Crypto ATM Market Outlook:

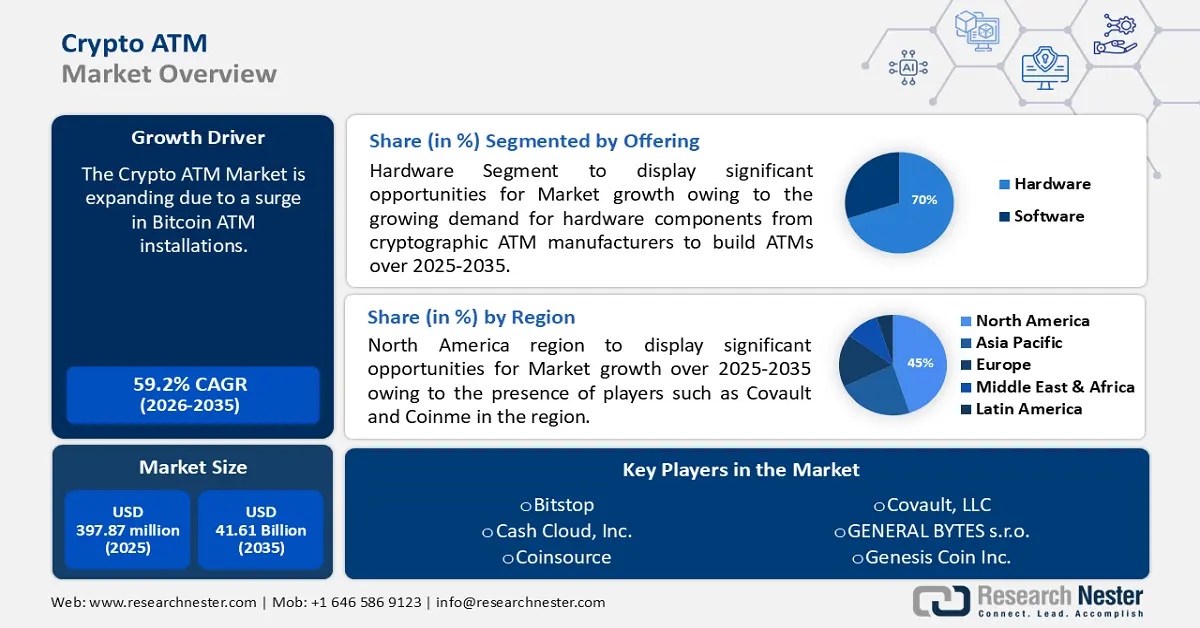

Crypto ATM Market size was over USD 397.87 million in 2025 and is projected to reach USD 41.61 billion by 2035, witnessing around 59.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of crypto ATM is evaluated at USD 609.86 million.

A surge in bitcoin ATM installations is what is augmenting the market expansion. Large R&D expenditures are being made by vendors to produce innovative goods and technologies. They are also expanding their footprint by introducing reasonably priced Bitcoin ATMs. For instance, globally, there were more than 32,000 Bitcoin ATMs as of January 1, 2024.

In addition, a factor that is believed to drive the market expansion of crypto ATMs is the rising popularity of ATMs that support several cryptocurrencies. ATMs for cryptocurrencies also facilitate transactions, allowing customers to obtain cash more quickly. Crypto ATMs are user-friendly and offer a straightforward, step-by-step procedure that makes it easy for consumers to complete transactions.

Key Crypto ATM Market Insights Summary:

Regional Highlights:

