Dairy Products Market Outlook:

Dairy Products Market size was valued at USD 61.68 billion in 2025 and is expected to reach USD 87.01 billion by 2035, expanding at around 3.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of dairy products is evaluated at USD 63.62 billion.

The global demand for dairy products is steadily expanding, mostly driven by population expansion, increasing incomes, urbanization, and the adoption of Western diets in many nations. The rising demand for dairy products is placing additional strain on natural resources such as freshwater and soil. The World Wildlife Fund collaborates with dairy farmers, industry associations, and other relevant parties in multiple countries to preserve and safeguard natural resources and habitats.

Approximately 270 million dairy cows are looked after by millions of farmers worldwide for the purpose of milk production. WWF envisions a worldwide market where all dairy products are produced in the most sustainable manner possible. WWF's objective is to revolutionize the milk production business by actively involving dairy farmers, co-ops, companies, and other stakeholders in the promotion and adoption of sustainable techniques further driving the market growth.

Key Dairy Products Market Insights Summary:

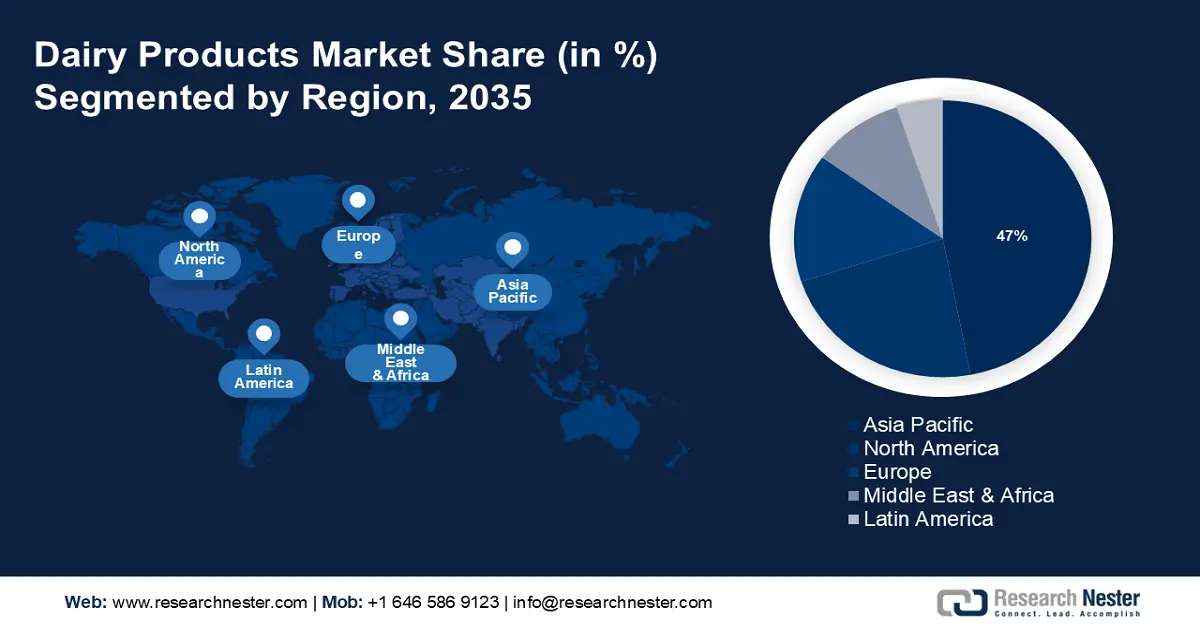

Regional Highlights:

- The Asia Pacific dairy products market will secure over 47% share by 2035, driven by large population, increasing milk demand, and consumer awareness of dairy benefits.

Segment Insights:

- The milk segment in the dairy products market projects a 65% share by 2035, driven by rising milk consumption in emerging economies.

- Supermarket/hypermarket segment in the dairy products market is forecasted to achieve 59% growth by the forecast year 2035, driven by wide product availability and convenience in large stores.

