Data Center Construction Market Outlook:

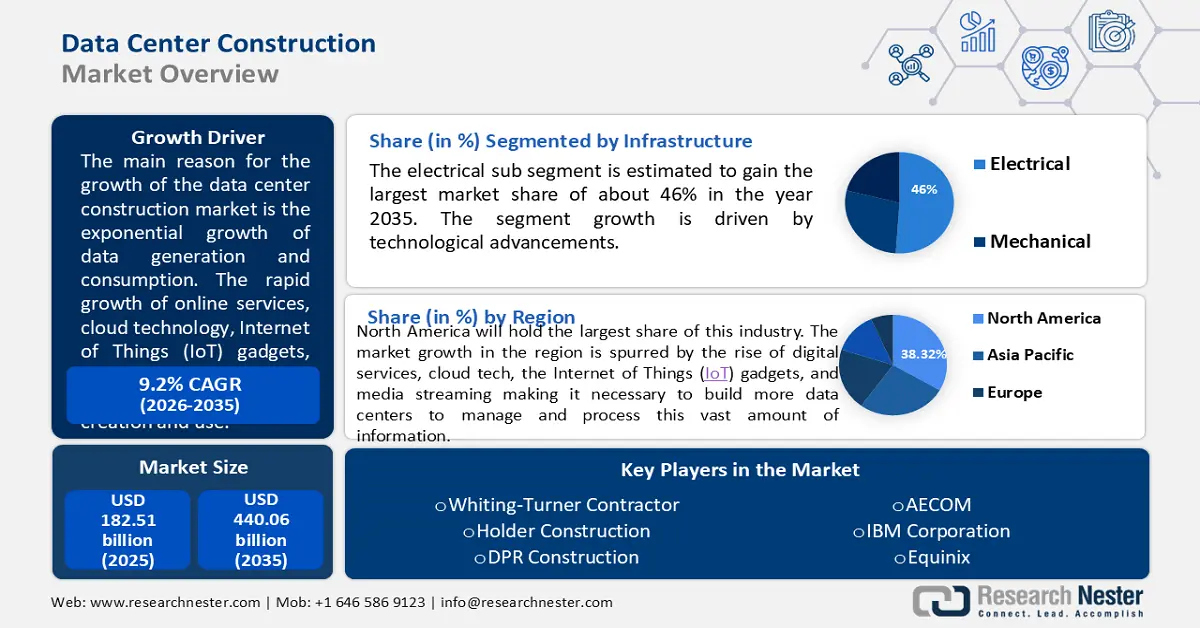

Data Center Construction Market size was over USD 182.51 billion in 2025 and is projected to reach USD 440.06 billion by 2035, growing at around 9.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of data center construction is evaluated at USD 197.62 billion.

The main reason for the growth of the data center construction market is the exponential growth of data generation and consumption. The rapid growth of online services, cloud technology, Internet of Things (IoT) gadgets, and streaming has led to an increase in data creation and use. This in turn translates to a need for more data centers to handle and process all this information. As companies move to cloud-based options, the need for data centers also goes up to keep up with the growing need for cloud services. For example, Amazon Web Services (AWS), a top cloud provider, keeps growing its global setup, adding new data centers to meet the rising demand for its offerings. Data centers offer a place for the ever-increasing number of servers and computers that drive our digital era. They also put in place strong security steps to keep important information safe. The huge amounts of data produced need strong computing power for analysis. Data centers give the needed setup to run complex programs and apps that pull insights from this data.

Key Data Center Construction Market Insights Summary:

Regional Highlights:

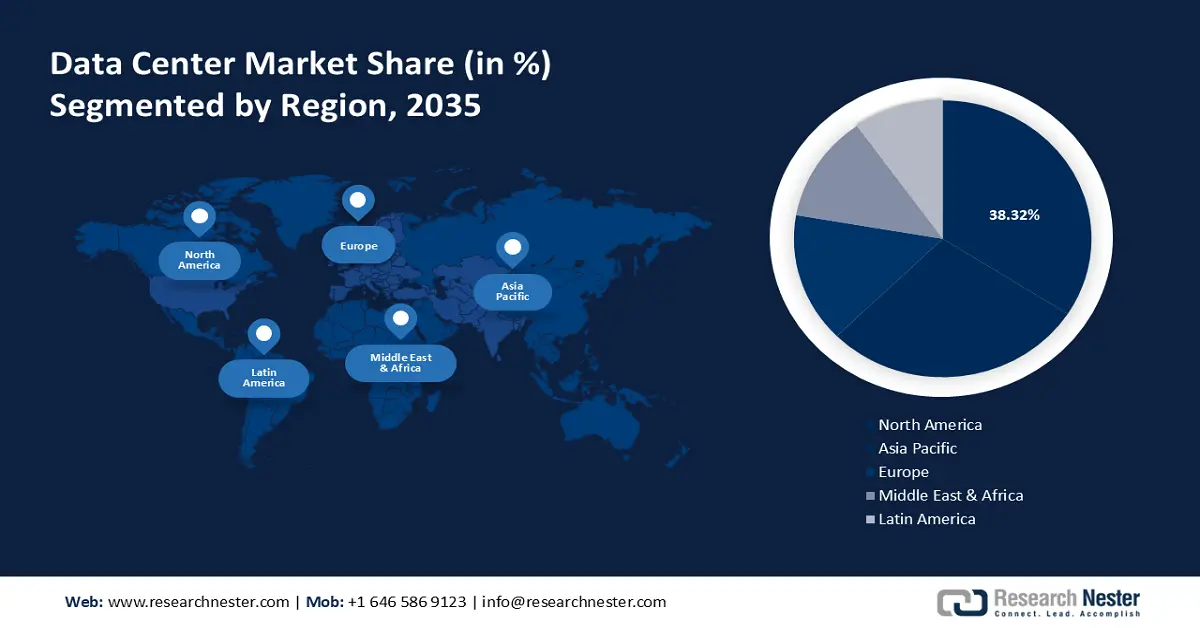

- North America data center construction market will hold more than 36% share by 2035, driven by rising digital services, IoT, media streaming, and demand for network solutions.

Segment Insights:

- The tier iii segment in the data center construction market is poised for strong growth over 2026-2035, driven by high availability needs and minimal service disruptions.

- The electrical (infrastructure) segment in the data center construction market is forecasted to secure a 46% share by 2035, driven by advancements in energy-efficient power systems.

Key Growth Trends:

- Expansion of Cloud Services

- IoT and AI

Major Challenges:

- Power and Cooling

- Choosing and Acquiring Land

Key Players: Whiting-Turner Contracting, Holder Construction, DPR Construction, AECOM, Arup, Jacobs, Cargan, IBM Corporation.

Global Data Center Construction Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 182.51 billion

- 2026 Market Size: USD 197.62 billion

- Projected Market Size: USD 440.06 billion by 2035

- Growth Forecasts: 9.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (36% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: China, India, Brazil, Mexico, Singapore

Last updated on : 17 September, 2025

Data Center Construction Market Growth Drivers and Challenges:

Growth Drivers

- Expansion of Cloud Services - The move to cloud-based offerings, like IaaS, PaaS, and SaaS, has sparked a surge in data center demand. Cloud providers need strong, scalable setups to back their services, leading to more data center builds. Shifting to cloud computing groups vast data amounts in cloud data centers, calling for more storage and computing power.

- Edge Computing - Edge computing, a distributed computing model, brings data analysis close to where data comes from. It allows for quicker handling of data and reduced delay by working on data locally, at the network’s edge and not in a central data center. This is key for applications that require real-time responses, such as self-driving cars or factory automation. Though edge data centers are smaller than conventional ones, their distributed nature means more of such edge computing data centers need to be built in different places. Edge computing's rise is fueled by the need for quicker responses, reduced latency, and better performance in areas like IoT, AI, and live analytics.

- IoT and AI - The growth of IoT devices, gadgets that gather and share data, is creating vast data volumes. These devices need a setup for storing, handling, and analyzing the data they make. Data centers are vital in managing and processing IoT data, giving the needed computing power, storage space, and connectivity. Training AI models needs huge data sets and strong computing resources. Data centers offer the setup necessary for these demanding tasks. Also, running AI apps at the edge often needs more data center capacity. AI thrives on data. As AI use grows in various fields, the demand for data storage, processing, and analysis will skyrocket, pushing the data center building market.

Challenges

- Power and Cooling - Data centers require a lot of power and generally get very heated. Handling the amount of energy used, making sure there is always enough power, and finding ways to cool the servers are key issues in building data centers.

- Choosing and Acquiring Land - Picking the right locations for data centers and acquiring the said land can be very challenging as well. Factors like being close to energy and cooling resources, being near internet connections, and following local rules matter a lot when choosing a location to build data centers.

Data Center Construction Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

9.2% |

|

Base Year Market Size (2025) |

USD 182.51 billion |

|

Forecast Year Market Size (2035) |

USD 440.06 billion |

|

Regional Scope |

|

Data Center Construction Market Segmentation:

Infrastructure Segment Analysis

Electrical sub segment is anticipated to hold over 46% data center construction market share by the end of 2035. The segment growth is driven by technological advancements. Advancements in electric and mechanical systems, like energy-saving UPS units, modern cooling methods, and intelligent HVAC systems, are driving the growth of both the electrical and mechanical infrastructure sub segments.

The mechanical infrastructure sub segment includes cooling mechanisms, racks, and other related components. Cooling mechanisms are key for keeping ideal temperatures inside data centers. The growth of the mechanical infrastructure section is due to the expanding size and complexity of data centers. Effective cooling is essential to avoid overheating and to make sure data center gear works correctly.

