Current Sensor Market Outlook:

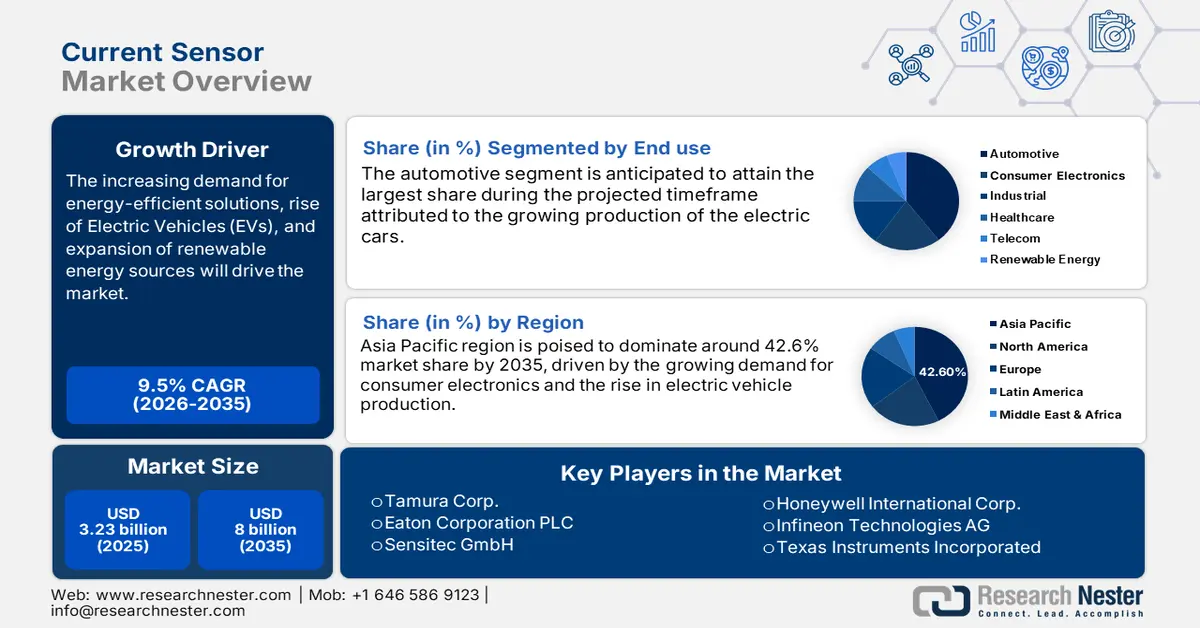

Current Sensor Market size was over USD 3.23 billion in 2025 and is projected to reach USD 8 billion by 2035, growing at around 9.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of current sensor is evaluated at USD 3.51 billion.

The growth of the market can be attributed to the growing demand for consumer electronics which includes smartphones, tablets, TVs, and more. In 2022, it was predicted that consumers would spend about USD 500 billion on electronics across the globe. All these electronic products are deployed with sensors. Hence, owing to the growing adoption of these products, the adoption of the current sensor is also estimated to boost.

Moreover, the global market for current sensor is expected to expand significantly as a result of considerable technological developments in the semiconductor and communications industries. Current sensors, which generate a signal that is proportional to the current that is flowing through the wire, are able to detect electric current in a wire. Modern sensor development has led to a decrease in sensor size, which simultaneously increases cost-effectiveness, efficiency, and compatibility. Additionally, their adoption is also growing in industries such as aerospace, agriculture, and medical. Further, sensors are used in automobiles to control the motor drive, the direct current conversion control of the motor's regeneration current, and the detection of the charged and discharged currents of the batteries in electric and hybrid vehicles, all of which are crucial components of control.

Key Current Sensor Market Insights Summary:

Regional Highlights:

