Crane Market Outlook:

Crane Market size was over USD 34.99 billion in 2025 and is poised to exceed USD 53.82 billion by 2035, growing at over 4.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of crane is evaluated at USD 36.38 billion.

The booming construction industry is the main driver of the crane market's strong expansion. Cranes are required for the lifting and transportation of large, heavy materials due to the proliferation of high-rise structures and infrastructure projects globally. For instance, over 200,000 cranes are thought to exist worldwide, of which 125,000 are employed in the construction sector and 80,000-100,000 in the general and maritime industries.

To upgrade electricity grids, transportation networks, bridges, and other essential infrastructure elements, local governments are initiating large-scale infrastructure investment schemes. The market is being shaped by technological developments in crane design to increase lifting capacities, enhance safety measures, and offer sophisticated control systems.

Key Crane Market Insights Summary:

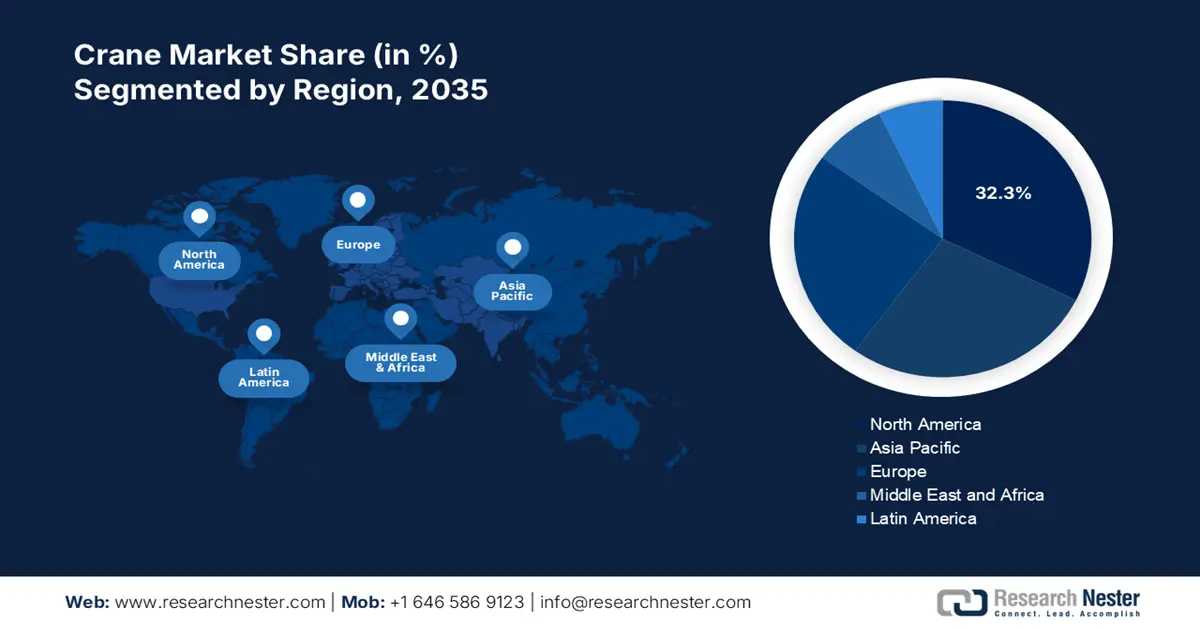

Regional Highlights:

- North America dominates the Crane Market with a 32.3% share, fueled by active infrastructure development and large investments in residential and commercial buildings, driving growth through 2026–2035.

- The Asia Pacific crane market is projected to maintain a stable CAGR through 2026–2035, driven by the swift expansion of infrastructure in China, India, and Japan, and rising investments in transportation infrastructure.

Segment Insights:

- The Mobile Crane segment is projected to capture a 65.2% share by 2035, driven by rapid urbanization and the expansion of global infrastructure projects.

- The Construction & Mining segment is expected to hold a significant market share by 2035, propelled by increased construction activities and technological advancements in crane technology.

