Cross-border Payments Market Outlook:

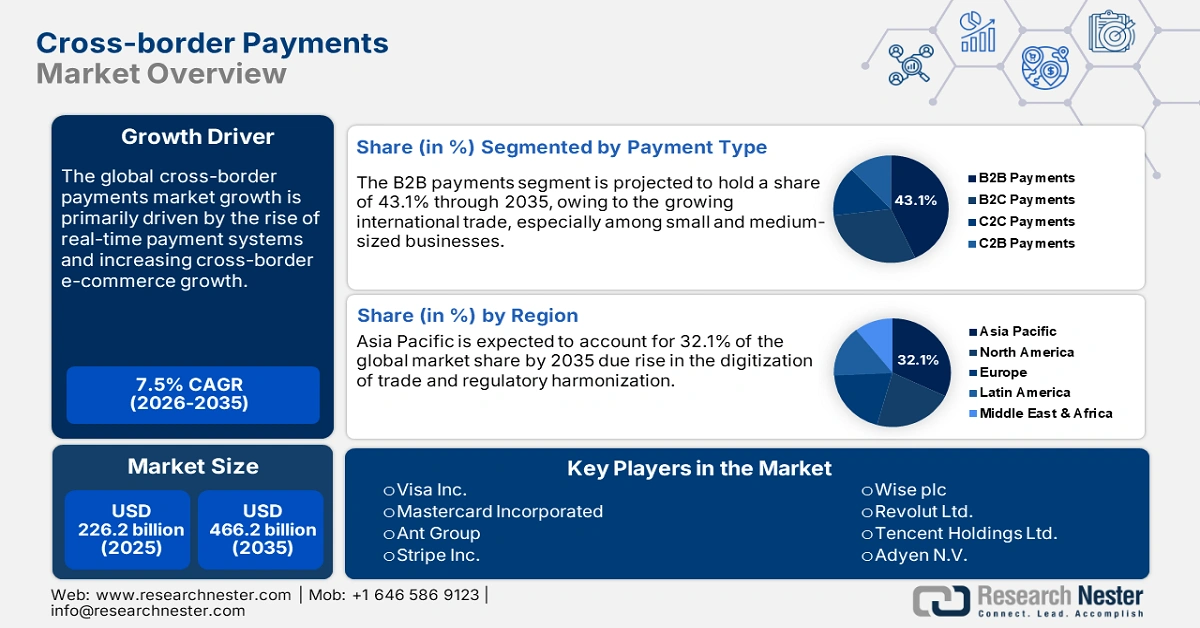

Cross-Border Payments Market size was USD 226.2 billion in 2025 and is estimated to reach USD 466.2 billion by the end of 2035, expanding at a CAGR of 7.5% during the forecast period, i.e., 2026-2035. In 2026, the industry size of cross-border payments is estimated at USD 243.1 billion.

International money transfers are closely tied to global trade and cross-border business activities, but often face delays, changing costs, and stringent regulations. According to the U.S. Bureau of Economic Analysis, the goods and services exports in July 2025 reached USD 280.5 billion, while imports were at USD 358.8 billion, an increase of USD 20.0 billion from the previous month, fueling a robust demand for cross-border payment services. This rising trade creates a robust need for services that handle payments across countries, as dealing with different currencies and following rules such as anti-money laundering (AML) and know-your-customer (KYC) make these payments more complicated and affect settlement timelines.

