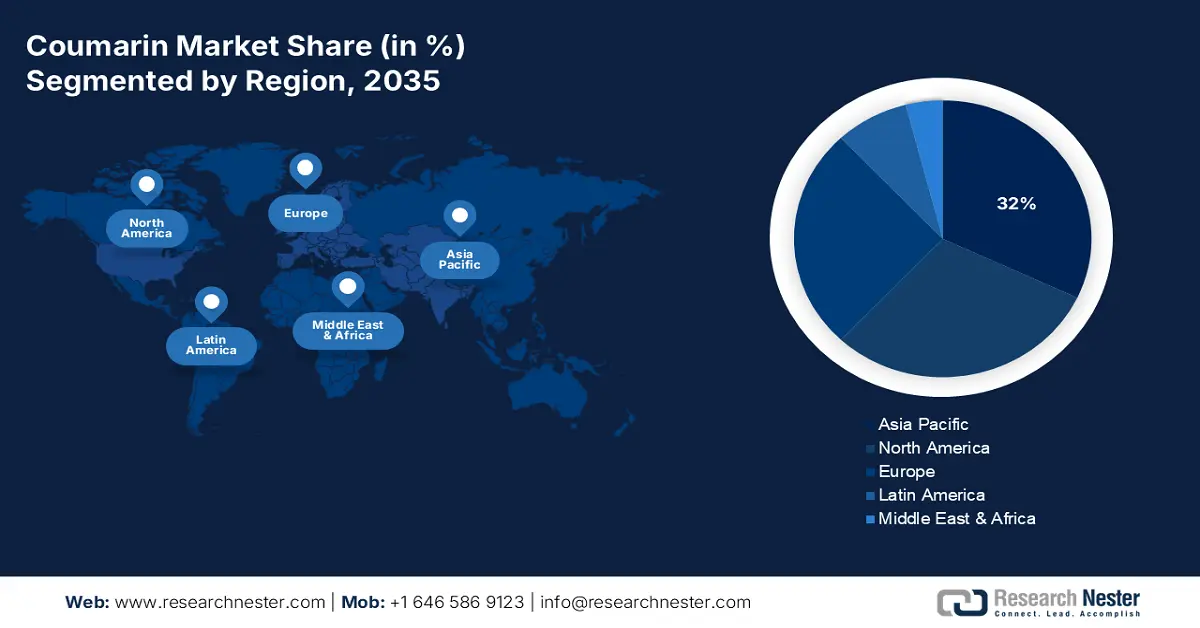

Coumarin Market - Regional Analysis

Asia Pacific Market Insights

The coumarin market in the Asia Pacific is expected to hold the highest market share within the forecast period, with the highest growth rate of 32% owing to increasing pharmaceutical and cosmetic demand, supported by improved manufacturing facilities and increasing healthcare investments. Besides, throughout the previous decade, the contribution of public spending towards overall health expenditure increased amongst every income group within the Asia Pacific region. As per a report by OECD, November 2022, lower-middle and lower-income countries, on the other hand, had a lower growth of 41.4% compared to upper-middle of 62.5% and high-income countries of 74.1%. The difference shows the growth prospect of healthcare access and coumarin demand within developing Asia-Pacific nations during the projection period.

The coumarin market in China is expected to grow steadily within the forecast period due to supportive government policies towards the pharmaceutical and chemical industries, domestic consumption, and export trade. As per a report by NLM in March 2025, China's regulatory system has 8 main laws, 24 administrative regulations, and 11 judicial interpretations that pertain to pharma alone. Expanding the horizon to broader rules traces 92 regulations, 171 administrative rules, and 44 court interpretations, emphasizing China's rigorous control and commitment to quality coumarin-type drug products. The strict regulatory system ensures market stability and growth within the projection period.

The coumarin market in India is expected to grow steadily within the forecast period due to growing awareness of natural scented components and growing investment in the herbal medicine and traditional medicine industries. As per a report by the Government of India, April 2025, the pharmaceutical export market in India has witnessed high growth, from ₹1,80,555 crore (USD 22.0 billion) in 2020 to 2021 to an estimated ₹2,19,439 crore (USD 26.7 billion) in 2023 to 2024, driven by high overseas demand and increasing manufacturing capacities. This growth is also driven by government assistance to pharmaceutical exports and increased focus on quality standards and regulatory demands in the healthcare sector.

