Crown Caps Market Outlook:

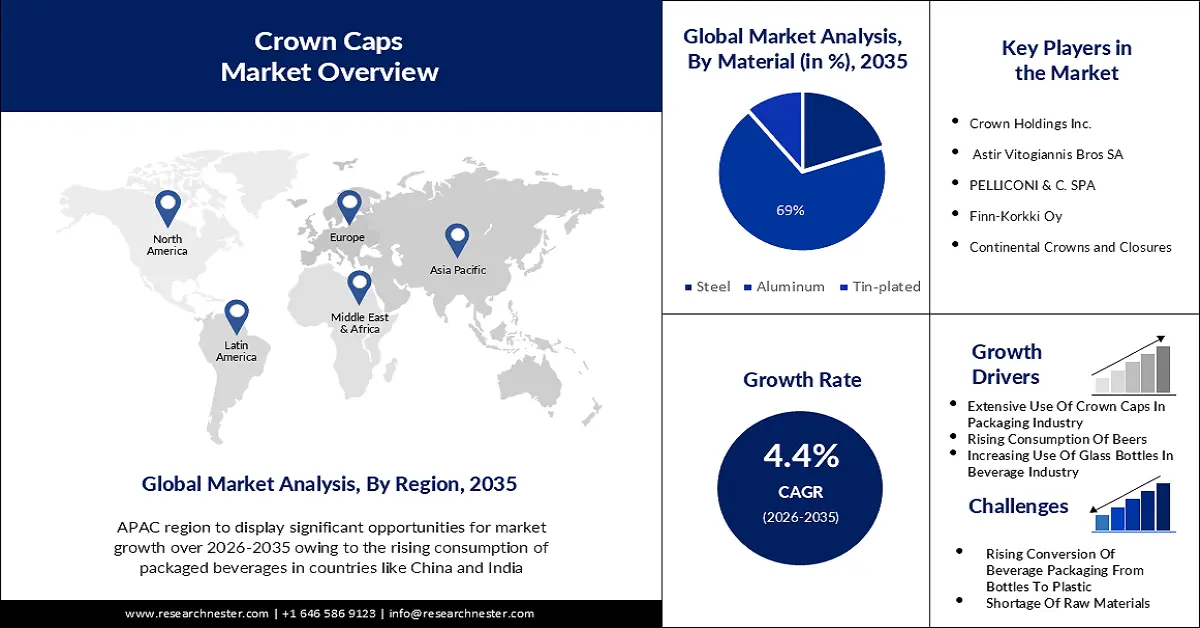

Crown Caps Market size was valued at USD 1.79 billion in 2025 and is expected to reach USD 2.75 billion by 2035, expanding at around 4.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of crown caps is evaluated at USD 1.86 billion.

The primary reason behind the growth of the market because of the wide use of crown caps in packaging glass bottles. Acknowledged for its look, the crown cap is used to seal beer bottles, carbonated beverages, brilliant mineral water, and zymolysis wine. The dimensions adopted by big-sized punch presses are 907×1018mm (width × length), with 702 closures generated from each sheet, while the dimensions taken by small-sized punch presses are 508×712mm (width × length), with 270 closures generated from each sheet. The usual steel sheet density is 0.23mm. Another reason that will propel the market of crown caps by the end of 2036 is the increasing sale of beer glass bottles worldwide. According to the newest research, there are 155,448 restaurants and +71,634 bars and nightclubs in North America. That's a complete maximum of 227,082 places that sell alcohol. The objective is to gather information from an extensive range of places so that it will be more precisely assumable across the US. For some of the techniques of reutilizing or recycling glass containers, the chemistry of the glass is crucial. The data given here is quite usual, but should be of guidance for those utilizes who rely on the chemical composition. Moreover, Western Europe was the only regional crown caps market to record reduced volume sales of beer sold in glass bottles from 2003. This was somewhat because of pack-type transformation in favor of PET bottles and somewhat because of less consumption of beer in countries like Germany.

