Customized Avionic Systems Market Outlook:

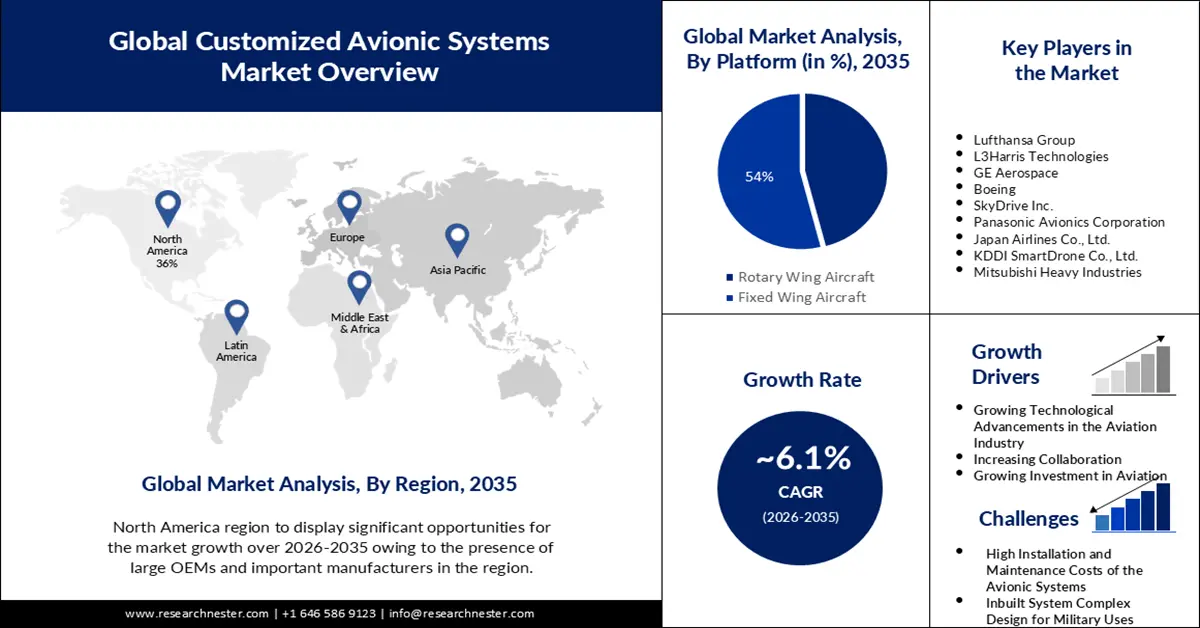

Customized Avionic Systems Market size was valued at USD 7.03 billion in 2025 and is expected to reach USD 12.71 billion by 2035, registering around 6.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of customized avionic systems is evaluated at USD 7.42 billion.

The growing requirement for real-time data, in-flight entertainment services, growing aircraft deliveries, and the expansion of new nations are all contributing to the growth of the customized avionics system market. As per a report, while European rival Airbus (AIR.PA), opens a new tab, continued to be the top planemaker for the sixth consecutive year, Boeing (BA. N), opened a new tab to fulfill its goals for the delivery of jetliners and saw 70% increase in net orders in 2023, indicating robust demand for aircraft and air travel. The growth of aircraft manufacturers, who are now able to offer a greater variety of aircraft with advancements like bit-screen panel area units and upgraded GPS systems, is another factor driving the industry.

The aviation industry's growing concerns about operational effectiveness, economic & environmental performance, aircraft safety & security, and passenger comfort are driving the market for customized avionic systems. Furthermore, the employment of avionic systems in military and high-tech aircraft will support customized avionic systems market expansion and raise demand.

Key Customized Avionic Systems Market Insights Summary:

Regional Highlights:

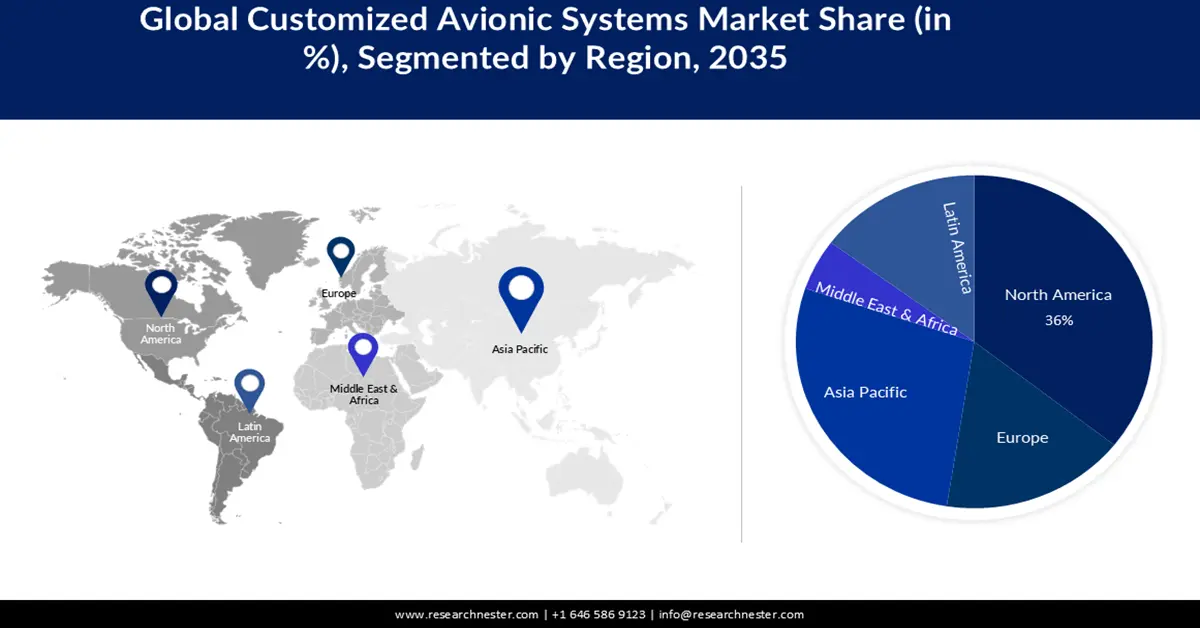

- North America customized avionic systems market will dominate more than 36% share by 2035, driven by the presence of large OEMs and important manufacturers in the region.

- Asia Pacific market will secure 28% share by 2035, fueled by increasing deliveries of commercial aircraft in the region.

Segment Insights:

- The fixed wing aircraft segment in the customized avionic systems market is expected to achieve a 54% share by 2035, driven by the growing need for commercial aircraft to carry passengers globally.

Key Growth Trends:

- Growing Technological Advancements in the Aviation Industry

- Increasing Collaboration between Avionics Manufacturers and Aviation Service Providers

Major Challenges:

- Growing Technological Advancements in the Aviation Industry

- Increasing Collaboration between Avionics Manufacturers and Aviation Service Providers

Key Players: Indra Company, Lufthansa Group, L3Harris Technologies, GE Aerospace, Boeing, SkyDrive Inc., Panasonic Avionics Corporation, Japan Airlines Co., Ltd., KDDI SmartDrone Co., Ltd., Mitsubishi Heavy Industries.

Global Customized Avionic Systems Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 7.03 billion

- 2026 Market Size: USD 7.42 billion

- Projected Market Size: USD 12.71 billion by 2035

- Growth Forecasts: 6.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (36% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, France, Japan

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 16 September, 2025

Customized Avionic Systems Market Growth Drivers and Challenges:

Growth Drivers

- Growing Technological Advancements in the Aviation Industry - Developments in technology have a significant effect on the need for commercial avionics systems. The growth of the market was aided by advancements in health monitoring systems and in-flight entertainment. The aviation industry's increasing need for data analytics is the main factor propelling the customized avionic systems market growth. Quick data processing leads to cost-effective decision-making, which is made possible by real-time data analytics. Future generations of pilot/vehicle interfaces are anticipated to have features including voice-activated automated system interactions, graphical presentations of the aircraft's flying state, and physical control manipulator enhancements. Furthermore, as the aviation sector grows, major businesses are competing with one another to maintain their market position by offering innovative technologies. This is projected to propel the market for customized avionic systems.

- Increasing Collaboration between Avionics Manufacturers and Aviation Service Providers - Given the breadth of capabilities covered by the avionics retrofits, they may operate similarly to factory fitments installed on newer aircraft models. In order to extend the lifespan of the avionics, boost the value of existing assets, and enhance overall aircraft performance, many airline operators consider retrofit options. Consequently, leading avionics manufacturers are working with aviation service providers to integrate and implement systems that could meet the demand for avionics that are more advancek and meet the needs of future models.

- Growing Investment in Aviation Security Systems by the Government - The defense agency was forced by many branches of government to increase the amount of money it invested in security-related technologies, especially in the form of upgraded special-purpose aircraft. Military and special mission aircraft are equipped with modern RADAR, many safety sensors, and image sensors to alert the pilot. The government's regulations pertaining to security and the maximum level of expenditure in the military sector will therefore provide future growth prospects for the customized avionic systems market. For instance, the global geopolitical landscape has and probably will continue to propel defense budget increases. For the fiscal year 2024, the US Department of Defence has sought a budget of USD 842 billion, which is a 3.2% increase over the fiscal year 2023 at the enacted base level.

Challenges

- High Installation and Maintenance Costs of the Avionic Systems – As lightweight components and subsystems continue to evolve, continuing technological disruptions force systems to be replaced too soon to meet new standards. For example, within 15 years, CRT technology was replaced by LCD and then by LED to keep up with evolving trends and reduce weight significantly without sacrificing feature sets. As a result, operators had to pay hefty replacement expenses to make sure their fleet was updated per international standards and allowed to operate everywhere. Thus, this factor may hinder the expansion of the customized avionic systems market.

