Cotton Yarn Market Outlook:

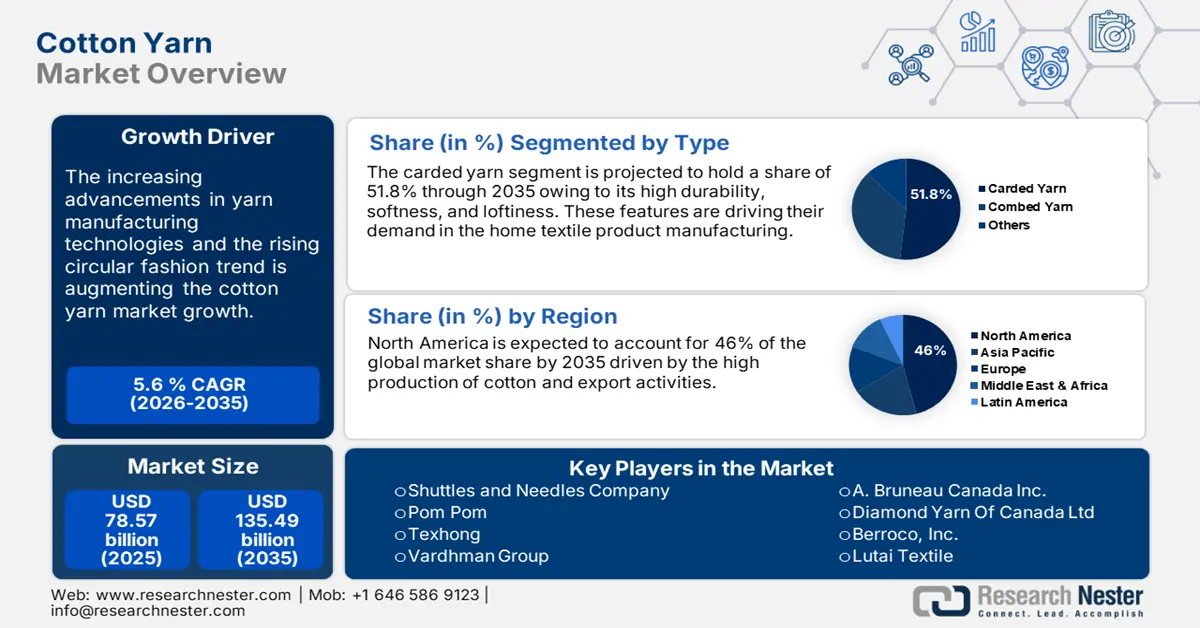

Cotton Yarn Market size was over USD 78.57 billion in 2025 and is projected to reach USD 135.49 billion by 2035, growing at around 5.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of cotton yarn is evaluated at USD 82.53 billion.

Cotton production worldwide is expanding at a healthy pace, which is positively influencing the sales of cotton-based yarns. For instance, as per the analysis by the World Population Review, around 25 million tons of cotton were produced in 2024, globally. China is the top producer of cotton and recorded over 6.4 million tons of production in 2021. The World Wildlife Organization estimates that cotton production is an income source for over 250 million people, globally and employs around 7% of all labor working in the high-potential economies.

China and the U.S. are the major exporters of textile yarn, in 2022, both countries totaled USD 16.3 billion and USD 3.5 billion, respectively. The major production of raw cotton and the rapidly developing textile industry are pushing the sales of cotton yarns in these economies. Furthermore, according to the report by the Observatory of Economic Complexity, retail cotton yarn was the 1111th most traded product worldwide, in 2022. France, Germany, and Denmark totaled USD 29.5 million, USD 17.0 million, and USD 15.6 million in retail yarn exports in 2022, respectively. The global retail cotton yarn market concentration was around 4.63 using Shannon Entropy, in 2022.

