Data Center Containment Market Outlook:

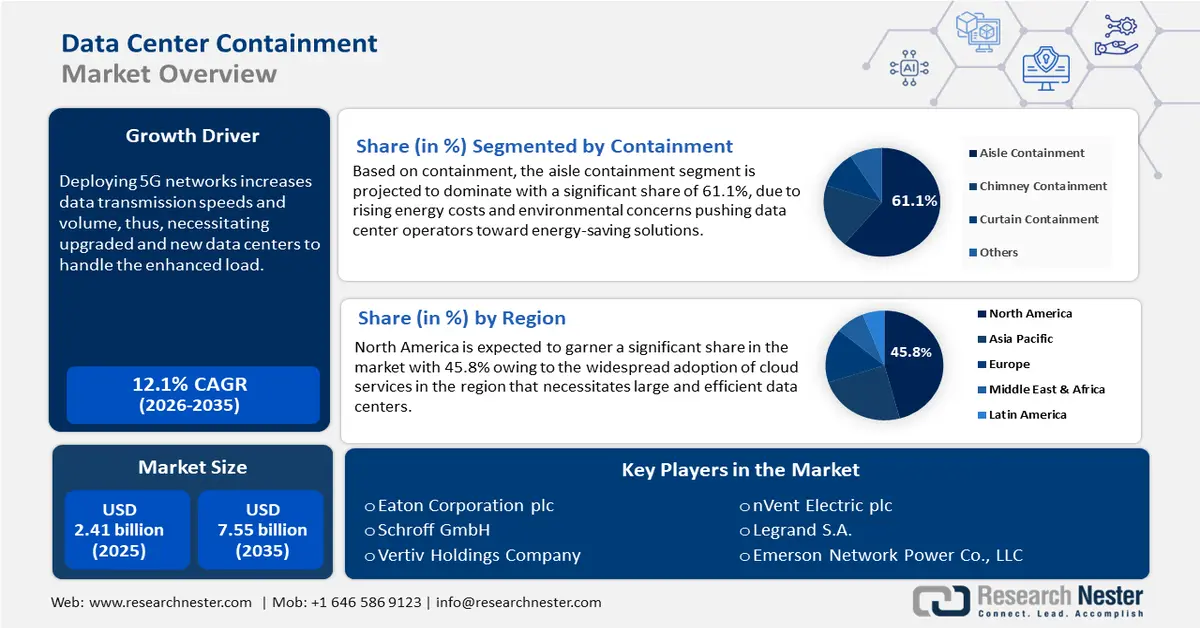

Data Center Containment Market size was over USD 2.41 billion in 2025 and is projected to reach USD 7.55 billion by 2035, growing at around 12.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of data center containment is evaluated at USD 2.67 billion.

The market has gained traction in the evolution of data centers, due to the increasing demand for efficient energy management, enhanced cooling solutions, and improved operational reliability. Moreover, the adoption of containment solutions includes rising energy costs and the push for sustainable data centers. For instance, in December 2024, AWS announced new data center components designed to support the next generation of artificial intelligence innovation and customers' evolving needs. These capabilities combine innovations in power, cooling, and hardware design to create a more energy-efficient data center that will underpin further customer innovation.

In addition, as organizations move forward with integrating advanced analytics, scalable and flexible infrastructure becomes a prerequisite in the data center containment market. Containment solutions not only help in better cooling efficiency but also in improved airflow management, which leads to better equipment performance and longevity. Furthermore, advanced monitoring and management technologies, integrated with containment solutions, support its growth by offering real-time analysis of data and proactive maintenance, thus enhancing the reliability and resilience of operations in a data center. Thus, strategic data center containment is a step forward by aligning with the larger trends around energy efficiency and sustainability in the landscape of IT.

Key Data Center Containment Market Insights Summary:

Regional Highlights:

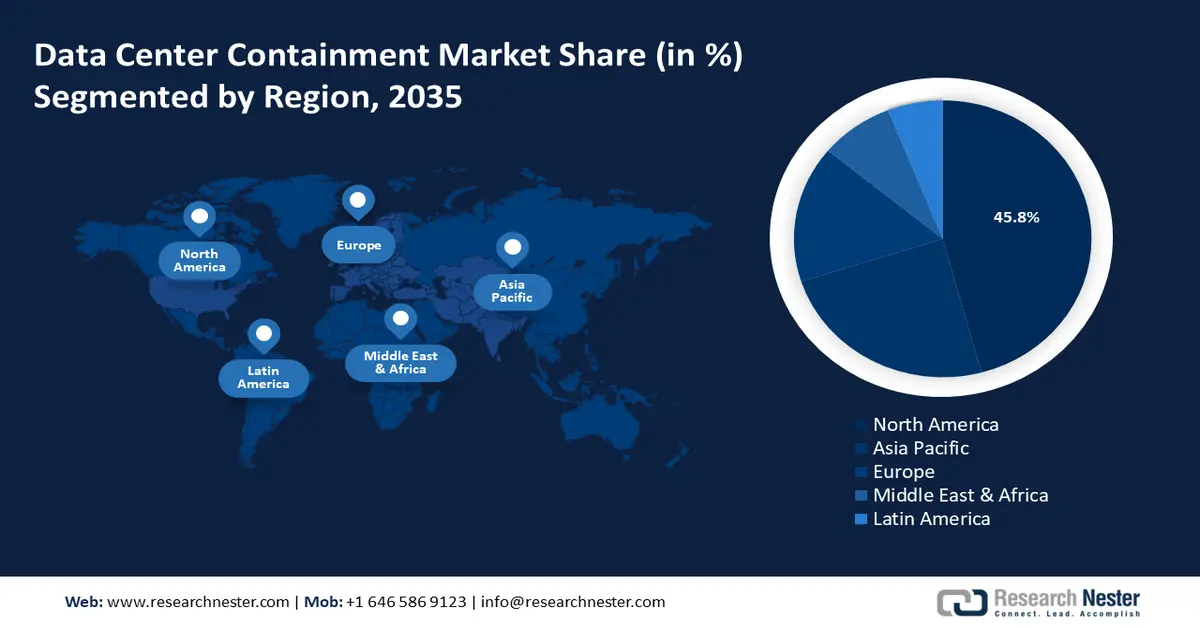

- North America's 45.8% share in the Data Center Containment Market is propelled by AI-powered containment systems, edge data center expansion, and government tech investments, ensuring its dominance in 2026–2035.

- Asia Pacific's data center containment market is projected for rapid growth by 2035, driven by sustainability initiatives, booming e-commerce, and advanced cooling technologies.

Segment Insights:

- The Aisle Containment segment is expected to dominate market share by 2035, driven by energy cost concerns and effective airflow management.

Key Growth Trends:

- Growing reliance on cloud computing and big data

- Increased data center density

Major Challenges:

- Potential for over-containment

- Regulatory compliance issues

- Key Players: Emerson Network Power Co., LLC, Legrand S.A., nVent Electric plc, Rittal GmbH & Co. KG, Schneider Electric SE, Schroff GmbH.

Global Data Center Containment Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.41 billion

- 2026 Market Size: USD 2.67 billion

- Projected Market Size: USD 7.55 billion by 2035

- Growth Forecasts: 12.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (45.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, United Kingdom, Japan

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 13 August, 2025

Data Center Containment Market Growth Drivers and Challenges:

Growth Drivers

- Growing reliance on cloud computing and big data: The growing reliance on cloud computing as well as big data significantly increases the expansion base for the solutions related to data center containment market. For instance, in March 2024, Eaton introduced the SmartRack modular data center solution designed for rapid deployment in response to the demands of edge computing, AI, and ML. This solution combines IT racks, cooling systems, and service enclosures, providing a comprehensive and efficient infrastructure for critical IT loads. Thus, containment strategies optimize cooling and airflow within the densest setups, keeping the equipment at safe temperatures with increased reliability.

- Increased data center density: As organizations deploy more powerful hardware and virtualization technologies, the concentration of equipment generates substantial heat, necessitating effective cooling strategies to maintain optimal operating conditions. For instance, in October 2022, Aligned Data Centers announced expansion in the Phoenix market to two mega campuses that offered more than 400 MW of IT load and approximately 2 million sq. ft. It integrated Delta cooling technology with a waterless heat rejection system, conserving local water resources. This critical need for effective thermal management in increasingly dense data centers underscores the importance of containment solutions in supporting operational performance and longevity.

Challenges

- Potential for over-containment: Data center containment market pose a significant challenge when containments are not well thought out and implemented. They can accidentally starve airflow to essential equipment, thus creating hotspots that put operational efficiency and equipment longevity at risk. This mismanagement can lead to increased downtime and maintenance cost, thus counteracting what containment solutions intended to achieve. Therefore, organizations lack efficient containment, appropriate planning and constant monitoring for containment strategy balance airflow.

- Regulatory compliance issues: Norms implemented by regulatory bodies put forth compliance issues in the data center containment market. An organization navigating a myriad of compliance on energy efficiency, emissions and operational practices can sometimes increase the complexity of the solutions to be implemented within the containment regime. Failure to abide with these regulations can sometimes entail severe penalties and operations would be disrupted, so making it essential for the operators that their containment strategy will contribute to performance improvement as well as compliance with regulatory requirements.

Data Center Containment Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

12.1% |

|

Base Year Market Size (2025) |

USD 2.41 billion |

|

Forecast Year Market Size (2035) |

USD 7.55 billion |

|

Regional Scope |

|

Data Center Containment Market Segmentation:

Containment (Aisle Containment, Chimney Containment, Curtain Containment, Others)

The aisle containment segment is predicted to capture over 61.1% data center containment market share by 2035. This growth is attributable to the increasing energy costs and environmental concerns forcing data center operators to seek energy-saving solutions. Aisle containment improves airflow management thereby allowing a significant reduction in cooling energy usage. In addition, it manages the dissipation of heat very effectively in high-density environments and is designed to be modular and scalable. For instance, in June 2024, Schneider Electric launched a new portfolio, consisting of the second generation of NetShelter SX Enclosures and NetShelter Aisle Containment. Tailored to the increased capacity essential for AI and high-compute loads, its enclosures can manage up to 25% more weight.