- Inbuilt System Complex Design for Military Uses may Hinder the Market Growth

- Limited Replacement Cycles may Impede the Growth of Customized Avionic Systems Market

Customized Avionic Systems Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.1% |

|

Base Year Market Size (2025) |

USD 7.03 billion |

|

Forecast Year Market Size (2035) |

USD 12.71 billion |

|

Regional Scope |

|

Customized Avionic Systems Market Segmentation:

Platform Segment Analysis

Fixed wing aircraft for customized avionic systems market is expected to hold the largest share of 54% by the end of 2035. The growing need for commercial aircraft to carry passengers on international flights has led to a greater share held by the fixed wing aircraft category. Because more and more people are choosing to travel by air, industrialized nations like the US, Canada, and the UK have seen a notable growth in air traffic in recent years. For instance, in North America International passenger traffic surged by 117.2% in 2022, while overall passenger traffic increased by 33.3%. As a result, there is a steady increase in demand for aircraft, especially from airlines operating in emerging nations. Regular maintenance and repair operations are necessary due to the increasing number of aircraft in the commercial and defense sectors. Improvements in aerodynamics, materials, and avionics systems have also resulted in improved safety features, improved performance, and longer range. Therefore, all these factors are propelling the growth of fixed wing aircraft segment.

Application Segment Analysis

The military aircraft segment in the customized avionic systems market is expected to hold a share of 37% during the forecast period. Over the course of the projected period, rising military spending around the globe is anticipated to fuel market expansion for military aircraft worldwide. Due to the constantly shifting international strategic landscape, increasing levels of unilateralism, hegemony, and power politics are undermining the structure of international security systems, which has resulted in numerous ongoing conflicts worldwide. As a result, military spending is rising globally to enhance national security. By acquiring new-generation military aircraft, many nations are concentrating on modernizing and growing their fleets of aircraft. These nations are becoming more proficient in fighting and aerial support due to their increasing technological advancements.

Our in-depth analysis of the global customized avionic systems market includes the following segments:

|

Sub-segment Types |

|

|

Platform |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Customized Avionic Systems Market Regional Analysis:

North American Market Insights

North America industry is expected to dominate majority revenue share of 36% by 2035, due to presence of large OEMs and important manufacturers in the region. The United States of America, which possesses one of the largest fleets of both commercial and military aircraft worldwide, is a major factor contributing to its significant proportion of the North American avionic system industry. The country's need for avionic systems is mostly driven by the presence of large OEMs and important manufacturers. In addition, the region is seeing a sharp increase in the use of UAVs for non-military objectives. For instance, at present, the value of commercial UAV production for mini-UAVs is 58.4 million US dollars. Because of these considerations, the North American region holds a dominant stake in the worldwide market for customized avionic systems.

APAC Market Insights

The customized avionic systems market in the Asia Pacific is expected to hold the second-largest share of 28% during the foreseen period. The market expansion is mostly attributable to the Asia Pacific region's increasing deliveries of commercial aircraft. This is due to the region's growing number of major aircraft original manufacturers as well as the fleet's expansion to accommodate the region's rising passenger volume. As per a report, Asia Pacific airlines experienced a dramatic comeback in H1 2023, with passenger volume rising by 125.5% over 2022 levels. The reopening of China, the largest passenger industry in the region, and the gradual resumption of foreign travel throughout the previous year were the main drivers of this resurgence. Furthermore, due to its immense size, China essentially exists as a separate entity inside the enormous Asia-Pacific region. Therefore, these factors are propelling the growth of the market in the region.

Customized Avionic Systems Market Players:

- Indra Company

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Lufthansa Group

- L3Harris Technologies

- GE Aerospace

- Boeing

Recent Developments

- January 2024 - Indra is a primary technology partner of Skyguide, a Swiss air navigation service provider, guaranteeing safe and effective operations of airports and air traffic. Following the positive outcomes at Zurich, where the Advanced Runway Safety Improvement (ARSI) solution has increased safety since its deployment in 2019, the firms have recently finished implementing the system at Geneva Airport. By automatically identifying when air traffic control issues conflicting clearances or when a pilot disobeys instructions, the ARSI technology increases runway safety. The air traffic controller automatically receives an electronic warning in the event of conflicting clearances or non-conformance, giving them extra time to respond and avert potentially dangerous circumstances. After applying the solution, Indra and Skyguide received the 2019 Jane's ATC Award.

- June 2023 - Optimizing a flight path lowers CO2 emissions and fuel consumption, the Lufthansa Group hopes to significantly enhance airspace management in Europe, reduce needless detours, and fly more sustainably with the standard installation of a new, cutting-edge system for conveying flight profile information in its new A320neo/A321neo aircraft. More than 65 Airbus A320neo/A321neo aircraft are on order with the Lufthansa Group, and they will be fitted with the new ADS-C EPP (Automatic Dependent Surveillance - Contract Extended Projected Profile) flight profile information technology as early as 2024.

- Report ID: 5608

- Published Date: Sep 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Customized Avionic Systems Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.