Key Cotton Yarn Market Insights Summary:

Regional Highlights:

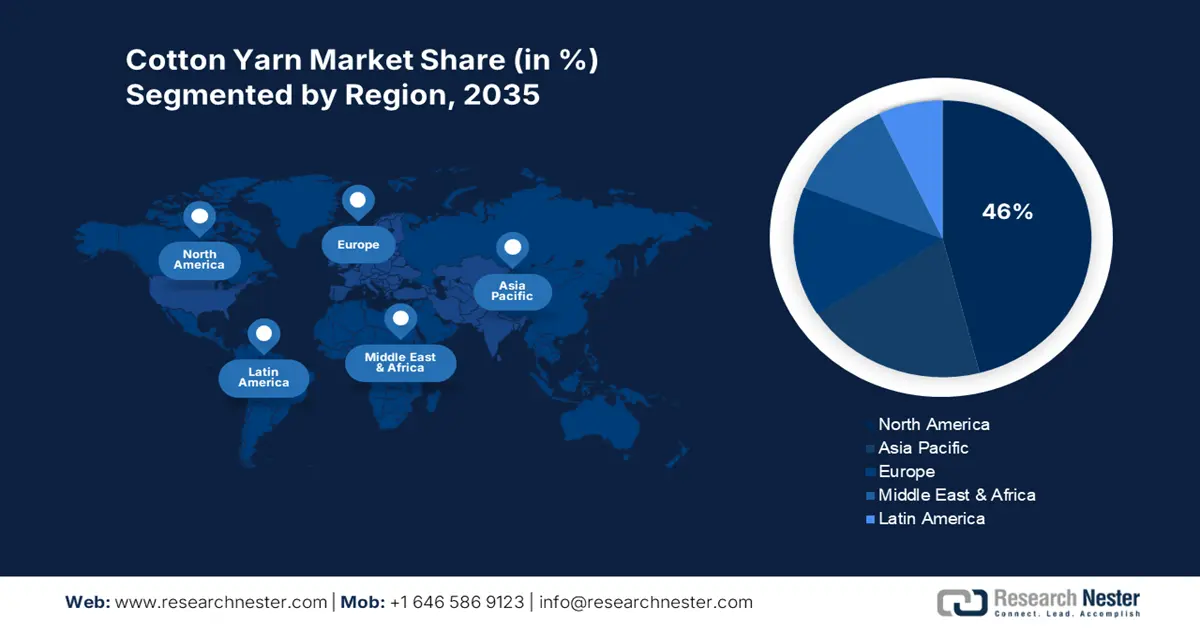

- North America's 46% share in the Cotton Yarn Market is driven by technological advancements, reinforcing its dominance through innovative production and strong demand for yarn-based clothing in 2026–2035.

- Asia Pacific’s cotton yarn market is expected to experience rapid growth by 2035, driven by high cotton production, government incentives, and a strong textile industry.

Segment Insights:

- The Carded Yarn segment is anticipated to hold around 51.8% market share by 2035, propelled by rising demand for breathable, comfortable, and natural materials for home textiles.

- The Apparel segment is expected to dominate by 2035, propelled by growing demand for organic and sustainable cotton yarn-based apparel products.

Key Growth Trends:

- Technological advancements

- Recycled cotton yarn tunning with circular fashion trend

Major Challenges:

- Fluctuations in cotton production and supply

- Easy and cost-effective availability of synthetic alternatives

- Key Players: Shuttles and Needles Company, Pom Pom, Texhong, and Vardhman Group.

Global Cotton Yarn Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 78.57 billion

- 2026 Market Size: USD 82.53 billion

- Projected Market Size: USD 135.49 billion by 2035

- Growth Forecasts: 5.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (46% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, India, United States, Japan, Germany

- Emerging Countries: China, India, Japan, South Korea, Taiwan

Last updated on : 14 August, 2025

Cotton Yarn Market Growth Drivers and Challenges:

Growth Drivers

-

Technological advancements: Modern yarn production technologies are significantly contributing to the overall cotton yarn market growth. Automation, artificial intelligence (AI), and machine learning (ML) are making yarn production more effective, efficient, and error-free. These advanced technologies aid in optimizing production times, analyzing demand, and ensuring quality control. Furthermore, technological advancements such as air jet spinning, ring spinning, and compact spinning are also improving the efficiency of cotton yarn production. These advanced techniques help in increasing production rates, reduce energy consumption, and mitigate errors.