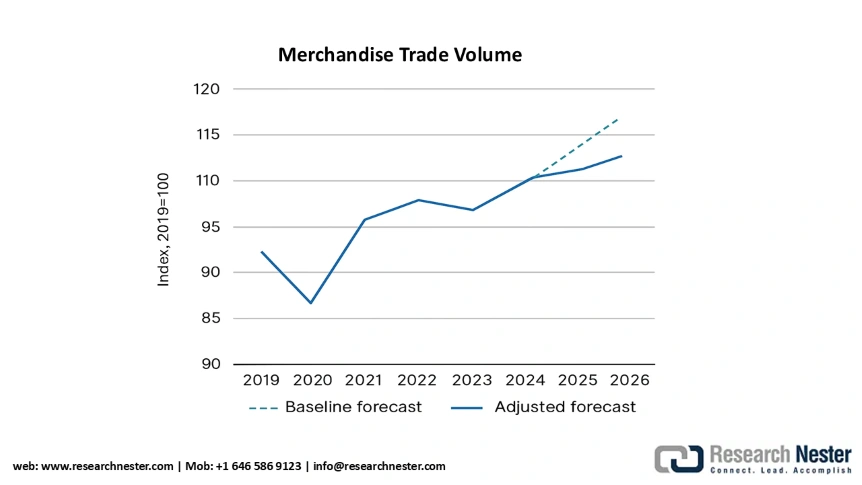

Moreover, rising international trade volumes and complicated supply chains promote the demand for secure, fast, and cost-efficient B2B payment solutions. According to the WTO’s Global Trade Outlook and Statistics 2025 Analysis, world merchandise trade went up by 3.6% in 2024, with a projected 0.9% growth in 2025, while trade in commercial services grew by 6.8% during the same period. This highlights high earning potential for cross-border payment technology producers.

World Merchandise Trade Volume, 2019-2026

As businesses increasingly operate across international markets, smooth settlement and reduced transaction risks have become important to supporting efficient global commerce. For instance, in March 2025, RTGS.global announced a strategic partnership with TransferMate to simplify cross-border transactions. Through this integration, TransferMate will use RTGS.global’s instant settlement infrastructure to allow seamless, real-time international payments. This step aims to lower dependence on traditional banking intermediaries and minimize risks commonly associated with cross-border money transfers.

Key Cross-border Payments Market Insights Summary:

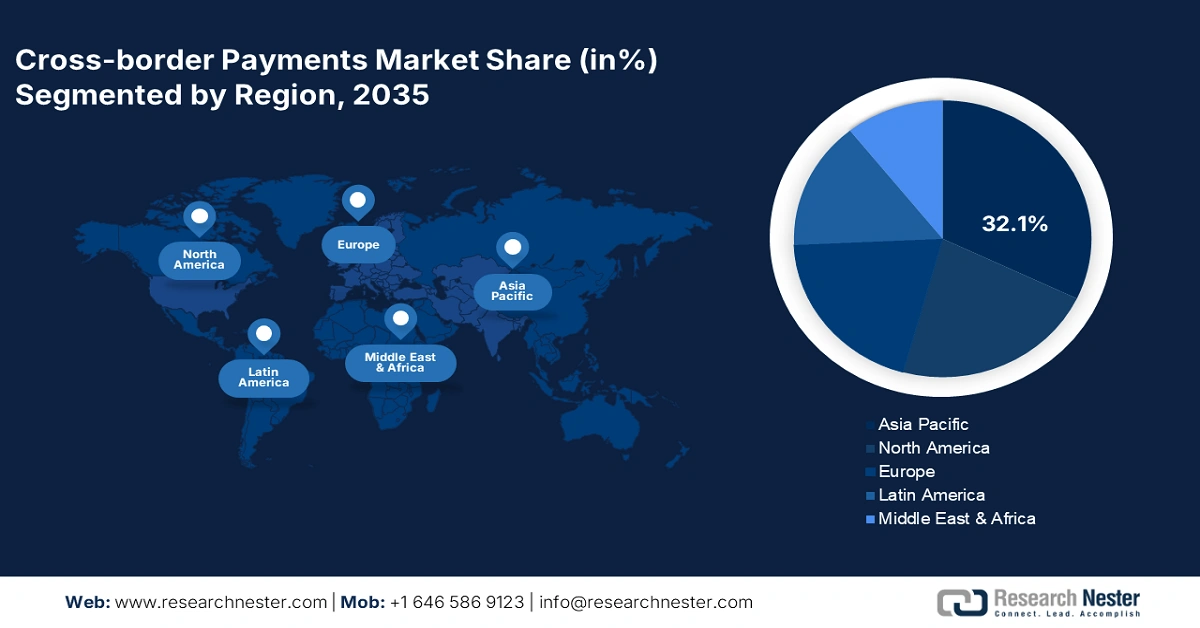

Regional Highlights:

- The Asia Pacific cross-border payments market is expected to command a 32.1% revenue share by 2035, stimulated by the rapid digitization of trade and regulatory harmonization across regional economies.