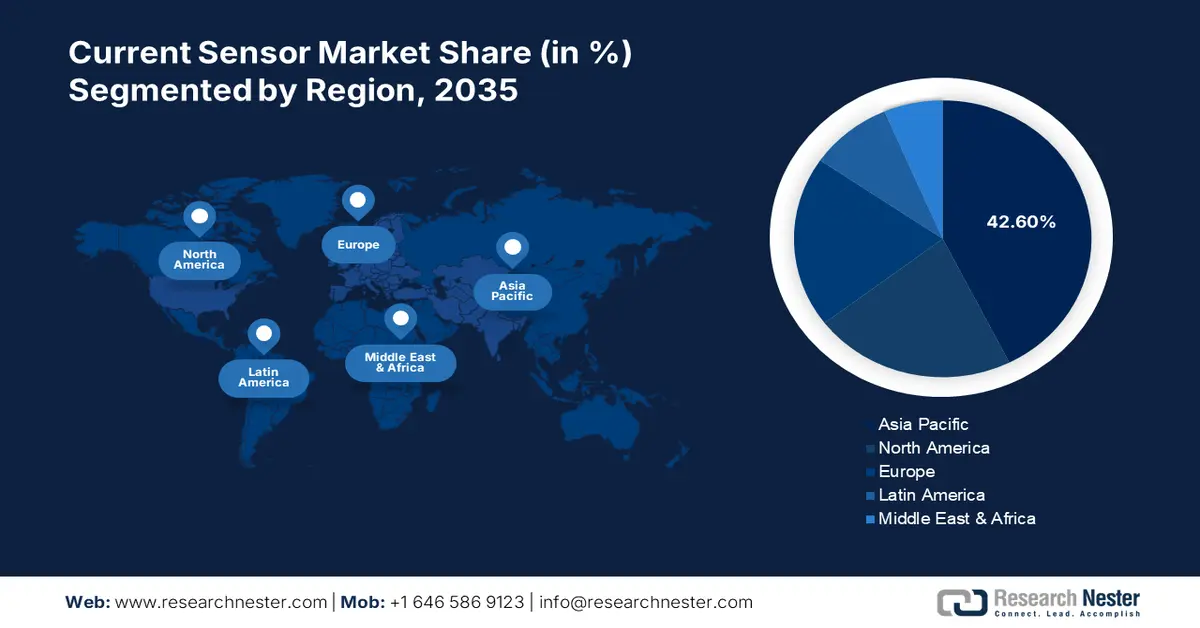

- Asia Pacific current sensor market will dominate more than 42.6% share by 2035, driven by the growing demand for consumer electronics and the rise in electric vehicle production.

- North America market records the highest CAGR during 2026-2035, attributed to the rising adoption of industrial robots and increasing government initiatives for solar power.

Segment Insights:

- The automotive segment in the current sensor market is expected to hold the largest share by 2035, driven by the growing production of electric cars.

- The motor drive application segment in the current sensor market is projected to exhibit significant growth over 2026-2035, influenced by growing industrial use and focus on energy reduction and carbon footprint.

Key Growth Trends:

- Rise in Need for Renewable Energy

- Growing Adoption of Electric Vehicles

Major Challenges:

- Inaccuracy for Different Temperature Ranges

- Availability of Substitutes

Key Players: Infineon Technologies AG, Honeywell International Inc., Texas Instruments Incorporated, Allegro Micro Systems, Inc., Tamura Corp., TDK Corporation, LEM International SA, Pulse Electronics, Eaton Corporation PLC, Sensitec GmbH.

Global Current Sensor Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.23 billion

- 2026 Market Size: USD 3.51 billion

- Projected Market Size: USD 8 billion by 2035

- Growth Forecasts: 9.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (42.6% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, South Korea

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 10 September, 2025

Current Sensor Market Growth Drivers and Challenges:

Growth Drivers

-

Rise in Need for Renewable Energy - Global renewable electricity capacity is anticipated to increase by more than 59% from 2020 levels to over 4799 GW by 2026, which is equal to the present total world capacity of nuclear and fossil fuels put together. Through 2026, the expansion in the world's electricity capacity is expected to come from renewable sources virtually exclusively— solar PV would provide more than half. This growing demand for renewable energy can be attributed to rising people awareness regarding growing pollution and rising government initiatives, further also boosting the market growth. Grid-tied systems require current sensors to manage the converters and inverters, optimize the extraction of energy from solar panels, and detect faults for safety. Hence the growing need for renewable energy is estimated to boost the market growth.

-

Growing Adoption of Electric Vehicles - Despite supply chain snags and the ongoing Covid-19 epidemic, electric car sales hit a new high in 2021. Sales nearly doubled to about 5 million around the world, representing a sales share of approximately 8%, compared to 2020, increasing the total number of electric vehicles on the road to about 15 million.

-

Surge in Electric Power Station - The quantity of charging stations increased by over a factor of two between 2015 and 2020. More than 55% more charging stations were added in 2021 alone in the United States.

-

Growth in Telecom Industry - In 2021, in India, there was estimated to be about 659,000 mobile towers, up from approximately 390,000 in 2014. According to this, the number of mobile base transceiver stations has climbed quickly, rising from about 790,000 in 2014 to approximately 3 Million in 2021, an increase of 187%. From about 43% in March 2014 to approximately 57% in October 2022, rural teledensity increases.

-

Upsurge in Adoption in Laptops - About 276 million laptops are anticipated to be shipped in 2021, together with almost approximately 159 million tablet computers, worldwide.

Challenges

-

Growing Pricing Pressure Which Has Resulted into Decline in Average Selling Price - Despite the fact that more and more current sensors are being used in automated cars, telecommunication equipment, consumer electronics, and healthcare devices, price erosion has severely slowed the rise of sales. The fierce competition among the growing number of sensor manufacturers contributes to some of this. While the drop in ASP is good for consumers, it causes suppliers' profit margins to contract. As a result of the extreme pricing pressure, the average selling price (ASP) declines, which inhibits revenue growth in the fiercely competitive current sensor market.

