Global Data Centre Liquid Cooling Market

- Introduction

- Study Objective

- Scope of the report

- Market Taxonomy

- Study Assumptions and Abbreviations

- Research Methodology & Approach

- Primary Research

- Secondary Research

- Data Triangulation

- SPSS Methodology

- Executive Summary

- Global Industry Overview

- Market Overview

- Regional Synopsis

- Industry Supply Chain Analysis

- DROT

- Driver

- Restraint

- Opportunities

- Trends

- Government Regulation: How they would Aid the Business?

- Competitive Landscape

- ALFA LAVAL

- Asperitas

- Cisco Systems, Inc.

- COOLIT SYSTEMS

- FUJITSU

- LiquidStack Holding B.V.

- Midas Immersion Cooling

- Rittal GmbH & Co. KG

- Schneider Electric

- Vertiv Group Corp.

- Ongoing Technological Advancements

- Price Benchmarking

- Recent Development Analysis

- Global Outlook and Projections

- Global Overview

- Market Value (USD Million), Current and Future Projections, 2024-2037

- Increment $ Opportunity Assessment, 2024-2037

- Global Segmentation (USD Million), 2024-2037, By

- Components, Value (USD Million)

- Solution

- Indirect Liquid Cooling

- Direct Liquid Cooling

- Services

- Consulting & Designing

- Deployment & Installation

- Support & Maintenance

- Solution

- Cooling Technology, Value (USD Million)

- Direct-to-chip cooling

- Immersion cooling

- Rear-door liquid cooling

- Others

- Data Center Type, Value (USD Million)

- Enterprise Data Centers

- Managed Services Data Centers

- Colocation Data Centers

- Cloud-based Data Centers

- Edge Data Centers

- Hyperscale Data Centers

- Data Center Size, Value (USD Million)

- Large Data Centers

- Small & Mid-Sized Data Centers

- End user, Value (USD Million)

- BFSI

- Energy

- Government & Defense

- Healthcare

- IT & Telecom

- Manufacturing

- Others

- Regional Synopsis, Value (USD Million)

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

- Components, Value (USD Million)

- Global Overview

- North America Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2024-2037

- Increment $ Opportunity Assessment, 2024-2037

- Segmentation (USD Million), 2024-2037, By

- Components, Value (USD Million)

- Solution

- Indirect Liquid Cooling

- Direct Liquid Cooling

- Services

- Consulting & Designing

- Deployment & Installation

- Support & Maintenance

- Solution

- Cooling Technology, Value (USD Million)

- Direct-to-chip cooling

- Immersion cooling

- Rear-door liquid cooling

- Others

- Data Center Type, Value (USD Million)

- Enterprise Data Centers

- Managed Services Data Centers

- Colocation Data Centers

- Cloud-based Data Centers

- Edge Data Centers

- Hyperscale Data Centers

- Data Center Size, Value (USD Million)

- Large Data Centers

- Small & Mid-Sized Data Centers

- End user, Value (USD Million)

- BFSI

- Energy

- Government & Defense

- Healthcare

- IT & Telecom

- Manufacturing

- Others

- Country Level Analysis Value (USD Million)

- U.S.

- Canada

- Components, Value (USD Million)

- Overview

- Europe Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2024-2037

- Increment $ Opportunity Assessment, 2024-2037

- Segmentation (USD Million), 2024-2037, By

- Components, Value (USD Million)

- Solution

- Indirect Liquid Cooling

- Direct Liquid Cooling

- Services

- Consulting & Designing

- Deployment & Installation

- Support & Maintenance

- Solution

- Cooling Technology, Value (USD Million)

- Direct-to-chip cooling

- Immersion cooling

- Rear-door liquid cooling

- Others

- Data Center Type, Value (USD Million)

- Enterprise Data Centers

- Managed Services Data Centers

- Colocation Data Centers

- Cloud-based Data Centers

- Edge Data Centers

- Hyperscale Data Centers

- Data Center Size, Value (USD Million)

- Large Data Centers

- Small & Mid-Sized Data Centers

- End user, Value (USD Million)

- BFSI

- Energy

- Government & Defense

- Healthcare

- IT & Telecom

- Manufacturing

- Others

- Country Level Analysis Value (USD Million)

- UK

- Germany

- France

- Italy

- Spain

- Russia

- Netherlands

- Switzerland

- Poland

- Belgium

- Rest of Europe

- Components, Value (USD Million)

