Data Center Colocation Market Outlook:

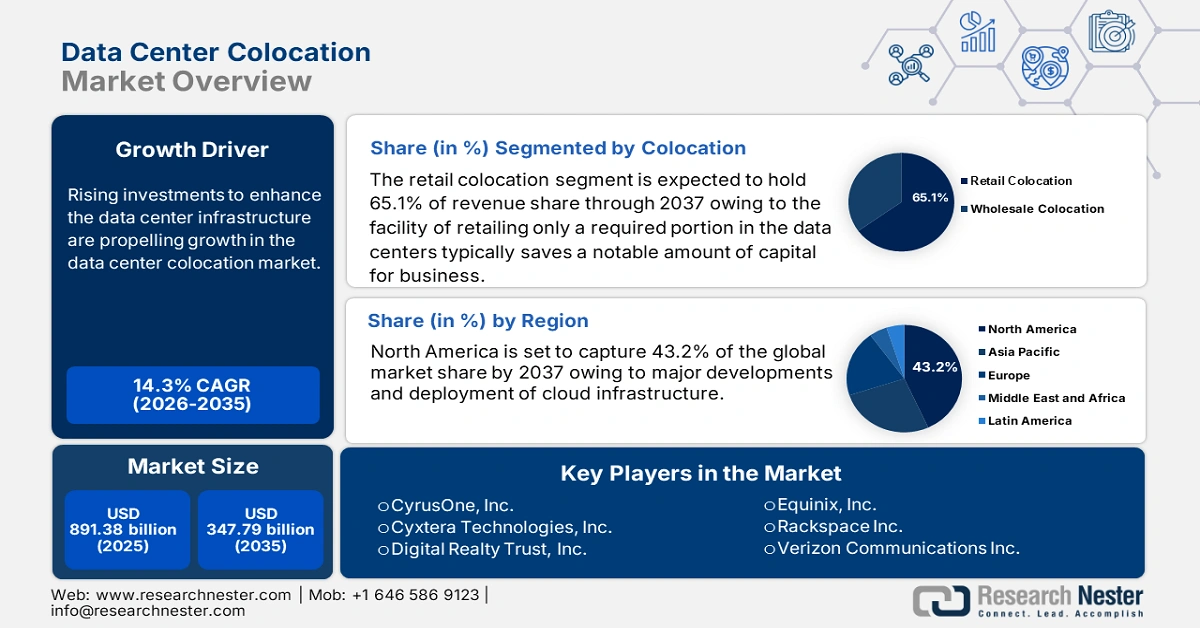

Data Center Colocation Market size was over USD 91.38 billion in 2025 and is anticipated to cross USD 347.79 billion by 2035, witnessing more than 14.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of data center colocation is estimated at USD 103.14 billion.

Rising investments to enhance the data center infrastructure are propelling growth in the data center colocation market. Integration of IoT devices, cloud computing, AI, data analytics, and social media has rapidly increased the workloads on individual data management systems. Thus, the inflated demand for data storage and processing is creating a surge for scalable and reliable infrastructure. Colocation service providers are equipped with advanced technologies and efficient operating techniques, making them the perfect fit for these requirements. For instance, in June 2024, a consortium of KKR and Singtel invested USD 1.3 billion in the digital infrastructure provider of Asia, STT GDC. With such funding, the leading colocation service provider plans to accelerate its international expansion.

This economic support from investors is further inspiring other competitors in the data center colocation market to magnify and improve their offerings worldwide. In addition, it brings more innovation and progress to this sector by utilizing the expertise, track record, financial strength, and proposed business strategies of investors. With such upgradation, the industry leaders are generating significant profit. For instance, in April 2022, the global colocation giant, Equinix released its financial quarter report highlighting its 77th consecutive quarter of revenue growth. The company further disclosed its earnings of over USD 1.7 billion in the first three months of 2022, marking an increment of over 2%. The report also mentioned the expansion of its global platform by signing 43 new data center projects across 20 countries.