Key Crown Caps Market Insights Summary:

Regional Highlights:

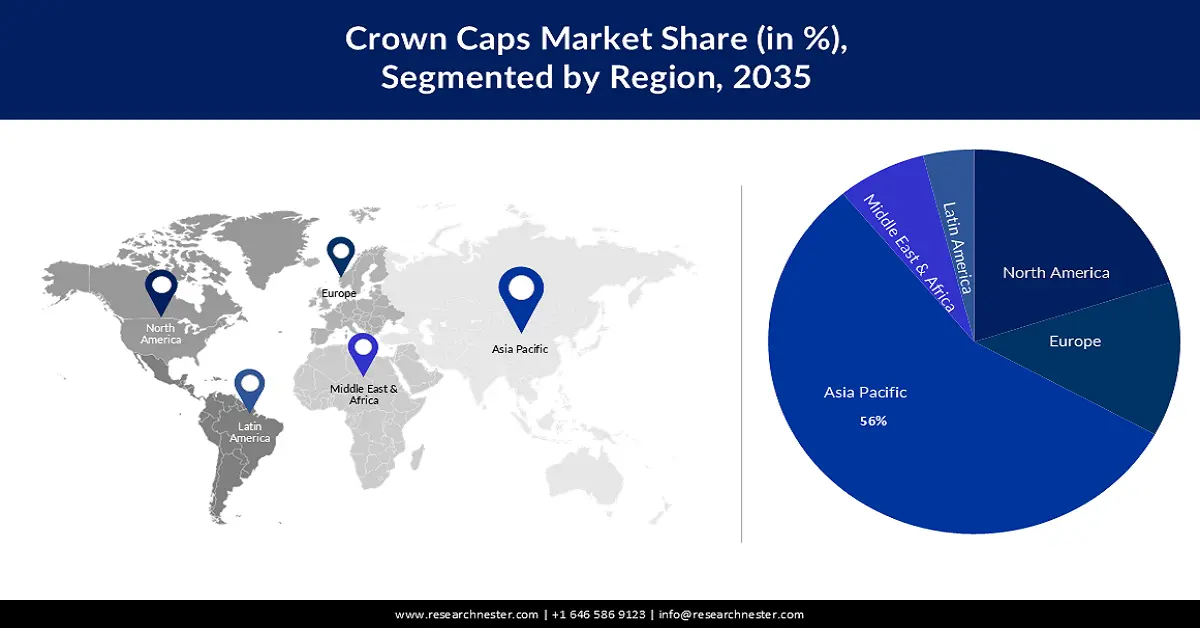

- The Asia Pacific region is predicted to hold a 56% share by 2035 in the crown caps market, owing to the rising consumption of packaged beverages in countries like China and India.

- The North American region is expected to witness significant growth during the forecast period, driven by increasing demand for beer and the expanding alcohol industry.

Segment Insights:

- The aluminum segment is projected to account for 69% share by 2035 in the crown caps market, impelled by the increasing use of aluminum to develop crown caps in the beverage packaging industry.

- The non-alcoholic beverages segment is expected to hold 60% of the revenue share by 2035, driven by rising global consumption of non-alcoholic beverages.

Key Growth Trends:

- Increasing Requirement for Amenities and Easy To Open Packaging Solutions

- Inclination Towards More Sustainable Choices

Major Challenges:

- Introduction of PET caps

- Shortage of Raw Materials

Key Players: Crown Holdings Inc., Astir Vitogiannis Bros SA, PELLICONI & C. SPA, Finn-Korkki Oy, Continental Crowns and Closures, RANKIN, Crown Seal Public Company Limited, Imran Crown Cork, Avon Crowncaps & Containers Nigeria Ltd., AMD Industries Inc., Nippon Closures Co., Crown Seal Public Company Limited, Mikasa Industry Co., Ltd., Toyo Seikan Group Holdings, Ltd.

