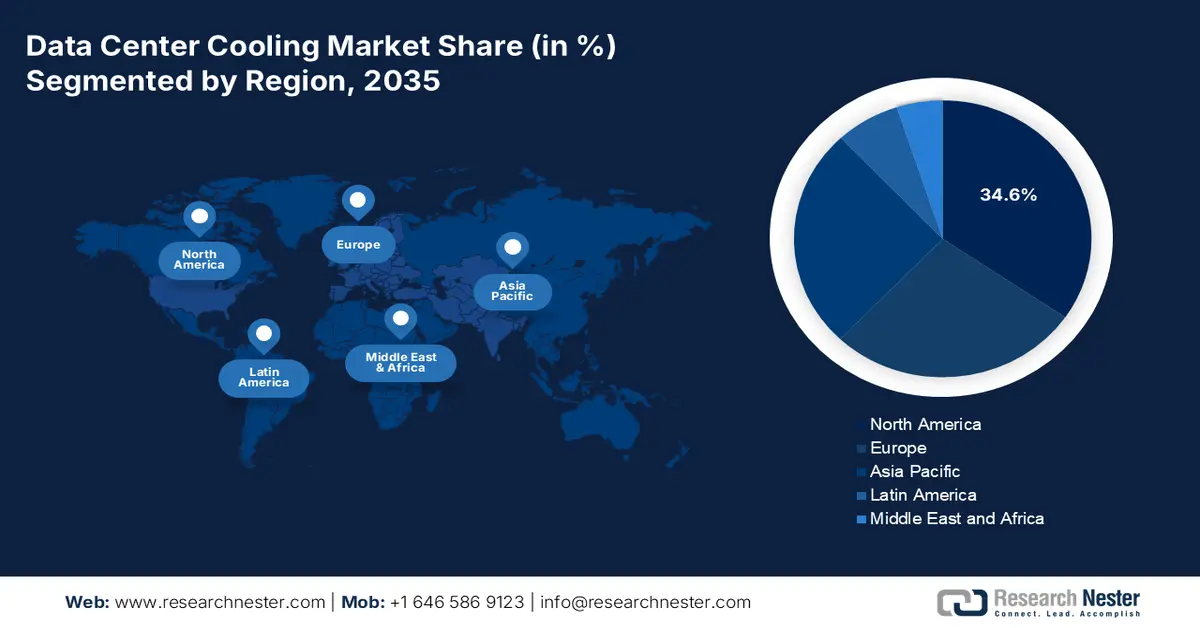

Data Center Cooling Market - Regional Analysis

North America Market Insights

The North America is dominating the data center cooling market and is expected to hold a share of the 34.6% by 2035. The market is driven by the unprecedented concentration of hyperscale cloud campuses and AI/ML infrastructure in the U.S. The region’s dominance is fueled by the massive capital investment from the technology giants and supportive federal policies such as the Science Act and CHIPS, which incentivize the domestic semiconductor and high-performance computing facilities that demand liquid cooling solutions. The key trends include a rapid industry-wide pivot from the traditional air conditioning to direct-to-chip and immersion cooling to manage heat loads, and growing regulatory and operational focus on water conservation in the drought-prone areas, pushing the adoption of closed-loop and adiabatic systems.

The U.S. data center cooling market is shaped by the federal energy efficiency funding and decarbonization priorities. The U.S. Department of Energy in May 2023, announced USD 40 million in targeted funding under the ARPA-E COOLERCHIPS program to support projects that are focused on high-performance cooling systems for data centers. The report explicitly notes that the data centers account for 2% of total U.S. electricity consumption, while the cooling alone can represent up to 40% of the total data center energy use, making cooling infrastructure a critical intervention points for the national energy policy. The selected projects span national laboratories, universities, and commercial entities, signaling a clear federal intent to move advanced cooling technologies closer to commercialization and operational deployment. This funding improves the infrastructure resilience reduce operational carbon emissions, and support high density computing environments.

Some DOE ARPA-E COOLERCHIPS Program - Funded Projects (2023)

|

Organization |

Location |

Cooling Focus / Project Scope |

Award Amount (USD) |

|

Flexnode |

Bethesda, MD |

Prefabricated, modular data center design leveraging system-level cooling efficiency improvements |

3,500,000 |

|

HP |

Corvallis, OR |

Advanced liquid cooling reducing thermal interface material and package thermal resistance; heat rejection to high ambient conditions |

3,250,000 |

|

HRL Laboratories |

Malibu, CA |

Novel low-thermal-resistance data center thermal management system for next-generation servers |

2,000,000 |

|

Intel Federal |

Austin, TX |

Adaptation of two-phase immersion cooling to improve heat spreading efficiency |

1,711,416 |

Source: DOE May 2023

Canada’s data center cooling market is shaped by stimulating the data center expansion, rising AI-driven electricity demand, and the strong alignment with the clean energy and efficiency policies. The report from the Canada Energy Regulator in October 2024 indicates that nearly 239 operational data centers are across Canada, with continued capacity additions driven by low electricity prices, abundant hydroelectric power, and a naturally cool climate that lowers baseline data centers consumed 460 TWh of electricity in 2022, with the demand projected to double by 2026, a trend reflected in Canada's utility planning. Hydro Quebec forecasts a 4.1 TWh increase in data center electricity demand between 2023 and 2032, while Ontario’s IESO and Alberta’s AESO explicitly identify data centers as a key source of the commercial load growth. These factors indicate sustained, policy-supported demand for the high-efficiency data center cooling solutions in Canada.

