Data Acquisition System Market Outlook:

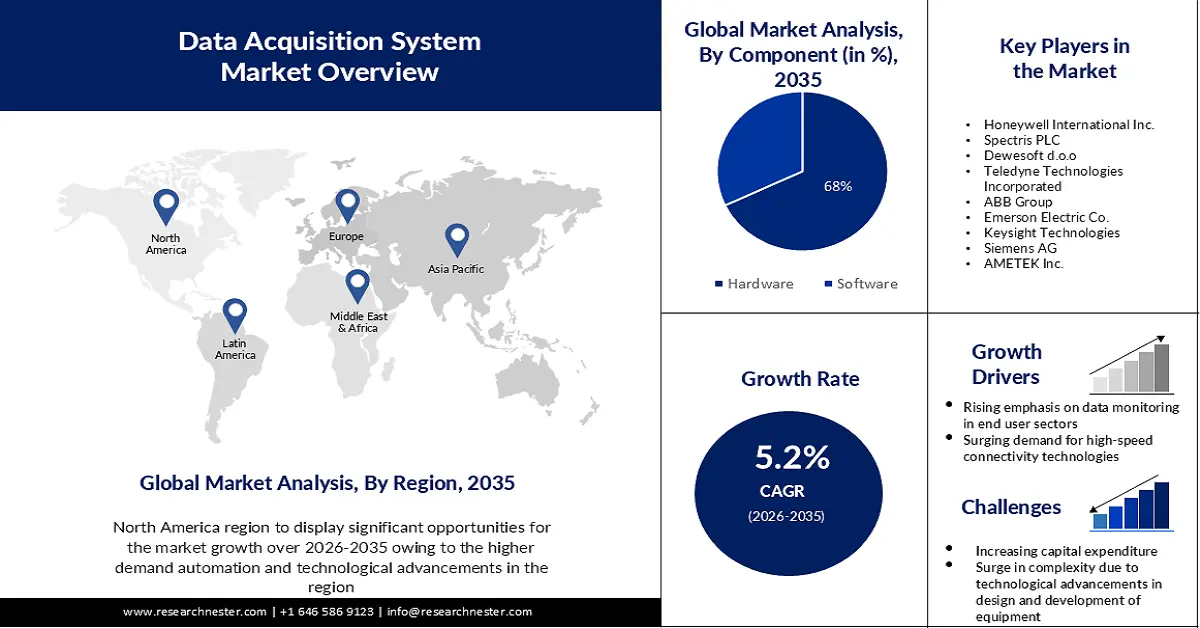

Data Acquisition System Market size was over USD 2.4 Billion in 2025 and is projected to reach USD 3.98 Billion by 2035, growing at around 5.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of data acquisition system is evaluated at USD 2.51 Billion.

The demand for industrial Ethernet, which addresses the particular issues faced by factory environments, such as noise, specialized process requirements, and severe circumstances, is on the rise, thus resulting in the growth of the global market. According to estimates, the data transmission rate ranges from 10 Mbps to 1 Gbps with the industrial Ethernet.

The data acquisition (DAQ) system market is expanding as a result of the increasing adoption of Internet of Things (IoT)-based systems in a variety of industries. These systems enable businesses to monitor inventory in real time and receive prompt warnings in case of any deviations, enabling proactive and effective management. China, Western Europe, and North America account for 67% of IoT usage. 94 % of retailers who use IoT say the benefits exceed the risks. There will be a concentration of 40% of the value that IoT creates in developing economies.

Key Data Acquisition System Market Insights Summary:

Regional Highlights:

