Critical Care Information Systems Market Outlook:

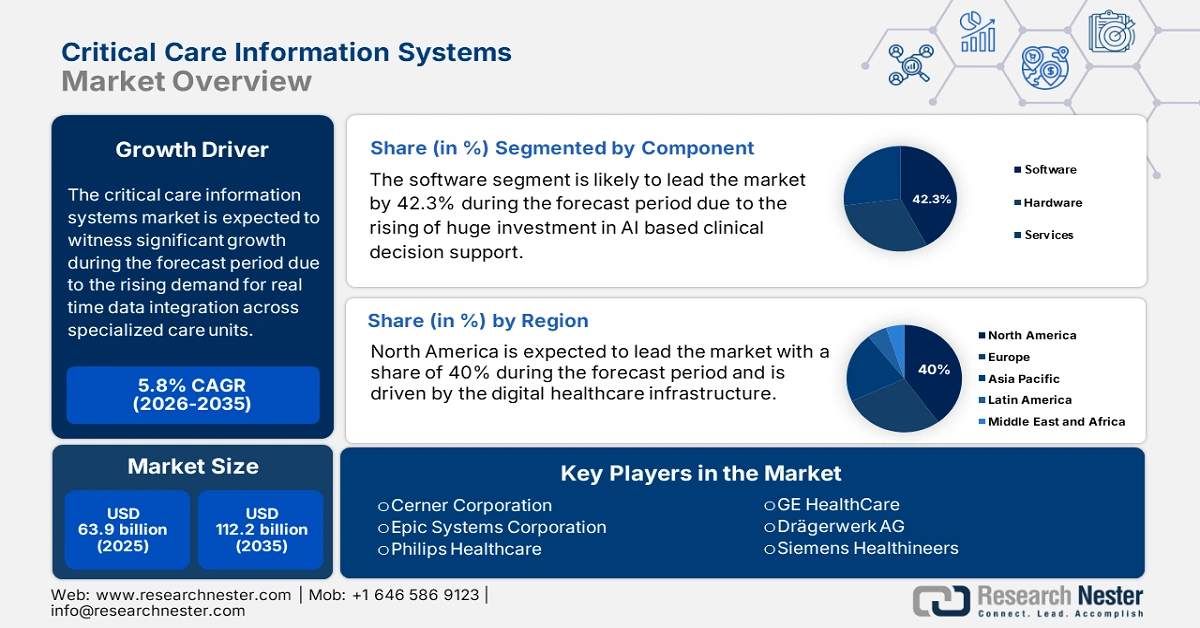

Critical Care Information Systems Market size was valued at USD 63.9 billion in 2025 and is projected to reach USD 112.2 billion by the end of 2035, rising at a CAGR of 5.8% during the forecast period, 2026-2035. In 2026, the industry size of critical care information systems is assessed at USD 67.6 billion.

The critical care information systems market is expanding rapidly, driven by the rising demand for real-time data integration across specialized care units and hospitals, as well as increasing ICU admissions. According to the Society of Critical Care Medicine data from 2025, patients are admitted to ICUs in the U.S. are 5 million annually, for intensive or invasive monitoring. With a steady increase in critical care admissions, particularly among the elderly and chronic illness populations, the patient pool in both established and emerging economies is putting enormous pressure on healthcare systems to implement interoperable and predictive technology. The global components of production and deployment, including server modules and patient monitoring interfaces, are highly dependent on medical device OEMs, which operate in centralized assembly hubs in Japan, the U.S., and Germany.

On the supply chain side, most of the imported components are semiconductors and microcontrollers, which are used in device architecture. Most of these products are imported from Taiwan and South Korea. According to the OEC data in 2023, the global trade of medical devices reached USD 167 billion, which is a 7.8% rise YoY. This demand is rising in the U.S. for high-performance embedded systems that are used in ICU device technology. Furthermore, due to inflation in microelectronics, embedded chipsets, and data integration services, the Producer Price Index (PPI) for electronic medical equipment and software used in CCIS has been rising steadily. The market of critical care information systems further expands with the advancements in technologies.

