- Introduction

- Study Objective

- Scope of the report

- Market Taxonomy

- Study Assumptions and Abbreviations

- Research Methodology

- Secondary Research

- Primary Research

- SPSS Approach

- Data Triangulation

- Executive Summary

- Global Industry Overview

- Market Overview

- Regional Synopsis

- Industry Supply Chain Analysis

- DROT

- Driver

- Restraint

- Opportunities

- Trends

- Government Regulation: How they would Aid the Business?

- Competitive Landscape

- Hewlett Packard Enterprise Limited

- Schneider Electric SE

- Stulz GmbH

- Vertiv Group Corp.

- Delta Electronics, Inc.

- CommScope Inc.

- Siemens AG

- Nlyte Software Limited

- FNT GmbH

- Eaton Corporation plc

- Recent Development Analysis

- Industry Risk Assessment

- SWOT Analysis

- Global Outlook and Projections

- Global Overview

- Market Value (USD Million) Current and Future Projections, 2025-2037

- Increment $ Opportunity Assessment, 2025-2037

- Year-on-Year Growth Forecast (%)

- Global Segmentation (USD Million), 2025-2037, By

- Data Center Type, Value (USD Million)

- Tier I

- Tier II

- Tier III

- Tier IV

- End user, Value (USD Million)

- Healthcare

- BFSI

- IT

- Others

- Component, Value (USD Million)

- Solution

- Service

- Management, Value (USD Million)

- Cooling

- Power

- Asset

- Security

- Network

- Regional Synopsis Value (USD Million) 2025-2037

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

- Data Center Type, Value (USD Million)

- Global Overview

- North America Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2025-2037

- Increment $ Opportunity Assessment, 2025-2037

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2025-2037, By

- Data Center Type, Value (USD Million)

- Tier I

- Tier II

- Tier III

- Tier IV

- End user, Value (USD Million)

- Healthcare

- BFSI

- IT

- Others

- Component, Value (USD Million)

- Solution

- Service

- Management, Value (USD Million)

- Cooling

- Power

- Asset

- Security

- Network

- Country Level Analysis Value (USD Million), 2025-2037

- U.S.

- Canada

- Data Center Type, Value (USD Million)

- Overview

- Europe Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2025-2037

- Increment $ Opportunity Assessment, 2025-2037

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2025-2037, By

- Data Center Type, Value (USD Million)

- Tier I

- Tier II

- Tier III

- Tier IV

- End user, Value (USD Million)

- Healthcare

- BFSI

- IT

- Others

- Component, Value (USD Million)

- Solution

- Service

- Management, Value (USD Million)

- Cooling

- Power

- Asset

- Security

- Network

- Country Level Analysis Value (USD Million), 2025-2037

- UK

- Germany

- France

- Italy

- Spain

- NORDIC

- Russia

- Rest of Europe

- Data Center Type, Value (USD Million)

- Overview

- Asia Pacific Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2025-2037

- Increment $ Opportunity Assessment, 2025-2037

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2025-2037, By

- Data Center Type, Value (USD Million)

- Tier I

- Tier II

- Tier III

- Tier IV

- End user, Value (USD Million)

- Healthcare

- BFSI

- IT

- Others

- Component, Value (USD Million)

- Solution

- Service

- Management, Value (USD Million)

- Cooling

- Power

- Asset

- Security

- Network

- Country Level Analysis Value (USD Million), 2025-2037

- China

- Japan

- India

- Indonesia

- Australia

- South Korea

- Vietnam

- Malaysia

- Rest of Asia Pacific

- Data Center Type, Value (USD Million)

- Overview

- Latin America Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2025-2037

- Increment $ Opportunity Assessment, 2025-2037

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2025-2037, By

- Data Center Type, Value (USD Million)

- Tier I

- Tier II

- Tier III

- Tier IV

- End user, Value (USD Million)

- Healthcare

- BFSI

- IT

- Others

- Component, Value (USD Million)

- Solution

- Service

- Management, Value (USD Million)

- Cooling

- Power

- Asset

- Security

- Network

- Data Center Type, Value (USD Million)

- Overview

- Middle East & Africa Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2025-2037