Data Center Type Segment Analysis

By the end of 2035, tier III data centers segment is set to capture around 51% data center construction market share. The growth of this segment is because of Tier III data centers offering a more reliable service compared to Tier I and II. They have varied distribution routes for both power and cooling systems, ensuring they can be maintained efficiently without interrupting service. These centers can offer around 99.982% uptime, which translates to about only 1.6 hours of downtime yearly. Tier III data centers are perfect for companies that that require high availability and cannot afford frequent or prolonged outages. Tier III centers are built to keep critical apps and business operations going without any glitches. Tier IV centers push for even higher reliability, targeting about 99.995% uptime. This means that they typically experience under 0.4 hours of downtime annually.

Organization Size Segment Analysis

In data center construction market, large organization size segment is estimated to capture over 42% revenue share by 2035.The growth of large organization data centers comes from the need for vast data handling and storage, the spread of cloud services, and the expansion of sectors like IT, telecom, and healthcare. These centers allow for the management of huge data sets, support cutting-edge tech like AI and ML, and provide solid groundwork for key tasks of organizations of all sizes. On the other hand, the increase in medium-sized data centers is due to more use of digital technologies, the need for smart data management, and the demand for reliable IT setups. These centers offer organizations the ability to grow their operations while keeping data safe and easy to access. These factors drive the demand for construction of data centers globally.

Our in-depth analysis of the data center construction market includes the following segments:

|

Infrastructure |

|

|

Data Center Type |

|

|

Organization Size |

|

|

End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Data Center Construction Market Regional Analysis:

North America Market Insights

North America industry is likely to hold largest revenue share of 36% by 2035. The market growth in the region is spurred by the rise of digital services, cloud tech, the Internet of Things (IoT) gadgets, and media streaming making it necessary to build more data centers to manage and process this vast amount of information. The demand for network and connectivity solutions that offer faster and more dependable links between data centers is also pushing the construction of facilities that can support strong infrastructure for these needs.

The data center construction market in the United States is forecasted to hit a value of USD 134.2 billion by the end of the forecast period, growing at a CAGR of 6%. The United States leads the market in North America, taking up a revenue share of 43% in 2022. The introduction of the Electronic Medical Records (EMR) Mandate in the United States has pushed the use of cloud-based healthcare systems for storing and safeguarding patient records. This development has boosted the demand for data center construction, fueled by the expansion of digital data in the healthcare industry.

Canada's data center construction market growth is propelled by the increased adoption of cloud computing, the need for more effective data center operations, and the rising demand for data center infrastructure. Factors like significant investments in tech infrastructure, higher data consumption, and the business demand for cloud services are fueling the data center construction market growth in Canada.

APAC Market Insights

The APAC region will also encounter huge growth for the data center construction market during the forecast period and will hold the second position owing to the increasing digitalization efforts. Several countries in Asia Pacific, such as Singapore, Malaysia, Thailand, and the Philippines, are prioritizing digital advancements. Government support and ongoing digital efforts are significant factors pushing the growth of the data center construction market in this area. The rising demand for cloud services also plays a crucial role in driving market growth. Moreover, the rollout of 5G networks is boosting the need for edge data centers in Asia Pacific. This demand is prompting the building of data centers closer to users, accelerating market growth.

China holds a dominant position in the APAC data center construction market. The Chinese government has issued policy papers advocating for the development of new data center clusters in four areas, as part of the 'Eastern Data, Western Computing' strategy to balance the supply and demand of computing capacity.

Singapore is another crucial player in the Asia Pacific data center construction market, recognized for its sophisticated infrastructure and connectivity. The country has become a central point for data centers in the region, drawing investments and acting as a gateway to Southeast Asia. Singapore's underwater cable connections have played a role in its emergence as a data center hub.

Data Center Construction Market Players:

- Whiting-Turner Contracting

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Holder Construction

- DPR Construction

- AECOM

- Arup

- Jacobs

- Cargan

- IBM Corporation

- SAS Institute Inc.

- Equinix

The landscape for companies in the data center construction market is lively and marked by competition. Numerous leading companies are at play, each pushing to bring forward newer solutions to satisfy client needs and upgrade their range of services. These organizations aim relentlessly to stand out by delivering inventive and more efficient offerings in response to evolving market demands.

Recent Developments

- Whiting-Turner Contracting - Design LLC, a company owned by tech leader Google, has chosen the Baltimore-based Whiting-Turner Contracting Co. to develop a $600 million data hub in Wasco County, Oregon, as per documents with the Dalles Community Development Department. This new 290,000-square-foot building will join Google’s existing network of data centers in the region. Since 2006, Google has poured over $1.8 billion into its Oregon sites, notes the firm from Mountain View, California. Google picked Wasco County for its power setup, land ready for development, and the skilled people available, Google says.

- Holder Construction - EdgeCore Digital Infrastructure, from Broomfield, Colorado and specializing in data center creation, ownership, and management, has selected the Atlanta-based Holder Construction for its $1.9 billion data center site in Mesa, Arizona. Once finished, this water-wise site in Mesa will have the power to support at least 450 megawatts of critical load and will be built to serve the current and future needs of its clients over 3.1 million square feet. The site already has one working data center, EdgeCore states. To keep cool, the site uses an air-cooled method and a looped chilled water system, says Holder Construction.

- Report ID: 6126

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Data Center Construction Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.