Crushing and Screening Systems Market Outlook:

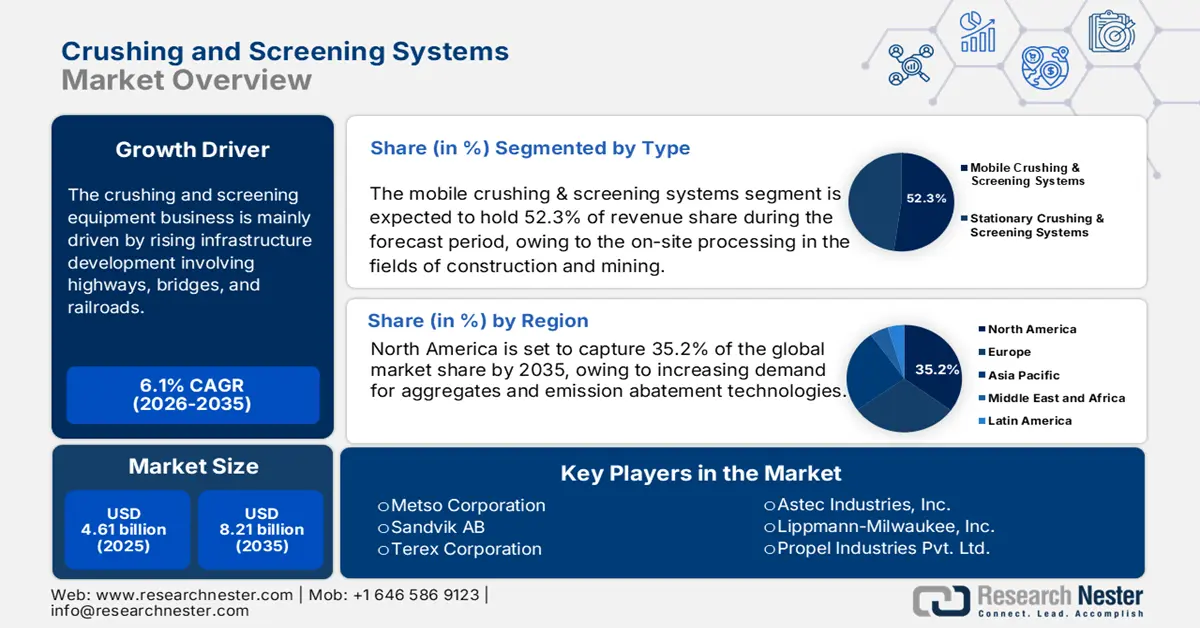

Crushing and Screening Systems Market size was estimated at USD 4.61 billion in 2025 and is expected to surpass USD 8.21 billion by the end of 2035, rising at a CAGR of 6.1% during the forecast period, i.e., 2026-2035. In 2026, the industry size of crushing and screening systems is assessed at USD 4.88 billion.

The crushing and screening equipment business is mainly driven by rising infrastructure development involving highways, bridges, and railroads. This drives the need for efficient crushing and screening systems to supply high-quality stone and gravel essential for durable, large-scale infrastructure development. According to the U.S. Geological Survey (USGS), in 2023, the United States produced 1.5 billion tons of crushed stone, worth over $24 billion. This output came from about 1,400 companies operating 3,500 quarries and more than 180 sales or distribution yards across all 50 states.

Rising energy and mineral costs have seen the Producer Price Index (PPI) of stone mining and quarrying reach 488.314 in June 2025, according to the Federal Reserve Bank of St. Louis. Manufacturers are increasing their mobile unit capacity and complying with the EPA AP-42 emission accounting standards. U.S. exports of crushing equipment to expanding markets such as Nepal & Pakistan. Current and long-term research and development are being done through the EPA, the DOE, and the FHWA to implement energy reserves and advanced processing systems.

Key Crushing and Screening Systems Market Insights Summary:

Regional Highlights:

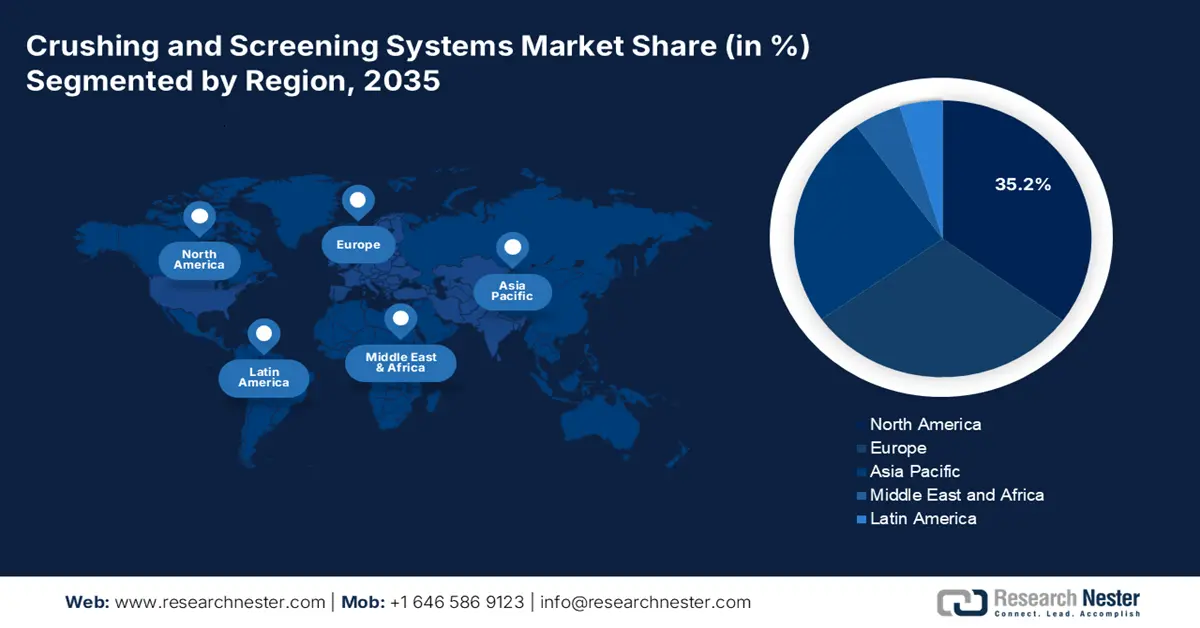

- The North American Crushing and Screening Systems Market is projected to secure a 34.2% share by 2035, attributed to infrastructure investments, growing aggregate demand, and stricter emission regulations.

- The Asia Pacific market is expected to achieve a 34.2% share by 2035, supported by rapid urbanization and expanding mining and infrastructure activities across China and India.

Segment Insights:

- The mobile crushing & screening systems segment is projected to capture a 52.3% share of the Crushing and Screening Systems Market by 2035, propelled by the rising need for flexible, on-site processing across construction and mining sectors.

- The mining & quarrying segment is expected to hold a 38.1% share by 2035, fueled by the surging demand for advanced minerals in EVs, renewable energy, and electronics.

Key Growth Trends:

- Digitalization and automation in chemical plants

- Material innovation and advanced catalysts

Major Challenges:

- Rising environmental compliance costs

- Trade barriers and WTO compliance

Key Players: Metso Corporation, Sandvik AB, Terex Corporation, Astec Industries, Inc., Kleemann GmbH (Wirtgen Group), Komatsu Ltd., thyssenkrupp Industrial Solutions AG, McCloskey International (Metso), H-E Parts International (Hitachi Construction), Lippmann-Milwaukee, Inc., Propel Industries Pvt. Ltd., Nanchang Mineral Systems Co., Ltd. (NMS), STRIKER Crushing & Screening, CPC Equipments Pvt. Ltd., Nakayama Iron Works, Ltd.

Global Crushing and Screening Systems Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 4.61 billion

- 2026 Market Size: USD 4.88 billion

- Projected Market Size: USD 8.21 billion by 2035

- Growth Forecasts: 6.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (34.2% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, India, Japan

- Emerging Countries: South Korea, Malaysia, Indonesia, Brazil, Mexico

Last updated on : 30 September, 2025

Crushing and Screening Systems Market - Growth Drivers and Challenges

Growth Drivers

- Digitalization and automation in chemical plants: Technologies associated with Industry 4.0 sensor-based automation, AI-based monitoring, and software tools are influencing the uptake of smart crushing and screening systems in chemical manufacturing. Smart machines within aquaculture and chemical processing systems can continuously produce performance analytics in real-time, along with analytics to support predictive maintenance cycles and quality control. Smart machines reduce unplanned downtime and help to achieve optimal throughput, performance improvements that also drive costs down. In the first quarter of 2025, an estimated 273 million metric tons (Mt) of crushed stone were produced and delivered for consumption in the United States, a 6% reduction from the same time in 2024.

