Crotonic Acid Market Outlook:

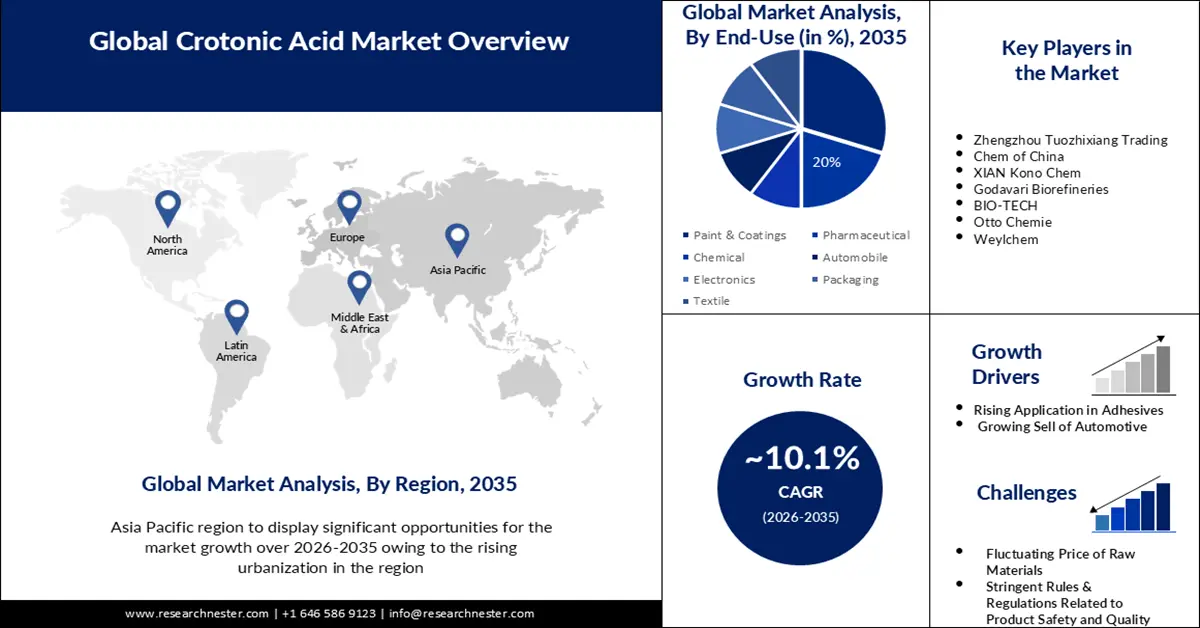

Crotonic Acid Market size was over USD 951.1 million in 2025 and is poised to exceed USD 2.49 billion by 2035, witnessing over 10.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of crotonic acid is estimated at USD 1.04 billion.

The reason behind the growth is due to the rising prevalence of cancer around the world. It is claimed that isoxazole and crotonic acid compounds of formulas (I) and (II), can be used to cure cancer since it enhances glycolytic activity and the proliferation of cancer cells. By 2040, it's estimated that there will be over 27 million new instances of cancer annually worldwide.

The growing collaborations between major players are believed to fuel the market growth. Major companies are forming strategic alliances and working together to improve their product lines, broaden their geographic reach, launch new products, and accomplish other goals for the investigation of novel uses for crotonic acid in developing markets.

Key Crotonic Acid Market Insights Summary:

Regional Highlights:

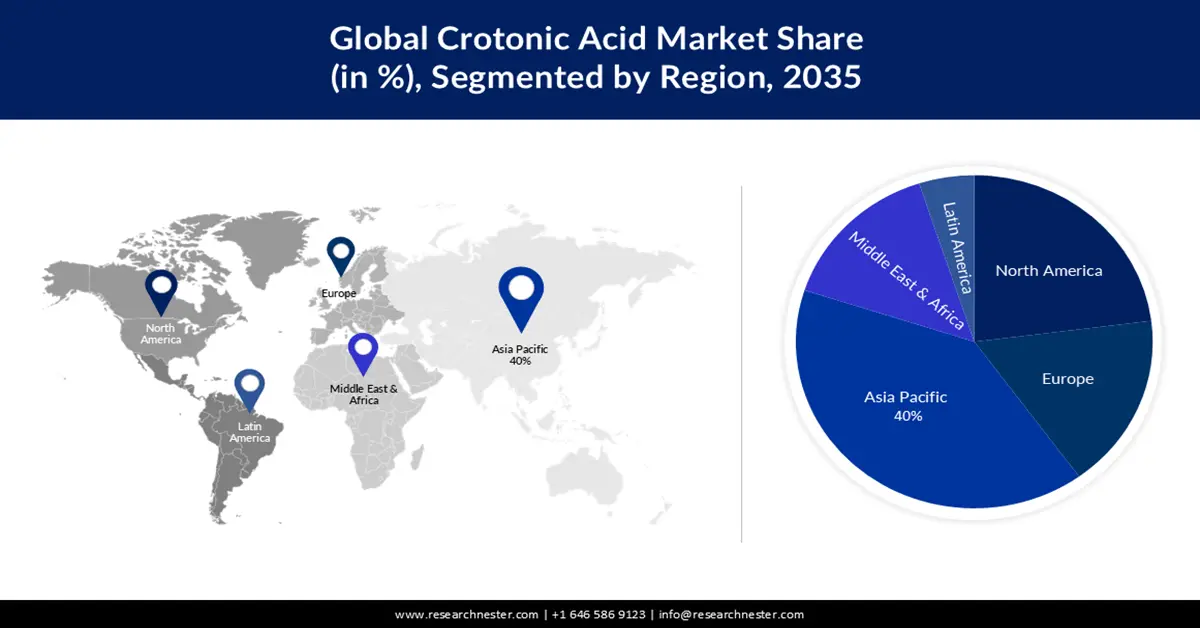

- Asia Pacific crotonic acid market is anticipated to achieve a 40% share by 2035, driven by rising urbanization, which boosts demand for building supplies.

- North America market is expected to hold the second largest share by 2035, driven by rising spending in the healthcare sector and the demand for crotonic acid in pharmaceuticals.

Segment Insights:

- The paint & coatings segment in the crotonic acid market is expected to capture a 30% share by 2035, attributed to the rising demand for emulsion paints with crotonic acid-based binders.

Key Growth Trends:

- Growing Sell of Automotive

- Spiking Popularity of Skin and Hair Care Products

Major Challenges:

- Fluctuating Price of Raw Materials

- Stringent Rules & Regulations Related to Product Safety and Quality Highly Competitive Market Owing to the Presence

Key Players: Tianjin Jinhui Pharmaceutical Group, Zhengzhou Tuozhixiang Trading, Sun Pharmaceutical Industries Ltd., Chem of China, XIAN Kono Chem, Godavari Biorefineries, BIO-TECH, Otto Chemie, Weylchem, ALB Technology Limited, DuPont, Penta Manufacturing Company, Spectrum Manufacturing Corporation.

Global Crotonic Acid Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 951.1 million

- 2026 Market Size: USD 1.04 billion

- Projected Market Size: USD 2.49 billion by 2035

- Growth Forecasts: 10.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (40% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, India

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 11 September, 2025

Crotonic Acid Market Growth Drivers and Challenges:

Growth Drivers

-

Rising Application in Adhesives - A crotonic acid-modified aqueous emulsion comprising an aqueous emulsion of a polymeric compound is mainly used as a comonomer with vinyl acetate that can be used in the formulation of adhesives.

- Growing Sell of Automotive - Crotonaldehyde is the source of crotonic acid, which is utilized as a raw material to make a variety of coatings that are used to coat most automotive surfaces mainly to provide protection and decoration.More than 68 million cars are expected to be sold worldwide in 2023.

- Expanding Packaging Sector - Crotonic acid is primarily used as a raw material for copolymers, which are created by copolymerizing it with other compounds used to coat polyolefin films, which are used to package baked food items such as pastries.

- Spiking Popularity of Skin and Hair Care Products - Crotonic acid is a naturally occurring substance present in Carica papaya, Coffee Arabica, and other species, can be used as a film-forming ingredient in aerosol hair sprays and other hair preparation products and is mostly utilized in cosmetic and personal care goods and it appears as translucent solid beads.

- High Usage in Chemical Sector - Crotonic acid is a raw ingredient used to make a variety of different chemicals such as Ethylene, Crotonate, Polyhydroxyalkanoate, Acrylic Acid, and Copolymer. Moreover, Vinyl acetate and crotonic acid combine to form a copolymer, a polymer that may be used safely as a coating or as a coating component.

- Increasing Utilization as Flavoring Agent - Crotonic acid also referred to as 2-butenoic acid, is a white to tan solid that has a phenolic smell and is used as a flavoring agent to provide dairy or green flavor.

- Rising Environmental Pollution - Crotonic acid hydrogels allow fertilizers to be released by the infiltration of water into the polymeric network, and solute release from the hydrogel during swelling conditions that aid in preventing contamination of the environment.