Key Growth Trends:

- Technology Advancements

- Rising Health Concerns of Polish Consumers

Major Challenges:

- Customer Preferences For Plant-Based Products

- Emphasis on Ethical Practices and The Well-being of Animals

Key Players: Friesland Campina, Fonterra USA, Danone, Arla Foods, Dairy Farmers of America, Lactalis American Group, Amul, Saputo Inc.

Global Dairy Products Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 61.68 billion

- 2026 Market Size: USD 63.62 billion

- Projected Market Size: USD 87.01 billion by 2035

- Growth Forecasts: 3.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (47% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, France, India

- Emerging Countries: China, India, Brazil, Mexico, Indonesia

Last updated on : 17 September, 2025

Dairy Products Market Growth Drivers and Challenges:

Growth Drivers

- Technology Advancements - Emerging technology is transforming the dairy industry worldwide. Data-driven precision agriculture is growing due to AI (artificial intelligence) and IIOT (Industrial Internet of Things). Genomic advances and new breeding methods will allow producers to select and raise animals with desirable qualities, such as milk-producing cows. With increased preservation and microbial control, technology is helping companies meet and exceed new food safety regulations further driving the market growth.

MyAniML, a Kansas City-based animal health technology business, is studying the cow's muzzle for health improvements. Their computer vision system analyzes the face and muzzle for early signs of illness using machine learning and facial recognition. - Rising Health Concerns of Polish Consumers - Consumers who prioritize their health are increasing the demand for dairy products that have been fortified with additional nutritional advantages. Producers are enhancing the utility of items beyond fundamental nutritional needs. The current emphasis lies in the development of goods containing minimal fat content and augmented levels of protein, probiotics, minerals, and vitamins.

Dairy products possess a suitable nutritional composition that has a beneficial impact on human health. Dairy products also have a significant impact on the occurrence and management of some diseases, such as obesity, hypertension, type 2 diabetes, and cardiovascular disease. - Rising Govt. schemes and initiatives - The dairy products market is projected to expand due to the increasing government schemes and initiatives aimed at enhancing milk output and improving cow productivity. For instance, In 2021, The Philippines entered into a five-year cooperation with the private sector to enhance the dairy industry through the implementation of the Dairy Training and Development Program.

The main objective is to enhance the quality of milk and augment both cow productivity and the accessibility of farmers to the market. Moreover, milk is now widely recognized as a crucial and regularly consumed item in most households. Hence, it is anticipated that the worldwide market will experience significant growth over the projected timeframe.

Challenges

- Customer Preferences For Plant-Based Products - There has been a significant increase in the demand for goods that are derived from plants and do not contain dairy. The increase in demand can be attributed to the growing number of customers adopting vegetarianism and veganism. Additionally, there has been a significant rise in the population of lactose-intolerant individuals. Furthermore, the desire for alternative dairy products derived from soy, almond, oat, or coconut is being propelled by health and environmental considerations.

- Emphasis on Ethical Practices and The Well-being of Animals - Consumers are increasingly expressing apprehension regarding the well-being of cows, buffalos, lambs, and goats utilized in the dairy industry. Analysis indicates that manufacturers in emerging countries, such as Africa and China, as well as higher-income regions, such as America and Europe, will need to implement stricter animal welfare requirements. Anticipated is the increased likelihood of additional nations mandating the inclusion of labelling and certification as a means to substantiate compliance with animal welfare criteria.

Dairy Products Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

3.5% |

|

Base Year Market Size (2025) |

USD 61.68 billion |

|

Forecast Year Market Size (2035) |

USD 87.01 billion |

|

Regional Scope |

|

Dairy Products Market Segmentation:

Product Segment Analysis

Milk segment is estimated to dominate dairy products market share of around 65% by the end of 2035. The increase in milk consumption in emerging nations can be attributed to its high nutritional value, as it provides ample amounts of protein and calcium.