Key Critical Care Information Systems Market Insights Summary:

Regional Highlights:

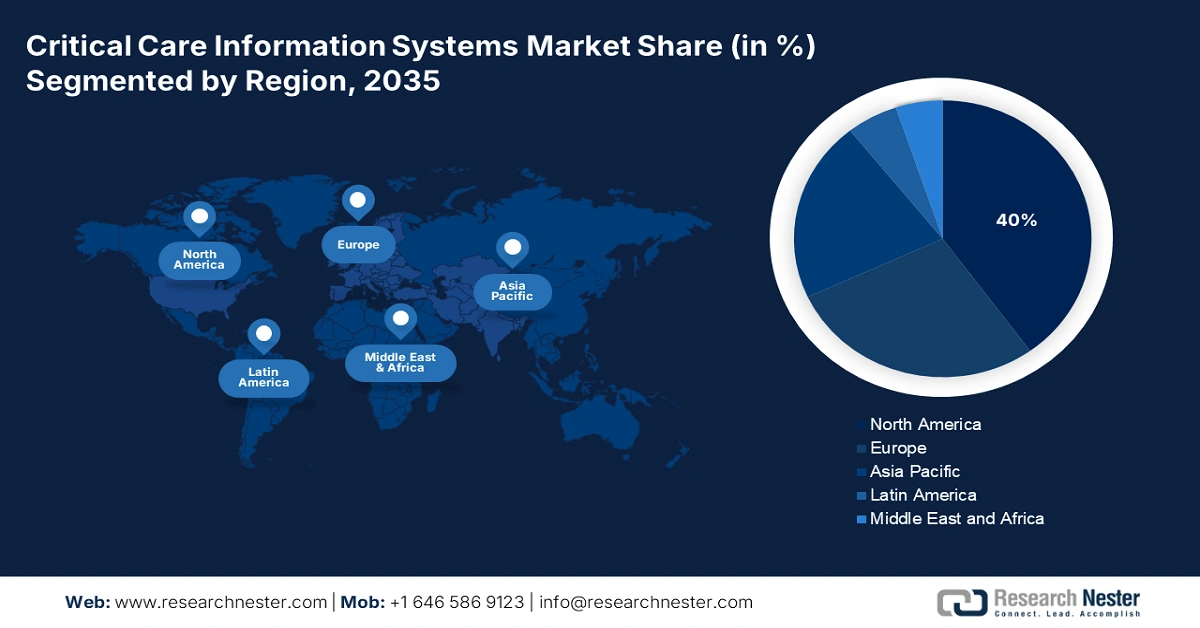

- North America in the critical care information systems market is projected to hold a 40% share by 2035, supported by advanced digital healthcare infrastructure, growing ICU admissions, and rapid adoption of AI-powered decision tools.

- Asia Pacific is anticipated to witness the fastest growth by 2035, driven by large-scale government digitization initiatives, increased ICU investments, and emphasis on predictive analytics for improved critical care management.

Segment Insights:

- The software segment in the critical care information systems market is projected to secure a 42.3% share by 2035, driven by rising investments in AI-based clinical decision support tools that enhance ICU outcomes and streamline real-time decision-making.

- The cloud-based segment is anticipated to command a substantial share by 2035, fueled by the growing demand for scalable, integrated, and cost-efficient healthcare data management solutions.

Key Growth Trends:

- Government spending on ICU digitization and interoperability

- Healthcare quality improvement initiatives

Major Challenges:

- Government price caps and reimbursement limitations

- Lack of training in emerging markets

Key Players: Cerner Corporation, Epic Systems Corporation, Philips Healthcare, GE HealthCare, Drägerwerk AG, Siemens Healthineers, Allscripts Healthcare, Wipro GE Healthcare, Mindray, Alcidion Group, Spacelabs Healthcare, Medisys Healthcare, InTouch Health, FUJIFILM Holdings, Samsung Medison, IMD Soft, Baxter International, NextGen Healthcare, iProcedures, Platinum Analytics

Global Critical Care Information Systems Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 63.9 billion

- 2026 Market Size: USD 67.6 billion

- Projected Market Size: USD 112.2 billion by 2035

- Growth Forecasts: 5.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, United Kingdom, China, Japan

