Crash Barrier Systems Market Outlook:

Crash Barrier Systems Market size was over USD 8.74 billion in 2025 and is projected to reach USD 14.37 billion by 2035, witnessing around 5.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of crash barrier systems is evaluated at USD 9.14 billion.

The growth of the market can primarily be attributed to infrastructure development such as roads, highways, and bridges, along with the rising need for crash barrier systems to avoid road disasters. According to the India Brand Equity Foundation (IBEF), in 2021, 5,835 km of the highway was constructed across India. Highway safety can be improved with the use of crash barriers. The accident risk on the highways is caused by the high speed of vehicles and no crash barriers in the areas of accident-prone zones. Many accidents can be reduced by the use of crash barriers as they help to slow down the vehicles in the crash zone. Crash barriers in the middle and sides of the roads on highways can prevent accidents and promote the safety of vehicles. Additionally, crash barriers give positive results by preventing vehicles from crossing over into the main road vehicles which is highly risky.

Crash barriers are considered to be proof against the impact of vehicles of certain weights at a disquieted angle while traveling at a certain speed. The increasing movement of rural populations to urban areas in developing countries has risen the demand for safety systems in overpopulated cities. It is estimated that by the end of 2050, India will have more than 400 million urban dwellers, while China will have over 250, and Nigeria with about 190 million urban dwellers. The increasing number of people migrating from the villages to cities for jobs, education, and business increase the population of urban cities, causing heavy traffic on roads. The increasing urban population leads to more automobile purchases, followed by increasing disposable income. As the number of personal vehicles on the road increases, so do the chances of accidents and the need for crash barriers to control them. The growing prevalence of road accidents has increased awareness about road safety, which leads to market growth. Furthermore, the adoption of barrier systems across the globe has massively increased, which is projected to accelerate the global industry, in the coming years.

Key Crash Barrier Systems Market Insights Summary:

Regional Highlights:

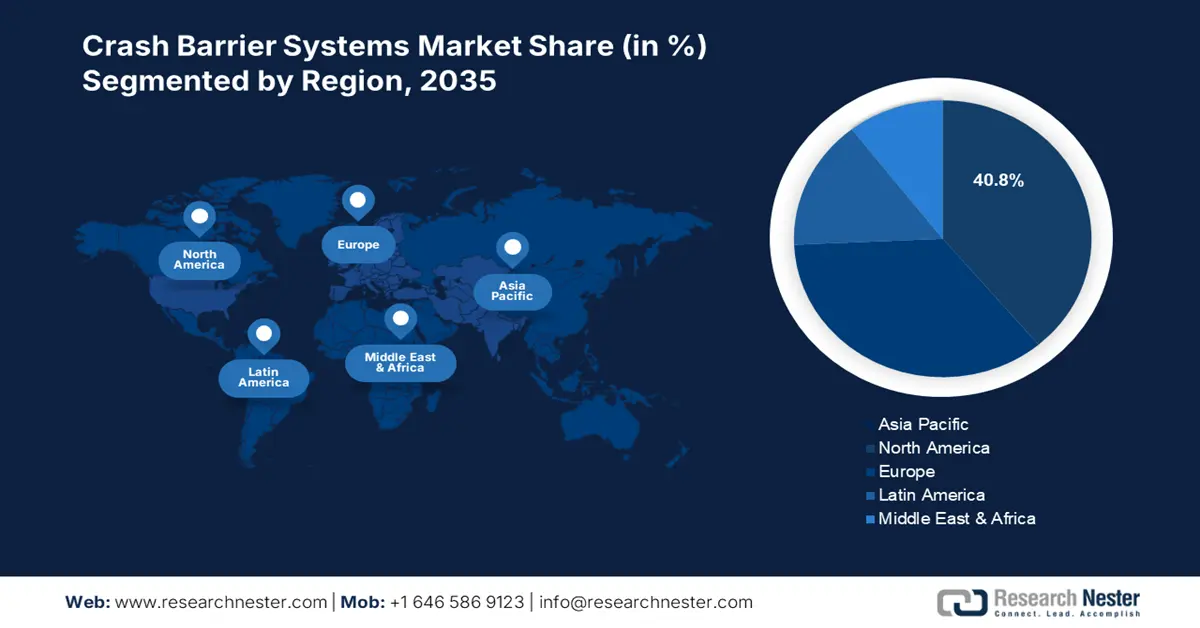

- Asia Pacific crash barrier systems market is predicted to capture 40.8% share by 2035, driven by population growth and road safety infrastructure development.

Segment Insights:

- The roadside barriers segment in the crash barrier systems market is expected to capture the largest share by 2035, driven by rising road accidents and implementation of road safety programs.

- The fixed barriers segment in the crash barrier systems market is projected to hold the largest share by 2035, driven by the need for continuous road protection and prevention of mountain slide accidents.

Key Growth Trends:

- Growing Construction and Automotive Industries Owing to Rising Traffic

- Rapid Urbanization & Industrialization with Improving Standard of Living of People

Major Challenges:

- High Cost of Barrier Systems

- Price Arbitrariness of Raw Material Prices

Key Players: Roadsafe Traffic Systems, Inc., Hill & Smith Holdings PLC, Pinax Steel Industries, Tata Steel, Lindsay Corporation, Transpo Industries, Inc., Valmont Industries, Inc., Nucor Corporation, Avon Barrier Corporation Ltd.

