Texas, and Virginia, are reporting increased activity in data center construction and modernization. According to Research Nester, hyperscale data centers in the U.S. contributed to nearly 50% of the total capacity in 2024, all due to AI workloads, cloud computing, and machine learning. The adoption of liquid cooling solutions is gradually increasing as the operators of the data centers look for ways to minimize expenses, greenhouse emissions, and thermal issues.

Canada data center liquid cooling market is growing due to its environmental concerns, rising use of artificial intelligence and cloud services, and government encouragement. The country is promoting itself as a green data center market that uses renewable energy and efficient cooling solutions. As the government of Canada set the goal to achieve Net Zero by 2050, data centers in the country began to integrate liquid cooling in 2024. The country also has a favorable climate that is conducive to the operation of data centers, and the availability of hydropower has made it one of the most favored nations for data centers.

Asia Pacific Market Insights

Asia Pacific region is expected to register significant growth till 2035, owing to cloud computing, AI, and hyperscale data center growth. The region is at the forefront of supplying the global market, contributing to 30% of global capacity expansion, with investments exceeding USD 564 billion over the next five years. The emergence of 5G, edge computing, and AI applications that are currently being rapidly deployed increase the density of power consumption, which means that liquid cooling has become a vital solution. The governments of China, India, and Southeast Asia countries have been supporting the green data center and the use of liquid cooling to reduce energy consumption and carbon footprint.

India is one of the lucrative countries for data center liquid cooling due to the rising AI workload, growth in cloud services, and government digitalization. The country has some of the fastest growing hyperscale data centers, and the investment in this sector is projected to reach over USD 10 billion by 2030. Government initiatives like Digital India and Make in India are supporting the IT structure that needs energy-efficient cooling systems. Given that the power density in data centers is rising, liquid cooling solutions are now emerging as a major investment priority for cloud and AI companies. In July 2024, Yotta Infrastructure and Data Center plans to build India’s first large-scale AI data center that will employ a direct-to-chip liquid cooling system for managing the high-performance computing demand. This further enhances the position of India as one of the prominent markets for data centers in the APAC.

China remains the largest data center liquid cooling market in the Asia Pacific region due to the government’s support of AI, the growth of cloud computing, and smart cities. Despite the increase in energy consumption, efficient cooling has become a critical concern for hyperscale data centers. Some of the largest cloud service providers in the country, such as Alibaba Cloud and Tencent Cloud, are now adopting liquid cooling in their hyperscale data centers. In September 2024, Alibaba Cloud introduced China’s first liquid cooling AI data center that cuts energy consumption by 30% and increases the efficiency of computing. This move underlines the notion that China has been leading in the development of liquid cooling solutions that meet modern and efficient data center needs.