- Emerging Countries: India, South Korea, Australia, Singapore, Brazil

Last updated on : 24 September, 2025

Critical Care Information Systems Market - Growth Drivers and Challenges

Growth Drivers

-

Government spending on ICU digitization and interoperability: The governments are prioritizing digitization in the ICU to improve efficiency, enabling real-time critical care decisions and minimizing clinical errors. The Medicare spending on healthcare, including the digital tools in the ICU including critical care information systems, have increased to USD 1,029.8 billion in 2023. In a similar vein, the EU4Health initiative allocated a considerable amount for the modernization of intensive care unit infrastructure. Further, Germany and France allocate substantial investments supporting digital integration and boost quality of healthcare nationwide.

-

Healthcare quality improvement initiatives: The demonstrated effects of critical care information systems (CCIS) on patient outcomes and cost effectiveness are driving the market adoption. According to the 2021 NLM study, in Germany, nearly 53% of the population required ICU hospital admission for disease treatments. Additionally, these systems enhance early sepsis detection and hence reduce the hospitalization days. These advantages highlight the importance of CCIS in hospital systems' efforts to improve healthcare quality and implement performance-based care.

- Rising prevalence of chronic and critical conditions: The growing patient pool suffering from complex, life-threatening conditions necessitates advanced care coordination. The aging population and high prevalence of diseases like sepsis, respiratory failure, and cardiac arrest increase the hospitalization of ICU admissions. As per the CDC report in August 2025, in the USA, sepsis affects at least 1.7 million adults annually, with many requiring intensive care. To effectively handle these increased patient admissions, there is a great need for systems to optimize patient flow and clinical decision-making.

Export Data on Electronic drop counter, IV fluids used in ICUs in 2023

|

Country |

Trade Value 1000 USD |

Quantity |

|

European Union |

331,532.43 |

8,466,360 |

|

China |

289,607.12 |

31,131,000 |

|

Germany |

219,047.02 |

5,301,070 |

|

Mexico |

197,231.20 |

3,756,040 |

|

France |

180,286.76 |

11,418,100 |

|

Italy |

140,365.30 |

6,241,010 |

|

United States |

116,873.60 |

629,697 |

Source: WITS, 2023

Challenges

-

Government price caps and reimbursement limitations: The price controls on ICU software by the governments of Italy and France have restricted reimbursement, due to the profitability issues for CCIS providers. To overcome these constraints, firms collaborated with France healthcare authorities to implement a tiered pricing system that prioritizes national eHealth priorities. This has helped many hospitals to enhance affordability and increase access, demanding CCIS adoption by public hospitals to grow further. These partnerships highlight the necessity of agile pricing models to reduce the challenge of reimbursement pressures in guided European healthcare markets.

-

Lack of training in emerging markets: The main issue in the adoption of critical care information systems in emerging markets is the gap in the skilled professionals in hospitals in using the advanced tech-based system for improved outcomes. Many hospitals face difficulties in operating and maintaining these systems as they lack trained staffs and hence result in delayed deployment of systems. This results in the healthcare providers utilizing the complete CCIS to enhance decision-making, efficiency, and patient outcomes in the critical related issues.

Critical Care Information Systems Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.8% |

|

Base Year Market Size (2025) |

USD 63.9 billion |

|

Forecast Year Market Size (2035) |

USD 112.2 billion |

|

Regional Scope |

|

Critical Care Information Systems Market Segmentation:

Component Segment Analysis

The software segment holds the largest share and is poised to have a market share of 42.3% by 2035. The market of the software segment is rising due to the huge investment in AI based clinical decision support modules to minimize the ICU mortality rates and stay period. The software solutions in the hospital sector are mainly used for clinical decision support, ICU workflow software, and HER integrated platforms due to the requirement of data-driven, and real time decision making. As the patient volume increases in the ICU the complexity of the care also rises and requires an additional support such as software to make fast alert and predictive analytics.