Global Crash Barrier Systems Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 8.74 billion

- 2026 Market Size: USD 9.14 billion

- Projected Market Size: USD 14.37 billion by 2035

- Growth Forecasts: 5.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (40.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, India

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 10 September, 2025

Crash Barrier Systems Market Growth Drivers and Challenges:

Growth Drivers

-

Growing Construction and Automotive Industries Owing to Rising Traffic - Crash barriers are installed to prevent vehicle intrusion. According to the International Organization of Motor Vehicle Manufacturers (OICA), the automotive industry in India, Brazil, and South Africa, along with the US, Canada, Germany, Italy, and Australia, is projected to grow at more than 10% in the next five years, which will result in high demand for crash barrier systems for furthering road safety.

-

Rapid Urbanization & Industrialization with Improving Standard of Living of People - As per the United Nations, nearly 68% of the total population across the globe is expected to live in urban areas by the end of 2050.

-

Innovation of Technology in Barrier Systems with Advancements in Technology and Manufacturing Material - As per the data from the World Bank, 2.33% of the global GDP was spent on research and development activities in 2019, which increased to 2.63% in 2020.

-

Increased Awareness Regarding Road Safety with Growing Road Accidents and Deaths - As per the data by the WHO, approximately 1.3 million people die each year as a result of road traffic crashes. Road traffic injuries are the leading cause of death for children and young adults aged 5-29 years.

Challenges

- High Cost of Barrier Systems - barrier systems which are built to lower the crash impact, need high investments. Barriers such as concrete blocks, wooden fences, and end treatments need high costs for their reconstruction. The costs for managing and maintaining road devices such as safety barriers are very high.

- Price Arbitrariness of Raw Material Prices

- Rigid Barriers Cause a High Fatality Rate in Accidents and are Less Effective

Crash Barrier Systems Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.1% |

|

Base Year Market Size (2025) |

USD 8.74 billion |

|

Forecast Year Market Size (2035) |

USD 14.37 billion |

|

Regional Scope |

|

Crash Barrier Systems Market Segmentation:

Application Segment Analysis

The global crash barrier systems market is segmented and analyzed for demand and supply by application into the roadside, median, bridge, and work zone barriers. Amongst these segments, the roadside barrier segment is anticipated to garner the largest revenue by the end of 2035, backed by the extensively increasing number of road accidents combined with the implementation of road safety programs. According to National Crime Records Bureau (NCRB), in 2021, more than 1.55 lakh people were killed in road crashes across India. Road accidents are caused by negligence, fast driving, distractions, drunk driving, not wearing seat belts, weather disturbances, bad roads, the absence of dividers, or car brake issues. The absence of dividers or road separators can be done by improving road infrastructure. Crash barriers are one such category that can be used as dividers. With increased traffic and no proper direction for the coming and going vehicles a single one-way road is very dangerous. Moreover, it becomes difficult for pedestrians to cross the road with heavy traffic, which increases road crashes. In addition, the adoption of automotive safety systems in the form of crash imminent braking, pedestrian emergency braking, is anticipated to boost the segment’s growth in the market.

Type (Portable, Fixed)

The global crash barrier systems market is also segmented and analyzed for demand and supply by type into the fixed and portable barriers. Among these, the fixed barrier segment is estimated to garner the largest market share owing to the growing need for continuous guards on the roads to prevent road crashes. An increasing number of road accidents and mountain slide deaths is also estimated to boost the growth of the segment. In the U.S. as per the reports, about 48 people die every year from landslides. Fixed crash barriers are safety barriers that are assembled at the corners and middle of the road with a permanent setting, unlike portable plastic barriers. The fixed barriers are usually made of steel to withstand climatic conditions and fast-moving vehicles to improve road safety thereby increasing the growth of the fixed crash barrier market’s segment. Moreover, the roads along the hill areas, water lands, and mountain roads are installed with fixed barriers to prevent vehicles from going close to the mountain rocks as they may slide suddenly.

Our in-depth analysis of the global market includes the following segments:

|

By Type |

|

|

By Technology |

|

|

By Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Crash Barrier Systems Market Regional Analysis:

APAC Market Insights

Asia Pacific region is projected to account for more than 40.8% market share by 2035, fueled by population growth and road safety infrastructure development.. According to the World Bank, the population of India and China has increased from 1.06 billion and 1.26 billion in 2000 to 1.39 billion and 1.41 billion in 2021 respectively. The economic growth of India is estimated to improve roads to meet high standards. Moreover, the increasing transport dependent on roads is increasing day by day with more imports, exports, and e-commerce sales. In addition, everything is being purchased from e-commerce platforms with increasing internet penetration. This promotes the installation of crash barriers on highways, roads, flyovers, and bridges. Furthermore, flyovers are being built in many areas to control traffic, which is expected to boost market growth in the region, according to market analysis. Even the government has sanctioned funds for many road projects to reduce road accidents and improve the beauty of the cities by planting trees in the middle and side paths of the roads.

Crash Barrier Systems Market Players:

-

Trinity Highway Products, LLC

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Roadsafe Traffic Systems, Inc.

- Hill & Smith Holdings PLC

- Pinax Steel Industries

- Tata Steel

- Lindsay Corporation

- Transpo Industries, Inc.

- Valmont Industries, Inc.

- Nucor Corporation

- Avon Barrier Corporation Ltd

Recent Developments

-

Trinity Highway Products has announced that the company has entered into a definitive agreement to sell its highway products business for USD 375 million in cash.

-

Roadsafe Traffic Systems announced the acquisition of Clark Pavement Markings, Inc. Based in Apex, North Carolina, CPM is a leading supplier of pavement marking products and services in North Carolina market.

- Report ID: 4623

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Crash Barrier Systems Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.