Data Center Cooling Market - Growth Drivers and Challenges

Growth Drivers

- Public spending on AI and high-performance computing infrastructure: Government investments in AI defense computing and scientific research are increasing the rack densities and intensifying cooling requirements. The White House data in March 2023 indicates that USD 2 million is allocated towards the AI, quantum information sciences, and microelectronics. The national laboratories and federally funded research facilities are deploying high-performance computing clusters that operate at significantly higher thermal thresholds than conventional enterprise IT. The European Commission similarly supports AI compute capacity via Digital Europe and Horizon Europe programs, which explicitly fund data infrastructure expansion. These deployments generate sustained demand for high-capacity cooling systems capable of handling continuous high-load operations.

- Expansion of government cloud and digital public services: Government migration to cloud-based platforms is stimulating the demand for data center capacity and associated cooling infrastructure. The U.S. Federal Cloud Computing Strategy continues to drive the agency migration to shared and commercial data centers, increasing utilization rates and thermal loads. The U.S. Government Accountability Office in August 2025 indicates that the federal IT spending exceeded USD 100 billion, with a growing share allocated to cloud-hosted environments. Similar trends are witnessed in Asia and Europe, where the governments are digitizing healthcare taxation and identity systems. Higher server utilization intensifies cooling needs, mainly in colocation facilities serving public sector clients.

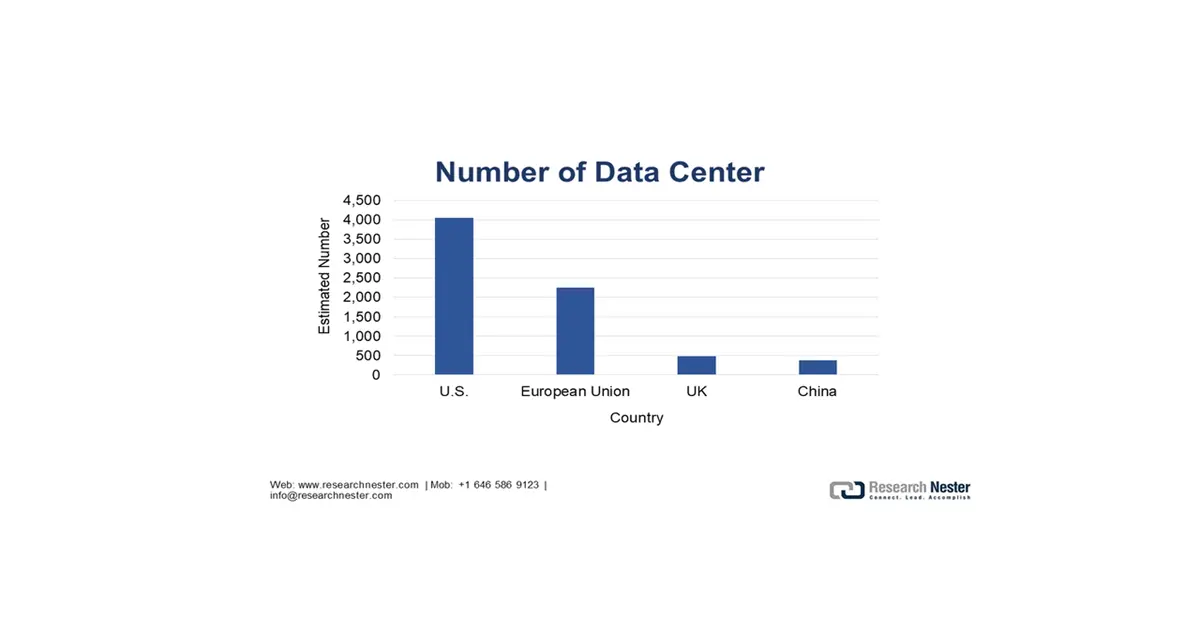

- Rapid expansion of data center capacity: The U.S. has the largest data center cooling market and is driven by the volume and intensity of data center development, as well as capacity expansions. The Federal Reserve System in October 2025 depicts that the U.S. hosted an estimated 4,049 data centers in 2024, significantly exceeding the installed base in the EU, UK, and China. In terms of capacity, the US installed roughly 5.8 GW of new data center power capacity in 2024, compared to 1.6 GW in WU and 0.2 GW in the UK, demonstrating the disproportionate expansion of the competitive infrastructure in the US market. On a per capita basis, the U.S. server base reached 99.9 servers per 1,000 people, far surpassing other advanced economies and China, indicating higher average server and rack densities.

Source: Federal Reserve System, October 2025

Challenges

- Capital intensity and R&D costs: Entering into the data center cooling market needs an immense capital for the R&D and production of complex systems like immersion cooling. Smaller firms struggle to match the investment of giants such as Vertiv, which spent a huge amount on R&D to advance its liquid cooling portfolio. High initial costs create a significant barrier to scaling competitive solutions. This financial disparity ensures that the innovation remains largely concentrated within the well-funded incumbents, constricting the pace of breakthrough technology from new market entrants.

- Supply chain volatility for critical components: The market relies on specialized components, such as controllers and compressors, with the supply chains prone to disruptions. The top players use their scale and vertical integration to ensure supply, a key advantage highlighted during the chip crisis, resulting in more dependable product delivery than smaller competitors.

Data Center Cooling Market Size and Forecast:

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

16.8% |

|

Base Year Market Size (2025) |

USD 26.7 billion |

|

Forecast Year Market Size (2035) |

USD 126.3 billion |

|

Regional Scope |

|

Browse key industry insights with market data tables & charts from the report:

Frequently Asked Questions (FAQ)

In the year 2025, the industry size of the data center cooling market was over USD 26.7 billion.

The market size for the data center cooling market is projected to reach USD 126.3 billion by the end of 2035, expanding at a CAGR of 16.8% during the forecast period i.e., between 2026-2035.

The major players in the market are Vertiv, Schneider Electric, STULZ, and others.

In terms of the component segment, the solutions sub-segment is anticipated to garner the largest market share of 80.3% by 2035 and display lucrative growth opportunities during 2026-2035.

The market in North America is projected to hold the largest market share of 34.6% by the end of 2035 and provide more business opportunities in the future.