Deployment Mode Segment Analysis

Cloud-based segment is the dominant platform and expected to hold a significant share by 2035. The deployment mode segment in the critical care information systems market is mainly driven by the support of scalable, integrated and cost-effective solution in healthcare systems in the U.S. meanwhile, the EU is facing some challenges related to budget optimization. The ASTP report in 2021 depicts that 9 in 10 U.S. office-based physicians adopted any electronic health record, which is nearly 88% of the hospitals integrate cloud-based model in healthcare. This segment is further gaining the attraction as it minimizes the infrastructure costs and enhances the data interoperability.

End user Segment Analysis

Hospitals are leading the end-user segment and are driven by their high concentration of ICUs, complex caseloads, and significant financial capacity. Large hospitals must invest in advanced CCIS to enhance patient outcomes and prevent reimbursement penalties due to government incentives and penalties from Medicare's Hospital Inpatient Quality Reporting (IQR) program and Promoting Interoperability mandates. Hospitals are the main market because of the urgent need to manage resources, minimize the hospital stays, and coordinate care for the sickest patients.

Our in-depth analysis of the global critical care information systems market includes the following segments:

|

Segment |

Subsegments |

|

Component |

|

|

Deployment Mode |

|

|

End user |

|

|

Application |

|

|

Functionality |

|

|

Integration Type |

|

|

System Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Critical Care Information Systems Market - Regional Analysis

North America Market Insights

North America is the dominant player in the critical care information systems market and is expected to hold the maximum share of 40% by 2035. The market is driven by the digital healthcare infrastructure and high ICU patient admissions across the region, including Canada and the U.S. Further, the increasing integration of cloud-based data platforms makes the hospital sector adopt digital solutions. As per the CDC and AHRQ report, the ICU-based digital solutions in the healthcare sector in the U.S. are increasing rapidly since 2021. Advancements in technologies such as AI decision tools and enhanced analytics dominate the market preferences.

The critical care information systems market in the U.S. is growing rapidly and is driven by the rising ICU admissions, federal policy alignment, and expanded reimbursement via Medicaid and Medicare. Adoption is further driven by FDA regulatory backing for clinical decision assistance software. The NLM report in September 2024 depicts that the AHRQ has funded over USD 711 million on digital healthcare innovations. This includes telehealth, clinical decision support, virtual care, and AI in healthcare. Hospitals in the U.S. are combining CCIS with telemetry and remote surveillance systems, especially in tertiary care networks.

Canada is the second largest country in the critical care information systems market in North America. The market is driven by the federal-provincial collaborations focused to modernize digital health infrastructure. The latest trend is the push for pan-Canadian interoperability standards, led by Canada Health Infoway, to make a secure sharing of critical patient data among the provinces and care settings. As per the DIGITAL’s data in July 2024, investment of USD 15.3 million to support the consortium of organizations, leveraged into a total project value of USD 44 million, further reflects the national commitment to expanding digital health capacity.

Description of Hospital Admissions in Canada

|

Variable |

January 2 to January 29, 2022 |

January 30 to February 26, 2022 |

February 27 to March 26, 2022 |

March 27 to April 23, 2022 |

||||

|

n |

% |

n |

% |

n |

% |

n |

% |

|

|

Admitted to ICU |

565 |

13.4 |

187 |

12.1 |

89 |

8.8 |

185 |

7.7 |

Source: Government of Canada 2024

Asia Pacific Market Insights

The APAC region is the fastest-growing sector in the market, fueled by the government digitization programs, urgent requirement of modernize critical care infrastructure, and rising ICU admissions. EHR-integrated dashboards, AI-powered clinical decision support systems, and real-time intensive care unit monitoring are becoming top priorities for nations in the area. Governments have accelerated investments in smart intensive care units and predictive analytics after the COVID-19 pandemic highlighted the serious gaps in ICU interoperability. Further the market is also driven by the government budget allocation for ICU and IT with the focus on reducing the mortality rate and improving the decision making speed.

