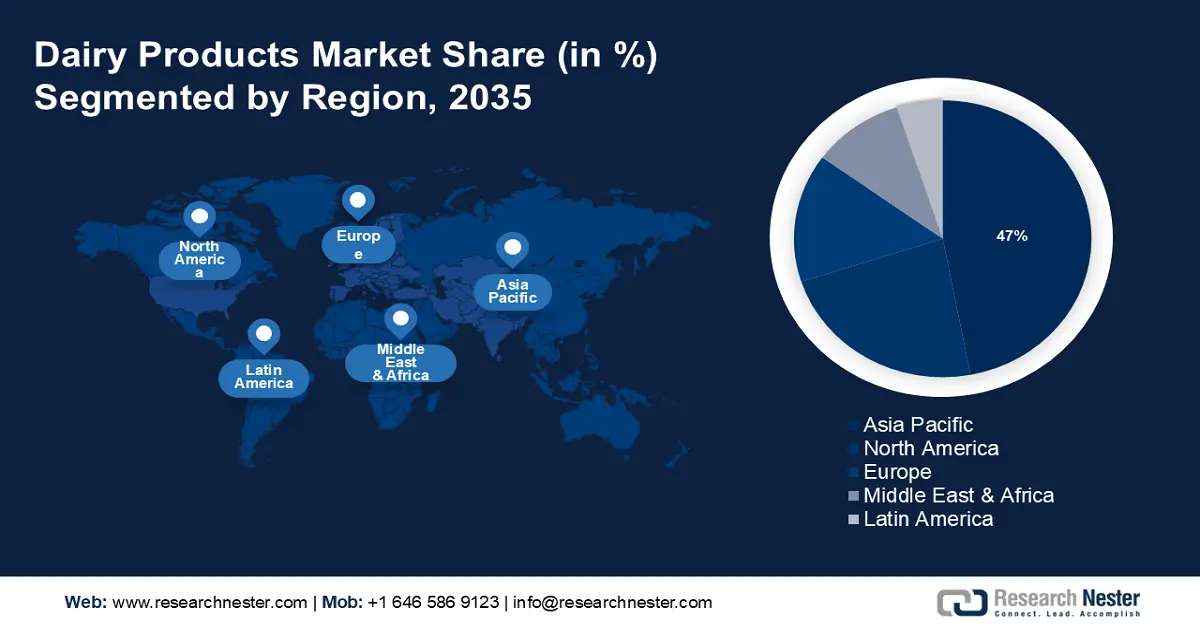

Dairy Products Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is anticipated to account for largest revenue share of 47% by 2035. The region's large population, expanding milk demand, production, and consumer knowledge of dairy's health benefits are driving market expansion.

From 2012 to 2024, China's dairy product output grew at a CAGR of 1.6%. The National Bureau of Statistics reported that there were 30.6 million tons of dairy production in China in 2023. Milk production rose to 39.33 million tons in 2022 from 30.2 million tons in 2013.

In South Korea, due to fewer dairy farms, milk cows, and demand, and a lowering birth rate, milk production is predicted to decline. Cheese consumption, as well as demand for other dairy products like cream and butter, is rising due to changing tastes and understanding of dairy's beneficial proteins. In 2023, high inflation and a falling Korean won may cause imports to drop unusually, especially versus the U.S. dollar.

North America Market Insights

North America is anticipated to be the most opportunistic market. Pizza Hut, Domino's, and various other Brands have played a vital role in driving the dairy production market growth as these eateries employ cheese and butter in most dishes. Over the projected period, North American consumers' increased love of yogurt and dairy desserts is anticipated to drive the dairy products market in the projected period.

Average milk cows, milk per cow, and total milk production in the U.S. are expected at 9.345 million, 24,330, and 227.3 billion pounds in 2024. Cheddar cheese and butter prices are risen for 2024, but non-fat dry milk and dry whey prices have dropped. Overall, the 2024 all-milk price estimate rises $0.30 to $21.20 per hundredweight.

After two years, Canada adopted the federal budget in 2021, committing to protect COVID-19-affected sectors and establish a resilient, fair economy. The government earmarked USD 5.2 billion for agriculture, including direct investment and programming-related expenditure in agriculture, forestry, and fisheries and support for temporary foreign workers' quarantine requirements. Thus, such initiatives boost market growth.