Data Center Interconnect Market Outlook:

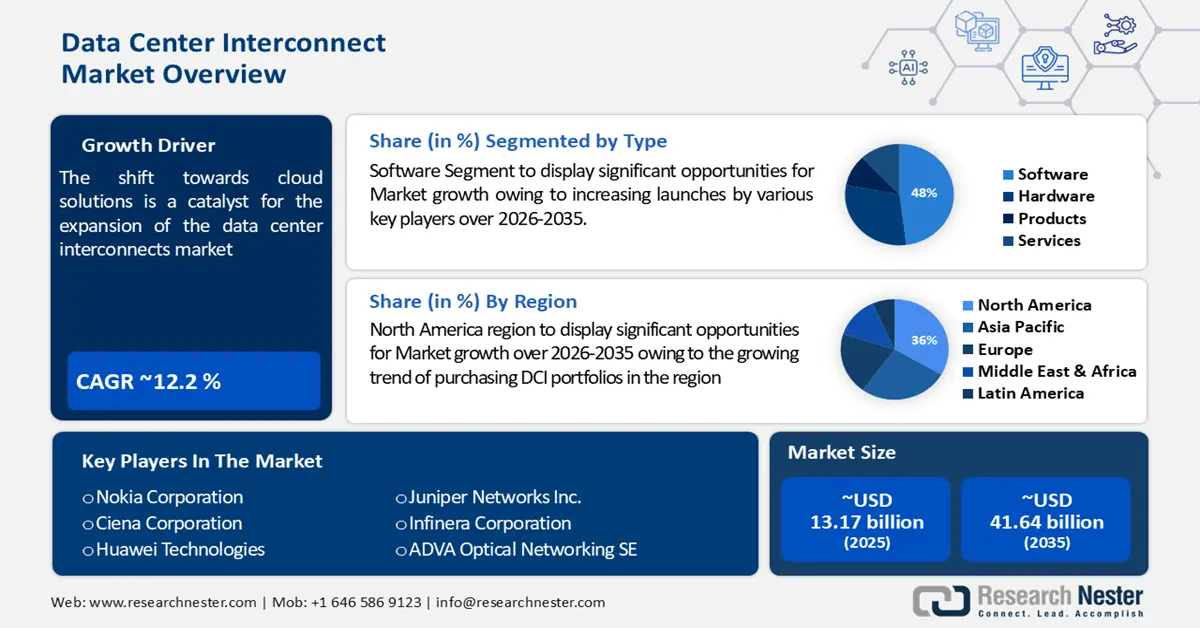

Data Center Interconnect Market size was valued at USD 13.17 billion in 2025 and is likely to cross USD 41.64 billion by 2035, expanding at more than 12.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of data center interconnect is assessed at USD 14.62 billion.

The shift towards cloud solutions is a catalyst for the expansion of the market, requiring strong, fast, scalable, and secure connections to meet increasing demands from businesses. For instance, the cloud applications industry is estimated to be worth USD 168.6 billion in 2025. Because of the growing number of applications that are stored, processed, or operated in clouds, a need for high-speed and reliable data transfer from one data center to another has become increasingly relevant. The increasing need for cloud services is supported by data center interconnect solutions that facilitate efficient and secure data transmission.

Furthermore, to provide distributed processing and analysis of data at the network edge, it is necessary to create interconnected edge data centers as a result of the increasing deployment of edge computing. The DCI solution enables seamless integration of edge resources with centralized data centers and cloud environments by extending connectivity to remote points. This interconnected infrastructure supports latency-sensitive applications and increases the overall performance of edge computing ecosystems.

Key Data Center Interconnect Market Insights Summary:

Regional Highlights:

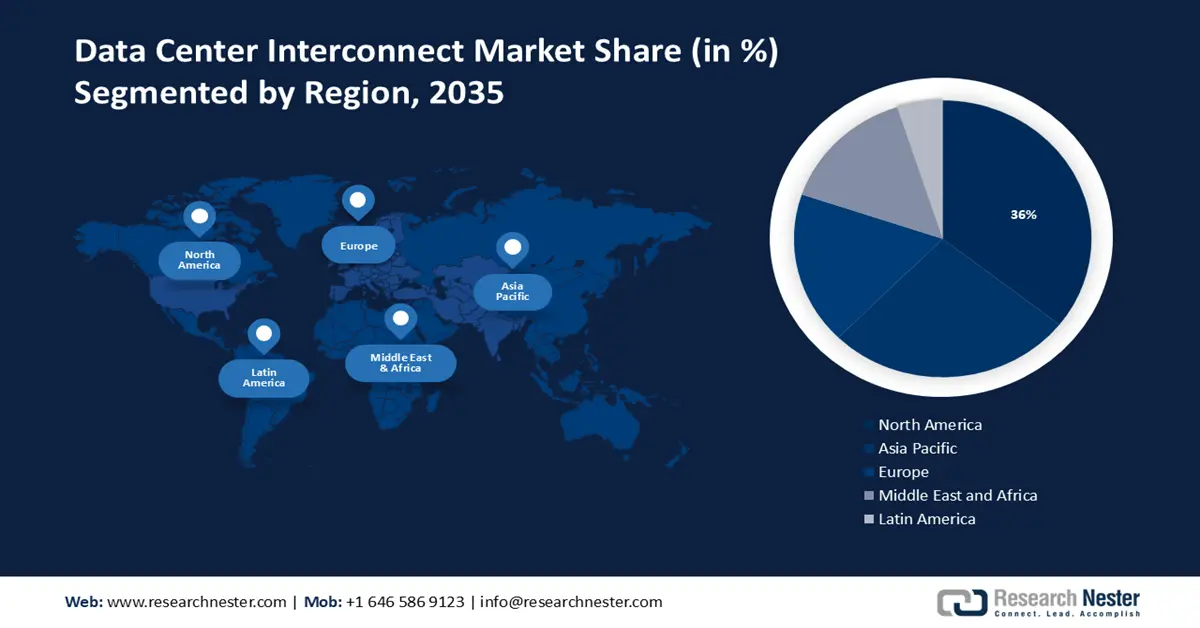

- North America data center interconnect market will dominate around 36% share by 2035, driven by the growing trend of purchasing DCI portfolios to increase network capacity and meet consumer demand for fast internet.

- Asia Pacific market will account for 27% share by 2035, fueled by the installation of optical transportation networking equipment and increasing adoption of cloud computing in data centers.

Segment Insights:

- The software segment in the data center interconnect market is anticipated to secure a 48% share by 2035, driven by DCI software solutions optimizing packet technology for linking data centers.

- The communication service providers segment in the data center interconnect market is projected to hold a 45% share by 2035, fueled by the continuous network expansion to meet growing demand for data transfer.

Key Growth Trends:

- Growing Disaster Recovery and Business Continuity Requirements

- Growing Number of Data Centers Globally

Major Challenges:

- Growing Disaster Recovery and Business Continuity Requirements

- Growing Number of Data Centers Globally

Key Players: Nokia Corporation, Ciena Corporation, Huawei Technologies, Juniper Networks, Inc., Infinera Corporation, ADVA Optical Networking SE, Cisco Systems, Equinix, Inc., Megaport, Evoque Data Center Solutions.

Global Data Center Interconnect Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 13.17 billion

- 2026 Market Size: USD 14.62 billion

- Projected Market Size: USD 41.64 billion by 2035

- Growth Forecasts: 12.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (36% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: China, India, Singapore, Japan, South Korea

Last updated on : 16 September, 2025

Data Center Interconnect Market Growth Drivers and Challenges:

Growth Drivers

-

Growing Disaster Recovery and Business Continuity Requirements - For users of data centers worldwide, disaster recovery is a top priority. Facilities with IT infrastructure are vulnerable to unforeseen incidents including fires, earthquakes, and security breaches. Appropriate disaster recovery procedures need to be in place to prevent firms from suffering significant losses as a result of such events. Facilities for connecting data centers are situated far from users' homes and are less vulnerable to natural disasters. The ability to remotely operate these facilities increases their dependability for disaster recovery plans. Because they allow companies to store important data in a remote location, interconnection facilities are therefore expected to develop into the perfect backup and recovery solution. Therefore, the availability of a robust and secure DCI solution enables business continuity, which is why there will likely be an increase in demand for these solutions.

-

Growing Number of Data Centers Globally - To fulfill the demands of rapid service development, data communication network (DCN) and data center interconnect (DCI) solutions are becoming more and more focused on swiftly rising DCN and DCI capacity. This is done to assure zero packet loss, low latency, and high throughput of lossless networks. DCI, which enables enterprises to connect their data centers with providers of computing services and other data center operators in order to facilitate the sharing of information and resources, is also growing as a result of the increasing use of data centers. As per a report, the United States, the world's most populous country, had reported 5,375 data centers as of September 2023.

- Increased Demand for 5G Networks in Various Industries - The increase in deployment of 5G networks globally is expanding the data center interconnect market. The ease of transferring, transmitting, and storing data from various Internet of Things devices is facilitated by the use of 5G. This is leading to increased demand for data centres with greater capacity, more precise network synchronization and a wider range of telecommunication services. In connection with hyperscale data centers, DCI solutions have traditionally played a small role.