- Increment $ Opportunity Assessment, 2025-2037

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Million), 2025-2037, By

- Data Center Type, Value (USD Million)

- Tier I

- Tier II

- Tier III

- Tier IV

- End user, Value (USD Million)

- Healthcare

- BFSI

- IT

- Others

- Component, Value (USD Million)

- Solution

- Service

- Management, Value (USD Million)

- Cooling

- Power

- Asset

- Security

- Network

- Country Level Analysis Value (USD Million), 2025-2037

- GCC

- Israel

- South Africa

- Rest of Middle East & Africa

- Data Center Type, Value (USD Million)

- Overview

- Global Economic Scenario

- World Economic and Risk Outlook for 2024

- About Research Nester

- Our Global Clientele

- We Serve Clients Across World

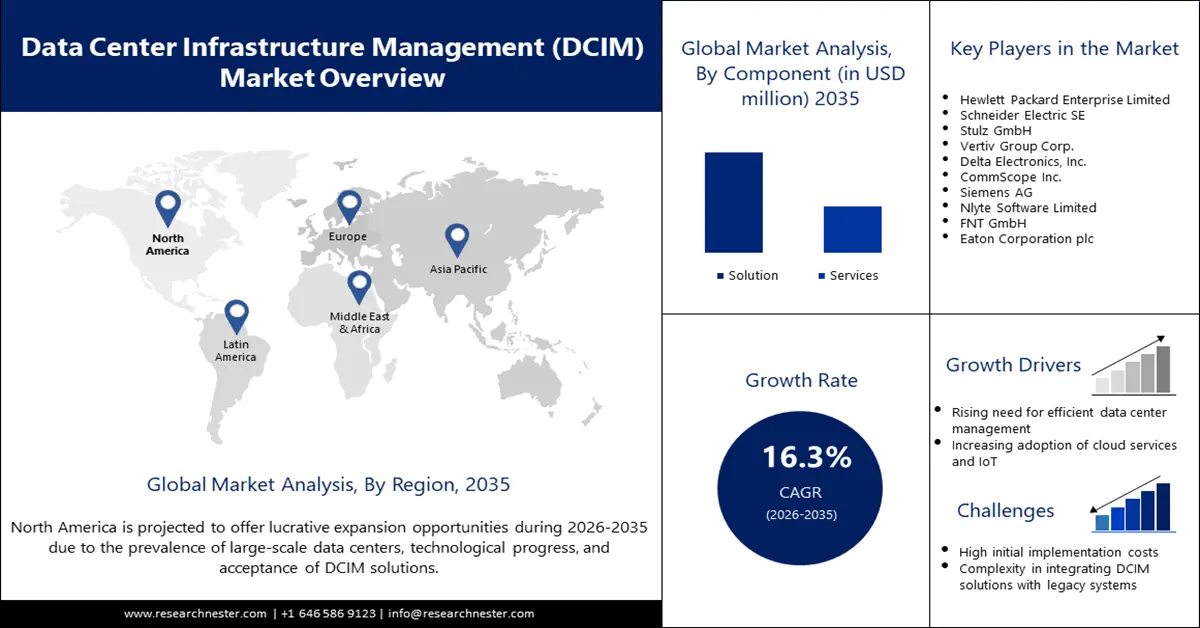

Data Center Infrastructure Management Market Outlook:

Data Center Infrastructure Management Market size was valued at USD 3.96 billion in 2025 and is expected to reach USD 17.93 billion by 2035, registering around 16.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of data center infrastructure management is evaluated at USD 4.54 billion.

The data center infrastructure management market is witnessing a surge due to the increasing demand for DCIM solutions across several sectors. This is owing to the fact that data centers are increasingly being leveraged as a prime source for operational efficiency, remote management, and sustainability reporting. The DCIM market continues to show steady growth, where organizations are now looking for ways to manage data centers within environmental regulations, reduce energy consumption, and monitor critical infrastructure. In July 2024, Vertiv, for instance, launched a liquid-cooled modular data center solution called MegaMod CoolChip, aimed at AI computing. This development shows how industry players are geared towards efficiency and innovation, offering support for intensive operations at data centers with energy usage as efficiently as possible.

