Cycloalkanes Market Outlook:

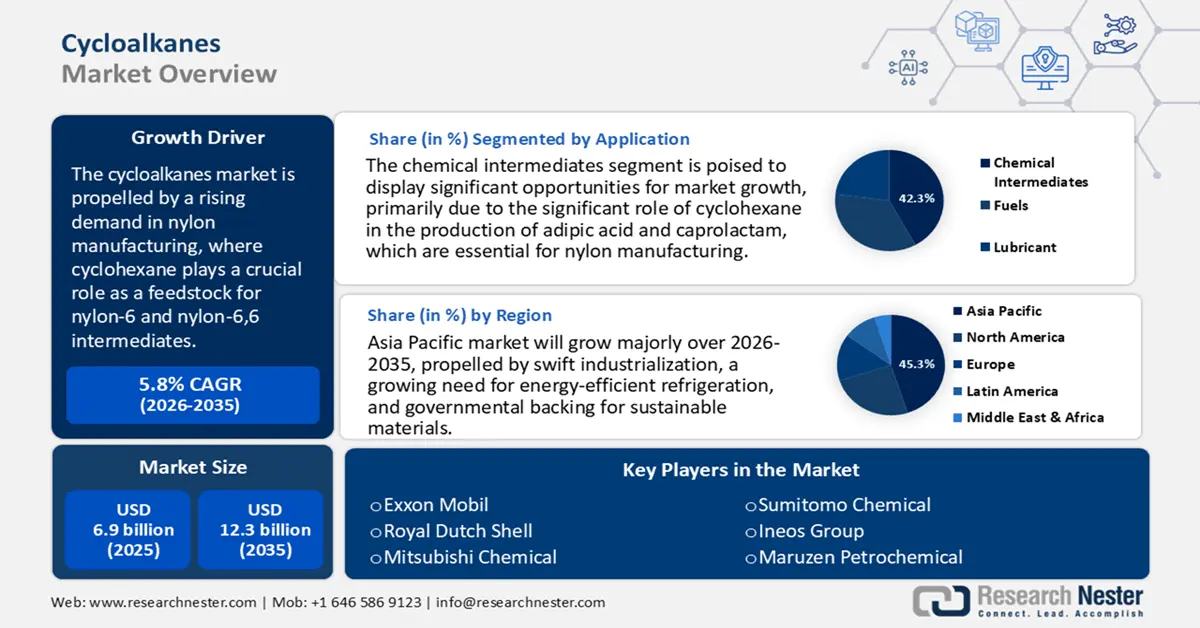

Cycloalkanes Market size was valued at USD 6.9 billion in 2025 and is projected to reach USD 12.3 billion by the end of 2035, rising at a CAGR of 5.8% during the forecast period, i.e., 2026‑2035. In 2026, the industry size of cycloalkanes is evaluated at USD 7.4 billion.

The market is propelled by a rising demand in nylon manufacturing, where cyclohexane plays a crucial role as a feedstock for nylon-6 and nylon-6,6 intermediates. The U.S. Environmental Protection Agency reports that the U.S. produced approximately 338 million gallons of cyclohexane, with demand anticipated to increase at an annual rate of 2–2.5%, highlighting its persistent industrial relevance within chemical supply chains. As global manufacturing continues to grow, particularly in sectors such as automotive, textiles, and engineering plastics, the requirement for nylon intermediates is driving an upward trend in cycloalkane consumption.

In addition to their role in polymers, cycloalkanes are increasingly utilized as solvents and intermediates in the production of specialty chemicals, which further supports market expansion. Their participation in processes like the synthesis of adipic acid, caprolactam, and hexamethylenediamine connects them directly to high-density industrial applications. This combination of consistent yearly production growth and widespread industrial application highlights both the quantitative momentum (2–2.5% growth) and the qualitative significance of cycloalkanes in facilitating modern manufacturing, a trend that is projected to continue in tandem with the global demand for advanced materials.