Key Data Center Colocation Market Insights Summary:

Regional Highlights:

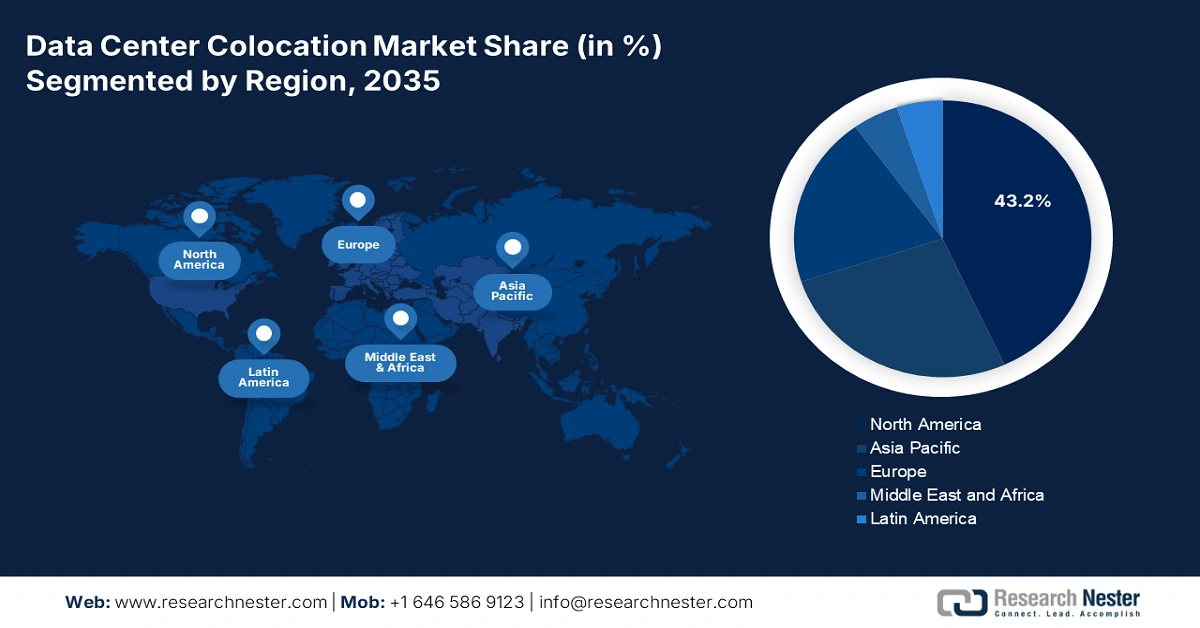

- North America data center colocation market is poised to capture 43.20% share by 2035, driven by major developments and deployment of cloud infrastructure in the region.

- Asia Pacific market will secure significant revenue share by 2035, driven by the integration of advanced technologies like AI and machine learning, which demands efficient data solutions.

Segment Insights:

- The retail colocation segment in the data center colocation market is anticipated to capture a 65.10% share by 2035, driven by cost-efficiency and flexible leasing options preferred by businesses.

- The sme (end use) segment in the data center colocation market is projected to achieve substantial share by 2035, driven by SMEs seeking cost-effective alternatives to traditional data infrastructure.

Key Growth Trends:

- Global expansion of businesses

- Improved data management and security

Major Challenges:

- Dependence on third-party vendors

- High capital cost and competition

Key Players: AT&T Inc., Cogent Communications, CoreSite Realty Corporation, CyrusOne, Inc., Cyxtera Technologies, Inc., Digital Realty Trust, Inc., Equinix, Inc., Rackspace Inc., Verizon Communications Inc.

Global Data Center Colocation Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 91.38 billion

- 2026 Market Size: USD 103.14 billion

- Projected Market Size: USD 347.79 billion by 2035

- Growth Forecasts: 14.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (43.2% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, United Kingdom, Japan

- Emerging Countries: China, India, Singapore, Japan, Brazil

Last updated on : 8 September, 2025

Data Center Colocation Market Growth Drivers and Challenges:

Growth Drivers

- Global expansion of businesses: Enlarging industrial needs to ensure low-latency connections in different regions as per the plan of setting footprints worldwide, increases demand in the data center colocation market. The colocation leaders tend to offer businesses strategically located facilities across multiple geographics. In addition, the localized infrastructure often helps them achieve compliance with strict regional regulations. For instance, in October 2024, Ziply Fiber launched its colocation services at more than 200 secure facilities across Washington, Oregon, Idaho, and Montana to offer all-sized businesses redundancy and compliance. The cost-effective alternative allows for housing their network servers and critical infrastructure.