- The Europe region is projected to secure a 22.2% share by 2035, attributed to expanding trade networks, high e-commerce penetration, and the implementation of SEPA Instant Credit Transfer across EU nations.

Segment Insights:

- The B2B payments segment is projected to hold a 43.1% revenue share by 2035 in the cross-border payments market, propelled by the increasing global trade volumes and integration of SMEs into international supply chains.

- The financial institutions segment is anticipated to capture a 37.5% share by 2035, supported by its pivotal role in currency clearing, correspondent banking, and the growing adoption of SWIFT GPI and ISO 20022 messaging standards.

Key Growth Trends:

- Rise in real-time payment systems

- Increasing cross-border E-commerce growth

Major Challenges:

- Infrastructure gaps & digital divide

- Regulatory fragmentation across jurisdictions

Key Players: PayPal Holdings Inc., Visa Inc., Mastercard Incorporated, Ant Group (Alipay), Stripe Inc., Wise plc, Revolut Ltd., Tencent Holdings Ltd. (WeChat Pay), Adyen N.V., FIS (Worldpay), Nium Pte. Ltd., Payoneer Global Inc., Airwallex, Toss Payments, Razorpay Software Private Ltd., Kyodai Remittance, SBI Remit Co., Ltd., NTT Data Corporation, Japan Post Bank Co., Ltd., Seven Bank, Ltd.

Global Cross-border Payments Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 226.2 billion

- 2026 Market Size: USD 243.1 billion

- Projected Market Size: USD 466.2 billion by 2035

- Growth Forecasts: 7.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (32.1% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, China, United Kingdom, Japan, Germany

- Emerging Countries: India, Brazil, Indonesia, Mexico, South Korea

Last updated on : 24 September, 2025

Cross-border Payments Market - Growth Drivers and Challenges

Growth Drivers

- Rise in real-time payment systems: New real-time payment systems such as India’s UPI, Europe’s TIPS, and the U.S.’s FedNow are transforming settlement expectations. In the past, payments between countries took 2 to 6 days, but now instant payments are becoming common. In 2023, 266.2 billion real-time payment transactions were made globally, a 42.2% year-over-year increase. Countries such as India, Singapore, and the U.K. have made agreements, for instance, the India-Singapore UPI-PayNow link, to allow money transfers in just 60 seconds. It was initially limited to a set of banks, but it has now expanded to 19 Indian banks as of July 2025. The strategic partnerships among countries to boost real-time payments are opening lucrative doors for leading companies.

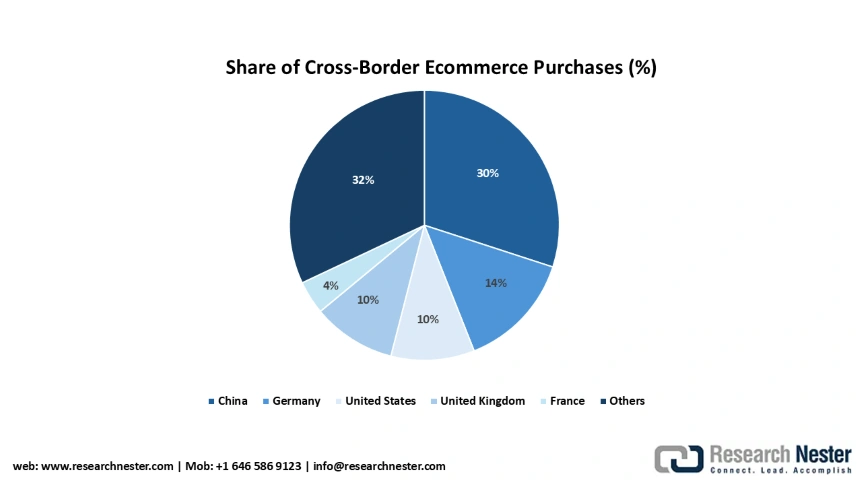

- Increasing cross-border E-commerce growth: The growing online shopping trend across countries is increasing the need for quick and affordable international payment solutions. According to the International Trade Administration (ITA) Report on 2024 e-commerce size and sales forecast, the global B2B e-commerce sales have shown constant year-on-year growth over the last decade. A significant share of this value comes from sectors like advanced manufacturing, energy, healthcare, and professional business services. Asia Pacific is expected to continue leading the global cross-border payments market, with China at a 32% share.