- Material innovation and advanced catalysts: The control of material inputs required by novel catalysts or engineered materials in chemical synthesis is impacting chemical manufacturing processes. For example, nano-structured catalysts and zeolites require narrow particle size distributions to achieve consistent reactivity. Increasingly, chemical manufacturers are requiring precision screening systems to meet the specific input requirements of their new catalytic technologies. The recent advancements in catalytic technology have created new efficiencies in production while reducing energy consumption and demonstrated that high-performance material preparation systems are necessary in chemical manufacturing.

- Recycling & waste management: Strict environmental regulations, in addition to circular economy-feeding strategies, act as a stimulus to recycle construction and demolition waste. Mechanical crushing and screening systems normally can process and convert concrete, asphalt, and rubble into reusable aggregates. Compared to the global average of 450 tons per acre, India's resource extraction rate is 1,580 tons per acre. India's 131 non-attainment cities are required by the National Clean Air Program to cut their particle pollution by 40% by 2026. Therefore, managing waste from construction and demolition (C&D) has become essential to any attempt to reduce pollution levels. This decreases the need for landfills for that waste, can lower the cost for potential raw materials, and helps meet green building objectives. Due to this, recycling is now a prominent growth focus for equipment manufacturers across the globe.

- Emerging Trade Dynamics

Top Iron Ore-Producing and Exporting Countries in 2023

|

Producing Country |

Quantity |

Exporting Country |

Quantity |

|

Australia |

952,510 |

Australia |

898,459 |

|

Brazil |

417,958 |

Brazil |

407,970 |

|

India |

277,955 |

South Africa |

59,424 |

|

China |

188,585 |

Canada |

58,250 |

|

Russia |

101,944 |

India |

43,818 |

|

Iran |

67,313 |

Sweden |

32,844 |

|

South Africa |

65,800 |

China |

21,481 |

|

Canada |

59,422 |

Malaysia |

20,211 |

|

Kazakhstan |

47,583 |

Netherlands |

18,912 |

|

United States |

43,800 |

Ukraine |

17,749 |

Source: World Steel

2. Trade and Export Data in the Market

Export of Crushing/Grinding Machines for Earth/Stone/Ore in 2023

|

Country / Region |

Export Value (USD thousands) |

Quantity (Items) |

|

China |

1,177,339.61 |

159,218 |

|

European Union |

1,078,296.95 |

24,139 |

|

Germany |

640,489.12 |

16,701 |

|

United Kingdom |

593,837.19 |

13,294 |

|

Finland |

182,073.24 |

4,076 |

|

Italy |

171,035.35 |

3,829 |

|

United States |

143,548.30 |

3,704 |

|

Austria |

135,897.19 |

3,042 |

|

India |

121,828.82 |

- |

|

Turkey |

115,468.32 |

2,585 |

Source: WITS

Challenges

- Rising environmental compliance costs: More stringent emissions regulations from agencies like the U.S Environmental Protection Agency (EPA) and the European Chemicals Agency (ECHA) mean compliance costs are rising. Crushing and screening systems typically cause emissions via dust, noise, and vibration, often meaning expensive retrofitting or upgrades will be required to meet these new emissions standards. The EPA Clean Air Act revisions in 2023, which revealed a steep decline in allowed emissions of particulate matter, will cost extra in small crushing and screening plants to operate, according to an EPA agency impact analysis. For instance, Caterpillar spent $551 million on research & development in the quarter that ended on June 30, 2025, a 2.99% increase from the previous year. This results in market saturation being slowed in chemical-saturated states like Texas and Louisiana.

- Trade barriers and WTO compliance: The World Trade Organization has stated that technical barriers to trade associated with equipment certification slow market access to core areas. For example, crushing systems that were imported into India were required to have a Bureau of Indian Standards (BIS) certification, and imported systems to the EU had to comply with CE Marking. In 2022, for Chinese manufacturers, the increased lead time due to delays with certification processes increased by up to 4 months when seeking certification. These certification processes will similarly slow down governments seeking to fast-track procurement, especially with public-private partnerships (PPPs), which rely on foreign direct investment (FDI).

