Cyber Threat Intelligence Market Outlook:

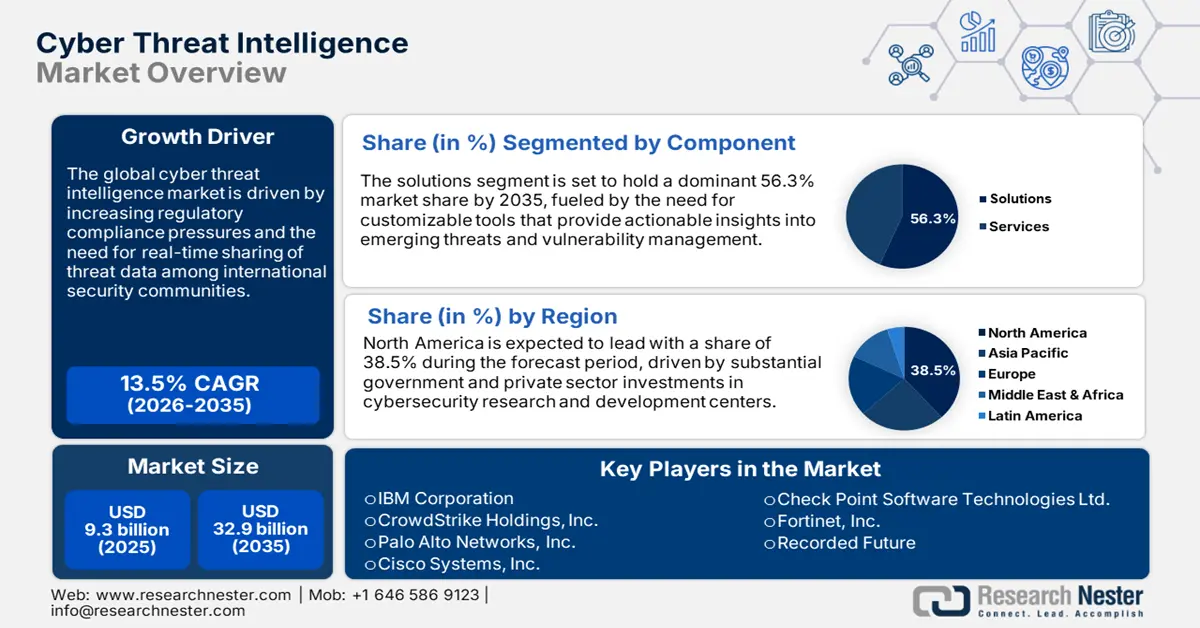

Cyber Threat Intelligence Market size is valued at USD 9.3 billion in 2025 and is projected to reach a valuation of USD 32.9 billion by the end of 2035, rising at a CAGR of 13.5% during the forecast period, i.e., 2026-2035. In 2026, the industry size of cyber threat intelligence is assessed at USD 10.5 billion.

The cyber threat intelligence market is experiencing rapid growth, as businesses globally seek to counter increasingly sophisticated cyber threats with advanced, proactive defense strategies. Key market growth drivers include the increasing frequency of sophisticated attacks, global digital transformation, and the critical need for actionable intelligence to protect assets. Companies are investing heavily in threat intelligence platforms to forecast potential attack paths, learn enemy strategies, and strengthen their overall security posture against contemporary threats. In August 2024, IBM Corporation released a generative AI-powered Cybersecurity Assistant that reduces the time to analyze alerts by 48% using automated historical correlation analysis and threat pattern detection. This reflects the industry trend for AI solutions to effectively manage threats. These technologies enable organizations to achieve faster response times and improved resource utilization in their security procedures.