Global Crown Caps Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.79 billion

- 2026 Market Size: USD 1.86 billion

- Projected Market Size: USD 2.75 billion by 2035

- Growth Forecasts: 4.4%

Key Regional Dynamics:

- Largest Region: Asia Pacific (56% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, United Kingdom

- Emerging Countries: India, Brazil, Mexico, South Korea, Indonesia

Last updated on : 27 November, 2025

Crown Caps Market - Growth Drivers and Challenges

Growth Drivers

- Increasing Requirement for Amenities and Easy-To-Open Packaging Solutions - Packaging has experienced a drastic evolution through the ages, from ancient times to the industrial age, revolutions, and wars, and into the current day. Creation, much like in other consumer-encountering industries, stays at the heart of producing the packaging industry flexible, future-proof, and promising. Captivatingly, every disorderly trend in the packaging industry has been pushed by the consumer’s requirement of the hour – be it cardboard boxes for more shelf life, bubble wrap for sensitive and subtle products, PET bottles to present advantages and availability, or recyclable bags made from ecologically friendly, natural components such as jute, cotton, etc. As it comes to the era of the next normal, the packaging industry is required to utilize multiple seminal megatrends to minister to clients efficiently.

- Inclination Towards More Sustainable Choices - Current studies have demonstrated that 90% of APAC customers are willing to invest a premium on renewability products, with renewable packaging being among the main benchmarks for buying. Superior packaging and renewability now go side by side because people’s priorities are converting. Brands are also starting to understand that “premium” doesn’t signify utilizing fancy components. Instead, it has to work with encompassing both renewability and benefits. The increasing requirement for renewable packaging gives scopes for companies and retailers to cooperate, create, and acclimate to transforming clients' tastes and administrative restrictions to give several solutions that match social and ecological objectives.

- Increasing Use in Product Differentiation and Brand Promotion- The crown cap gives over just a protected seal for breweries, but also an exceptional branding scope. By personalizing structure, color, and logo, breweries can set up their brand recognition to assist in rising profile and brand acknowledgment. This can be helpful equipment for materials placed in supermarkets, with a height of varying. The relation of particular crown cap structures to clients’ favorite breweries assists in developing acquaintance and reliability, which has assisted in increasing brand devotion for beer brands.

Challenges

- Introduction of PET caps- The global crown caps market is currently being challenged by the introduction of new recycled PET caps and ending closures, which are thought to have a lower environmental impact. Coca-Cola introduced plastic covers that stay connected to bottles in March 2023. This ensures that the bottle caps are collected for recycling alongside the bottles. Initiatives like this may function as constraints to crown caps market growth over the predicted period.

- Shortage of Raw Materials

- Stringent Government Policies

Crown Caps Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

4.4% |

|

Base Year Market Size (2025) |

USD 1.79 billion |

|

Forecast Year Market Size (2035) |

USD 2.75 billion |

|

Regional Scope |

|

Crown Caps Market Segmentation:

Material Segment Analysis

The aluminum segment of the crown caps market will notice the biggest growth during the forecast period and will hold around 69% of the revenue share owing to the increasing use of aluminum to develop crown caps in the beverage packaging industry. The aluminum beverage packaging industry is increasing immensely worldwide. In line with Ball Corp., the world’s biggest can manufacturer, about 100 billion cans are utilized each year in North America. The organization is purchasing a rising amount of aluminum cans utilized from outside the U.S. Ball told investors it planned to add 4-5 billion additional cans to its existing 105 billion yearly potential by mid-2021. U.S. requirement for aluminum can stock will increase by about 3-5% yearly by 2025, as metal cans arrest further market share over plastic, in line with Harbor Intelligence. But, it is noteworthy that this anticipation started before the coronavirus epidemic began. The newest information demonstrates that the requirement for can stock may rise even higher as an outcome of lockdowns. Moreover, Aluminum cans have acquired a huge reputation as a packaging choice for an extensive range of beverages because of their lightweight nature, reusability, and skill to preserve greenness. These cans present a multipurpose canvas for beverage creators to demonstrate their exceptional combinations and capture client attention.