Challenges

-

High Initial Investment Costs - When preparing to build up a data center, several factors must be considered. Engineering, permissions & approvals, power systems, enclosed generators, conduit & cabling for generators, data center lighting, lighting protection, HVAC, fire suppression, etc. are some of these aspects. The capital investments can soon be offset by these expenses. Therefore, this factor may hinder the growth of the data center interconnect market.

-

Capacity Limitations may Hinder the Growth of the Market

- Concerns Regarding Data Privacy Issues may Hamper the Growth of the Market

Data Center Interconnect Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

12.2% |

|

Base Year Market Size (2025) |

USD 13.17 billion |

|

Forecast Year Market Size (2035) |

USD 41.64 billion |

|

Regional Scope |

|

Data Center Interconnect Market Segmentation:

Type Segment Analysis

The software segment in the data center interconnect market is anticipated to hold a share of 48% during the forecast period. DCI software solutions contribute to the segment's expansion by assisting network operators in ensuring that the right mix of virtualization, security, and DCI-optimized packet technology is used to link data centers. In addition, DCI software solutions assist in resource sharing and balancing when network traffic rises and the need for sufficient bandwidth follows. Network operators can adapt the bandwidth in real-time to changing demand with the use of several features linked to the DCI software. Also, increased launches by various key players are also propelling the growth of the DCI software solutions segment. For instance, rekeying data may be eliminated and data quality can be improved with the help of Hawthorn River, a reputable leader in lending software solutions for community banks, which has successfully launched its real-time interface to DCI's iCore360 platform. Therefore, these factors are propelling the growth of the segment.

End-users Segment Analysis

The communication service Providers segment in the data center interconnect market is anticipated to hold a share of 45% during the forecast period. One important factor influencing the segment's growth is network expansion. CSPs are always expanding their network infrastructure to meet the growing need for dependable and high-quality data transfer. For instance, the Service Provider Network Infrastructure industry is expected to generate USD 143.21 billion in revenue by 2024. Also, as part of this development, data centers will be built or upgraded, and in order to connect them effectively, reliable data center interconnect solutions are needed. CSPs may better service consumers' ever-increasing connectivity needs and stay competitive in the telecoms sector by extending their network footprint and ensuring smooth data access. Therefore, altogether these factors contribute to the expansion of the market.

Our in-depth analysis of the global market includes the following segments:

|

Type |

|

|

Application |

|

|

End-user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Data Center Interconnect Market Regional Analysis:

North American Market Insights

North American data center interconnect market is expected to hold the largest share of 36% during the forecast period. The DCI market in North America is expanding as a result of the growing trend of purchasing DCI portfolios. To increase network capacity, broaden their service offerings, and satisfy consumer demand for dependable, fast internet, businesses are proactively procuring DCI solutions. Also, the growing number of internet users in the region is accelerating the market growth. For instance, it was predicted that between 2024 and 2029, there will be a steady increase in the number of internet users in North America, amounting to 51 million people (+11.03 percent). Furthermore, these data centers act as gathering places for a variety of stakeholders, such as telecom carriers, cloud service providers, and content providers, encouraging joint value creation and innovation, which is escalating the market growth in the region.

APAC Market Insights

Data center interconnect market in Asia Pacific is poised to grow at a significant rate with a share of 27% by the end of 2035. The APAC regional market is anticipated to increase as a result of the installation of optical transportation networking equipment in data centers and the ongoing construction of long-haul and metro networks. Furthermore, as digital technologies evolve and cloud computing becomes more and more popular, China's enterprise communications landscape is changing quickly. This demands the development of DCI services that are more flexible, scalable, and effective.

Data Center Interconnect Market Players:

- Nokia Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Ciena Corporation

- Huawei Technologies

- Juniper Networks, Inc.

- Infinera Corporation

- ADVA Optical Networking SE

- Cisco Systems

- Equinix, Inc.

- Megaport

- Evoque Data Center Solutions

Recent Developments

- October 2021 - Nokia announced that it has provided ESpanix, the biggest neutral internet exchange provider in Spain, with a modular optical data center interconnect (DCI) solution. Using dual optical lines for redundancy, the solution unites three data centers in the Madrid metro region. ESpanix can address the constantly growing internet connectivity needs of its customers by offering more dependable and responsive connectivity with an initial capacity of 4 Terabits Per Second (Tb/sec) between data centers thanks to this technology.

- November 2022 - The first and largest supplier of integrated telecommunication services in Oman, Oman Telecommunications Company (Omantel), announced the introduction of a 400GbE DCI service that makes use of Ciena's data center interconnect technology. The service is intended to give a better customer experience through optimal performance while satisfying the quickly increasing connection needs of Omantel's wholesale, cloud, and content provider customers.

- Report ID: 5904

- Published Date: Sep 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Data Center Interconnect Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.