Government policies and stringent regulatory regimes are also accelerating the implementation of threat intelligence solutions, as incident reporting requirements and strategic defense expenditure drive market expansion. For instance, in March 2023, the White House released its National Cybersecurity Strategy, followed by its implementation plan in July 2023, to articulate its strategy for creating a defensible, resilient digital ecosystem in the U.S. Artificial intelligence and machine learning integration are also transforming threat intelligence by automatically processing vast volumes of data and enabling predictive modeling. These technologies provide the speed and precision needed for today's cybersecurity processes, enabling companies to transition from a reactive to a proactive defense strategy.

Key Cyber Threat Intelligence Market Insights Summary:

Regional Highlights:

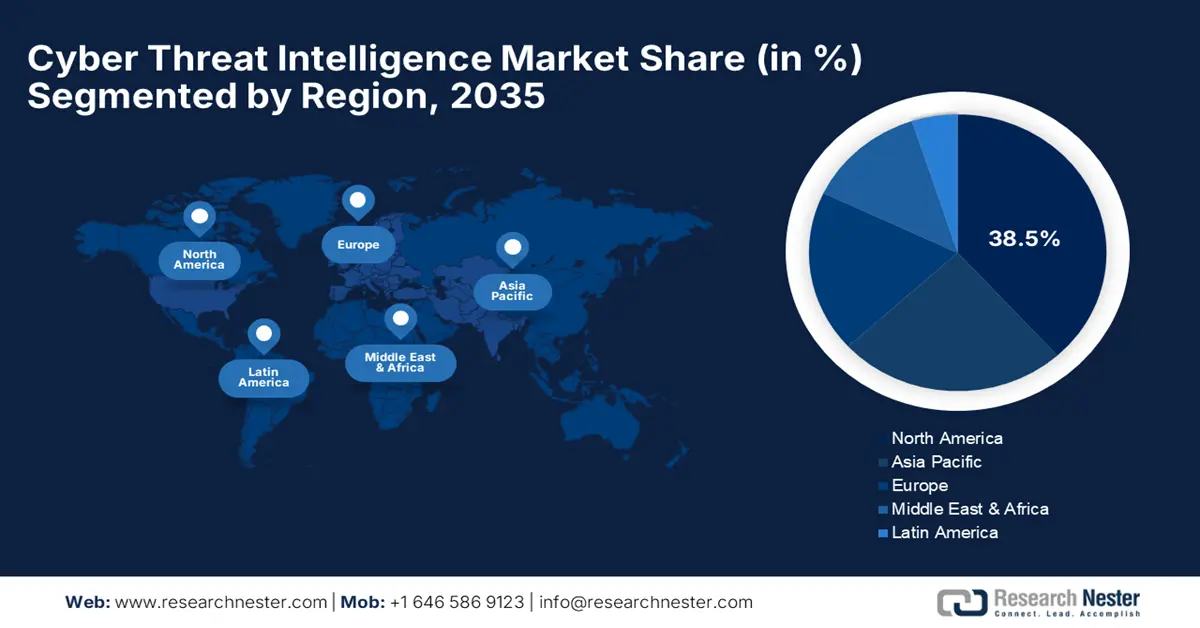

- North America is anticipated to secure a 38.5% share in the Cyber Threat Intelligence Market by 2035, propelled by the region’s mature cybersecurity infrastructure and the escalating frequency of sophisticated cyberattacks.

- Asia Pacific is projected to witness a CAGR of 14.5% through 2035, impelled by rapid digital transformation and significant investments in next-generation cybersecurity technologies.

Segment Insights:

- The solutions segment is forecasted to command a dominant 56.3% share in the Cyber Threat Intelligence Market during 2026–2035, driven by rising demand for integrated threat detection, analysis, and response automation platforms.

- The on-premises segment is estimated to hold a 54.5% market share by 2035, owing to the growing emphasis on data control, compliance, and the protection of critical information across regulated sectors.