Crushing and Screening Systems Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.1% |

|

Base Year Market Size (2025) |

USD 4.61 billion |

|

Forecast Year Market Size (2035) |

USD 8.21 billion |

|

Regional Scope |

|

Crushing and Screening Systems Market Segmentation:

Type Segment Analysis

The mobile crushing & screening systems segment is predicted to gain the largest market share of 52.3% during the projected period by 2035, due to the increasing need for flexible, on-site processing in the fields of construction and mining. The growing demand for infrastructure development and urbanization has required portable processing systems that ultimately improve efficiency and provide a cost-effective way of transporting material. India's urbanization rate is predicted to increase from the current 30% to 40% to 50% during the next 20 to 25 years, with more than 60 cities with a population of one million or more accounting for roughly 70% of the country's GDP. Frameworks, such as the U.S. Department of the Interior’s Critical Minerals Strategy, are pushing the need for responsible, sustainable practices and increasing the likelihood of adopting mobile crushing and screening systems. Additionally, the increasing need for modular and scalable solutions in emerging markets is also contributing to the dominance of this segment.

Application Segment Analysis

The mining & quarrying segment is anticipated to constitute the most significant growth by 2035, with 38.1% crushing and screening systems market share, mainly due to the increased demand for advanced minerals in electric vehicles (EVs), renewables, and electronics. According to the World Bank's "Minerals for Climate Action" report, minerals needed to satisfy clean energy objectives will grow by 500% by 2050. The explosion of the lithium, cobalt, and rare earth mines is further fueling the demand for effective crushing and screening systems to meet the urgent demands of global decarbonization. Emerging economies with vast, untapped mineral reserves are further adding fuel to the fire and opening up markets with unimaginable growth potential.

End use Segment Analysis

The mining companies’ segment is anticipated to constitute the most significant growth by 2035, with 30.1% crushing and screening systems market share, as they require continuous processing of ores and minerals for metal production and aggregate supply. Increasing global demand for iron ore, coal, and precious metals drives substantial uptake of advanced crushing and screening equipment, high productivity, reduced costs, and consistency of material quality in iron ore, coal, and precious metal operations around the world. By 2030, the mining and construction equipment industry in India is expected to expand by 19% a year, contributing Rs. 8.5 lakh crore (USD 99.3 billion) to the GDP and creating 20 million jobs, due to technological advancements and legislative support.

Our in-depth analysis of the crushing and screening systems market includes the following segments:

| Segment | Subsegment |

|

Type |

|

|

Application |

|

|

End user |

|

|

Equipment Type |

|

|

Technology |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Crushing and Screening Systems Market - Regional Analysis

North America Market Insights

The North American market is expected to hold 34.2% of the crushing and screening systems market share by 2035. Major contributors to growth will be spending on infrastructure, increasing demand for aggregates and emission abatement technologies, including electric crushers and automation. Mobile and portable units support mine rehabilitation and resource recovery. It is expected that countless charges in the market will be due to environmental responsibility and diesel emissions regulations.

Demand in the U.S. continues to increase because of federal investment in infrastructure spending and minerals processing. EPA and DOE priorities are aligned with adopting clean technologies. In 2023, approximately 69% of U.S. crushed stone production was comprised of limestone and dolomite, 15% was granite, 6% was traprock, 6% was miscellaneous stone, and 3% was sandstone and quartzite. The remaining 1% consisted of marble, volcanic cinder and scoria, calcareous marl, shell, and slate. About 70% of crushed stone production was used as construction aggregate, primarily for highway construction and maintenance. About 20% went into cement manufacturing, 7% was used for lime production, 1% went for agricultural uses, and the remaining 2% was for various chemical, special, and miscellaneous uses. Enumeration of the categories of crushed stone produced highlights that the basic driver of crushed stone demand is construction and infrastructure development.

Canada’s crushing and screening systems market continue to grow with investments in mining, oil sands, and sustainable infrastructure initiatives. Both federal and provincial funding for transportation, housing, and green energy projects creates a steady demand for aggregates. The government’s focus on low-emission and energy-efficient machinery is well-suited to the regulations currently in place to protect the environment. Canada joined the Global Offshore Wind Alliance (GOWA) in order to support the growth of their market for wind energy. At COP27 in 2022, the alliance was established, and by 2030, its member nations hope to have installed 380 GW of wind power. There is a long-term opportunity for equipment suppliers and service providers due to northern resource development and urbanization, as seen most notably in Ontario and British Columbia.

Europe Market Insights

The European market is expected to hold 34.2% of the crushing and screening systems market share by 2035, due to expenditures from mining, recycling, and infrastructure. This will be enhanced by increasing the stringency of environmental regulation and the demand for electric/hybrid systems. Digitalization, zero-emission models, and implementing circular economy goals will be the most significant trends impacting Europe. The construction and reconstruction of Western Europe is seeing substantial activity for each of the sub-national markets.