Key Cycloalkanes Market Insights Summary:

Regional Highlights:

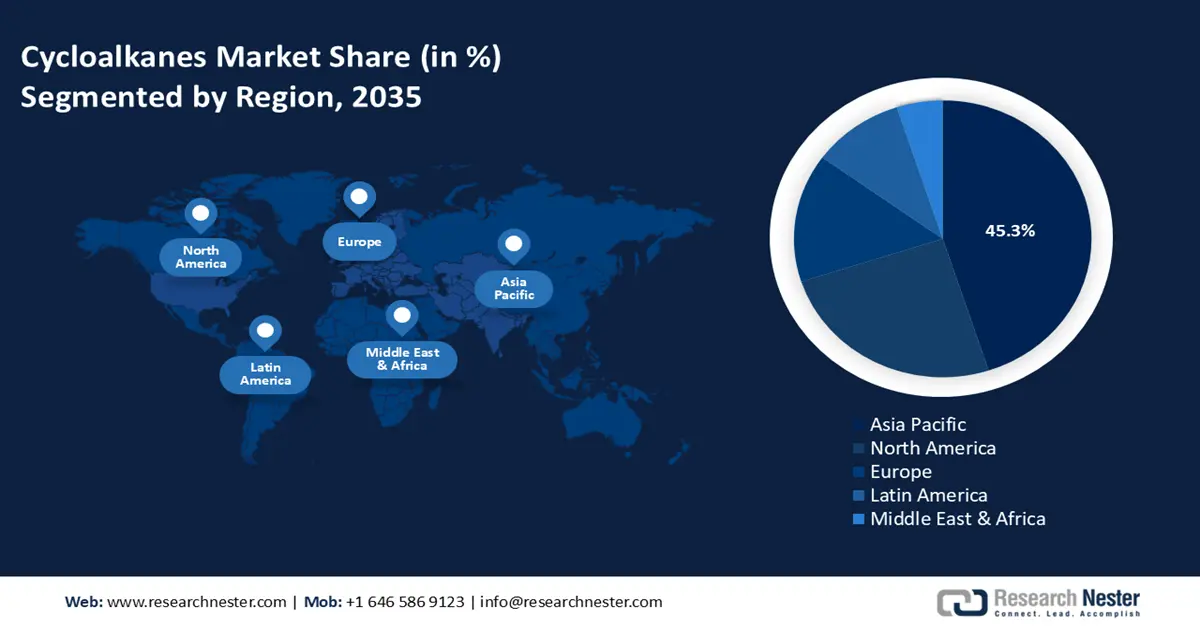

- The Asia Pacific Cycloalkanes Market is anticipated to capture a 45.3% revenue share by 2035, propelled by rapid industrialization and rising demand for energy-efficient refrigeration and sustainable materials.

- North America is projected to secure a 25.6% share of the cycloalkanes market by 2035, impelled by robust demand from paints, coatings, and adhesives applications alongside advancements in chemical synthesis technologies.

Segment Insights:

- The chemical intermediates segment in the Cycloalkanes Market is forecasted to hold a 42.3% share by 2035, driven by the essential role of cyclohexane in producing adipic acid and caprolactam for nylon manufacturing.

- The automotive components segment is anticipated to command a 31.4% share by 2035, sustained by the rising utilization of cycloalkane derivatives in developing fuel additives and lightweight engineering plastics

Key Growth Trends:

- Regulatory shift to climate-friendly foam blowing agents

- Strong availability of petrochemical feedstocks

Major Challenges:

- Environmental regulations and sustainability pressures

- Raw material supply volatility

Key Players: ExxonMobil Corporation, Chevron Phillips Chemical Company, SK Global Chemical, INEOS, Idemitsu Kosan Co. Ltd., TotalEnergies SE, LyondellBasell Industries Holdings B.V., BASF SE, Saudi Basic Industries Corporation (SABIC), China National Petroleum Corporation (CNPC), Reliance Industries Limited.

Global Cycloalkanes Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 6.9 billion

- 2026 Market Size: USD 7.4 billion

- Projected Market Size: USD 12.3 billion by 2035

- Growth Forecasts: 5.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (45.3% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, India

- Emerging Countries: South Korea, Indonesia, Brazil, Mexico, Thailand

Last updated on : 11 September, 2025

Cycloalkanes Market - Growth Drivers and Challenges

Growth Drivers

- Regulatory shift to climate-friendly foam blowing agents: Environmental regulations are increasingly promoting non-ozone-depleting alternatives in the production of foam. Under the EPA’s SNAP program, certain cycloalkanes, such as cyclopentane, have been approved as viable substitutes for high-GWP blowing agents, which aids in their adoption for refrigeration and insulation purposes. For instance, BASF has modified its polyurethane systems to incorporate cyclopentane-based blowing formulations, allowing appliance manufacturers to comply with new environmental standards while preserving performance.

- Strong availability of petrochemical feedstocks: The production of cycloalkanes is dependent on the availability of refined feedstocks like naphtha. The U.S. Energy Information Administration (EIA) indicates that the net production of naphtha for petrochemical uses by U.S. refineries and blenders reached around 4,411 thousand barrels daily in 2023, with consistent volumes anticipated through early 2024. ExxonMobil, utilizing its integrated refining-petrochemical facilities, such as those in Baytown, Texas, capitalizes on this feedstock supply to enhance cyclohexane production within its aromatics units, thereby supporting volume growth.