Japan is rising steadily, holds the largest share in the APAC region and is expected to have the largest market share by 2035. As per the International Trade Administration report in December 2022, the Japan’s healthtech segment will grow to USD 2 billion by 2025, part of which is focusing on focusing on ICU monitoring systems, decision support, tele-ICU, and interoperability in high-acuity care settings. The Agency for Medical Research and Development in Japan has launched various innovative grants in the market specially in urban tertiary centers and university hospitals. Furthermore, the government also supported the real time EHR integration pilots in the hospital ICU by providing funds to minimize the average length of stay period.

The market in India is growing rapidly, driven by governmental digital health initiatives such as the Ayushman Bharat Digital Mission (ABDM), which aims to create a single national digital health ecosystem. The drive for digitization, in conjunction with an increased patient burden and the pressure to improve ICU efficiency, has led to substantial investment growth. In February 2025, a report was published in Express Healthcare, which stated that over 77% of health technology startups were investing in advanced technology for critical solutions (like machine learning and artificial intelligence). Some notable trends to consider include the development of scalable, cost-effective cloud-based solutions and an increasing focus on interoperability to support the integration of CCIS within other hospital management solutions given the multiplicity of health care systems across India's health system.

Europe Market Insights

The critical care information systems market in Europe is significantly expanding. The market has risen due to the adoption of AI in ICU units, public health investments, and expanding EHR infrastructure. Rising ICU admissions in post-COVID and in elderly patients across the EU are increasing the demand for real-time patient monitoring, predictive analytics, and decision support. National digital health missions, AI regulatory frameworks, and advantageous reimbursement practices all help to promote adoption. The increasing need in tertiary hospitals and regional health networks presents an opportunity for vendors with scalable, AI-integrated, and HL7/FHIR-compliant solutions.

The Germany is leading the critical care information systems market and is expected to hold the market share of 7.6% by 2035. Germany is fueled by the robust policy frameworks, including the Krankenhauszukunftsgesetz, which allocated nearly €4.3 billion, including for intensive care technology upgrades, as per the NSIDE ATTACK LOGIC report in 2025. Many hospitals in the Germany have integrated cloud-based platforms in 2023, featuring AI-powered predictive diagnostics. The market in Germany is benefited by the high volume of local vendors and consistent public funding.

UK is a well-established and growing market and is primarily aimed at the National Health Service's long-term plan to digitize healthcare and ultimately realize the integrated care systems. The market is driven by optimizing operational efficiency in intensive care units, reducing clinician burnout via automated workflow support, and fulfilling government mandates to deliver a paperless NHS. As per the Bulletin of the Royal College of Surgeons of England article in June 2025, the announcement was made in February 2025 that £83 million is funded for projects aiming to integrate artificial intelligence to diagnose and tackle cancer, hence drive the use of new technologies in healthcare.

Key Critical Care Information Systems Market Players:

- Cerner Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Epic Systems Corporation

- Philips Healthcare

- GE HealthCare

- Drägerwerk AG

- Siemens Healthineers

- Allscripts Healthcare

- Wipro GE Healthcare

- Mindray

- Alcidion Group

- Spacelabs Healthcare

- Medisys Healthcare

- InTouch Health

- FUJIFILM Holdings

- Samsung Medison

- IMD Soft

- Baxter International

- NextGen Healthcare

- iProcedures

- Platinum Analytics

The market of critical care information systems is rapidly rising and is driven by the increase in AI integration, global expansions, and technology innovations. Dominant players like Cerner, Philips, and GE HealthCare play a major role due to the interoperable platforms, scalability, and strategic partnerships with health systems. Further, the APAC region manufacturers, including Mindray and Samsung Medison, are expanding aggressively by providing cost-effective solutions, and AI-powered solutions custom to local markets. Cross-border alliances, government-backed pilot programs, and AI diagnostics research and development are examples of strategic initiatives that will guarantee steady growth and market consolidation.

Below is the list of some prominent players operating in the market:

Recent Developments

- In October 2024, BD (Becton, Dickinson and Company) launched the new BD Intraosseous Vascular Access System, enabling access for rapid delivery of fluids or medication in critical emergencies.

- In September 2024, Medtronic plc announced the launch of a new ECMO system called VitalFlow, which is a configurable one-system ECMO solution, built on simplicity and performance.

- Report ID: 843

- Published Date: Sep 24, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.