Key Growth Trends:

- AI-powered intelligence analytics redefining threat detection

- Regulatory compliance requirements drive demand

Major Challenges:

- Threat intelligence overload and information processing complexity

- Manpower shortage and skills gap in threat intelligence

Key Players: IBM Corporation, CrowdStrike Holdings, Inc., Palo Alto Networks, Inc., Cisco Systems, Inc., Check Point Software Technologies Ltd., FireEye, Inc. (Mandiant), Fortinet, Inc., Recorded Future, Symantec Corporation (Broadcom), McAfee Corp., Sophos Group plc, Samsung SDS Co., Ltd., Trend Micro Incorporated, NEC Corporation, Fujitsu Limited.

Global Cyber Threat Intelligence Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: 9.3 billion

- 2026 Market Size: USD 10.5 billion

- Projected Market Size: USD 32.9 billion by 2035

- Growth Forecasts: 13.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Canada, United Kingdom, Germany, Japan

- Emerging Countries: India, China, Singapore, South Korea, Australia

Last updated on : 26 September, 2025

Cyber Threat Intelligence Market - Growth Drivers and Challenges

Growth Drivers

- AI-powered intelligence analytics redefining threat detection: The integration of cutting-edge machine learning and artificial intelligence is revolutionizing threat intelligence by enabling automated analysis, predictive modeling, and real-time cross-correlation of threats across different data sources. AI-driven platforms are being adopted by organizations with unprecedented speed in order to handle massive volumes of security data, identify complex attack patterns, and generate actionable intelligence with unprecedented speed and accuracy. These intelligent systems utilize deep learning and behavioral analysis to extract meaningful indicators from various data sources, including dark web destinations and internal network telemetry. IBM Corporation, in May 2025, launched QRadar Investigation Assistant, an AI solution to transform security operations by minimizing threat investigations with automated analysis and contextual knowledge. This announcement reflects the growing reliance on AI to enhance the effectiveness of threat detection. Thus, companies are well equipped to anticipate and resist rising cyber threats.

- Regulatory compliance requirements drive demand: Harsh regulatory settings, such as GDPR, NIS2, and DORA, compel companies to invest in real-time threat intelligence solutions to maintain compliance and enhance their security posture. Government laws mandating the protection of critical infrastructure and the reporting of cyber incidents are creating strong demand for automated platforms that can meet rigorous documentation and timeline requirements. The cost of non-compliance is the primary motivator for investments in offerings that provide audit trails and highly capable reporting. In January 2025, the U.S. General Services Administration initiated initiatives to help agencies implement policy-based measures that enhance the resiliency of government systems, including Federal Risk and Authorization Management Program modernization. This is a reflection of increasing emphasis on regulatory-led security enhancements. The outcome is higher adoption of intelligence tools among regulated industries.

- Cloud security transformation and multi-cloud intelligence requirements: The global shift to multi-cloud and cloud computing is fueling demand for standalone threat intelligence solutions that can monitor distributed and hybrid infrastructures. As workloads are shifted to AWS, Microsoft Azure, and other platforms, companies require intelligent platforms that provide homogeneous visibility and threat identification across their respective environments. Cloud-based offerings bring scalability, pricing, and real-time capability without the requirement for huge on-premise infrastructure. This is significant in addressing cloud-vendor-specific threats, such as container compromise and misconfiguration. In April 2025, CrowdStrike Holdings, Inc. unveiled Falcon Data Protection innovations to deliver converged data protection on endpoints, cloud, GenAI, and SaaS environments. This technology is indicative of the market's focus on end-to-end cloud security. Lastly, it also empowers firms to defend their digital transformations more effectively.