APAC Market Insights

The Asia Pacific is the fastest-growing market and is expected to grow at a CAGR of 14.5% by 2035. The market is driven by the potent mix of digitalization, government investment, and hyperscale expansion. The key drivers include national digital sovereignty initiatives such as China’s East Data West Computing project, which mandates the construction of massive data center clusters in western provinces, and India’s Digital India mission, fueling the demand for new facilities. A primary trend is the rapid adoption of innovative cooling technologies suited to the region’s diverse climates, from the water-scarce Australia to tropical Singapore, with a strong push toward liquid cooling for AI workloads. Governments are actively shaping the market via policies demonstrating leading-edge power and cooling efficiency, directly influencing technology adoption.

China’s data center cooling market is reshaped by the rapid growth in AI workloads, government-backed digital economy initiatives, and the rising deployment of high-density computing infrastructure. The launch of Chayora’s Ingenuity high-density data center solution in November 2023 reflects a broader market shift toward the liquid and hybrid cooling architectures, as traditional air cooling alone is insufficient for AI model training and inference workloads. This transition is reinforced by the national policy support China’s State Council’s New Generation Artificial Intelligence Development Plan, which elevated AI as a strategic industry, while the data from the Ministry of Industry and Information Technology indicates that China’s AI core industry reached RMB 500 billion in 2023, with over 4,300 operating enterprises driving the demand for compute-intensive infrastructure. China’s market is increasingly characterized by liquid cooling adoption, high rack power densities, and efficiency-focused design, positioning cooling systems as a critical enabler of the country’s digital economy expansion.

Recent Data Centers Developments in China

|

Company |

Announcement Date |

Key Development |

Details |

|

Envicool |

September 26 (implied) |

Intel Partnership (DCAI China Liquid Cooling Program) |

First local partner; full-chain solutions (BHS-AP cold plates, UQD quick disconnects, Manifold, CDUs) passed Intel tests for Xeon 6 Granite Rapids; manages 1GW+ cooling; whitepaper co-released |

|

GLP |

August 2025 |

RMB 2.5B Investment |

Landmark funding to scale China data center operations |

|

Vertiv |

July 2024 |

High-Density Prefab Modular Solution Launch |

Accelerates global AI compute deployment via modular data centers |

Source: Envicool, GLP, Vertiv

The data center cooling market in India is experiencing explosive growth and is driven by the government’s Digital India initiative, a surge in domestic data consumption, and massive investments by the global hyperscalers and local operators such as Adani and Reliance, establishing new facilities. The rapid expansion of cloud regions and AI workloads is pushing demand beyond traditional air cooling towards more efficient solutions such as liquid and evaporative cooling, particularly in tropical climates. A key statistical indicator from the PIB March 2024 shows the scale of this digital infrastructure push under the India AI Mission. The government has approved an outlay of ₹10,300 crore (approx. USD 1.24 billion) for 2024-2025 to build AI computing capacity, which will directly fund data centers requiring advanced thermal management.

Europe Market Insights

The data center cooling market in Europe is a mature but rapidly evolving sector primarily driven by the region’s strong sustainability directives and the explosive growth of cloud computing and AI workloads. The European Union’s Energy Efficiency Directives and the European Green Deal are the powerful regulatory drivers pushing the operators to achieve very low power usage effectiveness and adopt water efficiency technologies. Key trends include a strong shift towards liquid cooling solutions to handle high-density AI servers and the widespread use of free cooling systems that leverage the continent’s temperature climate. For example, countries such as Finland and Sweden are becoming major hubs by using outside air and seawater for cooling. These factors make Europe a leader in adopting innovative and environmentally sustainable cooling technologies.

Germany’s market leads in Europe and is driven by the robust national climate legislation and Frankfurt’s position as a global connectivity hub. The country’s Energy Efficiency Act and Federal Climate Change Act legally mandate continuous reductions in energy consumption for the digital infrastructure, making advanced cooling systems a critical compliance investment. This regulatory pressure stimulates the adoption of highly efficient solutions such as liquid cooling and waste heat recovery. A pivotal example of public funding for this transaction is the German government’s AI Action Plan. The Federal Ministry for Economic Affairs and Climate Action announced a funding package specifically for the construction and expansion of AI computing centers, which inherently require next-generation thermal management.

The UK data center cooling market is defined by the rapid growth in AI workloads, hyperscale and colocation expansion, and tightening energy efficiency and sustainability expectations. London remains one of Europe’s largest data center hubs, and rising rack densities associated with AI cloud and edge computing are increasing the thermal loads beyond the limits of conventional air-only cooling. Against this backdrop, in September 2025, Daikin’s focus on high-capacity CRAHs, modular fan arrays, glycol-free chillers, and AI-driven control systems reflects broader market demand in the UK for scalable, resilient, and low-carbon cooling infrastructure. UK operators are under pressure to improve the power usage effectiveness and water usage effectiveness while maintaining the Tier III and Tier IV availability, mainly as energy costs and grid constraints remain structural concerns.