- Improved data management and security: The development in technology has improved offerings of the data center colocation market. It makes these scalable, reliable, and cost-effective services and solutions attractive for global companies. In addition, data centers are continuously adopting edge computing to facilitate closer interconnection between end-users for establishing energy-efficient decentralized infrastructure. For instance, in October 2022, PhonePe launched its first green data center in India with solutions from Dell Technologies and NTT. This sustainable data management aims to offer the company power efficiency and ease of operations across the country on a flexible scale.

Challenges

- Dependence on third-party vendors: Many service providers in the data center colocation market often depend on external vendors for power, cooling, networking, and maintenance. Thus, the cascading impact on performance due to any disruptions in these third-party offerings may affect the company's reputation. Lack of effective vendor management can also hamper consumer trust in these colocation resources. In addition, penetrating sufficient components in their own premises may be expensive for them, making it difficult to cope with these issues.

- High capital cost and competition: Building a viable infrastructure to participate in the data center colocation market requires significant investment. Thus, the process of setting competitive pricing may be hindered due to the imbalance in engaging capital to enable power, cooling, and security systems. This can further make it difficult for companies to survive in such a highly saturated industry. New entrants may find it difficult to maintain service quality and innovations in offering reduced prices. Additionally, it may cause a struggle for smaller players to compete with established providers in the data center colocation market.

Data Center Colocation Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

14.3% |

|

Base Year Market Size (2025) |

USD 91.38 billion |

|

Forecast Year Market Size (2035) |

USD 347.79 billion |

|

Regional Scope |

|

Data Center Colocation Market Segmentation:

Colocation Segment Analysis

Retail colocation segment is poised to hold over 65.1% data center colocation market share by the end of 2035. The facility of retailing only a required portion in the data centers typically saves a notable amount of capital for business. Due to such flexibility, they prefer to invest in this segment, rather than taking the whole room. In addition, the diverse leased spaces can range from a single rack to multiple racks, making it more useful for individuals in case of fluctuations in their trading conditions. For instance, in November 2023, Equinix announced the launch of a new IBX retail colocation facility, SL4 in Seoul, South Korea by Q1 2024. The company planned to house the new facility inside SL2x.

End use Segment Analysis

SME segment is poised to hold substantial data center colocation market share by 2035, as it seeks cost-effective solutions for any scale of data management. Their tendency to avoid capital expenditure has made the colocation services most suitable for these businesses, which are unable to afford the high upfront cost of building or maintaining their own infrastructure. Moreover, the cost sensitivity of SMEs pushes the adoption of such budget-friendly alternatives. For instance, in September 2022, Bechtle collaborated with PFALZKOM to launch its new data center in the Rhine-Neckar, offering private cloud services to benefit a range of customers, particularly SMEs.

Our in-depth analysis of the global market includes the following segments:

|

Colocation |

|

|

End use |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Data Center Colocation Market Regional Analysis:

North America Market Insights

North America region is estimated to capture data center colocation market share of around 43.2% by the end of 2035. Major developments and deployment of cloud infrastructure are notable growth driver of this landscape. Ongoing R&D is a crucial part of this region’s leadership in various industries, which creates a surge for efficient and reliable sources of data management solutions. This further fosters a large consumer base for this sector by acquiring investments from various research institutions. For instance, in August 2024, the Texas Advanced Computing Center (TACC) partnered with Sabey Data Centers to support their Horizon supercomputer. Being a colocation partner of TACC, the company contributes to revolutionizing the computational research of America.