Emerging Threats and Corresponding CTI Demand (2025)

|

Threat Category |

CTI Market Impact & Organizational Response |

|

Supply Chain Vulnerabilities |

54% of large organizations now invest in third-party risk intelligence and supply chain monitoring solutions |

|

Geopolitical Cyber Operations |

60% of organizations allocate budget to geopolitical threat intelligence and nation-state actor monitoring |

|

AI Security Gaps |

Significant growth in demand for AI model vulnerability assessments and adversarial AI threat intelligence |

|

Generative AI-Enhanced Attacks |

42% of organizations prioritize AI-driven threat hunting and phishing detection intelligence platforms |

|

Regulatory Fragmentation |

76% of CISOs seek compliance-focused threat intelligence and cross-jurisdictional regulatory alignment services |

|

Cybersecurity Talent Shortage |

8% skills gap increase drives adoption of managed threat intelligence and automated CTI platforms |

Source: WEF

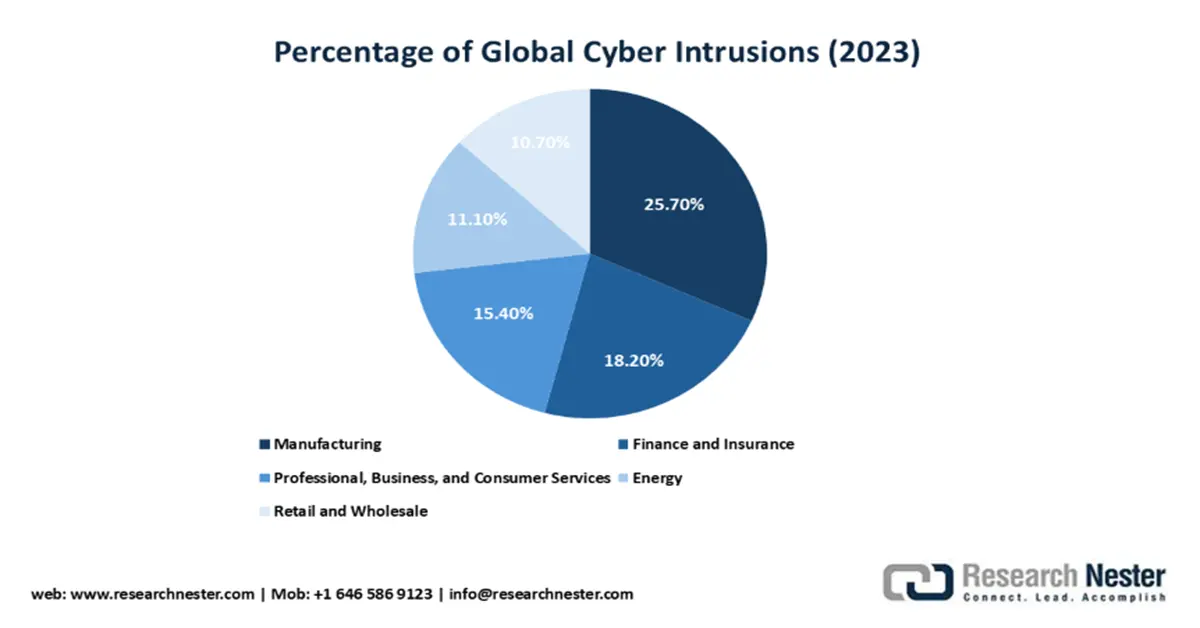

Global Cyber Intrusion Rates by Sector (2023)

This data reveals the prime targets for cyber threats, with Manufacturing (25.7%) and Finance & Insurance (18.2%) facing the highest intrusion rates, underscoring the critical need for specialized Cyber Threat Intelligence (CTI) in these sectors. CTI providers must prioritize delivering tailored intelligence feeds, real-time threat alerts, and sector-specific adversarial tactics to help these industries fortify their defenses.

Source: Homeland Security Committee

Challenges

- Threat intelligence overload and information processing complexity: Organizations are grappling with an excess of threat intelligence information from numerous sources, resulting in daunting challenges for sifting through actionable intelligence from noise and preventing analyst alert fatigue. Ironically, information overload decreases security effectiveness by inundating teams with unfiltered data that demands high levels of manual validation. Organizations are not equipped with the skilled professionals needed to analyze and put into context such diverse intelligence feeds, thereby deriving meaningful insights pertinent to their respective risk profiles. The Government of India had identified over 2 million cybersecurity events in 2024, a sudden spike over the previous year, indicating the growing volume of data to be processed by security teams. This statistic reflects the growing sophistication of threat data processing in the field. Therefore, it is likely to result in operational inefficiencies and delayed reaction to threats.

