Cryptocurrency Payment Apps Market Outlook:

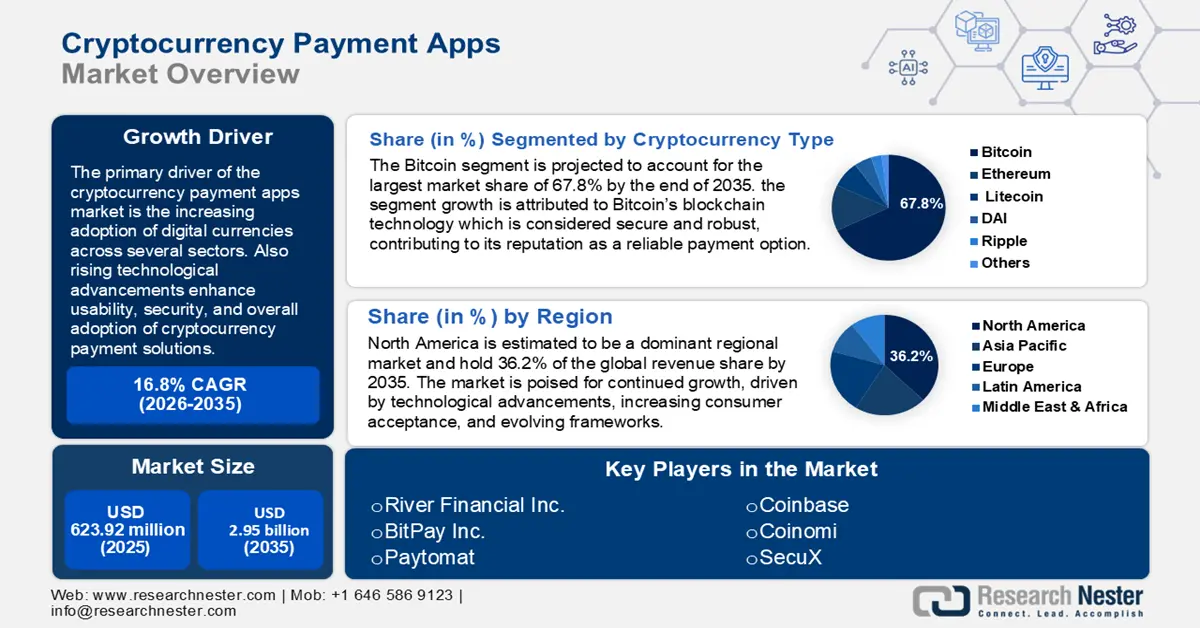

Cryptocurrency Payment Apps Market size was valued at USD 623.92 million in 2025 and is set to exceed USD 2.95 billion by 2035, registering over 16.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of cryptocurrency payment apps is estimated at USD 718.26 million.

The primary driver of the cryptocurrency payment apps market is the increasing adoption of digital currencies across several sectors. For instance, according to the Atlantic Council of United States as of September 2024, 134 countries and currency unions, representing 98% of global GDP, are exploring a Central Bank Digital Currency (CBDC).

Moreover, rising technological advancements enhance usability, security, and overall adoption of cryptocurrency payment solutions. Innovations such as Layer 2 solutions (e.g., Lightning Network, Raiden Network, Plasma, and Optimistic Rollups) allow for simpler and quicker transactions, making cryptocurrencies more viable for everyday payments. Advances in cryptography and biometric security protect user data and assets, boosting confidence in using these apps. Also, better app design and user interfaces, along with features such as QR code scanning and one-click payments, make transactions easier and more intuitive for users.