Europe Market Insights

The coumarin market in Europe is expected to be the fastest-growing market within the forecast period due to strict regulations propelling the demand for high-purity coumarin and green, eco-friendly cosmetic products. Moreover, investments in pharmaceutical research with coumarin-based anticoagulants and anti-inflammatory drugs are increasing their applications within healthcare. Growing consumers' demand for natural and clean-label personal care products also drives market growth, with mature supply chains and sophisticated production technologies in the top European nations.

The coumarin market in the UK is expected to grow steadily within the forecast period due to growing consumer demand for high-quality personal care products and high-grade R&D emphasis in the pharmaceutical sector. As per a report by The Health Foundation in March 2023, the advantages of higher levels of R&D reach far beyond health out into the economy and there are approximately 66,000 people employed in the pharma industry in the UK, of which about half are employed in direct R&D of pharmaceuticals. This robust R&D workforce drives coumarin formulation development for therapeutic application at a brisk rate. Government support for the life sciences and the innovation centers also sustains the UK as a leading market for advanced pharmaceutical intermediates such as coumarin.

The coumarin market in Germany is expected to grow steadily within the forecast period due to the country’s dominance in chemical manufacturing and significant investments in sustainable procurement and green chemistry. The established pharma sector and strong regulatory framework in Germany also ensure the application of high-purity coumarin in pharma. Furthermore, the cosmeceutical and personal care products for natural ingredients remain on the rise, and Germany plays an essential role in the European coumarin market. Increasingly, growth is also fueled by highly export-oriented economies within Germany, wherein coumarin-derived intermediates are increasingly and more into high-end specialty chemicals and pharma supply chains across Europe as well as from outside.

North America Market Insights

The coumarin market in North America is expected to grow steadily within the forecast period due to rigorous regulatory systems that ensure quality and safety, as well as growing demand in the pharmaceutical and fragrance industries. Consumer demand for natural and clean-label products is also propelling the utilization of coumarin in personal care products. Additionally, long-term R&D and capacity investments by major industry players drive innovation and growth in the region. Additionally, a close rapport among regulatory bodies and industry players enables quicker approvals on products and cultivates sustainable production processes in the market.

The coumarin market in the U.S. is expected to grow steadily within the forecast period due to growing applications in over-the-counter drugs and cosmetics, driven by strong consumer expenditure. As per a report by Research America, January 2022, U.S. expenditure on medical and healthcare R&D was USD 245.1 billion over the past 5 years. This level of investment is an inducement for coumarin drug formulation and drug-delivery system innovation. Moreover, market scale-up by high-quality pharmaceutical organizations and openness of regulation encourage commercial scale-up of APIs from coumarin.

The coumarin market in Canada is expected to grow steadily within the forecast period due to growing development in the sector of natural cosmetics and initiatives taken by the government to promote safer use of materials in consumer products. According to a report by World Health Systems Facts in August 2025, approximately 55% of Canada's public health expenditures are flowing into physician and hospital services. The other 45% is divided equally between other categories such as public health, drugs, and long-term care. This even distribution is evidence of an established system to accommodate new therapeutic as well as cosmetic ingredients such as coumarin. Further, Canada's focus on regulation of clean labeling and product safety is in alignment with increased consumer demand for plant-based, non-toxic products.

Health Spending by Type of Sponsor in America (2022 and 2023)

|

U.S. |

Canada |

|||

|

Sponsor Type |

Share of Total Spending |

2022 Growth Rate |

Components |

Amount/Rate |

|

Federal Government |

33% |

1.0% |

Overall Health Spending |

USD 344 billion |

|

Households |

28% |

6.9% |

Per Person Expenditure |

USD 8,740 |

|

Private Businesses |

18% |

6.0% |

GDP |

12% |

|

State and Local Governments |

15% |

6.5% |

Hospital Spending |

26% |

|

Other Private Revenues |

6% |

- |

Drugs and Physicians |

14% |

Source: CMS December 2023; 2025 Canada Medical Association