By employing such advanced technologies in yarn production, the key players are anticipated to earn high profits. For instance, in June 2024, Saurer introduced its advanced spinning and twisting yarn machines at the International Textile Machinery (ITM) Exhibition 2024, Istanbul. The company’s advanced machines allow easy production of any yarn required by fashion and interior designers. The new Autoairo 11 and Zinser 51 machines that aid in producing commodity yarns at competitive costs were introduced at the exhibition. - Recycled cotton yarn tunning with circular fashion trend: Recycled materials significantly aid in reducing greenhouse gas emissions and align with the neutral carbon and sustainability goals. The rising demand for sustainable textiles is generating high-profit opportunities for recycled cotton yarn producers. For instance, the Textile Exchange Organization reveals that around 300,000 tons of recycled cotton were produced, globally, in 2022. Yarns produced from recycled cotton perfectly align with the circular fashion trend and widely attract an eco-conscious consumer base. Recycled cotton is often sourced from pre-, post-consumer, and post-industrial cotton waste. Bangladesh’s ready-made garment (RMG) and fabric mills alone produce around 330,000 tons of 100% pure pre-consumer cotton waste. Recycled cotton yarn manufacturers are estimated to earn high incomes through this waste by considering it as a sustainable material.

Challenges

-

Fluctuations in cotton production and supply: Yarns produced from cotton are susceptible to various environmental factors such as weather conditions, geopolitical events, and crop yields. Fluctuations in cotton production and supply directly affect the final product costs. This price volatility often drives up the costs of cotton-based yarns leading to lower sales, hampering the profit margins of the manufacturers.

-

Easy and cost-effective availability of synthetic alternatives: The presence of alternative fibers made from synthetic materials such as nylon and polyester creates a challenge for cotton yarn manufacturers. These synthetic yarns are cheaper than pure cotton yarns and are often in high demand in mass-market products. Thus, the presence of alternatives threatens the dominance of cotton-based yarns.

Cotton Yarn Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.6% |

|

Base Year Market Size (2025) |

USD 78.57 billion |

|

Forecast Year Market Size (2035) |

USD 135.49 billion |

|

Regional Scope |

|

Cotton Yarn Market Segmentation:

Type (Carded Yarn, Combed Yarn, Others)

Carded yarn segment is projected to dominate cotton yarn market share of around 51.8% by the end of 2035. Carded yarn is considered a superior yarn and is widely used in the production of home textiles such as blankets, casual clothing, towels, and bed linens. Softness and loftiness are major characteristics of carded cotton yarns contributing to their sales growth. The rising consumer demand for breathable, comfortable, and natural materials for home textiles is further augmenting the sales of carded yarns.

The Federal Reserve Bank of St Louis reveals that the carded cotton spun yarns captured the 205.444 producer price index by commodity in 2022. Furthermore, as per the analysis by the Observatory of Economic Complexity, the cotton, carded, or combed global trade was totaled at USD 312 million, in 2022. Wherein India was the top exporter with USD 66.6 million and Vietnam was the prime importer with USD 49.9 million. Also, cotton, carded, or combed accounted for the 4498th rank in the product complexity index (PCI).

Application (Apparel, Home Textiles, Industrial Textiles, Others)

The apparel segment is estimated to hold a dominating share of the global cotton yarn market through 2035. The increasing demand for natural fibers in the fashion industry is positively influencing cotton yarn sales. Eco-conscious customers are major buyers of organic and sustainable cotton yarn-based apparel products. Cotton yarn’s softness, durability, and resistance to wear and tear compared to other fibers is a prime driver to its sales growth. For instance, the Federal Reserve Bank of St Louis estimated that the spun cotton yarns in textile products and apparel accounted for 153.826 producer price index by commodity, in 2024. Furthermore, the National Cotton Council of America reveals that cotton accounts for over 60% of the share in the retail apparel and home furnishings market.