Germany will be the largest market in the European market for crushing & screening systems by 2035. Trends include green chemistry, automation, and recycling. Innovations occurring in Germany are supported by funding from the BMWK and VCI, and companies like Kleemann and Thyssenkrupp continue to research opportunities for electrification and artificial intelligence in this space. GaAs wafer recycling and stringent landfill policies also demand systems.

The U.K. market has the benefit of infrastructure upgrades, the HS2 rail program, and significant road maintenance schemes that have already commenced. Aggressive recycling goals and landfill diversion regulations are models for a supply of mobile crushing and screening options for construction and demolition waste. Governing bodies are directing funding to help stimulate the use of low-carbon technologies and to help meet zero-carbon commitments, thereby strengthening the use of energy-efficient equipment. Approximately 90% of the nearly 250 million tons of aggregates produced by 1,300 quarries in the UK are used in the building sector. With a £3 billion yearly revenue, the industry directly employs about 20,000 people and indirectly supports another 20,000 jobs.

Asia Pacific Market Insights

The Asia Pacific market is expected to hold 34.2% of the crushing and screening systems market share by 2035, mainly as it gains momentum through urbanization across the region, and ongoing mining & infrastructure projects occurring in China and India. Japan & South Korea's governmental regulations continue to create a demand for cleaner & greener machinery, while developing markets like Malaysia seek robust, cheaper units. Trends in this gain are hybrid/electric machines, automation, and innovations being driven by companies like Metso and Sandvik.

China is expected to dominate the market in APAC by 2035 with the assistance of the Belt & Road Initiative and the country's massive mining sector. The Chinese government continues to encourage green construction in China, offering subsidies to promote these projects while providing funding for eco-equipment. The rise in exports, automation, and smart mining tools continues China's needed policy-driven shift towards sustainability, while confirming its supremacy in the market. According to "China Mineral Resources 2023," which was presented at the conference by the Ministry of Natural Resources, 132 new mineral deposits were found in 2022, and as of 2022, a total of 173 different types of minerals had been located in China.

India's growth is fueled by the National Infrastructure Pipeline and the Smart Cities Mission. Government entities have implemented an increase in R&D for sustainable crushing systems. Approximately ₹1.6 lakh crore, or more than 8,000 multi-sectoral projects, are being built by 100 cities. Under the Smart Cities Mission, 7,244 projects totaling ₹1,45,312 crore have been completed, or more than 90% of the total. There have been 580 kilometers of bike tracks built and more than 4,700 kilometers of smart roads built or upgraded. With the increasing number of manufacturers, with incentive programs, local manufacturers will feel the pressure to be on par with increasing demands for recycled materials and aggregates, making India the fastest-growing market in APAC.

Key Crushing and Screening Systems Market Players:

- Metso Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Sandvik AB

- Terex Corporation

- Astec Industries, Inc.

- Kleemann GmbH (Wirtgen Group)

- Komatsu Ltd.

- thyssenkrupp Industrial Solutions AG

- McCloskey International (Metso)

- H-E Parts International (Hitachi Construction)

- Lippmann-Milwaukee, Inc.

- Propel Industries Pvt. Ltd.

- Nanchang Mineral Systems Co., Ltd. (NMS)

- STRIKER Crushing & Screening

- CPC Equipments Pvt. Ltd.

- Nakayama Iron Works, Ltd.

The global crushing and screening systems market is very consolidated with the companies in this space: Metso, Sandvik, and Terex holding the greatest share over 30% of global revenue. Competition comes from European companies that are constantly looking to find innovative ways to automate options and create energy-efficient systems, while American companies can pivot with different product lines. Companies from Asia, primarily Japan and India, are looking to enter claims in markets with products and technology partnerships and joint ventures. Common strategic directions with companies are M&A, for example, Metso and McCloskey, local manufacturing, and after-sales service network development. Companies are also allocating funding to build electric and hybrid engines to comply with expanding, stringent emissions regulations and to meet sustainability goals, especially in Europe and North America.

Some of the key players operating in the market are listed below:

Recent Developments

- In February 2024, DuPont launched a new biodegradable mulch film that naturally decomposes and contributes to the reduction of plastics in the agricultural supply chain. Also, it was developed in response to farmers' need for sustainable options and may present a solid opportunity to acquire a large portion of the market in eco-agro products.

- In January 2024, BASF made a significant announcement for expanding its production capacity of PBAT (biodegradable plastic for flexible packaging) in Europe due to increased demand caused by the stricter EU controls. This investment improves BASF's position in the growing eco-packaging market.

- Report ID: 7814

- Published Date: Sep 30, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.