Key Growth Trends:

- Growth of mini-cranes and mobile

- Increasing use of hybrid and electric cranes

Major Challenges:

- High initial costs

- Regulatory compliance and safety standards

- Key Players: BUCKNER HEAVYLIFT CRANES, LLC, CARGOTEC CORPORATION, Caterpillar, CERTEX USA, Demag Cranes & Components GmbH, GORBEL INC., Konecranes, LIEBHERR.

Global Crane Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 34.99 billion

- 2026 Market Size: USD 36.38 billion

- Projected Market Size: USD 53.82 billion by 2035

- Growth Forecasts: 4.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (32.3% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 14 August, 2025

Crane Market Growth Drivers and Challenges:

Growth Drivers

- Growth of mini-cranes and mobile: Within the crane market, there is a discernible increase in demand for mobile cranes and mini-cranes. For example, according to a recent market analysis, demand for mobile cranes and mini-cranes has increased by 25% in the past 12 months. These cranes are very useful in crowded urban settings with little space as they can frequently lift up to 10 tons. This pattern reflects the changing demands of the construction sector, where equipment innovation is being driven by time and space restrictions.

- Increasing use of hybrid and electric cranes: The use of electric and hybrid cranes has significantly increased as sustainability has become a top priority. With a 50% reduction in noise pollution, hybrid cranes which can alternate between electric and conventional power have grown in popularity. They are therefore perfect for urban building sites, where noise levels must be maintained low to prevent upsetting nearby inhabitants and work frequently goes on into the night. These figures demonstrate the industry's dedication to ethical building methods and show a larger trend toward sustainability.

Due to their lower emissions and noise pollution, these environmentally friendly substitutes are appropriate for projects that are sensitive to the environment or for cities with strict laws. The industry's growing focus on environmentally friendly projects and ethical building methods is consistent with the move towards electric and hybrid cranes.

Challenges

- High initial costs: Cranes are sophisticated, costly machines that demand a large initial outlay of funds. The price covers not just the crane's purchase or leasing but also the costs of operating, maintaining, and adhering to safety regulations. The hefty initial cost may serve as a deterrent for small and medium-sized enterprises that might lack the funds to purchase cranes. Furthermore, the total cost may increase due to continuing maintenance and repairs. Crane adoption may be hampered by these issues, especially in markets where prices are sensitive or in sectors with tight budgets.

- Regulatory compliance and safety standards: Crane firms have significant difficulty due to strict rules and safety concerns. The industry places a high priority on safety, and adherence to rules controlling crane operation, lifting capacity, and operator qualification cannot be compromised. However, crane businesses that aim to maintain compliance while guaranteeing operational efficiency face operational difficulties and administrative overhead owing to strict regulatory compliance.

Crane Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.4% |

|

Base Year Market Size (2025) |

USD 34.99 billion |

|

Forecast Year Market Size (2035) |

USD 53.82 billion |

|

Regional Scope |

|

Crane Market Segmentation:

Product (Mobile Crane, Fixed Crane)

The mobile crane segment is set to dominate around 65.2% crane market share by the end of 2035, owing to rapid urbanization and the expansion of infrastructure projects worldwide. Additionally, the move to flexible and adaptive infrastructure models makes it possible for mobile cranes to meet a range of construction requirements. In the oil and gas industry, mobile cranes play a vital role in the installation and upkeep of equipment.

Throughout the projection period, the need for mobile cranes is projected to grow due to an increase in exploration operations in areas like the Middle East and North America. For instance, in March 2021, Liebherr unveiled the MK 73-3.1 mobile construction crane, a small one-man taxi crane. This most recent device was created to meet consumer expectations for a mobile construction crane that is small, lightweight, adaptable, and quick to operate.

Application (Construction & Mining, Utility, Manufacturing, Transport/shipping, Oil & Gas/ Energy)

The construction & mining segment is likely to hold a significant share in crane market by the end of 2035 due to their effectiveness and capacity to carry large weights, cranes are essential in a variety of building operations. Crane demand rises in tandem with construction activity, fostering a mutually beneficial link between the two sectors. Furthermore, the demand for sophisticated crane technology has been further stimulated by the development of construction methods and the need for increased efficiency.

Innovative crane solutions that provide better safety features, higher load capacities, and superior mobility are becoming more and more popular among contractors and construction businesses. The need to adhere to strict safety and regulatory requirements is another factor driving the crane market's push for technical improvement. In order to provide innovative crane models that meet the changing demands of the construction sector, manufacturers are spending money on research and development.