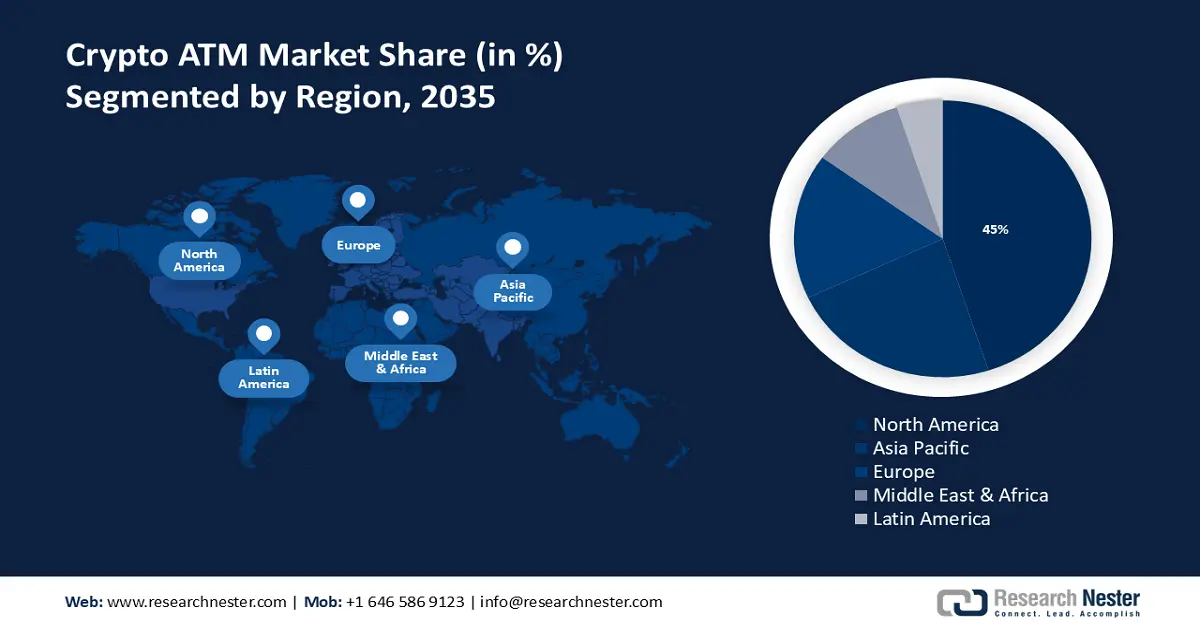

- North America crypto atm market will hold more than 45% share by 2035, driven by the presence of key players like Covault and Coinme and a large number of cryptocurrency owners in the United States.

- Asia Pacific market, with the second largest share by 2035, is propelled by increasing smartphone penetration and the growing popularity of Bitcoin ETFs and cryptocurrency investments in tier-2 and tier-3 cities.

Segment Insights:

- The hardware segment in the crypto atm market is expected to achieve a 70% share by 2035, driven by the increasing demand for hardware components for crypto ATM manufacturing.

- Bitcoin segment in the crypto atm market is anticipated to secure a notable revenue share by the forecast year 2035, driven by the increasing penetration of Bitcoin as a significant payment method and its adoption in retail.

Key Growth Trends:

- Expanding popularity of cryptocurrencies

- Growing prevalence of startups and crypto investment

Major Challenges:

- Expanding popularity of cryptocurrencies

- Growing prevalence of startups and crypto investment

Key Players: Covault, LLC, GENERAL BYTES s.r.o., Genesis Coin Inc., Kurant GmbH, TGU Consulting Group, Coinstar LLC..

Global Crypto ATM Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 397.87 million

- 2026 Market Size: USD 609.86 million

- Projected Market Size: USD 41.61 billion by 2035

- Growth Forecasts: 59.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (45% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Canada, Germany, United Kingdom, Japan

- Emerging Countries: China, India, Brazil, Mexico, South Korea

Last updated on : 16 September, 2025

Crypto ATM Market Growth Drivers and Challenges:

Growth Drivers

-

Expanding popularity of cryptocurrencies - Since many individuals believe cryptocurrencies are safer than fiat money and are easily accessible, their popularity has increased in recent years.As cryptocurrency continues to gain traction, crypto ATMs will grow and play an increasingly important role in this ecosystem as they enable users to purchase or trade cryptocurrencies without having to wait for drawn-out bank transactions in a matter of minutes. According to estimates, there were around 21,843 cryptocurrencies in use as of 2022, up from 50 in 2013, with more than 9,310 of them being active.

-

Growing prevalence of startups and crypto investment - To support the expansion of the cryptocurrency exchange, the majority of nations are investing in firms that focus on building cryptocurrency ATMs since they provide a highly reliable source of income and a far greater return on investment than a fiat currency exchange. These elements will thus provide the industry with profitable development potential in the upcoming years.

Challenges

-

Huge transaction fees - It is expected that market growth will be hampered by higher transaction charges imposed on users by operators. Crypto ATMs are terminals that accept payments and link to a user's virtual wallet. They are also well known for their high transaction fees, which could be for cash exchange, cryptocurrency exchange, or card processing.