- Overview

- Asia Pacific Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2024-2037

- Increment $ Opportunity Assessment, 2024-2037

- Segmentation (USD Million), 2024-2037, By

- Components, Value (USD Million)

- Solution

- Indirect Liquid Cooling

- Direct Liquid Cooling

- Services

- Consulting & Designing

- Deployment & Installation

- Support & Maintenance

- Solution

- Cooling Technology, Value (USD Million)

- Direct-to-chip cooling

- Immersion cooling

- Rear-door liquid cooling

- Others

- Data Center Type, Value (USD Million)

- Enterprise Data Centers

- Managed Services Data Centers

- Colocation Data Centers

- Cloud-based Data Centers

- Edge Data Centers

- Hyperscale Data Centers

- Data Center Size, Value (USD Million)

- Large Data Centers

- Small & Mid-Sized Data Centers

- End user, Value (USD Million)

- BFSI

- Energy

- Government & Defense

- Healthcare

- IT & Telecom

- Manufacturing

- Others

- Country Level Analysis Value (USD Million)

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Taiwan

- Thailand

- Singapore

- Philippines

- Vietnam

- New Zealand

- Malaysia

- Rest of Asia Pacific

- Components, Value (USD Million)

- Overview

- Latin America Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2024-2037

- Increment $ Opportunity Assessment, 2024-2037

- Segmentation (USD Million), 2024-2037, By

- Components, Value (USD Million)

- Solution

- Indirect Liquid Cooling

- Direct Liquid Cooling

- Services

- Consulting & Designing

- Deployment & Installation

- Support & Maintenance

- Solution

- Cooling Technology, Value (USD Million)

- Direct-to-chip cooling

- Immersion cooling

- Rear-door liquid cooling

- Others

- Data Center Type, Value (USD Million)

- Enterprise Data Centers

- Managed Services Data Centers

- Colocation Data Centers

- Cloud-based Data Centers

- Edge Data Centers

- Hyperscale Data Centers

- Data Center Size, Value (USD Million)

- Large Data Centers

- Small & Mid-Sized Data Centers

- End user, Value (USD Million)

- BFSI

- Energy

- Government & Defense

- Healthcare

- IT & Telecom

- Manufacturing

- Others

- Country Level Analysis Value (USD Million)

- Brazil

- Mexico

- Argentina

- Rest of Latin America

- Components, Value (USD Million)

- Overview

- Middle East & Africa Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2024-2037

- Increment $ Opportunity Assessment, 2024-2037

- Segmentation (USD Million), 2024-2037, By

- Components, Value (USD Million)

- Solution

- Indirect Liquid Cooling

- Direct Liquid Cooling

- Services

- Consulting & Designing

- Deployment & Installation

- Support & Maintenance

- Solution

- Cooling Technology, Value (USD Million)

- Direct-to-chip cooling

- Immersion cooling

- Rear-door liquid cooling

- Others

- Data Center Type, Value (USD Million)

- Enterprise Data Centers

- Managed Services Data Centers

- Colocation Data Centers

- Cloud-based Data Centers

- Edge Data Centers

- Hyperscale Data Centers

- Data Center Size, Value (USD Million)

- Large Data Centers

- Small & Mid-Sized Data Centers

- End user, Value (USD Million)

- BFSI

- Energy

- Government & Defense

- Healthcare

- IT & Telecom

- Manufacturing

- Others

- Country Level Analysis Value (USD Million)

- Saudi Arabia

- UAE

- Israel

- Qatar

- Kuwait

- Oman

- South Africa

- Rest of Middle East & Africa

- Components, Value (USD Million)

- Overview

- Global Economic Scenario

- World Economic Outlook

- About Research Nester

- Our Global Clientele

- We Serve Clients Across World

Data Center Liquid Cooling Market Outlook:

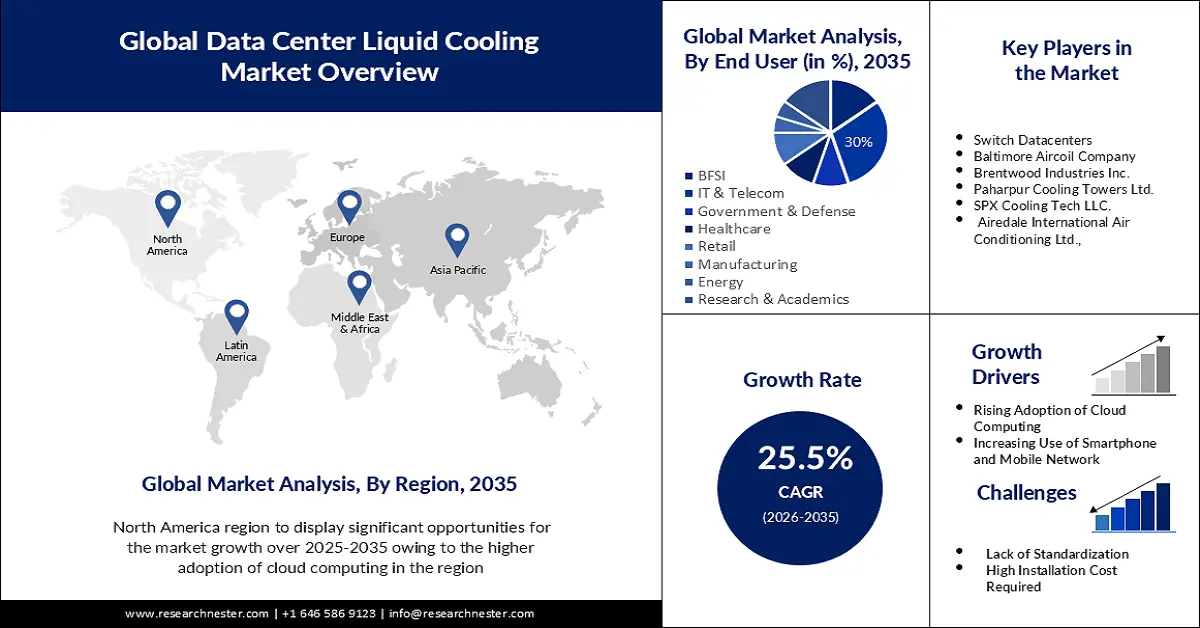

Data Center Liquid Cooling Market size was valued at USD 4.58 billion in 2025 and is likely to cross USD 44.39 billion by 2035, registering more than 25.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of data center liquid cooling is assessed at USD 5.63 billion.

The data center liquid cooling market is expanding at a fast pace due to the need for high-performance computing (HPC), AI-related workloads, and energy efficiency. Conventional cooler techniques are no longer effective as AI, edge computing, and cloud services consume more processing power, thus generating more heat. In July 2024, Vertiv launched the MegaMod CoolChip, the liquid-cooled prefabricated unit designed for data centers with a focus on AI. It is now a necessity rather than a luxury to incorporate liquid cooling into organizations since it is a more efficient way of cooling as the organizations look for solutions that are more efficient in terms of energy consumption.

Legal requirements and sustainability requirements are the two major factors that are driving the adoption of liquid cooling in data centers globally. Most areas are adopting policies of increased energy efficiency and encouraging the use of green cooling systems. In January 2025, Schneider Electric acquired Motivair, a New York-based liquid cooling technology provider, to enhance its high-pressure coolant pumping solutions. This is in line with the global trends towards the reduction of energy consumption of data centers and the meeting of new standards in sustainability. As countries strive to achieve net-zero emission targets, favorable policies to adopt liquid cooling will be instrumental in determining the data center’s future infrastructure.

Key Data Center Liquid Cooling Market Insights Summary:

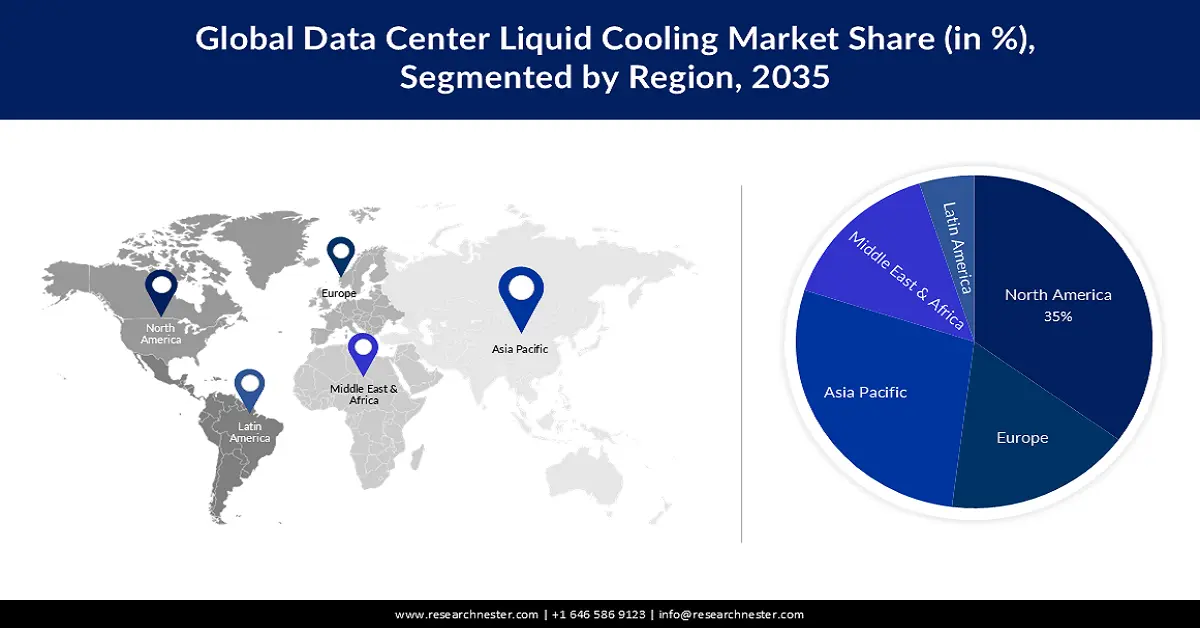

Regional Highlights:

- North America data center liquid cooling market is predicted to capture 38.6% share by 2035, fueled by hyperscale data centers and AI demand.

- Asia Pacific market will exhibit significant growth during the forecast timeline, driven by 5G, AI, and green data center investments.

Segment Insights:

- The solution segment in the data center liquid cooling market is expected to command a 73% share by 2035, fueled by growing demand for direct-to-chip and immersion cooling solutions for AI and cloud traffic.

- The direct-to-chip cooling segment in the market is forecasted to achieve a 45% share by 2035, influenced by its effectiveness in cooling processors and GPUs with reduced thermal resistance.

Key Growth Trends:

- Increasing AI and High-Performance Computing (HPC) Demands

- Energy Efficiency and Sustainability Goals

Major Challenges:

- Infrastructure Costs and Retrofitting Challenges

- Limited Standardization and Compatibility Issues

Key Players: ALFA LAVAL, Asperitas, Cisco Systems, Inc., COOLIT SYSTEMS, FUJITSU, LiquidStack Holding B.V., Midas Immersion Cooling, Rittal GmbH & Co. KG, Schneider Electric, Vertiv Group Corp.

Global Data Center Liquid Cooling Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 4.58 billion

- 2026 Market Size: USD 5.63 billion

- Projected Market Size: USD 44.39 billion by 2035

- Growth Forecasts: 25.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38.6% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, Singapore

- Emerging Countries: China, India, Singapore, South Korea, Malaysia

Last updated on : 10 September, 2025

Data Center Liquid Cooling Market Growth Drivers and Challenges:

Growth Drivers

- Increasing AI and High-Performance Computing (HPC) Demands: AI and machine learning applications, as well as high-performance computing (HPC), require high processing power and generate a lot of heat. Air cooling, which has been traditionally used in computer rooms, does not work effectively at such a high density of computations, which is why liquid cooling is necessary for stable work. In October 2024, Fujitsu collaborated with Supermicro to deliver liquid-cooled systems specifically for Gen AI, HPC, and new-generation green data centers. As the application of AI increases across various sectors, liquid cooling technologies will be vital in augmenting the efficiency and durability of hardware, minimizing thermal issues in high-density computing systems.

- Energy Efficiency and Sustainability Goals: Data centers consume about 1% of electricity globally, and cooling systems consume up to 40% of the total electricity used in data centers. This has led hyperscalers and enterprises to look at liquid cooling as a better option than traditional methods. For example, in August 2024, Microsoft launched a new waterless cooling technology for its AI workloads, bolstering its net-zero efforts. In general, liquid cooling also cuts down power usage while at the same time increasing the efficiency of the data center. As more organizations set targets to reduce their absolute carbon emissions, the demand for liquid cooling facilities is anticipated to rise steeply.