Approximately 45% of milk output is utilized for the consumption as fluid milk. Over 35% of the milk is transformed into butter, while around 7% is changed into cheese. Another 4% is processed into milk powder, and the remaining portion is utilized for the production of various items such as yogurt and flavored milk satisfying the customer demand and thus, driving the market growth.

Distribution Channel Segment Analysis

In dairy products market, supermarket/hypermarket segment is projected to dominate revenue share of around 59% by the end of 2035. Hypermarkets and supermarkets were the primary players in the worldwide dairy manufacturing business. The ample shelf space provided in supermarkets and hypermarkets contributed significantly to the robust sales. The increased accessibility of many brands, clarity in reading product labels, and convenience in comparing different products contribute to the growing popularity of this segment for acquiring dairy products.

Our in-depth analysis of the global market includes the following segments:

|

Product |

|

|

Distribution channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Dairy Products Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is anticipated to account for largest revenue share of 47% by 2035. The region's large population, expanding milk demand, production, and consumer knowledge of dairy's health benefits are driving market expansion.

From 2012 to 2024, China's dairy product output grew at a CAGR of 1.6%. The National Bureau of Statistics reported that there were 30.6 million tons of dairy production in China in 2023. Milk production rose to 39.33 million tons in 2022 from 30.2 million tons in 2013.

In South Korea, due to fewer dairy farms, milk cows, and demand, and a lowering birth rate, milk production is predicted to decline. Cheese consumption, as well as demand for other dairy products like cream and butter, is rising due to changing tastes and understanding of dairy's beneficial proteins. In 2023, high inflation and a falling Korean won may cause imports to drop unusually, especially versus the U.S. dollar.

North America Market Insights

North America is anticipated to be the most opportunistic market. Pizza Hut, Domino's, and various other Brands have played a vital role in driving the dairy production market growth as these eateries employ cheese and butter in most dishes. Over the projected period, North American consumers' increased love of yogurt and dairy desserts is anticipated to drive the dairy products market in the projected period.

Average milk cows, milk per cow, and total milk production in the U.S. are expected at 9.345 million, 24,330, and 227.3 billion pounds in 2024. Cheddar cheese and butter prices are risen for 2024, but non-fat dry milk and dry whey prices have dropped. Overall, the 2024 all-milk price estimate rises $0.30 to $21.20 per hundredweight.

After two years, Canada adopted the federal budget in 2021, committing to protect COVID-19-affected sectors and establish a resilient, fair economy. The government earmarked USD 5.2 billion for agriculture, including direct investment and programming-related expenditure in agriculture, forestry, and fisheries and support for temporary foreign workers' quarantine requirements. Thus, such initiatives boost market growth.

Dairy Products Market Players:

- Nestlé

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- FrieslandCampina

- Fonterra USA

- Danone

- Arla Foods

- Dairy Farmers of America

- Lactalis American Group

- Amul

- Saputo Inc.

- The Kraft Heinz Company

The Dairy Products market is dominated by key market players who are gaining traction in the market by adopting several strategies including mergers and acquisitions.

Recent Developments

- Nestlé - recently introduced a new product called N3 milk. Derived from cow milk production, this substance contains all the vital components present in milk, including proteins, vitamins, and minerals. Furthermore, it is enriched with prebiotic fibers, possesses a reduced lactose content, and boasts a calorie reduction of over 15%. Clinical trials have demonstrated that these fibers enhance the proliferation of several strains of bifidobacteria by a factor of three, resulting in advantageous effects on the gut microbiota of healthy individuals.

- Fonterra - a leading dairy cooperative, on May 16 declared its plan to divest its consumer brands segment, encompassing the manufacturing of renowned brands like Anchor, Fresh'n Fruity, and Mainland. Fonterra intends to sell its consumer brands division, prompting market expectations and forecasts. This decision has the potential to be one of the most substantial and impactful developments in the company's history in the last 23 years

- Report ID: 6254

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Dairy Products Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.