The U.S. is paving the way for generating maximum revenue from the data center colocation market due to its rapid industrial growth in recent years. Thus, the increasing need for businesses to manage a large amount of data is fueling the demand for efficient and safe housing solutions. This is further inspiring leaders to expand their reach across the country, availing proper data security and connectivity. For instance, in November 2024, Cologix announced the acquisition of land in Johnstown, Ohio as a part of its strategic investment in the country’s digital infrastructure. The company plans to utilize the acquired 154 acres to build 8 AI-driven data centers, delivering a potential 800MW of scalable capacity across 2.0 million square feet.

Canada data center colocation market is highly influenced by the extensive efforts made by the country’s government to digitalize their data management infrastructure. The authorities are now investing heavily in the cloud computing industry as an initiative to promote sustainability in data centers. This further creates lucrative business opportunities for both domestic and international colocation service providers to secure a good profit margin, inspiring them to invest more in this field. For instance, in October 2023, Columbia Data Vault launched a new colocation data center in a previous Blackberry facility in Waterloo, RIM10. The strategic investment was made to move forward with AI to harness the full potential of this transformative technology.

APAC Market Insights

In data center colocation market, Asia Pacific region is estimated to capture significant revenue share by 2035. The integration of advanced technologies such as AI and machine learning has compelled the volume of data produced in every sector. This demands secure efficient services and solutions to cope with such a large amount of data, making this region a central marketplace for global leaders. For instance, in November 2024, Digital Realty announced its continuation of expansion in Asia Pacific through strategic partnerships. The company looks forward to fueling AI innovation and future-ready digital infrastructure by availing advanced solutions such as colocation.

India has become the center of attraction for global leaders in the data center colocation market due to its remarkable progress in digitalization. The country is experiencing steady but promising economic growth, which increased the frequency of investments to improve cloud infrastructures. This is further influencing participants in this sector to leverage their business expansion across the country. For instance, in September 2021, Equinix acquired GPX India in a transaction of USD 161 million to access its fiber-connected campus in Mumbai with two data centers. This acquisition helped the company to extend its Platform Equinix by adding more than 90,000 square feet of colocation space along with an initial 1,350 and an additional 500 cabinets.

China is also progressing to be at the forefront of the regional data center colocation market with its large cloud computing, e-commerce, social media, and digital services industry. The rise of AI and IoT in these fields is generating massive amounts of data for processing and storage, creating a surge for reliable data center infrastructure. Thus, the colocation service providers play a pivotal role in managing such demand cost and energy efficiently. The increasing presence of international giants such as Microsoft Azure, AWS, and Google Cloud in this country is evidence of having potential for future growth in colocation. Moreover, the expansion strategies of global cloud and hyperscale providers are penetrating innovation in this sector.

Data Center Colocation Market Players:

- AT&T Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Cogent Communications

- CoreSite Realty Corporation

- CyrusOne, Inc.

- Cyxtera Technologies, Inc.

- Digital Realty Trust, Inc.

- Equinix, Inc.

- Rackspace Inc.

- Verizon Communications Inc.

The data center colocation market is expanding with the tendency of global leaders to set their footprint overseas. In addition, the goal of complete digitalization in developing countries such as Japan, India, China, and South Korea is paving the path to success for such participants. Many newcomers are starting their journey by localizing their network across the domestic region, inspiring other fintech companies to invest in this field. For instance, in June 2023, atNorth announced the placement of their third data center in Iceland, ICE03, having an initial capacity of 10 MW. In addition to the six facilities already operational in Iceland, the company mentioned one additional site, FIN02 to be under construction in Finland. Such key players include:

Recent Developments

- In December 2024, AT&T joined forces with DataBank to serve as a carrier for the LAX1 data center in Los Angeles. The merged relationship between these two companies aims to leverage their offerings such as enterprise-class and HPC-ready edge colocation, interconnection, and managed services.

- In January 2024, Digital Realty launched the MAA10 data center in Chennai, based on a 10-acre campus and 100 megawatts of critical IT load capacity. The new addition aims to meet digital transformation needs by providing exceptional data center solutions including colocation and interconnection.

- Report ID: 2001

- Published Date: Sep 08, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Data Center Colocation Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.