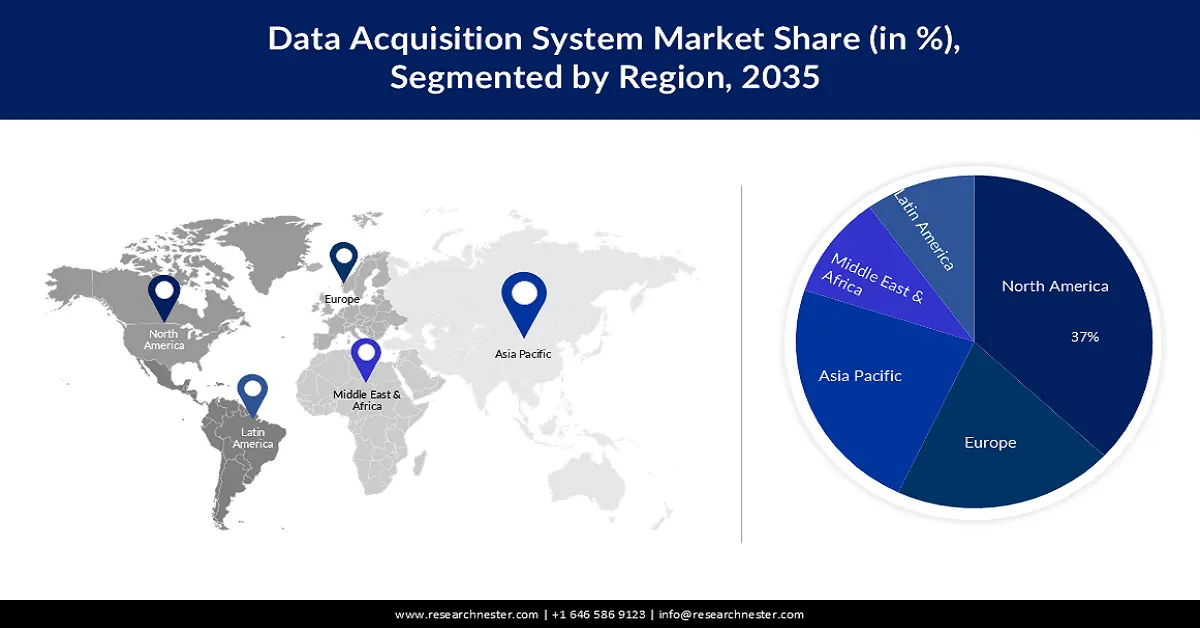

- The North America data acquisition (DAQ) system market is anticipated to achieve a 37% share by 2035, attributed to strong industrial sector development and technological infrastructure in the healthcare sector.

- The Asia Pacific market is projected to reach a 23% share by 2035, driven by rising adoption of new technologies like AI and IoT and strict regulatory standards for product testing and measurement.

Segment Insights:

- The hardware segment in the data acquisition system market is expected to command a 68% share by 2035, fueled by demand for USB and ethernet-based systems with integrated functionality.

- The research & development segment in the data acquisition system market is forecasted to secure a 38% share by 2035, driven by the rising need for testing tools and growing global R&D expenditure.

Key Growth Trends:

- Rising Emphasis on Data Monitoring in End User Sectors

- Surging Demand for High-Speed Connectivity Technologies

Major Challenges:

- Highly Competitive Market

- Increasing Capital Expenditure of the Data Acquisition Systems

Key Players: Rockwell Automation Corporation, Honeywell International Inc., Spectris PLC, Dewesoft d.o.o, Teledyne Technologies Incorporated, ABB Group, Emerson Electric Co., Keysight Technologies, Siemens AG, AMETEK Inc.

Global Data Acquisition System Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.4 Billion

- 2026 Market Size: USD 2.51 Billion

- Projected Market Size: USD 3.98 Billion by 2035

- Growth Forecasts: 5.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (37% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 11 September, 2025

Data Acquisition System Market Growth Drivers and Challenges:

Growth Drivers

-

Rising Emphasis on Data Monitoring in End User Sectors- Data monitoring enhances operational quality and aids in the early detection of production-stage faults in the aerospace & defence, government, energy, and automotive industries. Additionally, with the least amount of human involvement, data monitoring increases the operating efficiency of equipment. Data monitoring is useful in the energy business for assessing the operation of assets like solar PV, wind turbines, and other power-producing machinery. Today, more than 70,000 wind turbines are producing clean, dependable energy all over the nation. The fourth-largest source of electricity generation capacity in the nation, wind power has a capacity of 146 GW. This is equivalent to 46 million American homes' worth of wind energy.

-

Surging Demand for High-Speed Connectivity Technologies- Industries are increasingly adopting 5G technology. In the automotive sector, for instance, the current 4G technology is fast enough to support the development and adoption of autonomous cars. According to research, currently, there are about 236 million 5G network subscribers worldwide, however, the number is anticipated to grow to 3 billion by 2025.