- Manpower shortage and skills gap in threat intelligence: The cyber security industry continues to face a critical shortage of qualified threat intelligence researchers and analysts who can interpret complex threat data and make effective security recommendations. Organizations struggle to hire and retain individuals with advanced specialized skills in malware reverse engineering, threat attribution, and advanced persistent threat investigation. The rapid development of cyber threats requires ongoing training that many organizations cannot afford to provide, further exacerbating the workforce shortage. In August 2025, the U.S. National Initiative for Cybersecurity Education (NICE) enhanced its Workforce Framework for Cybersecurity to assist employers with filling critical skills gaps in cyber defense operations and cyber threat intelligence. It determines the persistent problem of talent deficiency within the sector. Hence, it acts as a hindrance to organizations' ability to maintain robust security stances.

Cyber Threat Intelligence Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

13.5% |

|

Base Year Market Size (2025) |

USD 9.3 billion |

|

Forecast Year Market Size (2035) |

USD 32.9 billion |

|

Regional Scope |

|

Cyber Threat Intelligence Market Segmentation:

Component Segment Analysis

The solutions segment is projected to maintain a dominant 56.3% market share during the forecast period. This growth is being driven by the demand for comprehensive platforms that offer integrated capabilities for data gathering, analysis, and response automation. Organizations are seeking to move toward end-to-end solutions, such as threat hunting, incident response, and strategic analysis, rather than isolated point products that require integration. Solution providers are offering converged platforms with advanced analytics and machine learning to simplify security operations. In April 2025, Cisco Systems, Inc. bought SnapAttack to enhance SIEM feed lifecycle management and spearhead the boost in advanced threat intelligence capabilities through AI integration. The acquisition further reinforces the segment's focus on integrated, innovative security solutions.

Deployment Segment Analysis

The on-premises segment is expected to hold a 54.5% market share by 2035, due to the need for complete control of data and data compliance with regulations in especially sensitive sectors. On-premises deployments are favored by applications such as government, finance, and healthcare to retain end-to-end control of threat intelligence data and comply with data sovereignty laws. Schneider Electric launched a Managed Security Services (MSS) solution for operational technology environments in August 2023, a vendor-neutral solution that coexists with existing IT/OT infrastructure while providing 24/7 monitoring. This launch reinforces the segment's popularity for governed, customized environments. It ensures robust protection for high-risk operations. The on-premises deployments support extensive customization and seamless integration with dominant legacy security infrastructures, providing organizations with end-to-end visibility into their intelligence processing.

Threat Intelligence Type Segment Analysis

The strategic intelligence segment is projected to hold a 36% market share by 2035, meeting organizational needs for high-level threat landscape analysis and long-term security planning. Such intelligence provides an in-depth analysis of threat actor capabilities and motivation, enabling executive leadership to make informed security investment and risk management decisions based on facts. This supports strategic planning by ensuring context-led analysis of threat trends and emerging challenges, which helps shape the business strategy. In April 2025, the UK Government published the Cyber Security and Resilience Bill to protect the providers of critical services, an act of strategic intent to address threats amounting to billions every year to the national economy. The announcement highlights the sector's role at the highest level of policy and planning. It enables security to support broader organizational goals.

Our in-depth analysis of the cyber threat intelligence market includes the following segments:

|

Segment |

Subsegments |

|

Component |

|

|

Deployment |

|

|

Threat Intelligence Type |

|

|

Organization Size |

|

|

End user Industry |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Cyber Threat Intelligence Market - Regional Analysis

North America Market Insights

North America is anticipated to maintain a 38.5% market share throughout the forecast period, propelled by its high-threat environment and well-established cybersecurity ecosystem. The region is among top targets for nation-states and cybercrime groups, compelling both public and private sectors to invest heavily in safe threat intelligence capabilities. North America is home to leading cybersecurity companies and innovation hubs, generating a high-intensity environment for the development and application of advanced threat detection technology.