Furthermore, government involvement in promoting energy-efficient data center infrastructure is a crucial factor in the sustainability objective of DCIM providers. The U.S. Department of Energy, for example, is working toward achieving the national goal of net-zero emissions by 2050, especially in terms of energy efficiency in data centers. Such policies are likely to help foster the growth of the DCIM industry, where this technology can be enhanced within an ideal atmosphere and minimal environmental degradation.

Key Data Center Infrastructure Management (DCIM) Market Insights Summary:

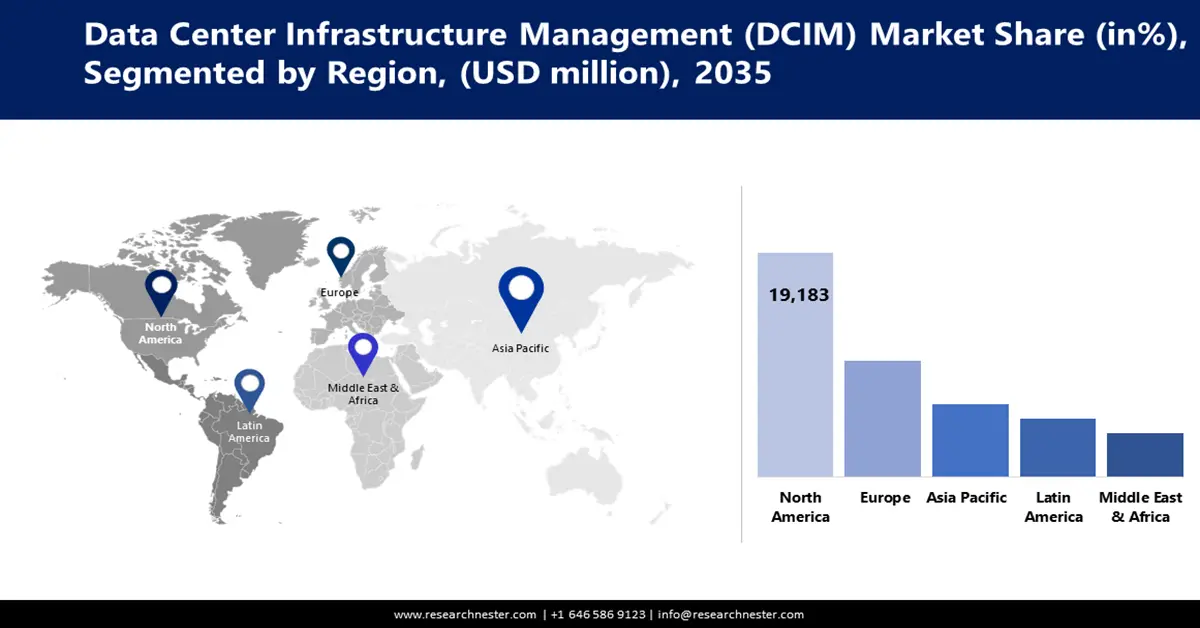

Regional Highlights:

- North America data center infrastructure management market will dominate over 43.50% share by 2035, driven by technological leadership, sustainability focus, and regulatory support for energy-efficient data centers.

- Asia Pacific market will exhibit significant growth during the forecast timeline, driven by rapid digital transformation, data center investments, and incentives for green technologies in countries like India and Japan.

Segment Insights:

- The solution segment in the data center infrastructure management market is forecasted to secure a 68% share by 2035, driven by the growing adoption of AI-driven solutions that enable real-time operational decisions.

- The asset management segment in the data center infrastructure management market is expected to achieve a 42.80% share by 2035, driven by the demand for lifecycle and resource optimization in data centers.

Key Growth Trends:

- Sustainability and energy efficiency requirements

- Emerging trends in IoT and edge computing

Major Challenges:

- Increasing cyber threats

- Energy consumption and sustainability regulations

Key Players: BASF SE, Synthos S.A., TotalEnergies SE, Dow Chemical Company, StyroChem International, SABIC, NOVA Chemicals Corporation, Kaneka Corporation, Alpek S.A.B. de C.V., SEKISUI Chemical Co., Ltd.