Leading Markets of Most Recent Cross-Border E-commerce Purchases

Worldwide - 2025

Moreover, small and medium-sized businesses in Asia and Europe are prioritizing payment service providers (PSPs) that offer instant payments, support for multiple currencies, and local payment processing. As online trade continues to grow, the demand for cross-border payment solutions is estimated to register a boom in the coming years.

- Fintech innovation and partnerships with banks: Fintech players are primarily working with banks to enhance speed, security, and cost efficiency in cross-border payments by leveraging blockchain and digital ledger technologies. This collaboration is reshaping settlement methods and boosting transparency. For instance, in September 2023, SBI Remit, a subsidiary of Japan's SBI Holdings, expanded its international money transfer services by incorporating Ripple's XRP-based payment solution. This collaboration allows real-time remittances from Japan to bank accounts in the Philippines, Vietnam, and Indonesia. By utilizing XRP as a bridge currency, SBI Remit removes the need for pre-funding destination accounts, significantly cutting transaction costs and settlement times. The integration uses Ripple's On-Demand Liquidity (ODL) service, which facilitates instant and low-cost cross-border payments.

Challenges

- Infrastructure gaps & digital divide: The infrastructure gaps mainly hamper the sales of advanced payment solutions in some parts of developing regions. The unavailability of API standardization, real-time payment networks, and poor rural connectivity are key factors limiting the adoption of cross-border payment solutions. The International Trade Union (ITU) reveals that more than 2.7 billion people were offline in 2023, which impacted the adoption of app-based or cloud-native payment tools. Overall, the developing cross-border payments market have the potential to influence trade both positively and negatively, based on the ongoing trends

- Regulatory fragmentation across jurisdictions: The inconsistent regulations across the world are hindering the sales of cross-border payment solutions. The cross-border payments are heavily governed by local financial regulators, but the fragmentation of regulations acts as a major restraining factor. They also increase the integration costs and delay cross-border payments market entry, hampering the pockets of key players. Payment providers consider regulatory misalignment as the top market entry barrier. To address this, companies are expected to enter into strategic partnerships with local players to align with the required directives.

Cross-border Payments Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

7.5% |

|

Base Year Market Size (2025) |

USD 226.2 billion |

|

Forecast Year Market Size (2035) |

USD 466.2 billion |

|

Regional Scope |

|

Cross-border Payments Market Segmentation:

Payment Type Segment Analysis

The B2B payments segment is projected to account for 43.1% revenue share throughout the forecast period due to the rising global trade volumes, especially among SMEs integrating into international supply chains. Businesses are increasingly demanding faster, more transparent, and cost-effective solutions to replace traditional methods like wire transfers and letters of credit, which are often slow and expensive. Growth is also fueled by the rise of digital platforms and real-time payment infrastructures that streamline cross-border settlements for enterprises. A recent example is Visa’s 2024 expansion of Visa B2B Connect in Asia Pacific, enabling companies to make direct, secure, and near real-time payments across more than 100 countries. Such innovations are accelerating the adoption of digital B2B cross-border payments, offering efficiency and liquidity benefits to enterprises worldwide.

End user Segment Analysis

The financial institutions segment is estimated to capture 37.5% of the cross-border payments market share by 2035. Financial institutions are leading end users that significantly contribute to revenue generation, owing to their central role in currency clearing, correspondent banking, and fraud prevention. In Q4 2024, global cross-border bank credit held steady at USD 32.6 trillion, as a USD 67 billion rise in lending to emerging cross-border payments market and developing economies (EMDEs) led by the Asia Pacific, was offset by a $248 billion decline in loans to non-bank financial institutions (NBFIs). Further, the adoption of SWIFT GPI and ISO 20022 messaging among major banks improves tracking and processing efficiency, making them the largest commercial users of cross-border payment platforms.