The U.S. is one of the largest markets, driven by extensive critical infrastructure and a broad regulatory environment that requires strong cybersecurity controls. Organizations within the U.S., particularly in the defense, finance, and technology sectors, are constantly faced with sophisticated threats from sophisticated adversaries, which require advanced threat intelligence to protect against and strategize effectively. Federal agencies, such as the CISA and NSA, have established large threat intelligence sharing programs with private industry partners. In January 2025, the U.S. Cyber Threat Intelligence Integration Center (CTIIC) began coordinating cross-community efforts to counter cyber threats by providing timely, actionable intelligence to critical infrastructure providers through classified briefings. Such a program enhances national security coordination and response capability, driving market growth.

Canada cyber threat intelligence market is expanding robustly, owing to government cybersecurity initiatives and increasing private sector investment. Canadian businesses in key sectors, including energy and finance, are adopting end-to-end threat intelligence solutions to guard against state-sponsored and criminal attacks. The government launched a national cybersecurity strategy with emphasis on public-private partnerships and international alliances to provide an assured cyberspace. Accenture acquired IAMConcepts in September 2025 in order to enhance its cybersecurity presence in Canada and improve its identity security services, which is a reflection of the rising demand for specialized security services within the country. The acquisition supports Canada's push toward more digital protection.

APAC Market Insights

Asia Pacific cyber threat intelligence market is expected to register a CAGR of 14.5% through 2035, driven by accelerated digitalization and huge investments in next-generation security technologies. The region's dynamic and diversified economic growth has created an increasing attack surface, necessitating advanced threat intelligence solutions to address evolving threats. APAC governments are implementing comprehensive cybersecurity strategies and regulatory measures, driving intelligence requirements in both the private and public sectors. For example, Palo Alto Networks, Inc. transitioned its IoT Security subscription to a comprehensive Device Security solution in August 2025, providing enhanced visibility and risk identification for all managed and unmanaged devices, a fitting move for the region's expanding digital landscape. This shift helps safeguard connected devices in APAC's emerging tech environment.

China cyber threat intelligence sector is rising, attributed to state-led cybersecurity policies and the rapid expansion of its digital economy. Cybersecurity has been prioritized as a national security interest by China government, and as such, it has invested heavily in indigenous threat intelligence services and advanced security infrastructure. In May 2025, China's National Data Administration accelerated its pace of digital transformation, with an emphasis on cybersecurity and data security as prerequisites for the development of the data industry. This includes promoting the application of digital security and artificial intelligence technologies to enterprises and expanding the establishment of digital infrastructure like 5G and the BeiDou Satellite Navigation System. These measures are making China an increasingly powerful region-level cybersecurity leader.

India is witnessing rapid growth in its market for cyber threat intelligence, due to digital transformation initiatives and increasing cybersecurity spending. India is facing increasing cyber threats to its national infrastructure, prompting the government to undertake large-scale programs for protecting its national infrastructure. In July 2025, the Government of India further secured its critical information infrastructure through the NCIIPC, which provides threat intelligence and vulnerability information to entities. The government also established a nationwide integrated system within the National Security Council Secretariat to facilitate coordination among agencies and create a secure and safe cyberspace for the nation. The system enhances India's overall cybersecurity standing and drives market growth.

Europe Market Insights

Europe cyber threat intelligence market is likely to record steady growth by 2035, backed by broad-reaching regulatory environments like GDPR and the NIS2 Directive. These regulations require robust threat intelligence capabilities, forcing organizations in the region to invest in advanced security technology to comply and protect sensitive data. The high priority of data protection and digital sovereignty on the continent is driving demand for intelligence platforms that can meet high data protection requirements.