- Rising chemical demand via downstream polymer synthesis: Cycloalkanes act as essential intermediates in the growth of nylon and specialty polymer production, which in turn drives the demand for cycloalkanes. Companies like Honeywell are investing in cyclohexane purification capacity to ensure a consistent downstream supply to caprolactam and adipic acid facilities, thereby linking the availability of cycloalkanes directly to polymer demand and market dynamics.

Cycloalkanes Market Price Dynamics (2026-2035)

The market examines fast pricing trends, regional differences, and significant factors affecting prices, providing essential insights for stakeholders maneuvering through this changing global chemical market.

Cycloalkane Export Values and Volumes by Country (2023)

|

Country |

Export Value (USD thousands) |

Export Volume (kg) |

|

Saudi Arabia |

240,332.21 |

103,701,000 |

|

Netherlands |

153,429.01 |

14,909,900 |

|

Germany |

137,432.49 |

121,492,000 |

|

Belgium |

117,309.65 |

17,850,000 |

|

United States |

69,165.85 |

10,060,600 |

Source: WITS

Challenges

- Environmental regulations and sustainability pressures: The cycloalkanes market is experiencing heightened regulatory oversight due to environmental issues, especially concerning greenhouse gas emissions and the management of chemical waste. Stricter governmental policies across the globe necessitate cleaner production methods and reduced carbon footprints, which in turn elevate operational expenses for manufacturers. Adhering to these regulations frequently demands substantial investment in environmentally friendly technologies, posing a challenge for smaller producers. This obstacle hampers market growth, as companies strive to balance profitability with sustainable practices.

- Raw material supply volatility: The production of cycloalkanes is significantly reliant on petrochemical feedstocks such as naphtha and benzene, whose prices fluctuate in response to global oil market dynamics. Geopolitical conflicts, disruptions in supply chains, and inconsistent availability of crude oil can lead to volatility in raw material prices, thereby affecting production costs and profit margins. This uncertainty complicates long-term planning and pricing strategies for manufacturers, potentially undermining market stability and deterring new investments in capacity expansion.

Cycloalkanes Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.8% |

|

Base Year Market Size (2025) |

USD 6.9 billion |

|

Forecast Year Market Size (2035) |

USD 12.3 billion |

|

Regional Scope |

|

Cycloalkanes Market Segmentation:

Application Segment Analysis

The chemical intermediates segment is projected to represent 42.3% of the global cycloalkanes market by the year 2035. This is primarily attributed to the essential role of cyclohexane in the production of adipic acid and caprolactam, both of which are critical for the manufacturing of nylon. Approximately 60% of the yearly output of adipic acid is utilized in the synthesis of nylon polymers, which is a crucial end-use for intermediates derived from cycloalkanes. For instance, INVISTA operates extensive facilities that transform cyclohexane into nylon intermediates, thereby supporting the industrial demand in both the textiles and automotive industries.

End‑Use Industry Segment Analysis

The automotive components segment is expected to secure 31.4% of the cycloalkanes market share. Derivatives of cycloalkanes play a vital role in the development of fuel additives and engineering plastics that enhance fuel efficiency and decrease vehicle weight. Research supported by the government aimed at improving fuel economy and emissions, such as the EPA test cycles, underscores the automotive sector's ongoing quest for advanced feedstocks that boost performance and ensure compliance with regulations. Manufacturers such as Toyota and Honda employ high-purity solvents derived from cycloalkanes in the production of lightweight composites, thereby facilitating these performance improvements.

Co‑Product Usage Segment Analysis

The solvents segment, which is projected to account for 26.4% of the market, benefits from regulatory changes that favor low-toxicity, non-aromatic cleaning and coating solutions. The EPA continues to promote safer solvent alternatives in accordance with environmental guidelines, which enhances the adoption of cycloalkanes over conventional aromatics. For instance, Dow Chemical has reformulated several lines of industrial cleaning and paint solvents to include cycloalkane-based blends, thereby meeting the evolving safety and environmental standards.

Our in-depth analysis of the cycloalkanes market includes the following segments:

|

Segment |

Subsegments |

|

Application |

|

|

End use |

|

|

Co-Product Usage |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Cycloalkanes Market - Regional Analysis

Asia Pacific Market Insights

The Asia Pacific is anticipated to account for 45.3% of the revenue share in the global cycloalkane market by 2035, propelled by swift industrialization, a growing need for energy-efficient refrigeration, and governmental backing for sustainable materials. Nations such as China and India are significant contributors to this growth, with considerable investments in chemical manufacturing and infrastructure development. The market is forecasted to experience significant growth, especially in areas like solvents, refrigeration, and fuel additives.

