Crane Aerospace AfterMarket Outlook:

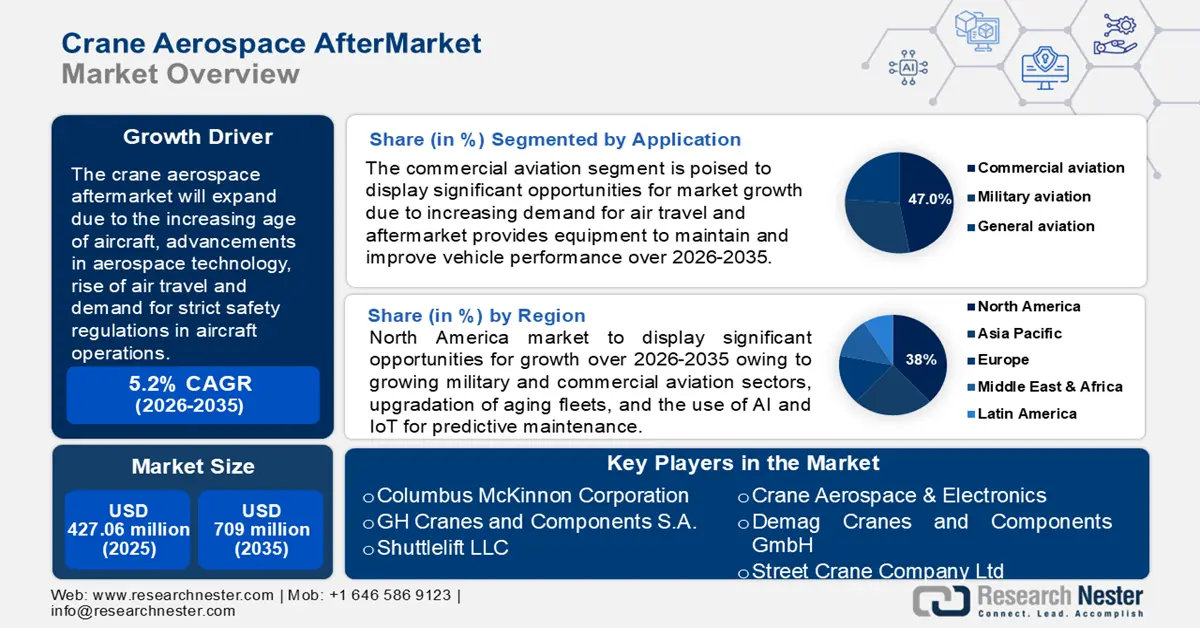

Crane Aerospace AfterMarket size was over USD 427.06 million in 2025 and is poised to exceed USD 709 million by 2035, witnessing over 5.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of crane aerospace aftermarket is estimated at USD 447.05 million.

Aircrafts require frequent maintenance and replacement parts to maintain performance, safety, and efficiency. This leads to the growing demand for new and refurbished parts for maintenance, which is driving the crane aerospace aftermarket. The development of aeronautical engineering has significantly increased the need for updated parts that can be replaced. Advanced systems like automated and electronic controls are driving demand for high quality replacement parts. Aircraft cranes with improved engines, electronics, and materials make aircraft safer and more efficient. This creates a consistent demand for replacement parts that meet modern operational standards.

In order to reduce maintenance costs, Crane Aerospace & Electronics developed a wireless tire pressure monitoring system for safe operations by minimizing unscheduled maintenance and extending tire life. By Smartstem Tire Pressure Monitoring Systems (TPMS) the tire pressure and temperature data are directly displayed in the cockpit, or the technology can be used with a convenient ground maintenance tool. When brake temperature monitoring and Crane Tire and Brake Monitoring Systems (TBMS) are combined, detailed information regarding the tires and brakes is provided to minimize maintenance and reduce cost. This continuous evolution of aerospace technology creates an urgent need for aftermarket parts that support the latest advancements and ensure aircraft remain up-to-date and capable of meeting current operational standards.