Data Center (Enterprise Data Center, Colocation Data Center, Hyperscale Data Center, Others)

Based on data centers, the enterprise data center is experiencing significant growth in the data center containment market. The growing demand amongst the enterprise, for modernization of data centers and the need for scalable infrastructure has also increased the demand for modular and flexible containment solutions. For instance, in September 2024, Princeton Digital Group announced its significant growth plan for India by adding capacity to a total of 230 MW in the country. This expansion drove an investment of USD 1 billion in India, in which the first phase of the 100 MW expansion is expected to be delivered in 2026. As cost saving, energy efficiency, and resilience in operation are crucial concerns for enterprises, the market will experience immense growth.

Our in-depth analysis of the global data center containment market includes the following segments:

|

Containment |

|

|

Data Center |

|

|

Arrangement |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Data Center Containment Market Regional Analysis:

North America Market Statistics

North America in data center containment market is set to dominate over 45.8% revenue share by 2035. Liquid cooling, AI-powered containment systems, and prefabricated containment modules are some of the emerging trends that are giving way to growth opportunities. Moreover, innovative solutions are being developed to address the challenges of high-density computing and the increasing adoption of edge data centers. Thus, the market is set to unfold numerous growth opportunities in the future.

The data center containment market in the U.S. is witnessing robust growth owing to the expanding data analytics infrastructure, that is spurring the demand for reliable containment solutions. For instance, in June 2021, Subzero Engineering, Inc. joined forces with Armstrong World Industries to bring together a single data center containment and structural ceiling solution to the market. The alliance intended to offer high-strength flexible and easy-to-install containment systems for the U.S. data center market to reduce its costs and improve its efficiencies.

Canada in the data center containment market is likely to expand exponentially over the projected timeline. This growth is attributable to the local and federal government funding initiatives that boast the technological infrastructure of the country. For instance, in December 2024, ensuring access to state-of-the-art computing infrastructure the government lend support of USD 700 million towards securing the AI advantage in expanded data centers. It is the chips and the data centers-the backbone of this transformative new technology.

Asia Pacific Market Analysis

The Asia Pacific is evolving rapidly in the data center containment market owing to sustainability, as containment systems with a lower environmental impact are gaining popularity. In addition, the increasing demand for data centers is fueling the growth of the data center containment solutions market. Moreover, growing e-commerce activities require managing complex datasets that further ask for sound data center infrastructure. In a nutshell, the market is highly competitive in the region.

In India, the companies are diversifying their footprints in the data center containment market. This move is assisting the country in upgrading and sustaining the dynamic landscape and need to advance the data analytics sector. For instance, in January 2023, NTT led the way in green technologies in data centers, with the first deployment of Liquid Immersion Cooling LIC and Direct Contact Liquid Cooling in India. These technologies aimed at a 30% rise in energy efficiency at data centers in comparison to traditional cooling systems.

The local government in China has taken crucial steps in enhancing the data center ecosystem to make companies flourish in the global competition in the data center containment market. For instance, in October 2024, China officially launched a pilot program in Beijing, and Shanghai, allowing 100% foreign ownership of data centers and value-added telecom services. More than 10 foreign companies, including Tesla and Apple, have joined the pilot. As part of an important attempt to attract foreign investment and power its technology infrastructure, the Ministry of Industry and Information Technology has rolled out this and abolished the longstanding 50% foreign ownership cap applied to data centers permitting full foreign ownership in the sector.

Key Data Center Containment Market Players:

- Schneider Electric SE

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Chatsworth Products, Inc.

- Eaton Corporation plc

- Emerson Network Power Co., LLC

- Legrand S.A.

- nVent Electric plc

- Rittal GmbH & Co. KG

- Schroff GmbH

- Subzero Engineering, Inc.

- Vertiv Holdings Company

- Microsoft

- EdgeConneX

The competitive landscape in the data center containment market would, however, remain dynamic and future-focused, with leading players vying to innovate strategies for gaining a competitive advantage. Such developments also line up with the latest market trends, through which vendors can help better match the changing needs of customers. For instance, in December 2023, Vertiv Group Corp. acquired CoolTera Ltd., including all its shares. This acquisition adds to the thermal management portfolio of Vertiv by adding advanced cooling technology, specialized expertise, control systems, and manufacturing capabilities tailored for high-density compute cooling needs. Here's the list of some key players:

Recent Developments

- In October 2024, Microsoft announced the building of the first data center made out of superstrong ultra-lightweight wood. The hybrid mass timber, steel, and concrete construction model is estimated to significantly reduce the embodied carbon footprint of two new data centers by 35% compared with conventional steel construction.

- In September 2023, EdgeConneX obtained a USD 403.8 million investment for developing a 120 MW hyper-scale data center campus in Jakarta. This is the growth, driven by an emerging digital economy in Indonesia, increasing data demands.

- Report ID: 6873

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Data Center Containment Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.