Application Segment Analysis

The non-alcoholic beverages segment in the crown caps market is expected to hold 60% of the revenue share by 2035. The non-alcoholic beverages will increase massively because of the increasing consumption of non-alcoholic beverages across the world. At-home profit in the non-alcoholic beverages market amounts to USD 953.30bn in 2024. The market is projected to increase yearly by 5.72% (CAGR 2024-2028). Client preferences play a critical role in pushing the expansion of the non-alcoholic beverages market. Customers are more and more seeking healthier beverage choices, taking to an increase in the requirement for non-alcoholic drinks without sugar. This conversion in preferences can be delivered to increasing health awareness, increased awareness about the adverse impacts of alcohol consumption, and the attempt for more various and creative beverage choices.

Our in-depth analysis of the global market includes the following segments:

|

Material |

|

|

Type |

|

|

Application |

|

|

Liner |

|

|

End-Use Industries |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Crown Caps Market - Regional Analysis

APAC Market Insights

The crown caps market in the APAC region will have the biggest growth during the forecast period with a revenue share of around 56%. This growth will be noticed owing to the rising consumption of packaged beverages in countries like China and India. For instance, the most famous beverages in China in 2022 were packed drinking water, carbonated beverages, dairy materials, and illuminating water, with utilization rates of 63%, 55%, 54%, and 45% individually. Additionally, health concerns are reshaping clientele preferences, taking to the increase of healthy nutrition materials. Benefit and newness are also essential to Chinese clients; however, material quality surpasses all the other characteristics. This transformation in consumption preferences has limited the requirement for conventional carbonated drinks. Simultaneously, health is increasing and impacting the beverage industry.

North American Market Insights

The crown caps market in the North American region will also encounter huge growth during the forecast period and will hold the second position owing to the increasing demand for beer and the increase in the beer industry in this region. The alcohol packaging industry in this region is increasing due to the increasing consumption of alcohol in the countries of North America. Moreover, the percentage of U.S. adults elderly 18 and older who say they drink alcohol middle 63% over the past two years, whereas 36% explained themselves as “total abstainers.” The drinking rate is equal to 65% when constricted to adults of lawful drinking age, which is 21 and older across the nation.

Crown Caps Market Players:

- Crown Holdings Inc.

- Company Overview

- Business Planning

- Main Product Offerings

- Financial Execution

- Main Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Astir Vitogiannis Bros SA

- PELLICONI & C. SPA

- Finn-Korkki Oy

- Continental Crowns and Closures

- RANKIN

- Crown Seal Public Company Limited

- Imran Crown Cork

- Avon Crowncaps & Containers Nigeria Ltd.

- AMD Industries Inc

Recent Developments

- July 19, 2023: Crown Holdings Inc., as part of its dedication to progressing accountable supply chains, adopted a renewability program called the Twentyby30 and declared expanding its Aluminum Stewardship Initiative (ASI) certifications over the Asia-Pacific region. The Organization's Nong Khai and Crown TCP beverage packaging farms in Thailand were currently awarded the ASI Performance Standard certification, carrying the total capabilities in Crown's network with the appointment of 12. Crown's operations in Brazil and Mexico have also accomplished ASI Performance Standard certification.

- December 6, 2023: Crown Holdings Inc., Aluminum manufacturers, reusers, rolling mills, can makers, and industry relations have set the aim having stressed the requirement for increased recycling to help the IEAs Net Zero 2050 objective. A 100 percent reusing aim by 2050 for the globe’s aluminum beverage cans has been set by industry leaders at COP 28.

- Report ID: 5729

- Published Date: Nov 27, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Crown Caps Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.