Our in-depth analysis of the global crane market includes the following segments:

|

Product |

|

|

Type |

|

|

Load Capacity |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Crane Market Regional Analysis:

North America Market Analysis

In crane market, North America region is expected to capture around 32.3% revenue share by the end of 2035, due to active infrastructure development and building. The need for cranes has been driven by the region's steady economic expansion as well as large investments in residential and commercial buildings. The industry's development is attributed to growing urbanization and an emphasis on updating deteriorating infrastructure. With the growing popularity of solar farms and wind turbines, the renewable energy industry is also flourishing. The need for cranes that can raise large, heavy components to vast heights is therefore increasing.

The U.S. crane market has grown steadily due to rising building activity in a variety of industries, including infrastructural, residential, and commercial. Growing urbanization and government spending on infrastructure projects are to blame for this expansion. Additionally, the necessity for effective lifting and material handling solutions in sectors like manufacturing, energy, and logistics has increased the demand for cranes. Furthermore, by improving operational efficiency and safety requirements, technological developments like the incorporation of telematics and IoT in crane systems have further fueled market expansion.

Market demand is rising drastically in Canada as a result of government programs including the Economic Action Plan and others that are designed to expand the nation's infrastructure through private investments. The factors driving the crane market in this country include the wide range of uses for cranes, the flexibility of fuel in reducing operating costs, and the development of infrastructure investments.

Asia Pacific Market Analysis

Asia Pacific crane market is expected to experience a stable CAGR during the forecast period due to the swift expansion of infrastructure in China, India, and Japan and rising investments in transportation infrastructure including highways, railroads, and airports. In particular, China has started a drive to modernize and develop its crane industry, emphasizing innovation, raising safety standards, and increasing the sector's competitiveness. For instance, in March 2022, XCMG introduced the all-terrain cranes in the Windflex XCA1800 series. At its highest lifting height of 140 meters, the crane can lift 148 tons. Its maximum gradeability is 27%, and it can transition to heavier loads with a maximum capacity of 284 tons.

The crane market in China is expected to expand owing to rapid urbanization and industrialization in the country, rising need for cranes for construction purposes, and the presence of leading companies investing in developing advanced cranes, maintaining China’s reputation for dependability, technical innovation, and precision engineering

The increasing need for development projects in urban areas is driving growth in India’s crane market. In order to support the growth and modernization of cities, cranes are pivotal for the construction of high-rise buildings, urban redevelopment, and infrastructural upgrades. As more people move into cities, there is a greater need for effective construction techniques, and cranes are essential for shortening project completion times and making the best use of available resources. For example, in April 2022, in the Union Budget 2022–2023, the government of India set aside USD 130.7 billion to hasten the construction of integrated infrastructure, such as ports and multimodal freight hubs, throughout the nation.

Key Crane Market Players:

- PALFINGER AG

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- BUCKNER HEAVYLIFT CRANES, LLC

- CARGOTEC CORPORATION

- Caterpillar

- CERTEX USA

- Demag Cranes & Components GmbH

- GORBEL INC.

- Konecranes

- LIEBHERR

To increase their business and clientele, market players are forming partnerships, strategic alliances, mergers, and acquisitions, as well as developing new products. Through strategic activities like technical innovation, product portfolio expansion, market entry, alliance formation, and sustainability prioritization, companies in the crane sector bolster their presence. By addressing changing industry demands and boosting competitiveness, these actions promote long-term growth and market leadership.

Here are some leading players in the crane market:

Recent Developments

- In August 2024, Konecranes unveiled its flagship Konecranes X-series industrial crane, the replacement for its well-liked CXT model. It features a sleek, compact design and dependable, safe technology that can be upgraded wirelessly to meet the needs of customers both now and in the future.

- In April 2024, Liebherr unveiled the third-generation LTM 1300-6.4, 300-ton crane at the Paris Intermat 2024. The LICCON3 control system, which powers the cranes, will increase operational efficiency by making them simple to use and ready for fleet management and telemetry systems.

- Report ID: 6775

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Crane Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.