- Government Regulations and Incentives: Currently, governments of various countries are providing subsidies, tax credits, and policy measures for energy-efficient cooling systems in data centers. Furthermore, a number of countries in Europe and North America have provided efficiency targets that promote the use of liquid cooling technologies. In September 2024, LiquidStack raised USD 20 million from Tiger Global to develop its research and development, and manufacturing for immersion cooling and direct-to-chip products. These investments demonstrate an increased focus on new generation cooling systems to meet environmental standards and foster data center liquid cooling market development.

Challenges

- Infrastructure Costs and Retrofitting Challenges: The cost of transitioning from air cooling to liquid cooling is high, especially for those data centers that have already been established. Installing liquid cooling systems in older facilities is expensive due to additional costs such as installation, redesigning of cooling loops, and the general layout of the facility. Some organizations have not adopted liquid cooling due to the high cost during installation, even though its benefits of energy conservation in the long run are well-known.

- Limited Standardization and Compatibility Issues: The absence of standardization of liquid cooling also leads to compatibility issues between different cooling solutions, server designs, and fluids. The costs of integrating liquid cooling are high due to the specificity of vendors and IT infrastructure, which makes the selection process lengthy. One of the main issues that arise when it comes to increasing the scale of liquid cooling is the compatibility between the cooling components and server systems.

Data Center Liquid Cooling Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

25.5% |

|

Base Year Market Size (2025) |

USD 4.58 billion |

|

Forecast Year Market Size (2035) |

USD 44.39 billion |

|

Regional Scope |

|

Data Center Liquid Cooling Market Segmentation:

Components Segment Analysis

Solution segment is set to dominate data center liquid cooling market share of around 73% by the end of 2035, owing to the growing demand for direct-to-chip cooling and immersion cooling solutions. IT departments and hyperscalers are moving to adopt fully immersed liquid cooling solutions to support the increasing AI and cloud traffic. In December 2024, Schneider Electric teamed up with NVIDIA to launch liquid-cooled AI cluster solutions with a power density of up to 132 kW per rack. With the increasing demand for AI workloads, data center cooling will become more focused on achieving high efficiency for the workload to run optimally while using less energy.

Cooling Technology Segment Analysis

In data center liquid cooling market, direct-to-chip cooling segment is expected to dominate revenue share of around 45% by the end of 2035. since it effectively cools processors and GPUs. Direct-to-chip cooling can reduce thermal resistance and does not require a lot of air-based cooling systems. In August 2024, LiquidStack released the high-performance Coolant Distribution Unit (CDU) compatible with commercial direct-to-chip cooling solutions. The need for more accurate cooling and the growth of AI and HPC are making direct-to-chip cooling a go-to solution for most data centers. As a result, the segment is anticipated to garner significant growth during the forecast period.

Our in-depth analysis of the global data center liquid cooling market includes the following segments:

|

Components |

|

|

Cooling Technology |

|

|

Data Center Type |

|

|

Data Center Size |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Data Center Liquid Cooling Market Regional Analysis:

North America Market Insights

North America data center liquid cooling market is set to hold revenue share of over 38.6% by the end of 2035. This growth is driven by the regional demand fueled by AI computing, the growing power densities, and the need to cool the data centers. In the case of increasing heat loads, immersion cooling, as well as direct-to-chip solutions, become crucial for data centers. In January 2025, Amazon Web Services (AWS) announced to invest USD11 billion in data centers in Georgia to promote cloud computing, artificial intelligence, and efficient cooling. This move signifies the state as an ideal technology hub, which strengthens North America position in cutting-edge data center solutions and liquid cooling technology.

The U.S. holds the largest share of the North America data center liquid cooling market owing to high investment in hyperscale data centers, government policies regarding energy efficiency, and the use of artificial intelligence. Some of the major technology markets, such as California, Texas, and Virginia, are reporting increased activity in data center construction and modernization. According to Research Nester, hyperscale data centers in the U.S. contributed to nearly 50% of the total capacity in 2024, all due to AI workloads, cloud computing, and machine learning. The adoption of liquid cooling solutions is gradually increasing as the operators of the data centers look for ways to minimize expenses, greenhouse emissions, and thermal issues.

Canada data center liquid cooling market is growing due to its environmental concerns, rising use of artificial intelligence and cloud services, and government encouragement. The country is promoting itself as a green data center market that uses renewable energy and efficient cooling solutions. As the government of Canada set the goal to achieve Net Zero by 2050, data centers in the country began to integrate liquid cooling in 2024. The country also has a favorable climate that is conducive to the operation of data centers, and the availability of hydropower has made it one of the most favored nations for data centers.