Challenges

-

Fluctuating Price of Raw Materials - Crotonic acid is produced by catalytically oxidizing crotonaldehyde, which is a clear, colorless straw-colored liquid with an overpowering smell the price of which keeps fluctuating owing to shifts in supply and demand dynamics and changes in the production process. As a result, the overall cost of producing crotonic acid may increase which makes it difficult for the producer to manage the resources.

- Stringent Rules & Regulations Related to Product Safety and Quality Highly Competitive Market Owing to the Presence

Crotonic Acid Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

10.1% |

|

Base Year Market Size (2025) |

USD 951.1 million |

|

Forecast Year Market Size (2035) |

USD 2.49 billion |

|

Regional Scope |

|

Crotonic Acid Market Segmentation:

End-Use Segment Analysis

The paint & coatings segment in the crotonic acid market is estimated to gain a robust revenue share of 30% in the coming years owing to the rising demand for emulsion paints. Emulsion paint is a water-based paint consisting of tiny polymer particles created by combining water, pigments, additives, and synthetic resins which are well-liked for their affordability, simple maintenance, and versatility to be applied to both exterior and interior walls.

Emulsion paints performance and quality are mostly determined by the ingredients they contain, including additives, pigment solvents, and binders that often utilize water-dispersed binders such as polyvinyl acetate (PVAc) and styrene acrylic crotonic acid monomer in their formulations. Moreover, the copolymerization of crotonic acid monomer with other compounds yields a thickener that is utilized in the manufacturing of glossy emulsion paints. One of the essential components needed in the creation of emulsion paints that give buildings' exteriors and interiors additional luminous effects and protective coatings.

Application Segment Analysis

Crotonic acid market from the adhesive resins segment is set to garner a notable share shortly. Adhesive resin is a type of precursor plastic compound made of carboxylic acids that are mostly liquid and consists of linear or branched oligomeric and polymeric molecules which are used to make plastics and adhesives for a variety of applications, including dental work, pressed construction board compounds, and regular commercial glues and are frequently employed in thermoformed sheets, multilayer films, and other applications as tie layers to join disparate components.

Crotonic acid is used in the production of adhesive resins, which are known for their versatility, making them suitable for use in packaging, construction, and automotive industries where reliable and strong bonding properties are essential.

Our in-depth analysis of the global crotonic acid market includes the following segments:

|

Product Type |

|

|

Application |

|

|

End-Use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Crotonic Acid Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is predicted to account for largest revenue share of 40% by 2035 propelled by the rising urbanization. Moreover, better job prospects, the presence of well-established institutions for higher learning, and an urban standard of living are the reasons why more people in countries such as India and China are choosing to relocate from rural to urban areas.

The construction sector has been significantly impacted by the rise in urbanization in the region which has led to an increase in the need for building supplies, including bricks, crushed rock, cement, steel, sand, and paint and coatings that are widely utilized on buildings for both decorative and protective functions. These factors may drive the demand for crotonic acid in the region. In India, more than 460 million people live in urban areas and the figure is increasing annually by over 2%.

North American Market Insights

The North America crotonic acid market is estimated to be the second largest, during the forecast timeframe led by the rising spending in healthcare sector. Moreover, the pharmaceutical sector in the United States creates several new medications each year that have significant medical benefits, which also makes the country the global leader in prescription drug spending per capita. As a result, there may be an increasing demand for crotonic acid in the region since it can be utilized in the manufacture of medicines. According to estimates, the amount spent on health care in the United States increased by over 2% in 2021 to around USD 12,910 per person.

Crotonic Acid Market Players:

- Tianjin Jinhui Pharmaceutical Group

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Zhengzhou Tuozhixiang Trading

- Sun Pharmaceutical Industries Ltd.

- Chem of China

- XIAN Kono Chem

- Godavari Biorefineries

- BIO-TECH

- Otto Chemie

- Weylchem

- ALB Technology Limited

- DuPont

- Penta Manufacturing Company

- Spectrum Manufacturing Corporation

Recent Developments

- Shiseido Company, Limited announced to collaborate with a partnership with Shoppers Stop Ltd. to introduce its makeup brand NARS Cosmetics in India to expand its revenue streams by leveraging India's expanding consumer market and bringing in additional brands in the future.

- Kao Corporation introduced a cosmetics brand for Gen Z men, UNLICS that has begun introducing a range of products to bring about a world in which people of all genders are free to pursue and express beauty, especially for Gen Z males, who have a far broader interest in beauty than just basic maintenance.

- Report ID: 5370

- Published Date: Sep 11, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Crotonic Acid Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.