Enterprise Size Segment Analysis

The large enterprises segment is expected to register rapid growth during the forecast period as multinational corporations require seamless, high-volume transactions across multiple currencies and regions. Their growing global supply chains and international workforce drive demand for efficient, cost-effective, and transparent payment solutions. With increasing pressure to reduce foreign exchange costs and improve liquidity management, large firms are embracing digital platforms and real-time payment technologies. A recent example is HSBC’s launch of its Global Wallet platform for corporates in November 2024, enabling large enterprises to send and receive international payments instantly in multiple currencies from a single account. Such innovations highlight why large enterprises are leading the adoption of advanced cross-border payment solutions.

Our in-depth analysis of the global cross-border payments market includes the following segments:

|

Segments |

Subsegments |

|

Enterprise Size |

|

|

Payment Type |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Cross-border Payments Market - Regional Analysis

APAC Market Insights

The Asia Pacific cross-border payments market is anticipated to hold 32.1% of the global revenue share through 2035. The rise in the digitization of trade and regulatory harmonization is propelling the sales of cross-border payment technologies. Regional initiatives, including the ASEAN Payment Connectivity framework, are also contributing to the trade of cross-border payment solutions. China, India, and Japan are leading the adoption due to robust digital infrastructures and government mandates. In Japan, millions of organizations are adopting cross-border payment platforms, owing to the rise in public spending on ICT solutions and the implementation of strict cybersecurity regulations.

China is expected to lead the sales of cross-border payment market during the forecast period, owing to the robust rise in public-private sector collaborations, massive export-driven economy, outbound tourism, and international e-commerce. The push for yuan internationalization and integration of fintech with traditional banking is expected to reshape the payment landscape. Due to this, the leading platforms are increasingly offering global wallet services to merchants and consumers. In addition, regulatory easing for fintech partnerships with global networks is fueling its efficiency. In May 2024, Ant Group announced its global expansion with cross-border payments offering Alipay+.

In India, the cross-border payments market is expected to expand at a rapid pace during the forecast period, owing to global trade expansion, high inward remittance volumes, and a rise in overseas education and travel payments. India's UPI is steadily becoming a model for fast, low-cost payments, and its international expansion is accelerating global adoption. The government and RBI are actively forming partnerships to connect UPI to foreign payment systems, fueling remittance efficiency. In July 2025, the Department of Posts (DoP), NPCI International Payments Limited (NIPL), the Ministry of Communications, and the Government of India signed an NDA to collaborate on a groundbreaking initiative to transform inward remittances to India. This partnership is likely to leverage UPI, UPU, and IP to create a secure, seamless, and affordable remittance channel for cross-border transactions.

Europe Market Insights

The Europe cross-border payments market is projected to account for 22.2% of the global revenue share throughout the study period, due to the strong trade networks, high e-commerce penetration, and regulatory push for harmonized payment systems. The introduction of SEPA Instant Credit Transfer (SCT Inst) allows euro transfers across 36 countries in less than 10 seconds, driving adoption among banks and businesses. Regulators are also targeting lower fees and greater transparency for both consumers and enterprises. A recent milestone was the European Parliament’s 2024 legislation mandating instant euro transfers at no extra cost, expected to accelerate uptake further.

The U.K. cross-border payments market is anticipated to expand at a high pace, owing to the regulatory flexibility and robust fintech innovation. The strong connectivity with SEPA and international clearing systems is enabling seamless euro and GBP transactions in the country. The cross-border payment volumes from the country grew by 28.5% between 2021 and 2024, with significant growth reported in the B2B and remittance segments, per the U.K. Finance Annual Payments Report (2024).