Global Data Center Infrastructure Management (DCIM) Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.96 billion

- 2026 Market Size: USD 4.54 billion

- Projected Market Size: USD 17.93 billion by 2035

- Growth Forecasts: 16.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (43.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, Singapore

- Emerging Countries: China, India, Brazil, Mexico, South Korea

Last updated on : 9 September, 2025

Data Center Infrastructure Management Market Growth Drivers and Challenges:

Growth Drivers

-

Sustainability and energy efficiency requirements: Data centers from all over the world are facing growing pressure to meet the energy efficiency threshold and goals related to sustainability. According to the International Energy Agency, data centers use about 1% of the total global demand for electricity in 2022. However, consumption is expected to surge immensely due to increased demand for digital services. As a result, the DCIM market is poised to grow as companies seek solutions that can streamline energy management and minimize their carbon footprint.

-

Emerging trends in IoT and edge computing: With the increased use of edge computing and IoT in enterprises continuously growing, there is a developing need for DCIM solutions that will support such technologies. In this respect, IoT devices and edge infrastructures are using DCIM platforms to manage huge volumes of data with respected operational efficiency and connectivity. In September 2023, Modius Inc. announced AI capabilities for the OpenData platform to recognize typical behavior in the data center and extend IoT integration, further reinforcing its capacity to support edge computing applications.

-

Increasing needs for regulatory compliance: Governments across the globe are prompting further regulations around data center energy consumption. In February 2024, Schneider Electric partnered with ASPEED Technology to develop a smart visual management solution for data centers, enabling facilities to meet compliance standards through enhanced real-time monitoring and operational oversight. This trend will continue to shape the data center infrastructure management market as data centers adopt these solutions to address constantly changing regulations.

Challenges

-

Increasing cyber threats: As these data centers get connected, the chances of a cyberattack on such infrastructure have increased. This has highlighted cybersecurity as one of the key issues, and with that concern, the vendors of DCIM ensure that their offerings are prevented from any foreseen risk. Initiatives to counter this have also been launched by governments around the globe, including the U.S. Department of Energy's 2022 report, which is developing robust cybersecurity measures for energy management and data management. This focus has increased the demand for secure DCIM solutions that protect data center operations from cyber threats.

-

Energy consumption and sustainability regulations: There is growing scrutiny of energy consumption in data centers as global sustainability goals become more mainstream. Due to outdated infrastructure and high demand for operations, many data centers are not well-positioned to operate within regulations that demand a reduction in energy usage.

Data Center Infrastructure Management Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

16.3% |

|

Base Year Market Size (2025) |

USD 3.96 billion |

|

Forecast Year Market Size (2035) |

USD 17.93 billion |

|

Regional Scope |

|

Data Center Infrastructure Management Market Segmentation:

Component

Solution segment is expected to hold over 68% data center infrastructure management market share by the end of 2035. This is largely due to the fact that automated and AI-driven solutions are increasingly transitioning and providing real-time data insights, thus presenting effective decision-making and resource allocation. For example, Schneider Electric and Planon in July 2024, announced to extend their digital transformation strategy for smart buildings and understand how the solution segment can support operational efficiency through integrated data insights.

Management

By 2035, asset management segment is projected to hold more than 42.8% data center infrastructure management market share owing to the increasing demand in data centers for efficient resource management. Thus, asset management solutions find their application in making data centers efficient and greener because companies focus more on lifecycle management and effective utilization of equipment within the data center. A recent announcement from Sunbird Software in March 2023 highlighted the launch of its dcTrack Release 9, which enhances asset management capabilities significantly. This release introduces features such as automatic, interactive single-line diagrams for better visualization of power chains and facility items, enabling data center managers to optimize resource allocation and improve uptime management.

Our in-depth analysis of the global market includes the following segments:

|

Data Center Type |

|

|

End user |

|

|

Component |

|

|

Management |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Data Center Infrastructure Management Market Regional Analysis:

North America Market Insights

North America in data center infrastructure management market is estimated to account for more than 43.5% revenue share by the end of 2035, due to the region’s technical orientation, apart from its strong emphasis on sustainable infrastructure and enabling regulatory environment. The U.S. has been at the forefront of innovations in data centers, with programs aimed at energy efficiency and the reduction of carbon emissions.