China is projected to hold the largest revenue share in the APAC cycloalkanes market by the year 2035. This leadership is due to its strong chemical industry, vast manufacturing base, and significant infrastructure investments. The nation's emphasis on sustainable and energy-efficient solutions further enhances the demand for cycloalkanes in uses such as refrigeration and solvents. China's dedication to lowering carbon emissions and improving energy efficiency is in line with the increasing adoption of cycloalkanes as eco-friendly alternatives.

India is forecasted to emerge as the top revenue-generating country in the APAC cycloalkanes market by 2035. The chemical industry of the country, which was worth approximately US$220 billion in 2024, is expected to expand to US$300 billion by the end of 2025. This growth reflects a compounded annual growth rate (CAGR) ranging from 10% to 12%. This growth is fueled by factors such as increasing domestic demand in sectors like packaging, automotive, and healthcare, along with substantial investments in infrastructure and manufacturing capabilities. India's strategic initiatives, including the Atmanirbhar Bharat program, are designed to decrease import reliance and foster domestic production, thereby further boosting the demand for cycloalkanes.

North America Market Insights

The North American cycloalkanes market is expected to hold a 25.6% share in the global cycloalkanes market by 2035, propelled by strong demand from the paints, coatings, and adhesives industries. This growth is further enhanced by its essential function as an intermediate in the production of pharmaceuticals and plasticizers. The market's development is significantly shaped by advancements in chemical synthesis technology and a steady industrial output throughout the region.

The U.S. is clearly projected to maintain the highest revenue share in the North American cycloalkanes market by 2035. This leadership is supported by its extensive and well-established industrial infrastructure, especially within the petrochemical and pharmaceutical sectors. The presence of significant manufacturing hubs and continuous investments in R&D strengthen its leading role in both production and consumption. Further, Canada is expected to emerge as a notable, albeit smaller, revenue-generating market for cycloalkanes, following the U.S. Its market share is bolstered by a robust export-driven chemical industry and the availability of ample natural gas feedstock, which aids in production. The growth of the market is closely linked to its primary end-use sectors, such as plastics and rubber manufacturing, which utilize cycloalkanes as vital intermediates.

Europe Market Insights

The European cycloalkanes market is defined by strict environmental regulations that encourage the use of high-performance, low-VOC solvents, which serve as a significant growth catalyst. Demand is predominantly concentrated in Western European countries, which are home to a robust network of chemical manufacturing and processing industries. The market's development is intricately tied to the performance of key end-use sectors, such as automotive coatings, industrial cleaning, and pharmaceutical synthesis. Production capacity is a vital element for regional supply, with numerous major plants situated within the EU.

Key Cycloalkanes Market Players:

- ExxonMobil Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Chevron Phillips Chemical Company

- SK Global Chemical

- INEOS

- Idemitsu Kosan Co., Ltd.

- TotalEnergies SE

- LyondellBasell Industries Holdings B.V.

- BASF SE

- Saudi Basic Industries Corporation (SABIC)

- China National Petroleum Corporation (CNPC)

- Reliance Industries Limited

Leading cycloalkane manufacturers distinguish themselves through the use of advanced processing technologies, integration of supply chains, and specialization in products. Key industry players depend on catalytic reforming and hydrogenation systems to efficiently convert feedstocks, while vertically integrated operations from refineries to downstream manufacturing improve cost management and reliability. Niche companies have focused on application-specific derivatives, such as ultra-pure methylcyclohexane for semiconductor applications or cyclopentane for foam insulation. Strategic partnerships and sustainability initiatives, such as the production of bio-based cycloalkanes, further differentiate the leaders in this industry.

Top 15 Global Companies in Cycloalkane Market

Recent Developments

- In June 2024, Merck KGaA commemorated the notable enlargement of its life science distribution facility situated in Schnelldorf, Germany. This enhancement introduced an additional 25,000 m² of state-of-the-art manufacturing and logistics space, thereby improving product availability and delivery for global research and medical users, all while complying with sustainable building practices and hygiene standards.

- In February 2023, Haltermann Carless, a prominent provider of sustainable hydrocarbon solutions, unveiled an ISCC‑PLUS certified range of low‑carbon mass-balance pentane products—including blends of cyclopentane—aimed at environmentally conscious sectors such as refrigeration and construction insulation.

- Report ID: 8083

- Published Date: Sep 11, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Cycloalkanes Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.