The cyber threat intelligence market in Germany is driven by its advanced cybersecurity initiatives and the need to protect its critical infrastructure and world-class industrial base. German companies, particularly those in the manufacturing and finance industries, face persistent threats that require advanced intelligence solutions to combat industrial espionage and other sophisticated threats. In 2024, Germany's Federal Office for Information Security (BSI) continued to operate its 24/7 National IT Situation Center, producing detailed threat analyses and combining operational measures through a Cyber Defense Center, which also engages federal police, intelligence agencies, and military units in a government effort. This activity supports coordinated and effective threat management nationwide.

UK cyber threat intelligence industry is experiencing robust growth with the support of advanced cybersecurity efforts and vast investments from the private sector as well as the government. UK organizations are facing a mix of sophisticated threats that need intensive intelligence solutions for protection and compliance with regulations. The state is actively shaping the security environment with new frameworks to counter new technologies and attendant threats. In January 2025, the UK Government announced a voluntary Code of Practice on the Cyber Security of AI, which provides minimum standards for security across the entire lifecycle of an AI system and aims to create a world standard for AI security.

Key Cyber Threat Intelligence Market Players:

- IBM Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- CrowdStrike Holdings, Inc.

- Palo Alto Networks, Inc.

- Cisco Systems, Inc.

- Check Point Software Technologies Ltd.

- FireEye, Inc. (Mandiant)

- Fortinet, Inc.

- Recorded Future

- Symantec Corporation (Broadcom)

- McAfee Corp.

- Sophos Group plc

- Samsung SDS Co., Ltd.

- Trend Micro Incorporated

- NEC Corporation

- Fujitsu Limited

The cyber threat intelligence market is dominated by aggressive competition from established cybersecurity leaders and the leading-edge tech companies. The market is led by IBM Corporation, CrowdStrike Holdings, Inc., Palo Alto Networks, Inc., Cisco Systems, Inc., and Check Point Software Technologies Ltd. They lead the market with leadership in advanced platform capabilities and extensive service offerings. They differentiate themselves from the competition with niche expertise in threat hunting, malware research, and industry-specific intelligence.

Strategic acquisitions continue to reshape the competitive landscape as leading companies acquire specialist providers to enhance their power and expand their marketplace footprint. This trend toward consolidation reflects the strategic appeal of consolidated threat intelligence in the broader cybersecurity sector. A pioneering example of this was witnessed in March 2025, when Alphabet (Google) announced its acquisition of Wiz, a cloud security platform, for USD 32 billion. This historic deal, the largest in cybersecurity to date, will significantly enhance Google's cloud security features and accelerate its competition with other major cloud players, including Microsoft and Amazon. Such developments are a demonstration of the ongoing drive for end-to-end, cloud-based intelligence solutions.

Here are some leading companies in the cyber threat intelligence market:

Recent Developments

- In August 2025, IBM Corporation launched IBM watsonx Orchestrate with new Agent Observability and Governance capabilities designed to streamline AI agent management and enhance performance across cybersecurity operations. The platform provides comprehensive oversight of AI-powered security agents while enabling automated threat detection and response workflows.

- In April 2025, Fortinet, Inc. announced significant FortiAI innovations embedded across the Fortinet Security Fabric platform to enhance protection against new and emerging threats, simplify and automate security and network operations, and secure employee use of AI-enabled services. The platform integrates advanced analytics, behavioral detection, and automated threat correlation while offering proactive intelligence-driven security guidance.

- In April 2025, Palo Alto Networks, Inc. announced the launch of Cortex XSIAM 3.0, an enhanced version of its leading SecOps platform. This latest iteration introduces proactive exposure management and advanced email security, allowing clients to further integrate their security operations with Cortex for improved efficiency, speed, and cost-effectiveness.

- Report ID: 8131

- Published Date: Sep 26, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Cyber Threat Intelligence Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.