The U.S. DCIM market is also fueled by substantial investments in green data centers, where both public and private sectors are working together to enhance sustainability. This is due to the objectives of the companies to adhere to environmental regulations so that operational costs may be cut down. This kind of supportive regulatory environment is boosting the adoption of DCIM solutions throughout the country, thereby propelling the data center infrastructure management market growth.

In Canada, cloud computing and colocation data centers are growing at high speed, which is driving the adoption of DCIM to keep operations efficient. A thriving technology sector and government incentives toward energy-efficient data centers support this demand for DCIM solutions in Canada. As a result, companies in Canada are investing in DCIM technologies to support their cloud infrastructure and optimize data center performance.

Asia Pacific Market Insights

Asia Pacific region is likely to observe significant growth till 2035, owing to rapid digital transformation and expansion of data center infrastructure. This is also being propelled by countries like India and China, making heavy investments in data centers to support rapidly increasing digital economies. A key example is an acquisition by Equinix of two data centers in Mumbai, India, for USD 161 million back in August 2020, showing the rising importance of DCIM solutions as data infrastructure in the region expands. This move also reflects the trend in Asia Pacific as international companies enter local markets to meet the growing demand.

India is a strong contributor to the Asia Pacific data center infrastructure management market, reaffirmed by the recent investments of major cloud service providers such as Microsoft and AWS in data centers. For example, Microsoft and AWS built infrastructure in Telangana to meet the growing demand for cloud services. This trend is also driven by incentives offered by the local government to attract technology investments and spur economic growth. In this way, India is rapidly emerging as a data center hub, which in turn further accelerates the adoption of DCIM solutions that promote operational efficiency and sustainability.

The government in Japan incentivizes energy-efficient technologies, including investments in green data centers. Its focus on sustainability concurs with the expansion in the DCIM market in Japan, which is being increasingly adopted owing to solutions supporting energy management and carbon reduction. Investment by the local government in green technology reflects the concern of the country towards reducing environmental impact, along with improvements in energy efficiency.

Data Center Infrastructure Management Market Players:

- Hewlett Packard Enterprise Limited

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Schneider Electric SE

- Stulz GmbH

- Vertiv Group Corp.

- Delta Electronics, Inc.

- CommScope Inc.

- Siemens AG

- Nlyte Software Limited

- FNT GmbH

- Eaton Corporation plc

The DCIM market is very competitive and includes several leading players like Schneider Electric, Eaton, Vertiv, and Modius, among others. These firms are committed to the strengthening of their offerings in a bid to overcome data center challenges that range from energy efficiency to regulatory compliance. Several companies are integrating AI, IoT, and edge computing capabilities to offer comprehensive DCIM solutions around the world.

For example, the strategic partnership between Ballard Power Systems and Vertiv in June 2024, in which Ballard's hydrogen fuel cells with Vertiv's Liebert EXL S1 UPS for emission-free backup power. Such a development not only suggests the industry's commitment to sustainability but also how companies are coming together to fulfill the growing demand for data centers worldwide. Here are some leading companies in the data center infrastructure management market:

Recent Developments

- In February 2024, KAYTUS introduced KSManage, a data center management platform that enhances operational intelligence and efficiency. The platform offers full lifecycle maintenance, precise fault diagnosis, and advanced energy management. It is specifically designed for the dynamic and evolving needs of modern data centers.

- In January 2024, Amazon Web Services (AWS) announced a USD 14.4 billion investment to expand its cloud infrastructure in Tokyo and Osaka by 2027. This investment aims to meet increasing customer demand for cloud services in Japan. It reflects AWS’s commitment to supporting digital transformation across the region.

- In September 2023, Eaton unveiled the Brightlayer Data Centers suite, a cutting-edge platform for data center infrastructure management. The suite includes performance management, power monitoring, and distributed IT asset management tools. It helps data centers optimize their operations and improve energy efficiency.

- Report ID: 4169

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Data Center Infrastructure Management (DCIM) Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.