Key Cryptocurrency Payment Apps Market Insights Summary:

Regional Highlights:

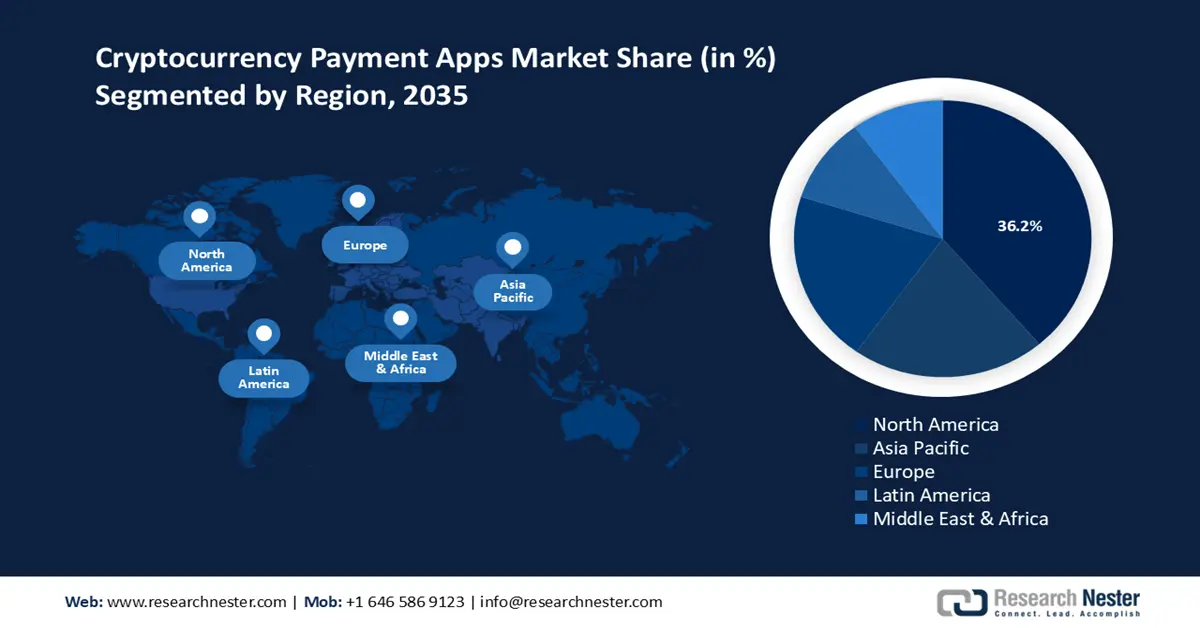

- North America leads the cryptocurrency payment apps market with a 36.2% share, driven by technological advancements fueling growth through 2026–2035.

Segment Insights:

- The In-store Payment Type segment is anticipated to rise significantly by 2035, propelled by growing acceptance in physical stores, reducing transaction times and enhancing legitimacy.

- Bitcoin segment is anticipated to dominate with over 67.8% market share by 2035, fueled by its strong brand, secure blockchain, and high adoption among users and businesses.

Key Growth Trends:

- Cross-border transactions

- Rising cryptocurrency investments

Major Challenges:

- Technical complexity

- Lack of awareness

- Key Players: Coinbase, BitPay Inc., Coinomi, Paytomat, SecuX, Circle Technology Services, LLC, and CoinJar.

Global Cryptocurrency Payment Apps Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 623.92 million

- 2026 Market Size: USD 718.26 million

- Projected Market Size: USD 2.95 billion by 2035

- Growth Forecasts: 16.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (36.2% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, South Korea, United Kingdom

- Emerging Countries: China, Japan, South Korea, Singapore, UAE

Last updated on : 14 August, 2025

Cryptocurrency Payment Apps Market Growth Drivers and Challenges:

Growth Drivers

- Cross-border transactions: Cryptocurrencies can lower fees associated with traditional banking methods and wire transfers, making international payments more affordable. Cryptocurrency transactions can be processed much faster than traditional cross-border payments, which often take several days. Also, unlike traditional banking systems that operate during business hours, cryptocurrencies allow for transactions anytime, anywhere, facilitating immediate payments across borders. In October 2024, Ripple partnered with Mercado Bitcoin to launch its novel crypto-powered payment solution in Brazil. Developments like these are expected to drive global cryptocurrency payment apps market growth going ahead.