Our in-depth analysis of the cotton yarn market includes the following segments:

|

Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Cotton Yarn Market Regional Analysis:

North America Market Forecast

North America in cotton yarn market is anticipated to hold over 46% revenue share by the end of 2035. The ongoing technological advancements in production techniques, high adoption of yar-based clothing, and strong presence of key market players are fueling the sales of cotton yarns. The U.S. and Canada both are the most lucrative marketplaces for cotton yarn manufacturers owing to a huge customer base.

The World Integrated Trade Solution report reveals that the U.S. exported around 605 kg of uncombed cabled cotton yarn in 2023. Furthermore, the Observatory of Economic Complexity report estimated that in 2022, around USD 46.6 million of retail cotton yarns were imported into the U.S. The continuous import and export trade activities in the country are creating a profitable environment for cotton yarn producers.

Canada exported around 1,510,150 kg of cotton yarn in 2021, according to the World Integrated Trade Solution. The increasing use of cotton yarn in textile manufacturing is positively contributing to the overall cotton yarn market growth. Some of the major importers of cotton yarns in the country are A. Bruneau Canada Inc., Diamond Yarn of Canada Ltd, and Berroco, Inc.

Asia Pacific Market Statistics

The Asia Pacific cotton yarn market is poised to expand at the fastest pace during the study period. The high production of cotton, supportive government policies and incentives, and the robust textile industry are pushing the sales of cotton yarns in the region. India and China followed by Japan and South Korea are some of the most high-earning marketplaces for cotton yarn manufacturers.

The Observatory of Economic Complexity report revealed that China is one of the major exporters of retail cotton yarn across the world and calculated around USD 41 million in 2022. The country produced over 6.7 million metric tons of cotton in 2023, this high production significantly contributes to the thriving sales of cotton yarns.

India’s boasting textile industry is contributing to high sales of cotton yarns in the country. The India Brand Equity Foundation estimates that the cotton production of the country is projected to reach 7.2 million tons by 2030. The local government approved R&D projects of around USD 7.4 million in the textile industry. Furthermore, the Wholesale Price Index of cotton yarn in the country was around 130 in FY 2024. Thus, the continuous developments in the textile industry are set to directly push the sales of cotton yarns in the country.

Key Cotton Yarn Market Players:

- Shuttles and Needles Company

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Pom Pom

- Texhong

- Vardhman Group

- Weiqiao Textile

- Bruneau Canada Inc.

- Diamond Yarn Of Canada Ltd

- Berroco, Inc.

- Lutai Textile

- Huafu Top Dyed Melange Yarn Co.,Ltd.

- Alok Industries

- Anhui Huamao Textile

- Bros Eastern Co., Ltd

- China Resources Holdings Company Limited

- Nahar Spinning

- Nishat Mills

- Trident Group

- KPR Mill Limited

The cotton yarn market is highly opportunistic for the players involved owing to trends such as circular fashion, AI integration, and supportive government schemes. Industry giants are adopting organic cotton and sustainable responsible manufacturing processes which appeal to eco-conscious consumers. This tactic aids manufacturers in grabbing premium pricing opportunities from sustainable yarn products.

Leading companies are also adopting advanced yarn manufacturing technologies to maximize their production cycles, ultimately contributing to high revenue growth. Furthermore, they are also adopting mergers and acquisitions tactics to increase the product portfolio and accelerate cotton yarn market reach.

Some of the key players include:

Recent Developments

- In August 2024, Pom Pom announced the launch of its first-ever yarn line Garland in collaboration with Hobbii Yarn. The super-soft Garland yarn is made from a blend of cotton and alpaca.

- In July 2022, the Shuttles and Needles Company announced the launch of cotton chenille yarn. Its unique fuzzy structure is boosting its application in sweater, skirt, and shawl making.

- Report ID: 6792

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Cotton Yarn Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.