-

Inaccuracy for Different Temperature Ranges

- Availability of Substitutes

Current Sensor Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

9.5% |

|

Base Year Market Size (2025) |

USD 3.23 billion |

|

Forecast Year Market Size (2035) |

USD 8 billion |

|

Regional Scope |

|

Current Sensor Market Segmentation:

End-Use Segment Analysis

The global current sensor market is segmented and analyzed for demand and supply by end-use into automotive, consumer electronics, industrial, healthcare, telecom, and renewable energy. Out of which, the automotive segment is anticipated to hold the largest market share over the forecast period. The growth of the segment can be attributed to growing production of electric cars. In the US alone, companies produced 442,000 electric automobiles in 2022. The hybrid electric vehicle (HEV), which is swiftly overtaking all other green vehicles in popularity, uses sophisticated electronic circuitry to regulate the flow of electricity throughout the vehicle. With a single-motor HEV, the motor functions as either a drive motor that runs in parallel with the internal combustion engine or as a generator that powers the regenerative braking system and charges the battery. A typical HEV has a number of electrical systems, such as those for an AC motor and a DC-DC converter, that need electrical current sensors to operate as efficiently as possible.

Application Segment Analysis

The global current sensor market is also segmented and analyzed for demand and supply by application into motor drive, converter & inverter, battery management, uninterrupted power supply, and grid infrastructure. Amongst these segments, the motor drive segment is anticipated to have a significant growth in the market over the forecast period, backed by its growing use in industries. A motor drive regulates a motor's output horsepower as well as its speed, torque, and direction. A shunt-wound dc motor with distinct armature and field circuits is often controlled by dc drives. Similar to their dc counterparts, ac drives regulate the speed, torque, and horsepower of ac induction motors. However, to insure smooth functioning of these processes the demand for current sensor is growing. The motor's current is precisely detected by the current sensor, enabling flawless synchronization and orientation control. Moreover, there has been growing focus on reducing the usage of energy and reducing the carbon footprint which would also drive the growth of the market.

Our in-depth analysis of the global current sensor market includes the following segments:

|

By Type |

|

|

By Technology |

|

|

By Application |

|

|

By End-Use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Current Sensor Market Regional Analysis:

Asia Pacific region is poised to dominate around 42.6% market share by 2035, driven by the growing demand for consumer electronics and the rise in electric vehicle production. Moreover, in 2021, the manufacturing of electric vehicles in Asia-Pacific had double-digit YoY growth, reaching 122,243 units. Asia Pacific nations' growing environmental consciousness and worries about green energy have prompted manufacturers of power electronics applications to continuously create new products to boost efficiency. Moreover, high efficiency power inverters are needed for grid-tied renewable energy systems and photovoltaic (PV) systems, expanding the market for current sensors in APAC. Additionally, growing government attempts to use renewable energy sources for electricity generation would accelerate market expansion.

The North America current sensor market, amongst the market in all the other regions, is projected to grow with the highest CAGR during the forecast period. The growth of the market in this region can be attributed to rising use of industrial robots for efficient workflow management in numerous manufacturing facilities. A current sensor responds quickly and accurately to detect overload current and phase control in a variety of industrial machines. To keep track of the voltage and current levels in microcontroller, industrial robots need current sensors. Hence growing adoption of robots is estimated to boost demand for current sensor. Moreover, increasing government attempts to hasten the region's use of solar power would increase market expansion prospects. Additionally, there has been growing trend of smart house in North America owing to which the adoption for electronic devices is growing. For the effective operation of batteries and current/voltage variations, different electronic devices such as HVAC control, portable electronics, lighting control, and infotainment systems require current sensors. Hence this factor is also estimated to boost the growth of the market in this region.

Additionally, the market in Europe region is also estimated to have a significant growth over the forecast period, backed by increasing government financing and attempts to encourage the use of electric vehicles and preserve the environment. These electric vehicles need a variety of powertrain subsystems, including inverters, battery management systems, and onboard chargers, which need current sensors to improve motor performance, bandwidth, and low noise & reaction time. Hence, growing adoption of electric vehicle is estimated to boost the growth of the market in this region. Moreover, the adoption of industries robot is also growing which would influence the growth of the market.

Current Sensor Market Players:

- Infineon Technologies AG

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Honeywell International Inc.

- Texas Instruments Incorporated

- Allegro Micro Systems, Inc.

- Tamura Corp.

- TDK Corporation

- LEM International SA

- Pulse Electronics

- Eaton Corporation PLC

- Sensitec GmbH

Recent Developments

-

The first industry-wide zero-drift Hall-effect current sensors were released by Texas Instruments Incorporated. The TMCS1100 and TMCS1101 provide stable 3-kVrms isolation and enable the lowest drift and maximum accuracy across time and temperature, which is crucial for AC or DC high-voltage systems such industrial motor drives, solar inverters, energy-storage devices, and power supplies.

-

The alliance between Trusted Positioning Inc. (TPI), a TDK Group Company and a market leader in inertial navigation software, and Uhnder, a market pioneer in digital radar technology, was announced by TDK Corporation. With the help of the software defined digital radar sensor from Uhnder and the AUTO positioning software from TPI, the two companies has collaborated to create a localization reference design with unmatched accuracy and performance.

- Report ID: 4737

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Current Sensor Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.