Most cryptocurrency ATMs impose a fee equal to a portion of the transaction value, which changes depending on the operator, area, and operating costs. For instance, the average online Bitcoin ATM fee charges between 11% and 25% of the total transaction. Compared to online cryptocurrency exchanges, where fees are often less than 1%, bitcoin ATM fees range from around 4 to 14%. - Limited knowledge available about bitcoin is likely to hamper market growth in the coming years.

- Lack of standardized regulations is estimated to pose limitations on market revenue through 2035.

Crypto ATM Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

59.2% |

|

Base Year Market Size (2025) |

USD 397.87 million |

|

Forecast Year Market Size (2035) |

USD 41.61 billion |

|

Regional Scope |

|

Crypto ATM Market Segmentation:

Offering Segment Analysis

The hardware segment is projected to account for 70% share of the global crypto ATM market in the year 2035. The segment growth can be attributed to the growing demand for hardware components from cryptographic ATM manufacturers to build ATMs. Hardware that can be integrated with the current standard ATMs is offered by crypto ATM providers.

Moreover, this integration makes it possible for financial institutions and businesses to offer their services in addition to traditional banking services by offering the ability to buy and sell cryptocurrencies.

Coin Segment Analysis

The bitcoin segment in the crypto ATM market is predicted to garner a notable share shortly. Increasing penetration of Bitcoin and use of it as a significant payment method are foreseen to raise segment growth in the projected period. For instance, in September 2022, a software-as-a-service e-commerce stage called BigCommerce reported its association with CoinPayments and Bitpay, empowering shippers to acknowledge Bitcoin and other cryptocurrency installments.

In addition, in May 2022, Gucci began accepting cryptocurrencies as bitcoin at some of its stores, and it has since expanded to more than 70% of retail outlets that accept crypto payments.

Our in-depth analysis of the global market includes the following segments:

|

Type |

|

|

Offering |

|

|

Coin |

|

|

Deployment |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Crypto ATM Market Regional Analysis:

North American Market Insights

North America industry is estimated to hold largest revenue share of 45% by 2035. The market growth in the region is also driven by the presence of players such as Covault and Coinme in the region. Multiple cryptocurrencies are supported at crypto ATMs in North America and are accessible to users including Bitcoin, and digital assets such as Ethereum, Litecoin, and Bitcoin Cash.

Additionally, the US is home to a large number of cryptocurrency owners and thus bodes well for growth in this region. For instance, in the United States alone, there are over 35,000 cryptocurrency ATMs and thousands more may be found in Canada.

APAC Market Insights

The Asia Pacific region will also encounter enormous growth for the crypto ATM market during the forecast period and will hold the second position, led by the increasing number of smartphones and the continued deployment of next-generation wireless networks in the region's markets. It was projected that around 1 billion Indians would own smartphones by 2040.

This may provide opportunities for regional market demand. Furthermore, in the Asia Pacific area, the burgeoning popularity of Bitcoin ETFs and the subsequent trend of millennial investing in cryptocurrencies in tier-2 and tier-3 cities have made India a significant player in the cryptocurrency ATM business.

Crypto ATM Market Players:

- Bitcoin Depot

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Bitstop

- Cash Cloud, Inc.

- Coinsource

- Covault, LLC

- GENERAL BYTES s.r.o.

- Genesis Coin Inc.

- Kurant GmbH

- TGU Consulting Group

- Coinstar LLC

Recent Developments

- Retail giant Walmart launched a pilot program in October 2021 to allow customers to buy bitcoin at Coinstar vending machines in its stores. Walmart claims that it will allow customers to buy Bitcoin in some of its stores across the U.S. by way of ATMs built and installed by Coinstar.

- In Honduras, the TGU Consulting Group introduced a crypto ATM in an office building in Bogota in August 2021 and has since installed it. The machine has been generally known as “la bitcoinera” and will enable users to acquire Bitcoin and Ethereum using the local lempira currency.

Through first-hand experience, the company seeks to raise people's awareness of Virtual Assets. This is the first crypto ATM in the country.

- Report ID: 5843

- Published Date: Sep 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Crypto ATM Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.