- Advancement in Sensor Technology- Advancements in sensor technology have revolutionized the field of data acquisition systems, fuelling their growth and adoption across various industries. These technological developments have led to the development of sensors with enhanced accuracy, reliability, and functionality, significantly expanding the capabilities of data acquisition systems.

Challenges

-

Highly Competitive Market- In order to address the rising demand for applications, various manufacturers are working to create new systems through advances in quality and service. The rising competition among OEMs to incorporate new technological developments in numerous areas has further fuelled this.

-

Increasing Capital Expenditure of the Data Acquisition Systems.

- Surge in Complexity due to Technological Advancements in the Design and Development of this Equipment.

Data Acquisition System Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.2% |

|

Base Year Market Size (2025) |

USD 2.4 Billion |

|

Forecast Year Market Size (2035) |

USD 3.98 Billion |

|

Regional Scope |

|

Data Acquisition System Market Segmentation:

Component Segment Analysis

The hardware segment is predicted to hold about 68% share of the global data acquisition (DAQ) system market.The movement towards USB and ethernet-based front-end systems, which provide PC processing power and functionality, is speeding up adoption rates. Hardware can be integrated into the motherboard or attached to the computer via a communication interface, such as a USB. The demand for this category is increasing as a result of these factors. The number of USB flash drives sold over the last few years has been fluctuating, with about 10.9 million units being sold in 2021. Compared with the previous year, this was a decrease.

Application Segment Analysis

data acquisition (DAQ) system market from the research & development application category is set to hold the greatest revenue share of about 38% during the forecast period. Committed test and measurement tools are necessary in R&D to ensure that the project performs in accordance with calculations and aids in problem-solving. Data acquisition systems are used in research and development to gather the component parameters and properties of prototypes and preproduction models. The US is expected to become the largest country in terms of R&D expenditures worldwide, with over 679 billion dollars spent on research and development by 2022. Research and development are estimated to be invested by China in around 554 billion U.S. dollars.

Our in-depth analysis of the global data acquisition (DAQ) system market includes the following segments:

|

Component |

|

|

Speed |

|

|

Application |

|

|

End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Data Acquisition System Market Regional Analysis:

North American Market Insights

North America industry is estimated to hold largest revenue share of 37% by 2035, due to its strong industrial sector development and technological infrastructure in the healthcare sector. For monitoring, analyzing, and optimizing their operations, this sector has a significant demand for data acquisition solutions. North America has become a leading participant in the market because of the adoption of modern data acquisition systems, which is fueled by the region's strong technological ecosystem and emphasis on innovation.

APAC Market Insights

The data acquisition (DAQ) system market in Asia Pacific is anticipated to account for 23% revenue share during the forecast period. This growth can be propelled by the rising adoption of new technologies like AI and IoT as well as the strict regulatory standards pertaining to product testing and measurement. Moreover, the strong government backing for manufacturing is another factor boosting the DAQ market expansion in the Asia Pacific region. As a result of the expanding e-commerce and retail sectors, Japan held a share of more than 15% in the Asia Pacific AI retail industry in 2020. By the end of 2021, 6.33 million more people are anticipated to purchase online than the 82.59 million current e-commerce users in the nation.

Data Acquisition System Market Players:

- Rockwell Automation Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Honeywell International Inc.

- Spectris PLC

- Dewesoft d.o.o

- Teledyne Technologies Incorporated

- ABB Group

- Emerson Electric Co.

- Keysight Technologies

- Siemens AG

- AMETEK Inc.

Recent Developments

- ABB offered Technology solutions that helped in supporting the clean energy transition and EV adoption. ABB recognized the urgent need to address climate change and reduce greenhouse gas emissions, leading to their commitment to developing and providing sustainable solutions.

- Emerson has tracked and benchmarked energy usage at more than 200 global sites that are designated ‘major energy-consuming facilities,’ as well as over 500 other offices and service centres. This proactive approach helped Emerson gain insights into their energy usage patterns and also enabled them to implement targeted strategies and initiatives to enhance energy efficiency and sustainability across their operations worldwide.

- Report ID: 5195

- Published Date: Sep 11, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Data Acquisition System Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.