The use of stablecoins offers a less volatile option for international payments, attracting businesses looking for stability in their transactions. For instance, BVNK's Cross-border Payment Solution the Global Settlement Network employs stablecoins to assist businesses in settling funds anywhere in the world and effortlessly trading between currencies. Moreover, one of the biggest fintech companies in the world, Stripe, allows merchants to pay out in cryptocurrency using the stablecoin USDC, which is issued by cryptocurrency startup Circle. - Rising cryptocurrency investments: Investments in cryptocurrencies boost cryptocurrency payment apps market liquidity making it easier for users to buy, sell, and transact using payment apps. Investments fuel the development of new features and technologies within payment apps, enhancing functionality and user experience. In a 2024 published report by the First Citizens Bank & Trust Company, large transactions such as Andreessen Horowitz's USD 100 million investments in re-staking platform EigenLayer have fueled increased activity and financing. In June, Paradigm unveiled a new USD 850 million dedicated crypto fund, the largest crypto-specific fund in two years.

- Collaboration between traditional payment providers and cryptocurrency technologies: Integration of crypto payment capabilities with traditional gateways makes it easier for businesses to accept cryptocurrencies alongside fiat currencies, fostering wider acceptance among merchants. For instance, according to Electronic Payments International in November 2021, PayCEC upgraded its payment gateway to accept cryptocurrency transactions, enabling merchants or providers to accept payments in different cryptocurrencies. Additionally, PayCEC is providing Single Euro Payments Area (SEPA) transfer acceptance, enabling quicker financial transfers within the Eurozone

Challenges

- Technical complexity: Many users find cryptocurrency transactions complicated due to the technical jargon and intricate processes involved in setting up wallets, managing private keys, and executing transactions. Moreover, apps that are not user-friendly or visually appealing can discourage users from engaging with the platform. Cluttered interfaces or poor navigation can complicate the payment process.

- Lack of awareness: Many merchants remain unaware of the benefits cryptocurrencies, leading to missed opportunities for increased sales and customer engagement. Common misconceptions about cryptocurrencies such as associating them solely with illicit activities can deter businesses from considering crypto payment options.

Cryptocurrency Payment Apps Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

16.8% |

|

Base Year Market Size (2025) |

USD 623.92 million |

|

Forecast Year Market Size (2035) |

USD 2.95 billion |

|

Regional Scope |

|

Cryptocurrency Payment Apps Market Segmentation:

Cryptocurrency Type (Bitcoin, Ethereum, Litecoin, DAI, Ripple, and others)

Bitcoin segment is projected to hold over 67.8% cryptocurrency payment apps market share by the end of 2035. Bitcoin has established a strong brand and recognition, making it the most well-known digital currency. Bitcoin’s blockchain technology is considered secure and robust, contributing to its reputation as a reliable payment option compared to other cryptocurrencies.

Accepting Bitcoin can drive tech-savvy consumers and those who prefer cryptocurrency for privacy or investment purposes. Bitcoin can be processed quickly, particularly across borders, compared to traditional banking methods, thus increasing its adoption among several businesses. Many enterprises in the U.S. are accepting Bitcoin as a form of payment, influenced by the growing interest in cryptocurrencies. For instance, around 15,200 businesses worldwide accept Bitcoin out of which 2,200 are located in the U.S. Microsoft is the largest U.S. Corporation to accept Bitcoin.

Payment Type (In-store, and Online)

The in-store segment in cryptocurrency payment apps market is estimated to rise at a significant CAGR throughout the forecast period. Several physical stores accept cryptocurrency and legitimize its use which encourages more consumers to explore digital payment options. Offering discounts or special promotions for cryptocurrency transactions can encourage usage, increasing overall transaction volumes. Moreover, cryptocurrency transactions can be quicker than traditional credit card processes, reducing wait times for customers.

Additionally, online payment type is also predicted to drive the cryptocurrency payment apps market. The segment growth is attributed to the rising prevalence of e-commerce platforms. Many online retailers are starting to accept cryptocurrency payments. Online firms such as airBaltic, Travala.com, Digital Gap Ltd, Raw Living Limited, and Amazon Technologies, Inc. all accept cryptocurrencies as payment options.