Key Crane Aerospace After Market Insights Summary:

Regional Highlights:

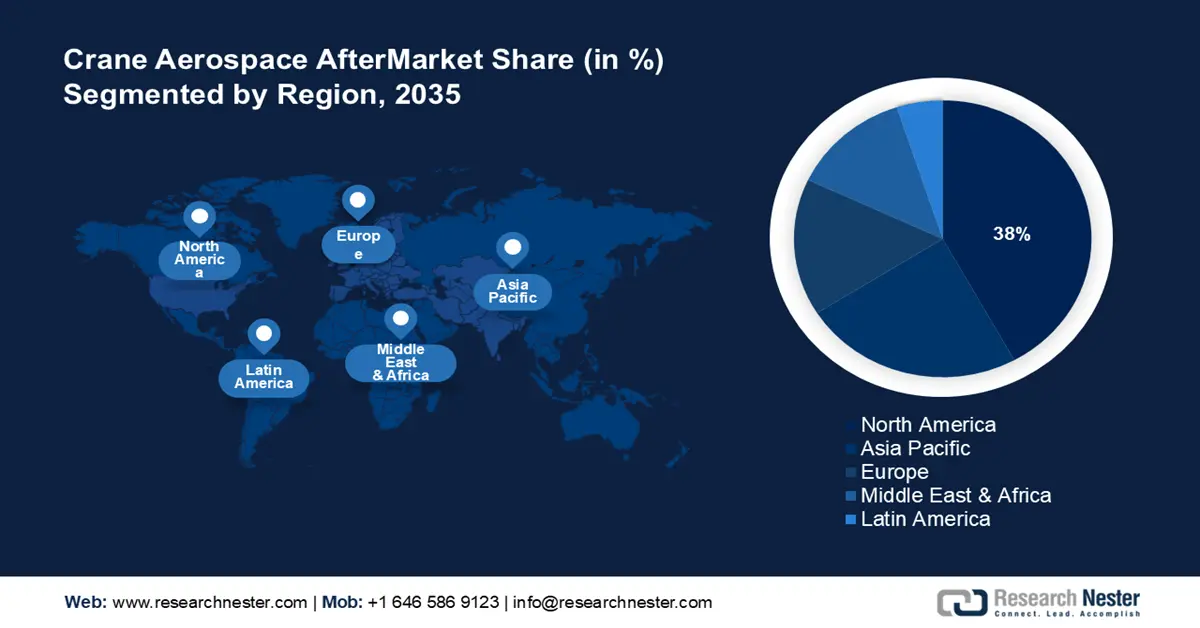

- North America leads the Crane Aerospace AfterMarket with a 38% share, driven by modernization of aging fleets and adoption of predictive maintenance technologies, bolstering growth through 2035.

- The Asia Pacific Crane Aerospace AfterMarket is expected to see rapid growth by 2035, fueled by growing commercial aviation, defense budgets, and MRO service innovation.

Segment Insights:

- The Replacement Parts segment is expected to hold a significant share by 2035, driven by the increasing need for vehicle maintenance, performance, and safety.

- The commercial aviation segment of the Crane Aerospace AfterMarket is forecasted to exceed 47% share by 2035, propelled by rising global air travel demand post-pandemic and a focus on aviation safety.

Key Growth Trends:

- Advancements in aerospace technology

- Strict safety regulatory compliance

Major Challenges:

- Cost management

- Increasing competition in the crane aerospace aftermarket

Key Players: Crane Aerospace & Electronics, Demag Cranes & Components GmbH, Eilbeck Cranes Pty Ltd, GH Cranes & Components S.A., Liebherr-International Deutschland GmbH, Munck Cranes Inc., Shannahan Crane & Hoist Inc., Shuttlelift, LLC, Street Crane Company Ltd..

Global Crane Aerospace After Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 427.06 million

- 2026 Market Size: USD 447.05 million

- Projected Market Size: USD 709 million by 2035

- Growth Forecasts: 5.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, France, United Kingdom, China

- Emerging Countries: China, India, Brazil, Mexico, Turkey

Last updated on : 13 August, 2025

Crane Aerospace AfterMarket Market Growth Drivers and Challenges:

Growth Drivers

- Advancements in aerospace technology: Technological advancements like advanced engines, improved avionics, and better materials create the need for regular updates and replacement of outdated components. This boosts efficiency in aircraft performance, fuel efficiency, and safety. New technologies in aerospace engineering have witnessed a recent trend, specifically for aerospace maintenance and repair. The adoption of AI, IoT, and predictive maintenance tools helps reduce operational costs and extend the lifespan of crane and aerospace systems.