Asia Pacific Market Insights

Asia Pacific region is expected to register significant growth till 2035, owing to cloud computing, AI, and hyperscale data center growth. The region is at the forefront of supplying the global market, contributing to 30% of global capacity expansion, with investments exceeding USD 564 billion over the next five years. The emergence of 5G, edge computing, and AI applications that are currently being rapidly deployed increase the density of power consumption, which means that liquid cooling has become a vital solution. The governments of China, India, and Southeast Asia countries have been supporting the green data center and the use of liquid cooling to reduce energy consumption and carbon footprint.

India is one of the lucrative countries for data center liquid cooling due to the rising AI workload, growth in cloud services, and government digitalization. The country has some of the fastest growing hyperscale data centers, and the investment in this sector is projected to reach over USD 10 billion by 2030. Government initiatives like Digital India and Make in India are supporting the IT structure that needs energy-efficient cooling systems. Given that the power density in data centers is rising, liquid cooling solutions are now emerging as a major investment priority for cloud and AI companies. In July 2024, Yotta Infrastructure and Data Center plans to build India’s first large-scale AI data center that will employ a direct-to-chip liquid cooling system for managing the high-performance computing demand. This further enhances the position of India as one of the prominent markets for data centers in the APAC.

China remains the largest data center liquid cooling market in the Asia Pacific region due to the government’s support of AI, the growth of cloud computing, and smart cities. Despite the increase in energy consumption, efficient cooling has become a critical concern for hyperscale data centers. Some of the largest cloud service providers in the country, such as Alibaba Cloud and Tencent Cloud, are now adopting liquid cooling in their hyperscale data centers. In September 2024, Alibaba Cloud introduced China’s first liquid cooling AI data center that cuts energy consumption by 30% and increases the efficiency of computing. This move underlines the notion that China has been leading in the development of liquid cooling solutions that meet modern and efficient data center needs.

Data Center Liquid Cooling Market Players:

- ALFA LAVAL

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Asperitas

- Cisco Systems, Inc.

- COOLIT SYSTEMS

- FUJITSU

- LiquidStack Holding B.V.

- Midas Immersion Cooling

- Rittal GmbH & Co. KG

- Schneider Electric

- Vertiv Group Corp.

The data center liquid cooling industry is highly competitive, with key players in the industry already investing in the advanced generation of cooling solutions. Some of the prominent players in the data center liquid cooling market are ALFA LAVAL, Asperitas, Cisco Systems, COOLIT SYSTEMS, FUJITSU, LiquidStack Holding B.V., Midas Immersion Cooling, Rittal GmbH & Co. KG, Schneider Electric, Vertiv Group Corp. These companies are growing immersion cooling solutions, creating direct-to-chip solutions, and scaling MW cooling solutions for AI, Cloud, and HPC.

In December 2024, Vertiv launched its new PowerUPS 9000, a high-density, energy-efficient UPS system that is suitable for liquid-cooled environments. This launch marks the evolution of the industry towards comprehensive power management and liquid cooling to enable greater efficiency, lower operational costs, and optimal thermal management of the next generation of Artificial Intelligence based data centers.

Here are some leading companies in the data center liquid cooling market:

Recent Developments

- In January 2025, Microsoft announced its plans to invest USD 80 billion in the development of AI-enabled data centers to support the training of AI models and the deployment of AI and cloud-based applications worldwide. The scale of this investment underscores the increasing demand for advanced cooling technologies, including liquid cooling solutions, to manage high-performance computing workloads.

- In November 2024, CoolIt Systems launched the CHx1000, the world’s highest-density liquid-to-liquid Coolant Distribution Unit (CDU). The system is designed to provide high-pressure delivery and large-scale capacity, enabling efficient direct liquid cooling for data centers handling AI, HPC, and cloud computing workloads.

- In October 2024, Fujitsu announced a strategic collaboration with Supermicro to develop liquid-cooled data center solutions optimized for AI computing, HPC, and next-generation green data centers. The partnership will also focus on marketing a platform featuring Fujitsu’s upcoming FUJITSU-MONAKA Arm-based processor, designed for energy efficiency and high-performance computing, with an expected release in 2027.

- Report ID: 4747

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Data Center Liquid Cooling Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.