The demand for cross-border payment solutions in Germany is estimated to be driven by the regulatory momentum, advanced fintech infrastructure, and digital public investment. The cross-border payments market is expanding as the country’s export-heavy economy and B2B trade volumes require fast, low-cost, and reliable international payment services. SMEs and large corporates are increasingly adopting fintech-led platforms to cut costs and improve transaction visibility. The growth of e-commerce, expected to capture an annual average growth rate of 12.6% by 2025, is also driving consumer demand for cross-border payment solutions. A recent example is Deutsche Bank’s adoption of SWIFT Go in 2024, enabling SMEs in Germany to send low-value international payments more quickly and affordably.

North America Market Insights

The North America cross-border payments market is anticipated to increase at a CAGR of 12.5% from 2026 to 2035, owing to strong demand from both B2B and remittance corridors. The federal programs supporting fintech infrastructure, real-time payment rails, and digital identity systems are boosting the adoption of cross-border payment technologies in both the U.S. and Canada. Also, in Canada, the CRTC's Universal Broadband Fund and ISED's Digital Charter are supporting secure and efficient digital transactions through advanced technologies.

The sales of cross-border payment technologies in the U.S. are expected to be driven by the high fintech adoption, regulatory modernization, and government-backed infrastructure projects. The introduction of FedNow Service by the Federal Reserve in 2023 is a critical upgrade for cross-border B2B settlements as it facilitates 24/7 real-time payments. Also, the Digital Equity Act, which provides targeted grants to marginalized communities, is indirectly supporting digital wallet penetration and secure authentication systems necessary for cross-border commerce.

The Canada cross-border payments market is estimated to increase at a high CAGR, owing to the regulatory transformation and domestic fintech scaling. The strategic infrastructure investments are also contributing to the high trade of cross-border payment technologies. The Innovation, Science and Economic Development (ISED) reveals that it has invested more than CAD 3.1 billion through the Universal Broadband Fund to bridge digital divides, which are crucial for enabling access to digital payment ecosystems.

Key Cross-border Payments Market Players:

- PayPal Holdings Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Visa Inc.

- Mastercard Incorporated

- Ant Group (Alipay)

- Stripe Inc.

- Wise plc

- Revolut Ltd.

- Tencent Holdings Ltd. (WeChat Pay)

- Adyen N.V.

- FIS (Worldpay)

- Nium Pte. Ltd.

- Payoneer Global Inc.

- Airwallex

- Toss Payments

- Razorpay Software Private Ltd.

- Kyodai Remittance

- SBI Remit Co., Ltd.

- NTT Data Corporation

- Japan Post Bank Co., Ltd.

- Seven Bank, Ltd.

The global cross-border payments market is characterized by the presence of fintech innovators and traditional financial giants. Leading companies are focused on the production and commercialization of advanced cross-border payment solutions. They are entering into strategic partnerships with other companies to boost their cross-border payments market reach and revenues. The industry giants are expanding their operations across developing markets to earn lucrative gains from untapped opportunities. Both the organic and inorganic marketing strategies are poised to double the revenues of key players by the end of the forecast period.

Here is a list of key players operating in the cross-border payments market:

Recent Developments

- In September 2025, Thunes, a global payments network, and Ripple, a leader in digital asset infrastructure for financial institutions, expanded their partnership to enhance cross-border payments worldwide. Building on their collaboration since 2020, the alliance aims to improve payout experiences, simplify international money transfers, and extend payout coverage across major markets.

- In August 2025, Mastercard and Infosys partnered to accelerate cross-border payments, giving financial institutions faster access to Mastercard Move, which spans 200+ countries and 150+ currencies. Infosys integrated its Finacle platform with Mastercard Move, allowing banks and financial institutions to deploy cross-border capabilities more quickly and with fewer resources than traditional integrations. The solution supports 95% of the world’s banked population, offering secure, efficient money transfers for both domestic and international transactions.

- In April 2024, SBI Remit Co., Ltd. expanded its blockchain-based remittance services to the Philippines and Vietnam. This move reported a 19.3% rise in cross-border transaction volume, particularly from Japanese SMEs employing foreign labor.

- In February 2024, NTT DATA Corporation introduced its Global Payment Gateway 2.0. Upgrading its cloud-based payment infrastructure with AI-enabled fraud monitoring and FX optimization tools.

- Report ID: 8121

- Published Date: Sep 24, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Cross-border Payments Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.