The implementation of IoT technology is being utilized to create a predictive maintenance approach to air and spacecraft by monitoring components. The integration of AI and data analytics is used to predict when equipment is likely to fail before the breakdown happens. The maintenance schedules are then updated based on these forecasts. It can further optimize the maintenance inspection time, improve equipment safety, and productivity, and save time and money on emergency repairs. From this data, it is possible to report repairs before part failure. Additionally, this data helps in gathering information to create better components for aircraft. - Strict safety regulatory compliance: Strict aviation safety and environmental regulations require companies to maintain and upgrade parts regularly to meet industry standards. The combination of digital technologies and sensors into aerospace controllers enables real-time monitoring, and predictive maintenance leading to optimized performance.

Moreover, Aircraft Health Monitoring Systems (AHMS) have revolutionized the aviation industry by changing how aircraft are operated and maintained. AHMS uses real-time data from integrated sensors to improve aircraft safety and reliability, offering remote monitoring of important components. Thus, aviation follows a strict set of laws, regulations, and guidelines designed to manage all aspects of operations. This framework ensures the industry’s dedication to safety, reliability, and efficiency. - Rise of air travel in emerging markets: The increase in global air travel drives the need for maintenance and support services. Emerging markets particularly Asia and Africa, are experiencing rapid growth due to urbanization, and the presence of middle-class population. The expanding middle-class population with an increase in purchasing power is bringing significant growth in demand for air travel. This demand creates opportunities for airlines, aircraft manufacturers, and aviation finance providers. According to Airbus’ latest global services forecast (GSF), the commercial aircraft services market in the Asia-Pacific region will double in value to USD 129 billion from USD 52 billion by 2043.

Challenges

- Cost management: Balancing cost efficiency while ensuring high quality, reliable products is a major challenge, especially in the competitive crane aerospace aftermarket. Airlines and operators seek cost-effective solutions, putting pressure on crane aerospace to deliver high-quality parts and services at competitive prices without compromising quality. Aircraft manufacturing companies must invest in cutting-edge equipment and technology to satisfy the latest safety and industry performance standards. This maintenance will further increase the upfront costs and ongoing maintenance expenses significantly.

- Increasing competition in the crane aerospace aftermarket: The aftermarket space is highly competitive, with numerous players offering similar services. Intense competition in the crane aerospace aftermarket requires crane aerospace to differentiate itself through superior technology, service quality, and customer relationships.

Crane Aerospace AfterMarket Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.2% |

|

Base Year Market Size (2025) |

USD 427.06 million |

|

Forecast Year Market Size (2035) |

USD 709 million |

|

Regional Scope |

|

Crane Aerospace AfterMarket Market Segmentation:

Product type (Replacement parts, Service)

Based on product, the replacement parts segment in crane aerospace aftermarket is estimated to grow at a significant share by 2035. The automotive market worldwide is expanding due to the increasing demand for replacement parts, which are necessary for maintaining and enhancing vehicle performance. The replacement segment consists of gears, shafts, control systems, motors, and brakes which are important in vehicle efficiency and safety. The demand for these parts is growing because vehicles need regular maintenance and reliable components such as gears, motors, and brakes. Additionally, regular updates and repairs are essential to maintain operational excellence.

Advanced systems like automated and electronic controls are driving demand for high-quality replacement parts. Companies are developing innovative components to improve vehicle safety and performance.

Crane Aerospace Aftermarket, By Application (Commercial Aviation, Military Aviation, and General Aviation)

The commercial aviation segment is likely to dominate crane aerospace aftermarket share of over 47% by 2035. Crane aerospace services ensure airplanes meet high safety and performance standards throughout their life. Crane aerospace provides special services for military aircraft, including troubleshooting, diagnostics, and repairs, ensuring safety and reliability.

In the commercial sector, the demand for air travel has increased in 2024 after the COVID-19 pandemic. The International Air Transport Association revealed that the demand for global air passenger traffic is expected to grow by 11.6% in 2024 compared with 2023.

Our in-depth analysis of the global crane aerospace aftermarket includes the following segments:

|

Product |

|

|

Application |

|

|

Cranes |

|

|

Sales Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Crane Aerospace AfterMarket Market Regional Analysis:

North America Market Forecast

North America crane aerospace aftermarket is expected to capture revenue share of over 38% by 2035. A major driver of the sector’s growth is the growing military and commercial aviation sectors, the upgradation of aging fleets, and the use of AI and IoT for predictive maintenance. Companies are developing advanced solutions to cut costs and extend the life of aerospace parts. For instance, Columbus McKinnon introduced the crane monitoring system Intelli-Connect Mobile+ diagnostics and analytics app to enable quick and easy programming, maintenance, monitoring, and troubleshooting of overhead cranes and hoists. It provides critical information, such as signal monitors, equipment status, and energy use, to keep the overhead crane and hoists functioning effectively.