Online platforms that accept cryptocurrencies can attract tech-savvy consumers and investors, driving demand for cryptocurrency payment apps. For instance, in August 2022, Crypto.com, the world's fastest-growing cryptocurrency platform, has announced its latest cryptocurrency payment revolution, allowing local customers to utilize their cryptocurrency for everyday transactions. Customers with a Crypto.com wallet can purchase everyday items, such as petrol, coffee, and sandwiches, across 175 OTR fuel and convenience store sites across Victoria, South Australia, and Western Australia using their cryptocurrency by simply scanning a QR code on their phone with the Crypto.com App.

Our in-depth analysis of the cryptocurrency payment apps market includes the following segments

|

Cryptocurrency Type |

|

|

Payment Type |

|

|

Operating System |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Cryptocurrency Payment Apps Market Regional Analysis:

North America Market Forecast

North America industry is expected to hold largest revenue share of 36.2% by 2035. The cryptocurrency payment apps market is poised for continued growth, driven by technological advancements, increasing consumer acceptance, and evolving frameworks. Many businesses from small retailers to large corporations, are adopting cryptocurrency payment solutions, driven by consumer demand for diverse payment options.

The U.S. government and agencies such as the SEC and IRS provide guidelines for cryptocurrency usage, which fosters business confidence. A growing number of retailers, both online and offline are accepting cryptocurrencies as payment, reflecting rising consumer demand. It has been estimated that 13.5% of the U.S. population owns cryptocurrency. Moreover, there is a growing awareness about cryptocurrency among individuals, with a staggering 81.4% of people being aware in 2021 as compared to 69.4% in 2020.

Canada has established a relatively clear regulatory framework for cryptocurrencies, with the Financial Transactions and Reports Analysis Center of Canada (FINTRAC) overseeing compliance. This clarity helps businesses feel more secure in adopting crypto payment solutions. Additionally, the Canada Revenue Agency (CRA) has provided guidance on the taxation of cryptocurrency transactions, which further encourages businesses to accept crypto payments.

APAC Market Analysis

The cryptocurrency payment apps market in Asia Pacific is rapidly evolving, owing to diverse adoption rates and regulatory landscapes across countries. Countries such as India, China, Japan, South Korea, and Singapore have shown significant engagement in cryptocurrencies, with many consumers and businesses adopting digital currencies for transactions.

In India the cryptocurrency payment apps market is on growth trajectory, influenced by rising consumer interest. Around 7.1% population own cryptocurrency. Moreover, awareness campaigns, workshops, and online resources are educating consumers about cryptocurrencies and their benefits. Several cryptocurrency payment processors such as CoinSwitch and UnoCoin are providing solutions tailored for local businesses to accept cryptocurrencies easily.

The Government of China is heavily investing in blockchain technology, which could indirectly support the development of cryptocurrency-related applications and infrastructure. Moreover, the growth of e-commerce can also bring in opportunities for cryptocurrency payments.

Key Cryptocurrency Payment Apps Market Players:

- River Financial Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Coinbase

- BitPay Inc.

- Coinomi

- Paytomat

- SecuX

- Circle Technology Services, LLC

- CoinJar

- CPS Solutions OÜ

- Apirone OÜ

Key players invest in advanced technology to enhance app security, speed, and user experience, making transactions smoother and more reliable. Collaborating with retailers, e-commerce platforms, and financial organizations increases acceptance and usability of cryptocurrency payments.

Here are some key players in the market

Recent Developments

- In December 2023, River Financial Inc., a Bitcoin technology and financial services firm, has launched an application called River Link, which allows global Bitcoin payments through text messaging.

- In October 2023, BitPay Inc., a US-based provider of Bitcoin and cryptocurrency payment services, has collaborated with Banxa to extend crypto payment options. This alliance intends to provide crypto customers in various regions with more diverse payment options.

- Report ID: 6523

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Cryptocurrency Payment Apps Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.