The U.S. crane aerospace aftermarket industry emphasizes air superiority and modernizing aging fleets, driving demand for advanced MRO services. The introduction of digitalization, including AI and IoT for predictive maintenance, reduces operational costs and extends the lifespan of aerospace parts. The crane aerospace aftermarket key players are developing innovative solutions to meet the growing demands of the aerospace and defense sector. For instance, Boeing and the U.S. government launched an initiative to promote the development and use of advanced sustainable aviation fuel in APEC (Asia-Pacific Economic Cooperation) economies. This sustainably produced jet fuel, reduces CO2 emissions by up to 85% as compared to petroleum, and is essential for reducing climate impact caused by the aviation sector. This initiative supports ICAO's (International Civil Aviation Organization) and the civil aviation industry’s goal of net-zero carbon emissions by 2050.

For instance, an AI-equipped aircraft can prevent any maintenance, repair, and overhaul issues as it fetches extra maintenance costs. The use of AI in aircraft uses historical data to determine patterns in engine overheating events. Hence, if overheating occurs, the temperature and speed sensors recognize that the engine was operating above 475 knots during periods when the outdoor temperature was above 80 degrees. Hence, through machine learning informed by data-collecting sensors, the AI-equipped aircraft builds an understanding of the conditions that surround the overheating events. Therefore, whenever an aircraft travels in above 80-degree temperatures, the AI-equipped aircraft can respond to speed increasing 475 knots by predictively executing a command to notify pilots of the possible maintenance issue and restrict speed at 470 knots to confirm the safe functioning of the engine.

APAC Market Analysis

Asia Pacific is one of the fastest-growing regions due to expanding commercial aviation and rising defense budgets. Markets like China and India lead with large fleets and focus on modern repair and overhaul services. The Asia Pacific region is witnessing a huge demand for sustainable aviation solutions, driven by environmental concerns and regulations. As these factors continue to drive growth and innovation, the APAC market will play an important role in the global aerospace aftermarket. As per reports, India is the seventh-largest civil aviation market in the world. According to IATA, India will become the world’s third-largest by 2026, representing a significant expansion scope for MRO facilities in India. Almost 90% of maintenance, repair, and overhaul requirements in India are currently dealt with through imports.

The crane aerospace aftermarket in China is experiencing steady growth, supported by various factors such as increasing demand for replacement parts and maintenance. The top key player Crane Aerospace & Electronics has signed an agreement with GAMECO for repairing crane products in China. Under this agreement, GAMECO will serve as an authorized repair station in China for several Crane products including Boeing aircraft fuel pumps, engine fuel flowmeters, brake control wheel speed transducers, and control valves.

Key Crane Aerospace AfterMarket Market Players:

- Columbus McKinnon Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Crane Aerospace & Electronics

- Demag Cranes & Components GmbH

- Eilbeck Cranes Pty Ltd

- GH Cranes & Components S.A.

- Liebherr-International Deutschland GmbH

- Munck Cranes Inc.

- Shannahan Crane & Hoist Inc.

- Shuttlelift, LLC

- Street Crane Company Ltd.

- Weihua Group Co., Ltd.

The growth of the crane aerospace aftermarket segment is driven by factors such as increasing aircraft fleet size, aging aircraft fleet, technological advancements, focus on defense aviation, regulatory compliance, strategic partnerships, global presence, sustainability and lifecycle management, growing demand for AOG support, and emerging new markets.

Major key players operating in the crane aerospace aftermarket are:

Recent Developments

- In July 2024, Casper Philips & Associates introduced a new four-rail stacker crane for aerospace painting services. This updated 1-ton crane replaced an older three-rail system. The features consist of a redesigned trolley, mast, and platform. CP & A worked closely with engineers and system integrators to manage mechanical design, calculations, and documentation.

- In April 2024, Honeywell introduced an AI-enabled software solution to improve commercial aerospace operations. The integration of AI and machine learning helps commercial aerospace manufacturing and maintenance, repair & overhaul (MRO) facilities that modernize production and lower operational costs through digitalization.

- Report ID: 6951

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Crane Aerospace After Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.